简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

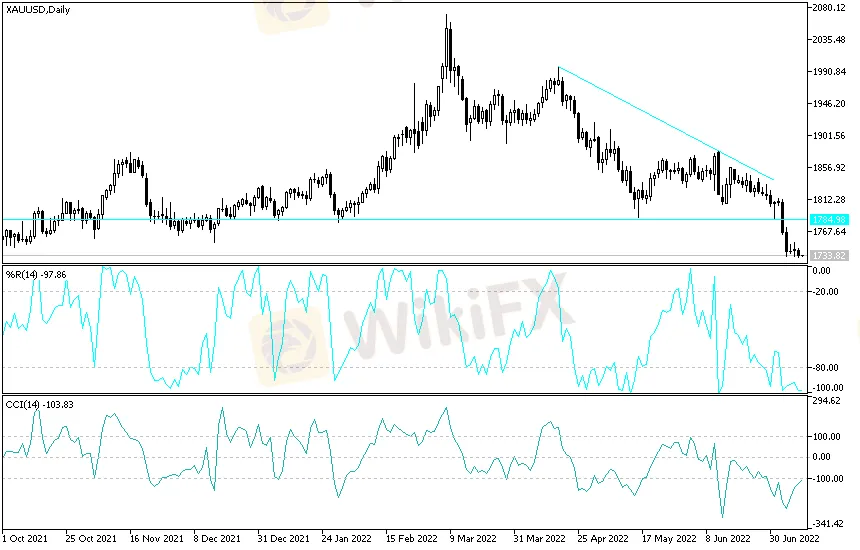

Gold Technical Analysis: Heading for Deeper Buying Levels

Abstract:With the beginning of this week’s trading, the gold price completed the broader downward path, as the US dollar continues its record gains. Despite fears of the future of the global economic recession and a new outbreak of the Corona virus, the gold price fell to the support level of $1723 an ounce in early trading today, Tuesday, the lowest price for the yellow metal in nine months.

With the beginning of this weeks trading, the gold price completed the broader downward path, as the US dollar continues its record gains. Despite fears of the future of the global economic recession and a new outbreak of the Corona virus, the gold price fell to the support level of $1723 an ounce in early trading today, Tuesday, the lowest price for the yellow metal in nine months.

The gold market was hit by the rising US dollar. Despite the hotter-than-expected inflation report this week and mounting fears of an economic recession, gold prices were falling, with most of their losses occurring after the Fed's tightening campaign began. In general, XAU/USD gold prices are retreating from a weekly loss of about 4%, in addition to their decline since the start of 2022 to date by more than 5%.

And for the price of silver, the sister commodity of gold, adding to its massive drop in 2022. Silver futures fell to $19.15 an ounce. The price of the white metal also decreased by about 3% last week, adding to its decline since the start of the year 2022 to date by about 18%. The biggest factor in the metal commodity price crash was the dollar's rise. Where the US dollar index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 108.05, from an opening at 106.93. In general, the index achieved weekly gains of 2%, which raised its gains since the beginning of 2022 to date to nearly 13%.

The strongest bearish price is for commodities priced in dollars because it makes them more expensive to purchase for foreign investors.

All in all, the Fed is preparing to push the trigger to raise the US interest rate by another 75 basis points this month in the face of high inflation. This has caused chaos in the bond market as investors anticipate a recession over the next two years. The US Treasury market was mixed, with the benchmark 10-year bond yield dropping 11.2 basis points to 2.989%. However, the main focus is on yield curve inversion between 2-year and 10-year yields. This is an important indicator of a recession because it has predicted all but one of the economic slowdowns since 1955.

The price of gold is sensitive to a high interest rate environment because it raises the opportunity cost of holding non-yielding bullion. Commenting on this, Naim Aslam, chief market analyst at AvaTrade said, “The price movement of the precious metal is largely driven by the dollar index, which is holding on to its strength.” Meanwhile, the US Consumer Price Index for June (CPI) will be released on Wednesday, with economists expecting a headline reading of 8.8%. If accurate, this would be up from the 8.6% figure in May.

In other metals markets, copper futures fell to $3.4055 a pound. Platinum futures fell to $862.60 an ounce. Palladium futures rose to $2,183.00 an ounce.

On the other hand, stocks fell, with traders preparing for a heated inflation reading and the start of a major earnings season that may provide clues as to whether the US economy is heading into a recession. The sell-off in shares of huge companies such as Tesla Inc. and Apple Inc. weighed on the stock market - which saw its lowest trading volume in 2022. Shares of Twitter Inc. fell. By 11 percent, Elon Musk walked away from his $44 billion deal to buy the company, setting the stage for a legal battle.

Amid a wide-ranging confluence of economic challenges, investors are waiting to see if earnings falter or whether companies will drastically lower their forecasts. One reason for caution is the split between two major forces on Wall Street. Analysts are betting that Corporate America is flexible enough to pass on higher costs to consumers at a time when many strategists aren't really convinced that this is the case.

Malley noted that stocks are trading at valuation levels that are seen as highs - not lows. He added that the current price-to-sales metric is, for example, at the same level from the market tops in 2020 and 2018 and in the tech bubble in 2000.

Gold Technical Analysis

So far, the general trend of the gold price is still bearish, taking into account that according to the performance on the daily chart, the recent losses of gold moved the technical indicators towards strong oversold levels, and accordingly, gold investors may think about buying gold from the support levels 1715, 1690 and 1660. On the other hand, the bullish view of the gold price will not return without breaching the psychological resistance level of 1800 dollars an ounce as soon as possible.

I still prefer buying gold from every bearish level.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator