简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 10 loan apps in Nigeria by number of downloads as of Q2 2022

Abstract:Despite the rising concerns over their modus operandi when it comes to loans recovery, loan apps have come to stay in Nigeria. The rate at which Nigerians patronize them leaves no one in doubt that there are, indeed, some benefits from these app.

Despite the rising concerns over their modus operandi when it comes to loans recovery, loan apps have come to stay in Nigeria. The rate at which Nigerians patronize them leaves no one in doubt that there are, indeed, some benefits from these app.

For a fact, they are daring the odds to provide collateral-free loans, which traditional banks dare not venture into. The speed at which the loans are disbursed, customized repayment plans, and less documentation make the loan apps the best bet for Nigerians in need of urgent cash.

While there are now tons of them licensed by the Central Bank of Nigeria (CBN) to provide loan services, even amidst rising allegations of breach of the countrys National Data Protection Regulation (NDPR). Nairametrics looks at the download figures of these apps on Google Play Store, which gives a fair idea of the apps being mostly used by Nigerians. Although some of the apps are available on the Apple Store, many of them are not, which is why Google Play Store is being used as the sole yardstick to measure their popularity.

Here are the top 10 most downloaded loan apps in Nigeria on Google Play Store as of the end of Q2 2022:

10. EasyCredit (1 million downloads)

EasyCredit prides itself as a secure, reliable, and online loan app in Nigeria. With over 1 million downloads as of Q2 2022, the app gives out instant loans from N3,000 to N100,000 with the lending term of 91 days – 365 days. Its interest ranges from 0.1% – 1%, one-time processing fee ranges from N1,256 to N6,000 and the Maximum Annual Percentage Rate (APR) is 40%.

9. Newcredit (1 million downloads)

Newcredit is another instant loan app in Nigeria that has crossed 1 million downloads. The personal loan app that gives Nigerian collateral-free loans of up to N300,000. The app uses Artificial Intelligence (AI) to analyze prospective customers financial records, including the bank transaction SMS on their phones and their credit worthiness from other lenders.

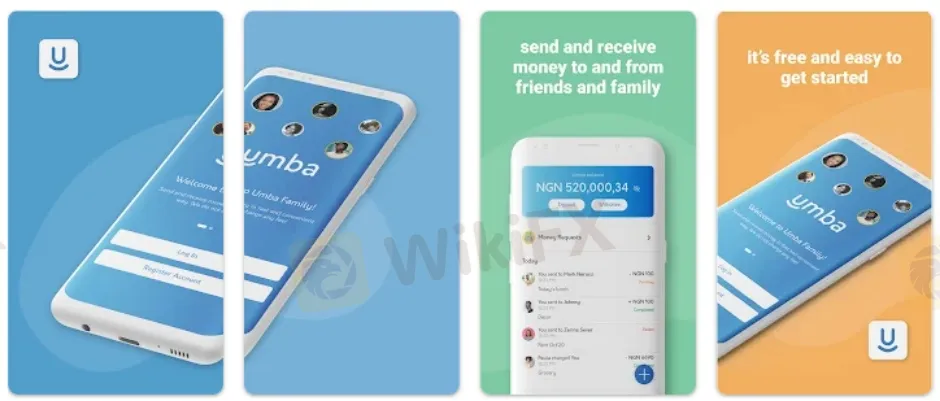

8. Umba (1 million downloads)

Umba, like other top loan apps in Nigeria, has crossed 1 million downloads. The lender prides itself as the leading digital bank in Africa. The app allows users to apply, draw down and repay loans directly from their smartphone or desktop computer. Once an individual is verified, it makes lending decisions based on an assigned risk rating.

This app allows a borrower to increase his or her loan limit once they are able to repay on time.

7. QuickCheck (1 million downloads)

QuickCheck is a quick loan app that uses machine learning to predict borrowers behaviour and instantly evaluate loan applications. This app is among the top loan apps in Nigeria that have crossed 1 million downloads. The company says it aims at offering digital financial services to help people get closer to their personal and business goals. The app also offers loans without collateral.

6. Aella Credit (1 million downloads)

Aella credit prides itself as a one-stop-shop for all your financial services. They offer short-term personal loans that range from N2000 to N1,000,000 with repayment periods from 1 – 3 months. Their interest rates range from 6% – 20%. The app is obviously popular among Nigerians as it has been downloaded over 1 million times on the Play Store.

5. Okash (1 million downloads)

Okash is a convenient quick online loan platform for Nigeria mobile users managed by Blue Ridge Microfinance Bank Limited. OKash fulfils customers‘ financial needs completely online 24/7. The application process takes just a few steps with minimal documentation and the approved loan amount is transferred to the applicant’s bank account. The app offers loans ranging from N3,000 to N500,000 and the repayment plan ranges from 91 days to 365 days.

The app is one of the most-downloaded loan apps on Play Store as it had crossed 1 million downloads as of Q2 2022.

4. Carbon (1 million downloads)

Carbon is a digital financial service platform that provides a range of financial services, including personal loans, business loans, payments, funds transfers, credit scoring, savings, and investments. The Carbon loan application process typically takes less than 5 minutes to complete. Their rates range from 2% to 30%, and this depends on the loan repayment period and the amount of money you wish to borrow. As of Q2 2022, the app had been downloaded over 1 million times.

3. FairMoney (5 million downloads)

FairMoney says it offers fast loans within 5 minutes with no documentation or collateral required. The loan amounts vary based on your smartphone data and repayment history. Loan amounts range between N1,500 to N500,000 with repayment periods from 61 days to 180 days at monthly interest rates that range from 10% to 30%. The app is, no doubt, one of the most used by Nigerians as it has also been downloaded 5 million times and still counting.

2. Palmcredit (5 milllion downloads)

Palmcredit comes a distant second to Branch in terms of downloads, it is nonetheless one of the most patronized loan apps in Nigeria. The lending platform says it can provide a quick loan of up to N300,000 in less than 3 minutes without any form of collateral. You can borrow between N2,000 to N300,000 quick loan and if your documentations are complete and accurate, you can get your disbursement within a business day, the platform claims. The app has been downloaded over 5 million times on the Google Play Store.

1. Branch (10 million downloads)

Branch is a platform that offers quick online loans in Nigeria. As of Q2 2022, this app is the most-downloaded loan app in Nigeria that has crossed 10 million downloads on Google Play Store.

The app determines loan eligibility and personalized loan offers using the users smartphone data. Their interest rates range from 15% – 34%. You can get access to loans from N1,000 to N200,000 within 24hrs, depending on your repayment history, with a period of 4 to 40 weeks to pay back.

All you need to apply is your phone number or Facebook account, bank verification number (BVN) and bank account number. They will also request access to the data on your phone in order to build your credit score.

Note: Many operators of loan apps have been known to recover their monies through harassments, including calling a defaulter‘s telephone contacts to request the contact’s intervention. Such contacts may be friends, family members, co-workers or even a borrowers employers.

Once you register for loan on any of these apps, you are surrendering your contacts list privacy to them and this is used if you default in repaying. The watchwords in dealing with the loan apps are: Do not owe them.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator