简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

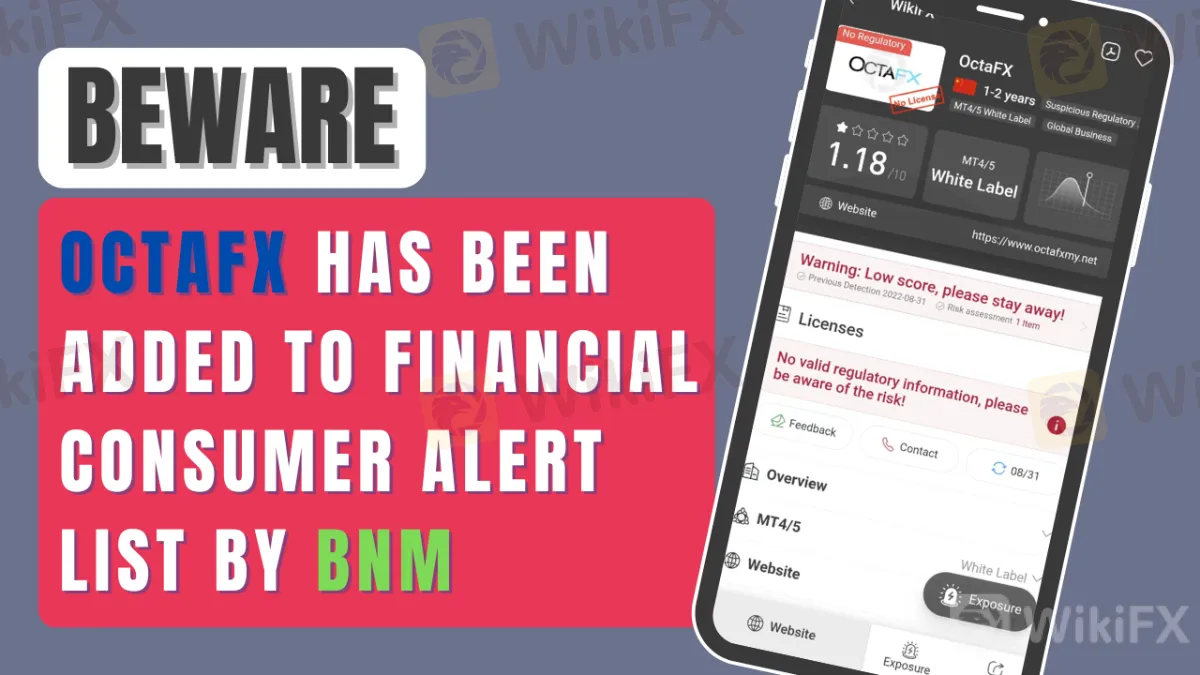

BEWARE! OctaFX Has Been Added To Financial Consumer Alert List By BNM

Abstract:Bank Negara Malaysia (BNM) has included the foreign exchange (forex) trading platform OctaFX to its list of Financial Consumer Alerts. The central bank has so stated that the platform is not permitted nor allowed under BNM rules.

Bank Negara Malaysia (BNM) has included the foreign exchange (forex) trading platform OctaFX to its list of Financial Consumer Alerts. The central bank has so stated that the platform is not permitted nor allowed under BNM rules.

BNM said in its statement that OctaFX's website and official social media profiles have all been put to the Financial Consumer Alert list. These include the platform's accounts on Facebook, Twitter, Instagram, YouTube, and LinkedIn.

BNM also said that the Financial Consumer Alert list serves as a reference for investors, informing them of businesses and schemes that “may have been incorrectly perceived or represented as licensed or regulated by BNM.” Furthermore, the list is updated depending on information supplied by members of the public, with evaluations made on the reported businesses and schemes as needed.

Aside from BNM, OctaFX was previously listed to the Securities Commission Malaysia's (SC) Investor Alert List. It was listed on the grounds that the platform had engaged in capital market operations such as trading in derivatives without a license and running a recognized market without SC authorisation.

Meanwhile, OctaFX is a worldwide forex broker with a presence in over 100 countries. It has steadily gained attention and momentum among investors in Malaysia as a result of its massive advertising efforts, with celebrities such as Fizo Omar and Wak Doyok appearing as “ambassadors.” At the time of writing, OctaFX's website and social media profiles were still operational (such as Facebook).

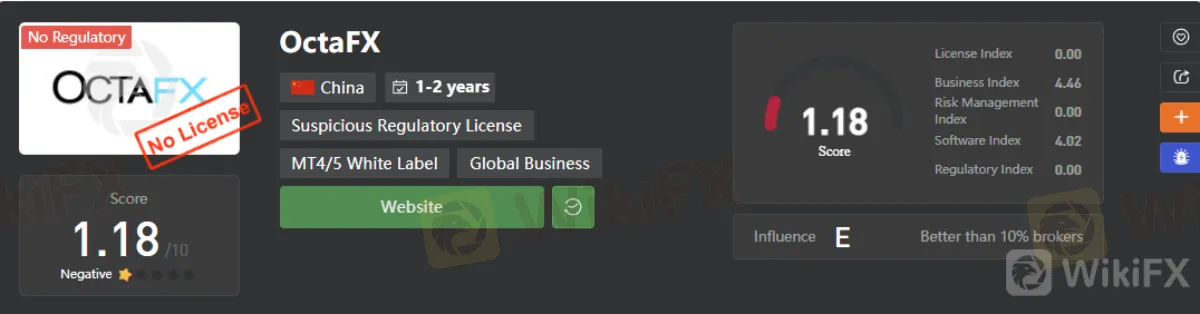

OctaFX Regulation

OctaFX is not regulated based on an inquiry of their address. Their office is in Griffith Corporate Centre, Suite 305, Beachmont, Kingstown, St. Vincent and the Grenadines. There were no hits when I searched their name on SVG FCA.

OctaFX's on the WikiFX App

The WikiFX forex trading search engine software has been watching OctaFX's operations owing to a large number of complaints filed to the WikiFX team by its traders all around the world, most of which were “Unable to Withdraw.”

Here are some latest complaints WikiFX has received.

The complaints may be seen at https://www.wikifx.com/en/exposure/exposure/1941447945.html.

Scammers, in general, dress to seem legitimate. A phony broker may supply false information about the company's registration, license, and location. As a consequence, stay alert and do comprehensive research to discover if there are any red flags or warnings about the broker, such as OctaFX. Furthermore, remember to cross-check and verify company data in forex regulators' registries before joining, and to join a licensed and well-known organization.

If you are a trader who has engaged in illegal activities with your broker. Go to the WikiFX official website, www.wikifx.com, and go to the Exposure page.

You may also contact WikiFX Customer Support.

Keep an eye out for further broker news.

WikiFX App may be downloaded through the App Store or the Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Broker Comparison: FXTM vs XM

Currency Calculator