简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Reversal Persists, Technical Picture Looking Worrying

Abstract:The technical picture for the USD is looking more troubled as the index extends losses below the 103 handle. The latest catalyst stemming from reports that US President Biden is considering a move to cut China tariffs in order to ease inflationary pressures.

USD Price Analysis & News

· USD Losses Extend as China Tariff and ECB REC Hike Talk

· Build up of USD Longs Create Worrying Short Term Picture

The technical picture for the USD is looking more troubled as the index extends losses below the 103 handle. The latest catalyst stemming from reports that US President Biden is considering a move to cut China tariffs in order to ease inflationary pressures. This prompted a modest boost in risk sentiment, sapping demand from the safe-haven Dollar. What‘s more, hawkish comments from ECB’s Laggard further exacerbated losses in the greenback with the ECB President essentially pre-committing to a 25bps rate hike in July and September.

ECB LAGARDE

“Based on current outlook, we are likely to be in a position to exit negative interest rates by the end of the third quarter”

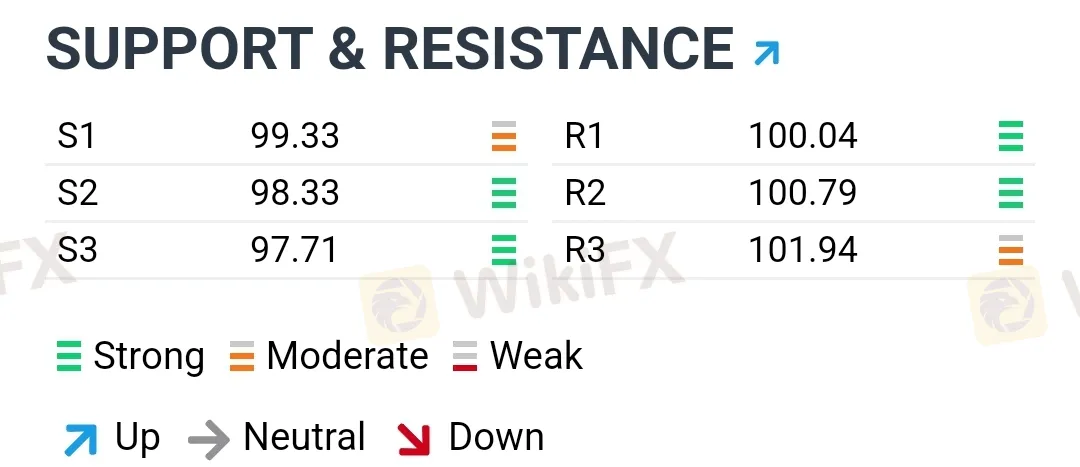

That being said, with positioning also very much on the long USD side, there could more pain for the USD as bullish bets are squeezed, particularly if equities remain stable. In turn, 103 now represents resistance, while short term support sits at 101.28, which marks the 23.6% retracement of the Jan 2021-May 2022 bull trend. Elsewhere, across the majors, while 1.07 will be watched in EUR/USD the area to watch will be 1.0750, meanwhile, 127.00 will be key for USD/JPY

Data shows 67.81% of traders are net-long with the ratio of traders long to short at 2.11 to 1. The number of traders net-long is 0.12% lower than yesterday and 15.26% lower from last week, while the number of traders net-short is 0.94% lower than yesterday

and 26.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR /USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

US Dollar Chart: Daily Time

If you want to know more information about the reliability of certain

brokers, you can open our website (https://www.WikiFX.com/en). Or you

can download the WikiFX APP for free through this link

(https://www.wikifx.com/en/download.html). Running well in both the

Android system and the IOS system, the WikiFX APP offers you the easiest

and most convenient way to seek the brokers you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

A Must-To-Watch Top Trading Pairs This 2025

Discover the top trading pairs to watch this week, including Bitcoin, Euro, USD, and more. Market trends, key resistance levels, and price movements analyzed.

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator