简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly Forex Forecast

Abstract:Start the week of April 18, 2022 with our Forex forecast focusing on major currency pairs here.

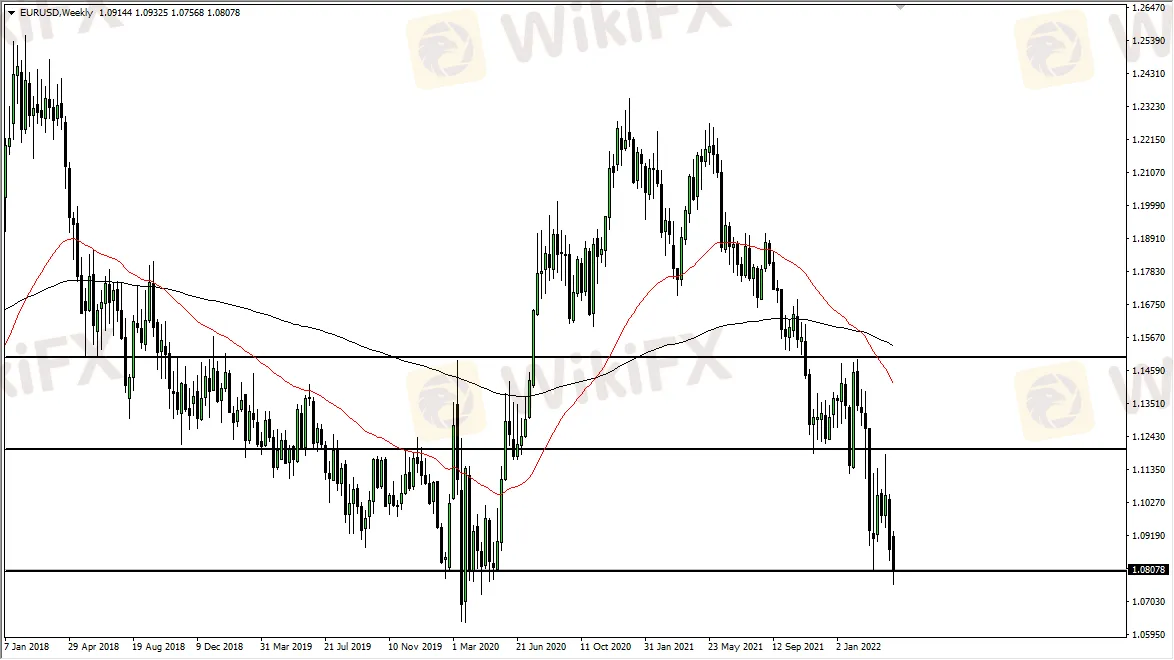

EUR/USD

The euro continues to get punished, and I think at this point we are getting ready to attempt to break down below the 1.08 level. Having said that, there is a significant amount of support here, so a short-term rally is almost certain to happen. Nonetheless, this should end up being a nice shorting opportunity and at this point, I have no interest in trying to buy this market. Keep in mind that the area below 1.08 is very noisy, so the drive down to the 1.06 level will more than likely be more of a grind than any type of freefall unless headline shocks cross the wires

GBP/JPY

The British pound has rallied again against the Japanese yen, breaking through a major barrier in the form of the ¥165 level. That being said, we are overstretched, so I think this is a situation where you may look for a short-term pullback in order to get involved again. The ¥162.50 level should be supported, just as the ¥160 level will be. That being said, I do not expect that deep of a correction, but it is certainly within the realm of possibility. Keep in mind that as long as the Bank of Japan is looking to find interest rates rising, they will have to continue to keep quantitative easing in play, the main driver of this move.

AUD/USD

The Australian dollar fell during the trading week, breaking below the 0.74 level. This was preceded by a massive shooting star at the 0.75 handle, so it all ties together quite nicely. I suspect at this point in time that any short-term rally that you get is more than likely going to be an opportunity to short this market again. That being said, a breakdown below the are where we are closing more than likely will send fresh sellers into the market.

EUR/GBP

The euro is approaching a very important region on the longer-term charts as far as support is concerned. The 0.82 level being tested is a big deal, and if we were to break down below that level, the bottom will follow out of this pair. More likely than not, we will get a short-term bounce, but I would be a seller of that move because without a doubt the euro is one of the weakest currencies that we currently deal with. If we do get that breakdown, it will become a longer-term position.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OPEC+’s Output Boost & Tariffs: A Perfect Storm for Oil Prices

Oil prices have been on a continuous decline, and with the combined pressure of OPEC+ production increases and tariff policies, the downward trend may persist in the short term.

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

The Japanese yen has been experiencing frequent surges recently. What’s driving this trend? Let’s dive in and uncover the reasons behind it.

Nifty 50 Index Futures Now Available at Interactive Brokers

Trade Nifty 50 Index Futures with Interactive Brokers. Access India’s top 50 firms, diversify portfolios, and manage risk on a powerful trading platform.

Trade245 Review 2025: Live & Demo Accounts, Withdrawals to Explore

Trade345, a young South African broker, has gained some regional popularity, but lacks an established reputation. Trade245 offers access to FX pairs, indices, stocks and commodities CFDs with operation on both MetaTrader 4 and MetaTrader 5. Although this broker only asks for a modest minimum deposit, it does not shine on trading costs. Besides, this broker heavily relies on bonuses to attract new investors and it does not provide trading signals.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

FINMA Opens Bankruptcy Proceedings

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FCA Issues Warning Against 14 Unregistered Financial Firms

Currency Calculator