简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UK service sector gains momentum,

Abstract:despite fastest rise in output charges since the survey began in July 1996

Key findings

Embargoed until 0930 BST (0830 UTC) 5 April 2022

News Release

S&P Global / CIPS UK Services PMI®

Source: S&P Global, CIPS.

UK service providers signalled an exceptionally strong

increase in business activity during March and the rate of

expansion accelerated to its fastest for 10 months. Survey

respondents widely noted that the removal of pandemic

restrictions and return to offices had led to a sharp rebound

in customer demand.

However, business expectations for the year ahead dropped

for the second month running and were the lowest since

October 2020. Weaker optimism was mainly linked to the war

in Ukraine and subsequent economic uncertainty. Severe

cost pressures also weighed on confidence and led to a rapid

rise in output charges. The rate of prices charged inflation

was the steepest since the index began in July 1996.

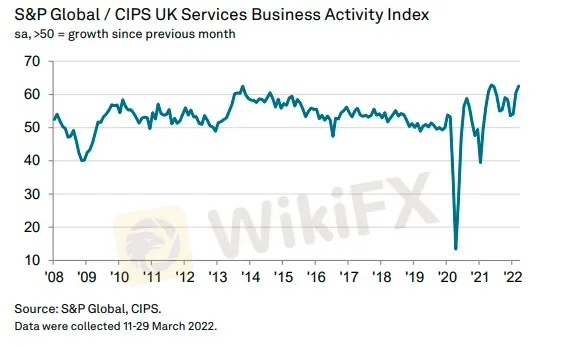

The headline seasonally adjusted S&P Global / CIPS UK

Services PMI® Business Activity Index rose for the third

month running to reach 62.6 in March, up from 60.5 in

February. This highlighted a continued rebound in output

growth from the Omicron-related slowdown seen at the

end of last year. Moreover, the rate of expansion was the

second-strongest since May 1997 (exceeded only by the

post-lockdown recovery in May 2021).

Higher levels of business activity were supported by a strong

rise in new work during March. More than twice as many

survey respondents (31%) reported an increase in new orders

as those that signalled a fall (15%). Businesses operating in

the travel, leisure and entertainment sectors commented on

especially strong demand during the latest survey period.

Greater business requirements and robust long-term

expansion plans fuelled another month of strong job

creation in March. The latest rise in staffing numbers was the

fastest since October 2021. Survey respondents suggested

that tight labour market conditions had made it difficult to

fill vacancies and pushed up starting salaries.

Recruitment difficulties, capacity constraints and worsening

supplier performance all contributed to an increase in

backlogs of work across the service economy in March.

Higher levels of unfinished business have been recorded in

each of the past 13 months, although the latest rise was the

slowest so far in 2022.

An unprecedented 40% of the survey panel reported an

increase in their average prices charged in March, while only

3% signalled a decline. The resulting seasonally adjusted

Prices Charged Index pointed to the strongest rate of

inflation since the survey began in July 1996.

Another rapid rise in output charges was overwhelmingly

linked to higher salary payments and increased prices paid

for energy, fuel and raw materials. Around 65% of the survey

panel reported a rise in their operating expenses in March,

while less than 1% noted a decline. The latest index reading

signalled the second-fastest rate of input cost inflation since

the survey began (exceeded only by the record high seen last

November).

Concerns about the impact of escalating inflationary

pressures on household budgets acted as a brake on growth

expectations across the service sector in March. Survey

respondents also cited uncertainty related to the war in

Ukraine and greater hesitancy among clients. The overall

degree of positive sentiment regarding the business outlook

dropped to its lowest for 17 months.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

A Must-To-Watch Top Trading Pairs This 2025

Discover the top trading pairs to watch this week, including Bitcoin, Euro, USD, and more. Market trends, key resistance levels, and price movements analyzed.

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator