简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best Binary Options Indicators: Enhance Your Trading Strategy

Abstract:Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Binary Indicators: A short Introduction

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

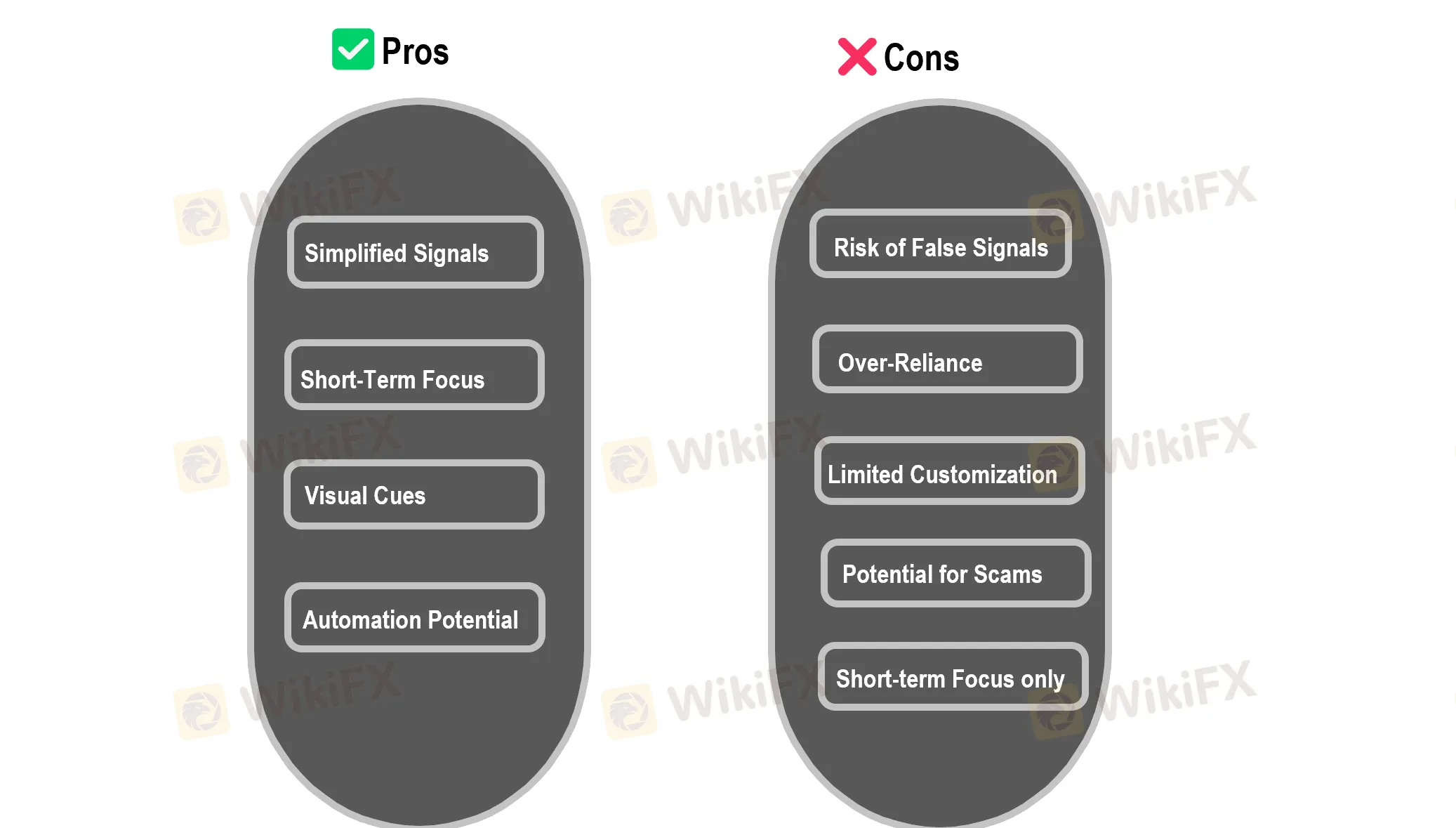

Pros and Cons of Binary Indicators

Pros of Binary Indicators:

- Simplified Signals: Binary indicators often provide clear, straightforward buy/sell signals, making them accessible to novice traders.

