Overview of Scotia iTRADE

Scotia iTRADE, established in 2018 and based in Canada, is an investment platform that remains unregulated.

It offers a wide range of products and services including equities, ETFs, mutual funds, options, GICs, bonds, new issues, and commission-free ETFs.Meeting diverse investor needs, Scotia iTRADE provides various account types such as registered, non-registered, non-personal, and a risk-free practice account for beginners.

The platform has a tiered commission structure, offering rates of $4.99 for traders with over 150 transactions and $9.99 for those with fewer. It supports a demo account, provides customer support via phone and email, and facilitates deposits and withdrawals through credit/debit cards and bank transfers.

Scotia iTRADE also offers educational resources like webinars, infographics, and articles/videos to aid investors in their trading journey.

Is Scotia iTRADE Limited Legit or a Scam?

Scotia iTRADE operates as an unregulated investment platform, meaning it does not hold a formal regulatory status with financial regulatory authorities.

Pros and Cons

Pros of Scotia iTRADE:

1. Diverse Product Offering: Scotia iTRADE provides a wide array of investment options, including equities, ETFs, mutual funds, options, GICs, bonds, and new issues, meeting a variety of investor preferences and strategies.

2. Tiered Commission Structure: The platform offers a competitive commission structure, with lower fees for active traders (those conducting more than 150 trades), which can be advantageous for high-volume traders.

3. Educational Resources: A wealth of educational tools such as webinars, infographics, articles, and videos are available, supporting both novice and experienced investors in enhancing their trading knowledge and skills.

4. Demo Account: The availability of a risk-free practice account allows new traders to familiarize themselves with trading platforms and strategies without risking real money.

5. Multiple Account Types: Scotia iTRADE accommodates a range of investor needs by offering different types of accounts, including registered, non-registered, and non-personal accounts.

Cons of Scotia iTRADE:

1. Unregulated: The lack of regulation can be a significant downside, as it may imply fewer protections for investors and less oversight on the platform's operations and financial practices.

2. Higher Fees for Low-Volume Traders: Traders with fewer than 150 trades face higher commission fees, which could be a drawback for casual or low-volume investors.

3. Limited Global Reach: Being based in Canada and focusing primarily on Canadian investors will limit the platform's appeal to international traders looking for global investment opportunities.

4. Potential for Limited Customer Support: While customer support is available via phone and email, the effectiveness and responsiveness of this support are crucial and could be a concern if not up to par.

5. Dependence on Traditional Banking Methods: The reliance on credit/debit cards and bank transfers for deposits and withdrawals will not meet users looking for more modern or diverse payment methods, such as digital wallets or cryptocurrencies.

Products & Services

Scotia iTRADE's offerings are designed to meet a wide range of investment strategies and preferences, providing a variety of products and services:

Equities: Scotia iTRADE's equities trading service allows investors to engage in the buying and selling of shares from a broad spectrum of public companies across multiple industries and geographical locations. This service is ideal for investors looking to have direct ownership in companies and benefit from both dividend payments and capital gains.

Exchange-Traded Funds (ETFs): The platform offers a diverse selection of ETFs, which are investment funds traded on stock exchanges much like stocks. ETFs typically hold a portfolio of assets, such as stocks, bonds, or commodities, offering investors a convenient way to achieve diversified exposure to a broad array of markets or sectors with a single transaction.

Mutual Funds: Scotia iTRADE provides access to a wide range of mutual funds, allowing investors to pool their money in a professionally managed investment fund. Mutual funds invest in a diversified portfolio of assets and are an attractive option for individuals seeking to leverage the expertise of fund managers for asset allocation and risk management.

Options: The platform offers options trading, which involves contracts that give the investor the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a certain date. Options trading can be used for various strategies, including hedging, income generation, or speculating on the direction of markets or individual securities.

Guaranteed Investment Certificates (GICs): Scotia iTRADE offers GICs, which are secure investment products that guarantee to return the principal amount plus interest at a fixed rate over a specified term. GICs are an appealing choice for conservative investors seeking a stable and predictable return, without exposure to market volatility.

Bonds: Investors have access to a variety of bonds through Scotia iTRADE, including government bonds, which are issued by national or local governments, and corporate bonds, which are issued by companies. Bonds are debt securities that pay periodic interest payments and return the principal at maturity, suitable for investors looking for regular income and lower risk compared to stocks.

New Issues: Scotia iTRADE provides its clients with opportunities to invest in new issues, which are securities or financial instruments being offered to the public for the first time. This can include initial public offerings (IPOs) of stocks, new bond issuances, or other financial instruments, offering investors a chance to get in on the ground floor of potentially lucrative investments.

Commission-Free ETFs: The platform features a selection of ETFs that can be traded without incurring commission fees, making it more cost-effective for investors to build and adjust their investment portfolios. This is particularly beneficial for those who engage in frequent trading or wish to employ a cost-effective dollar-cost averaging strategy.

Account Types

Scotia iTRADE offers a variety of account types to meet the diverse needs of investors, including:

Registered Accounts: These accounts allow investors to defer taxes on their investment gains, providing a tax-advantaged way to save for the future. Examples of registered accounts include Tax-Free Savings Accounts (TFSAs), Registered Retirement Savings Plans (RRSPs), and other government-sponsored investment accounts.

Non-Registered Account: This type of account allows investors to borrow money against the investments held within the account, offering flexibility in managing investment strategies and capital. Non-registered accounts are subject to taxation and do not offer the same tax advantages as registered accounts.

Non-Personal Accounts: Scotia iTRADE provides investment products and services designed to help manage the financial needs of businesses, organizations, or other entities. These accounts are tailored to support the investment goals and requirements of non-individual investors, helping them manage their bottom line.

Risk-Free Practice Account: For those new to investing or looking to test out strategies without any financial risk, Scotia iTRADE offers a practice account. This type of account allows users to simulate trading and investing in a risk-free environment, using virtual money on the Scotia iTRADE platform to gain experience and confidence before committing real funds.

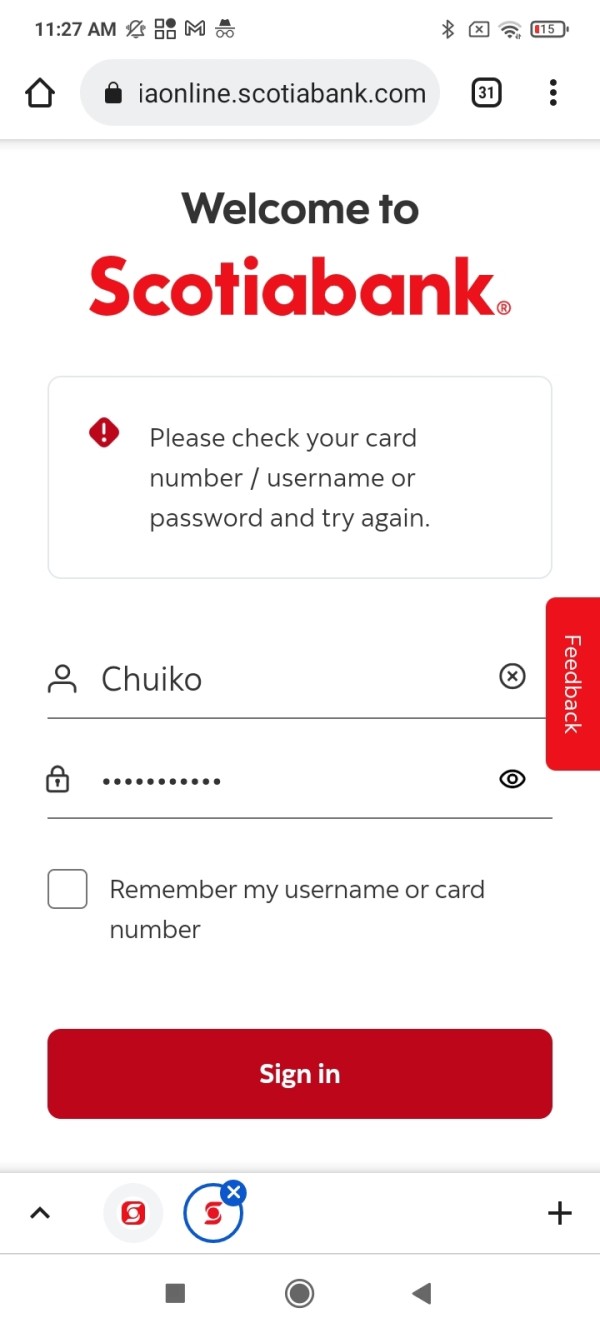

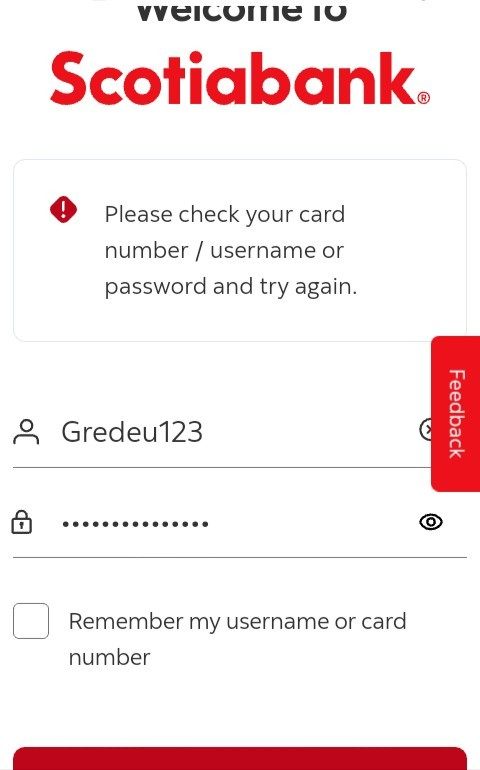

How to Open an Account?

Opening an account with Scotia iTRADE can be streamlined into the following four key steps:

1. Research and Choose the Account Type: Start by exploring the different account types Scotia iTRADE offers, such as registered accounts (e.g., TFSA, RRSP), non-registered accounts, and non-personal accounts, to determine which best suits your investment goals and financial situation.

2. Gather Required Information and Documents: Prepare all necessary personal information and documentation needed for the account application. This typically includes government-issued identification (such as a passport or driver's license), Social Insurance Number (SIN), employment information, and financial details.

3. Complete the Online Application: Visit the Scotia iTRADE website and navigate to the account opening section. Fill out the online application form with your personal, financial, and employment details. You will also need to answer questions regarding your investment experience and goals, which help in tailoring the service to your needs.

4.Fund Your Account: Once your application is approved, you'll need to fund your new account to start trading. Scotia iTRADE offers various funding options, including bank transfers, cheques, and transferring assets from another brokerage. Choose the method that works best for you, and follow the instructions provided to complete the funding process.

Commissions & Fees

Scotia iTRADE offers a clear and competitive pricing structure for its commissions and fees, with details outlined as follows:

Commissions & Fees for Stocks, ETFs, and Options:

Equities and ETFs:

For those executing 150 or more trades per quarter: $4.99 per trade

For those executing fewer than 150 trades per quarter: $9.99 per trade

An additional $65 is charged for trades placed with a telephone representative.

Options:

For 150+ trades/quarter: $4.99 per trade, plus $1.25 per contract

For less than 150 trades/quarter: $9.99 per trade, plus $1.25 per contract

An additional $65 is charged for trades placed with a telephone representative.

Mutual Funds:

Buy, sell, and switch orders placed online are charged at $9.99, with an added $65 for orders placed through a telephone representative.

Fixed Income Securities:

For online secondary market trades, there's a fee of $1 per $1,000 face value (with a minimum of $24.99 and a maximum of $250).

The same fee structure applies to trades placed by telephone representatives, plus an additional $65.

High Interest Savings Account & Money Market Funds:

Other Fees:

Exchange Traded Debentures are subject to the same fee structure as fixed income securities, including the additional $65 for trades placed by telephone representatives.

Various interest rates apply to the Cash Optimizer Investment Account and margin accounts, with rates dependent on the balance and account type (e.g., iClub Platinum, iClub Gold, Standard Rate).

Additional Notes:

The pricing is subject to change without notice, and investors need to aware that additional fees such as the SEC fee for U.S. sell transactions and early redemption fees for mutual funds may apply.

The commission structure incentivizes active trading by offering lower fees for those who trade more frequently within a quarter.

Here's a concise table summarizing the commissions and fees for Scotia iTRADE:

Note: The “$65 for trades placed with a telephone representative” applies to equities, ETFs, options, and mutual funds when assistance is used.

Trading Platform

The Scotia iTRADE® app is the trading platform offered by Scotiabank, designed for an intuitive and user-friendly investment management experience.

This application integrates banking and online trading into a single interface, enabling users to execute trades with just a few clicks while providing access to essential research and tools for informed decision-making.

It also includes the Trade Pro feature, a premium component of the platform that offers advanced, customizable tools for equity and options trading.

Trade Pro is equipped with real-time data streaming, charting, and the capability to prepare multiple stock and options orders in advance, ensuring traders have complete control and flexibility over their investments, along with in-depth analysis to support their trading strategies.

Customer Support

Scotia iTRADE offers comprehensive customer support to assist with trading inquiries, account opening, asset transfers, and technical support questions.

Clients can reach out by phone with the toll-free number 1-888-TRADE88 (1-888-872-3388) for general inquiries within Canada or the USA, available Monday to Friday from 8:00 a.m. to 8:00 p.m. ET, or call 416-214-6457 for assistance from outside Canada or the USA.

For account opening and onboarding questions, there is a dedicated line at 1-888-769-3723, available Monday to Friday from 8:30 a.m. to 5:30 p.m. ET. Additionally, 24/7 support is available through the Automated Scotia iTRADE TeletraderTM Client Service.

Clients can also contact Scotia iTRADE via email for service inquiries at service@scotiaitrade.com and for opening an account at openaccount@scotiaitrade.com.

For in-person assistance, clients can visit the Scotia iTRADE Investor Information Centre located at Scotia Plaza in Toronto, Ontario, or drop off documentation at any Scotiabank branch.

Education Tools

Scotia iTRADE provides a wealth of educational tools and resources designed to empower investors of all levels with the knowledge and skills needed for successful trading and investing.

The platform offers webinars that cover a wide range of topics, including retirement planning and investment strategies, providing an interactive learning experience.

Additionally, Scotia iTRADE makes available various links to detailed information on different account types, helping clients make informed decisions based on their individual investment goals.

Infographics are also part of the educational suite, offering visual guides that simplify complex trading concepts and processes.

Furthermore, a comprehensive collection of articles and videos is accessible, covering diverse subjects from basic trading principles to advanced investment tactics.

These educational materials are crafted to enhance the trading acumen of Scotia iTRADE clients, aiding them in navigating the markets more effectively.

Conclusion

Scotia iTRADE stands out as a versatile investment platform, meetng a diverse clientele with its wide array of account types, competitive commission structure, and comprehensive suite of investment products and services.

Despite the lack of regulatory oversight, it endeavors to provide value through educational resources, a user-friendly trading environment, and dedicated customer support.

Its commitment to offering both novice and seasoned investors the tools and information necessary for informed decision-making underscores Scotia iTRADE's dedication to client empowerment and satisfaction in the dynamic world of online trading and investing.

FAQs

Q: Is Scotia iTRADE regulated?

A: Scotia iTRADE operates as an unregulated platform.

Q: What types of accounts can I open with Scotia iTRADE?

A: Scotia iTRADE offers a variety of account types including registered accounts (for tax-deferred investments), non-registered accounts, non-personal accounts for entities, and risk-free practice accounts for beginners.

Q: What are the commission fees for trading on Scotia iTRADE?

A: The commission fees vary: $4.99 per trade for those with 150+ trades per quarter and $9.99 per trade for fewer than 150 trades. Options trading incurs an additional $1.25 per contract, and certain transactions may attract additional fees.

Q: Can I trade mutual funds on Scotia iTRADE, and what are the fees?

A: Yes, you can trade mutual funds on Scotia iTRADE. The fee for mutual fund transactions is $9.99 for online orders, with an additional $65 fee for trades placed with a telephone representative.

Q: How can I contact Scotia iTRADE customer support?

A: Scotia iTRADE can be contacted via toll-free phone numbers for general inquiries and account opening, by email for service inquiries and new account requests, and in person at the Scotia iTRADE Investor Information Centre in Toronto or at Scotiabank branches.

Q: Does Scotia iTRADE offer educational resources for investors?

A: Yes, Scotia iTRADE provides a range of educational tools including webinars, informational links, infographics, and a collection of articles and videos to help investors make informed decisions.