简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Not quite “Together”

Abstract:A look at the day ahead in markets from Dhara Ranasinghe.

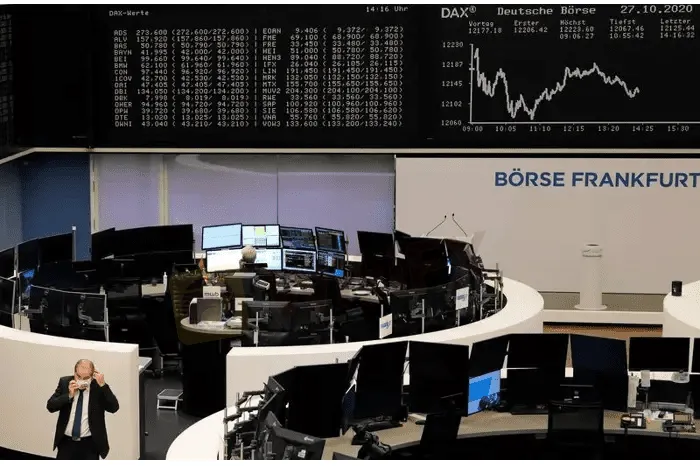

On top of surging inflation, rising interest rates and growing global recession risks, markets in Europe are waking up on Monday to the prospect of heightened uncertainty in France — the euro areas second biggest economy.

French President Emmanuel Macron is trying to salvage a ruling majority and his economic reform agenda after voters punished his centrist ‘Ensemble’ (Together) alliance in Sundays parliamentary election.

While Ensemble secured the largest number of lawmakers in the 577-seat National Assembly, it fell short of the threshold required for an absolute majority in a vote that saw a leftwing alliance and the far-right perform strongly.

The euro has softened slightly and the premium investors demand to hold French 10-year government bonds over top-rated Germany widened to 57 basis points from 52 bps on Friday.

France now faces a period of prolonged political instability, while confronting an international crisis in Ukraine and the prospect of slowing growth at home.

Crypto currencies are also in the spotlight, highlighting that turmoil seen across world markets last week isnt over just yet.

Bitcoin fell below $20,000 over the weekend for the first time since December 2020. That level is of symbolic significance, as it was roughly the peak of the 2017 cycle.

Its hovering around $20,000 as early European trade gets underway but clearly sentiment is fragile. Bitcoin has lost 57% so far this year and 37% this month.

Asian shares meanwhile have been unable to sustain a rare rally as Wall Street futures shed early gains on worries the U.S. Federal Reserve would this week underline its commitment to fighting inflation with further large rate hikes.

European stock futures are flat to a touch higher.

A U.S. holiday means thinned-out trading conditions – a factor that could of course exacerbate volatility.

Key developments that should provide more direction to markets on Monday:

– China keeps lending benchmarks unchanged, wary of policy divergence risks

– U.S. markets closed on Monday for Juneteenth holiday

– Crypto industry gripped by anxiety as bitcoin wobbles near key $20,000 level

– China keeps lending benchmarks unchanged, wary of policy divergence risks

– German PPI +1.6% m/m, +33.6% y/y in May

– ECB President Christine Lagarde, ECB board member Fabio Panetta, ECB chief economist Philip Lane

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The internet is inundated with advertisements and promotions from self-proclaimed trading gurus who promise to teach you how to become a successful trader and earn a substantial secondary income. These individuals often claim that their trading techniques can make you rich, even if you have zero experience. However, these assertions are typically false, and many people fall victim to these scams. This article aims to expose these fake trading gurus, explain how they operate, and provide tips on how to avoid being scammed.

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The One Fear That’s Costing You More Than Just Profits

Currency Calculator