- Short-Term Focus: Binary indicators are typically tailored for short-term predictions, aligning with the fast-paced nature of binary options.

- Visual Cues: Many binary indicators use visual cues, such as arrows or color changes, to quickly communicate trading opportunities.

- Automation Potential: Some binary indicators can be integrated with automated trading platforms, allowing for hands-free trading.

Consof Binary Indicators:

- Increased Risk of False Signals: Due to their focus on short-term predictions, binary indicators can generate a higher frequency of false signals.

- Over-Reliance: Traders may become overly reliant on these indicators, neglecting other crucial aspects of market analysis.

- Limited Customization: Compared to standard technical indicators, binary indicators often offer limited customization options.

- Potential for Scams: The binary options market is known for scams, and many “guaranteed” binary indicators are fraudulent.

- Short-term focus only: Since binary options are short term, indicators made for them, usually do not give a good long term view of the market.

Best Binary Indicators to Explore

Strategy for Binary Options Galaxy (MetaTrader 4)

This premium algorithmic tool, specifically optimized for 5-minute binary option expiries, leverages historical data dating back to 2011 to generate buy/sell signals. It performs best when trading EURUSD and GBPCHF pairs during high-liquidity sessions, such as the London/New York overlap. For optimal performance, it is recommended to pair this tool with a 14-period RSI to filter out false overbought/oversold signals. For example, a trader with a $1,000 account achieved a 28% monthly return by executing 3-5 daily trades, adhering to a strict 5% risk management strategy per trade.

MACD (Moving Average Convergence Divergence)

This versatile trend-following tool effectively highlights momentum shifts, making it a valuable asset in binary options trading. Specifically, traders can utilize the MACD crossover—where the signal line intersects the MACD line—to identify potential trading opportunities with 15-minute expiry times. For instance, a bullish crossover observed on the GBPUSD currency pair during the Asian trading session, typically between 02:00 and 05:00 GMT, frequently precedes rallies of 20 to 30 pips.

Pivot Points

Pivot Points provide daily support and resistance levels derived from the previous day's price action. In binary options trading, traders can capitalize on price bounces off the S1 and R1 levels, utilizing 30-minute expiry times. For instance, in Gold binary options, prices frequently demonstrate a tendency to rebound from the Central Pivot Point during U.S. trading hours.

Bollinger Bands + RSI Combo

This strategy combines volatility and momentum indicators for effective breakout trading. Specifically, traders should initiate a CALL option when the asset's price touches the lower Bollinger Band, indicating an oversold condition, and simultaneously, the RSI rises above 30, confirming upward momentum. Backtest data reveals that on NASDAQ 100 binary options, this combination achieved a 68% win rate during sideways market conditions.

Ichimoku Cloud

The Ichimoku Cloud is a multi-dimensional indicator that offers insights into trend direction, support and resistance levels, and momentum. For binary options, traders can focus on price breaks above or below the cloud to inform 1-hour expiry trades. For example, a USDJPY price break above the Ichimoku Cloud during the Tokyo trading session, from 00:00 to 06:00 GMT, frequently signals a period of 4 to 6 hours of bullish momentum.

Sniper Alert Signals

The “Sniper Alert Signals” tool is designed for scalping, specifically targeting 60-second binary options trades. It operates by detecting micro-reversals in EURGBP and AUDJPY currency pairs through the analysis of fractal patterns. To mitigate the rapid drawdown risks inherent in such short-term trading, it's crucial to limit each trade to 1–2% of your trading capital.

The Fear & Greed Index

The Fear & Greed Index serves as a sentiment tool, quantifying market psychology on a scale from 0 (extreme fear) to 100 (extreme greed). In binary options trading, a strategy involves purchasing PUT options when the index exceeds 75, indicating overvalued markets driven by excessive greed, or conversely, buying CALL options when the index falls below 25, signaling undervalued markets due to extreme fear. Notably, in 2025, AI-powered sentiment analysis has been introduced, integrating this data into platforms like Deriv and IQ Option, enhancing the tool's accessibility and utility.

Case Studies: Real-World Success

Case 1: Scalping with Bollinger Bands

| Trader Type | Short-Term trader |

| Tradable Product | USDJPY |

| Expiry Time | 60-second |

| Entry | Price touches lower band + RSI < 35 |

| Results | 72% win rate over 200 trades, 18% monthly ROI |

A trader specializing in ultra-short-term trades employed Bollinger Bands on USDJPY 60-second binary options to capitalize on brief price fluctuations. The strategy hinged on identifying oversold conditions and potential reversals. Specifically, the trader monitored the 60-second chart for instances where the USDJPY price touched the lower Bollinger Band, indicating a potential oversold state. To further confirm this, they required the 14-period RSI to be below 35, signaling strong downward momentum that was likely unsustainable and ripe for a rebound.

When both conditions were met, the trader executed a 'Call' option, anticipating a short-term price increase. Over a period of 200 trades, this strategy yielded a 72% win rate, demonstrating its effectiveness in capturing small, rapid price movements. Implementing strict risk management, the trader achieved an 18% monthly return on investment (ROI), highlighting the potential profitability of well-executed scalping strategies with binary options. This case highlights the efficacy of pairing volatility and momentum indicators for rapid-fire trading strategies

Case 2: Trend Trading with Ichimoku

| Trader Type | swing trader |

| Tradable Product | Gold |

| Expiry Time | 1-hour expiries |

| Entry | Price breaks above cloud + volume surge |

| Results | 65% accuracy, 25% monthly returns |

A swing trader, focusing on medium-term price movements, utilized the Ichimoku Cloud indicator to identify strong, sustained trends in Gold binary options, targeting 1-hour expiry trades. The strategy centered on capitalizing on confirmed breakouts, indicating the beginning of a robust trend. The trader waited for the Gold price to decisively break above the Ichimoku Cloud, a signal that the asset was transitioning into a bullish phase. To further validate this breakout, the trader also required a noticeable surge in trading volume, confirming increased market participation and conviction behind the price movement.

When both the cloud breakout and volume surge conditions were met, the trader executed a 'Call' option, anticipating a continuation of the upward trend over the next hour. This strategy, implemented consistently, resulted in a 65% accuracy rate, meaning that 65 out of every 100 trades were profitable. This level of accuracy, combined with sound risk management principles, enabled the trader to achieve a 25% monthly return on their investment. This case illustrates the effectiveness of using a comprehensive indicator like the Ichimoku Cloud to identify and trade on significant trend shifts in binary options.

Some Common Mistakes to Avoid

Overloading Charts with Too Many Indicators

Many traders fall into the trap of cluttering their charts with excessive technical indicators, creating what's often called “indicator soup.” This approach can lead to analysis paralysis and contradictory signals that cloud judgment rather than enhance it.

For example, a trader might simultaneously use RSI, MACD, Stochastic Oscillator, Bollinger Bands, and multiple moving averages on a single chart. When these indicators give conflicting signals—perhaps RSI shows oversold conditions while MACD indicates a continuing downtrend—the trader becomes confused about which signal to prioritize. This confusion often leads to delayed decision-making or emotional trading based on whichever indicator confirms the trader's existing bias.

A more effective approach is to select 2-3 complementary indicators that serve different analytical purposes. For instance, combining a trend-following indicator (like a moving average) with a momentum oscillator (like RSI) and a volatility measure (like ATR) provides a more balanced and focused analysis framework.

Ignoring Asset-Specific Settings

Different market instruments behave according to their own unique characteristics, yet many traders apply the same technical analysis settings across all assets without adjustment. This one-size-fits-all approach significantly reduces analytical effectiveness.

For example, forex pairs like EUR/USD typically exhibit different volatility patterns than commodity futures like crude oil. Using the same 14-period RSI settings for both would be suboptimal. Forex markets might benefit from shorter timeframe indicators due to their 24-hour trading nature and tighter ranges, while commodities often require longer-period settings to filter out noise from their more volatile price movements.

Similarly, stock indices like the S&P 500 often respond well to volume-based indicators, whereas many forex pairs don't incorporate actual volume data (only tick volume), making such indicators potentially less reliable for currency trading. Traders should research optimal settings for each asset class and further fine-tune these parameters based on the specific instrument's historical behavior.

Neglecting Market News and Economic Events

Focusing exclusively on technical analysis while ignoring fundamental factors and scheduled economic releases is another common mistake that can lead to unexpected losses.

Consider a trader who spots what appears to be a perfect technical setup for a short position in USD/JPY, unaware that the Federal Reserve is scheduled to announce an interest rate decision in 30 minutes. When the Fed unexpectedly signals a more hawkish stance than anticipated, the market moves sharply against the trader's position, triggering stop losses.

Successful traders integrate economic calendars into their trading routine, noting high-impact events that could affect their positions. They either adjust their risk management approach before such events (widening stop losses or reducing position sizes), temporarily step aside from the market during major announcements, or deliberately trade the events with appropriate strategies designed for heightened volatility.

Additionally, staying informed about broader market themes—such as central bank policy directions, geopolitical developments, or sector-specific news for stocks—provides crucial context for technical analysis and helps traders understand the “why” behind price movements rather than just the “what.”

Useful Tips to Optimize Your Strategy with Indicators

Backtest Strategies on Historical Data

Effective backtesting of binary options strategies involves simulating your approach on historical price data using platforms like MetaTrader or TradingView. To ensure consistency, it's essential to test across a variety of market conditions, including trending, ranging, and volatile periods. This comprehensive testing approach helps validate the strategy's performance under different market dynamics, providing a more reliable assessment of its potential.

When evaluating backtest results, focus on key metrics such as win rate, risk-reward ratio, and maximum drawdown. For example, if a strategy combining RSI and Moving Averages yields a 65% win rate on EUR/USD hourly data but only 45% on GBP/JPY, adjustments to parameters or a shift in asset focus may be necessary. Crucially, prioritize robustness over perfection when optimizing indicators to avoid curve-fitting. Over-tweaking settings to precisely match historical data often leads to poor performance in live trading conditions, as the strategy becomes overly specialized to past market behavior.

Adjust Timeframes Based on Expiry

When trading binary options, aligning your chart timeframe with your chosen expiry time is critical. For short-term expiries, ranging from 1 to 15 minutes, utilize faster timeframes such as 1-minute or 5-minute charts. Employ responsive indicators like the Stochastic Oscillator or a 5-period RSI to capture quick momentum shifts, enabling you to capitalize on fleeting price fluctuations. These indicators are designed to react swiftly to short-term market changes, making them ideal for rapid trading decisions.

Conversely, for longer expiry times of 1 hour or more, shift your focus to higher timeframes, such as 15-minute or hourly charts. Opt for trend-focused tools like a 20-period EMA or the Ichimoku Cloud to filter out market noise and identify more sustained trends. These indicators provide a broader perspective, allowing you to discern the underlying market direction and make informed decisions for longer-duration trades. A crucial warning: mismatching your chart timeframe with your trade's duration, such as using a 1-minute chart for a 4-hour expiry, can lead to premature exits and missed opportunities. Always ensure your chart timeframe accurately reflects the intended duration of your binary options trade.

Combine Indicators with Price Action for Confirmation

Combining technical indicators with price action analysis can significantly enhance binary options trading strategies. Candlestick patterns, for example, can be paired with indicators to confirm potential reversals or continuations. A bullish MACD crossover, when coinciding with a bullish engulfing candle, strengthens buy signals by validating both momentum and price action. Similarly, identifying support and resistance levels can be augmented with indicator confirmations. If the price tests a key support level and the RSI indicates an oversold condition (≤30), it reinforces the likelihood of a price reversal.

Furthermore, integrating volume analysis, where available, can provide valuable insights into momentum. A Bollinger Band squeeze accompanied by rising volume suggests an impending breakout, indicating increased market participation and conviction. Combining indicators with price action provides a holistic market view, enabling traders to make sharper, more potentially profitable decisions.

Conclusion

Overall, successful binary options trading requires a strategic blend of technical indicators and disciplined risk management. By tailoring indicators to specific assets and timeframes while conducting thorough backtesting, traders can improve their accuracy. However, maintaining market awareness and avoiding common pitfalls like indicator overload also matters.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Baazex Review: Is it safe to invest in it?

Baazex is a relatively new broker registered in the United Arab Emirates, with an operating history of between 2 to 5 years. Despite its claims of offering over 1500 trading instruments—from foreign exchange pairs like EUR/USD, GBP/USD, and AUD/JPY, to major stocks including Apple, Meta, Disney, LVMH, and Tesla; as well as commodities (oil, gold, silver, coffee), indices, cryptocurrencies, and futures—investors should be aware of some critical risks.

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Currency Calculator