简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

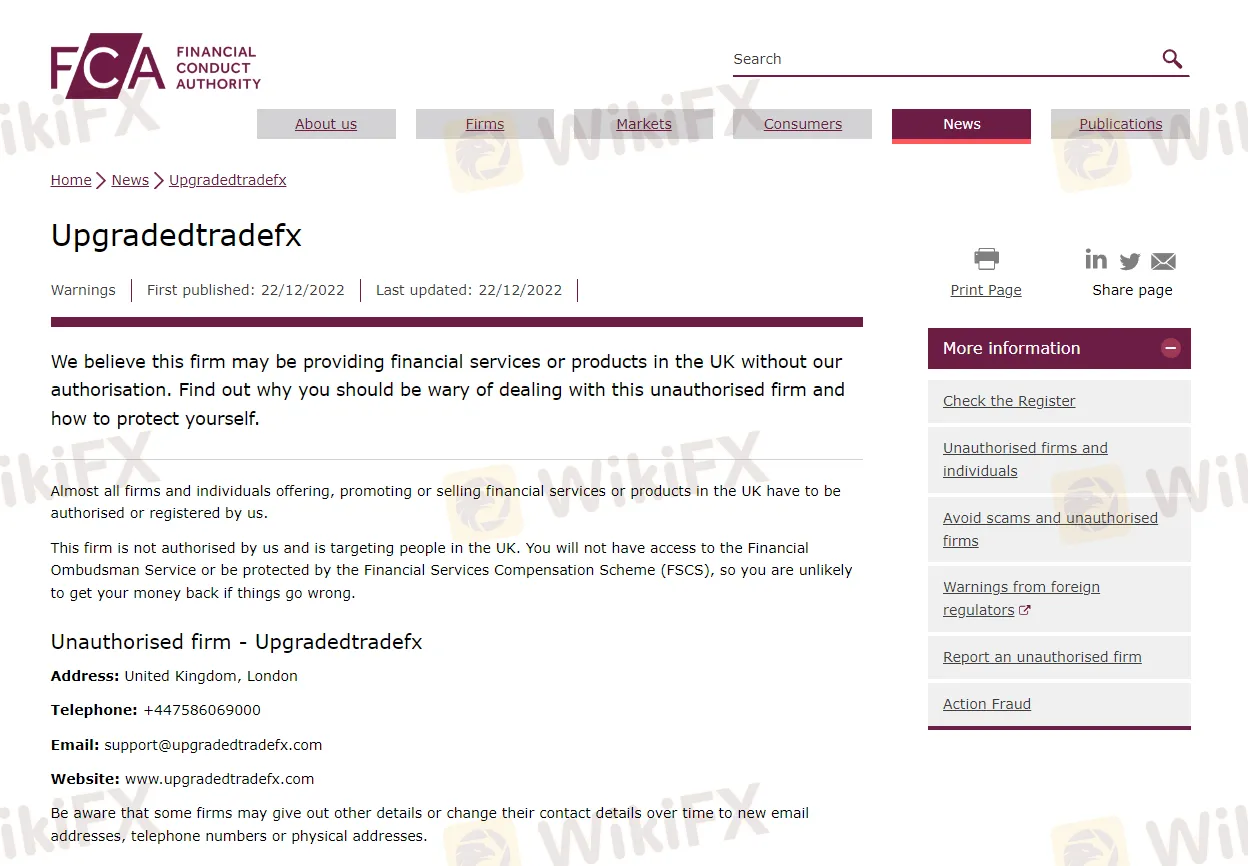

WikiFX Scam Alert: FCA Updates Blacklist of Unauthorized Brokers On Dec 22!!!

Abstract:The British regulator FCA has issued official warnings against more unauthorized brokers on December 22th!!!

Anyone who invests in the forex market has to bear some of the risk, but that is no reason for brokers to commit fraud. However, with the recent proliferation of broker fraud, the cases of fraud were also repeated. The British authorities receive different complaints of fraud on a daily basis and the FCA draws up a blacklist of scam brokers based on investor complaints, please kindly check the warning on the screenshot below.

According to the FCA, none of these brokers is authorized to offer financial services in the UK. In fact, the FCA has stated that these are not licensed brokers and therefore you would not be end to any protections. Such warnings prove with almost absolute certainty that a company is running some sort of scam – so refrain from choosing shady enterprises that have received the negative attention of reputable financial authorities like the FCA. The only way to be sure that your investment is in good hands and that you would be treated fairly and in accordance with all laws would be to turn to a licensed, legitimate broker.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oleg Mukhanov Steps Down as TradingView CEO Amid Leadership Shakeup

In a surprising announcement on Thursday, Oleg Mukhanov, who has been at the forefront of TradingView’s growth over the past few years, revealed his decision to step down as CEO. Mukhanov, who ascended to the role in January 2024 after joining the technology giant in mid-2022 as Group Chief Financial Officer, will continue to serve as an advisor to TradingView’s board.

Deutsche Bank Facing Record Fine from German Watchdog – What’s the Price

Germany's watchdog imposed a EUR 23.05 million penalty to Deutsche Bank AG for violating several regulatory requirements under German law. According to the Authority, the company breached organisational requirements under the German Securities Trading Act in connection with the sale of derivatives. In addition, its Postbank branch disregarded the obligation to record investment advice and repeatedly failed to comply with the requirements of the German Payment Accounts Act regarding the account switching service.

The Hidden Tactics Brokers Use to Block Your Withdrawals

In the fast-paced world of online trading, liquidity is everything. Traders and investors must have unrestricted access to their funds at all times. Any broker that imposes unnecessary conditions or delays when it comes to withdrawals is raising a glaring red flag.

Forex Trading: Scam or Real Opportunity?

Meta: Explore forex trading: Is it a scam or real opportunity? Learn how it works, debunk myths, manage risks, and avoid scams with tools like WikiFX App. Start trading safely today!

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Donald Trump’s Pro-Crypto Push Boosts PH Markets

Japan’s Shift in Crypto Policy and What It Means for Investors

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Currency Calculator