简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

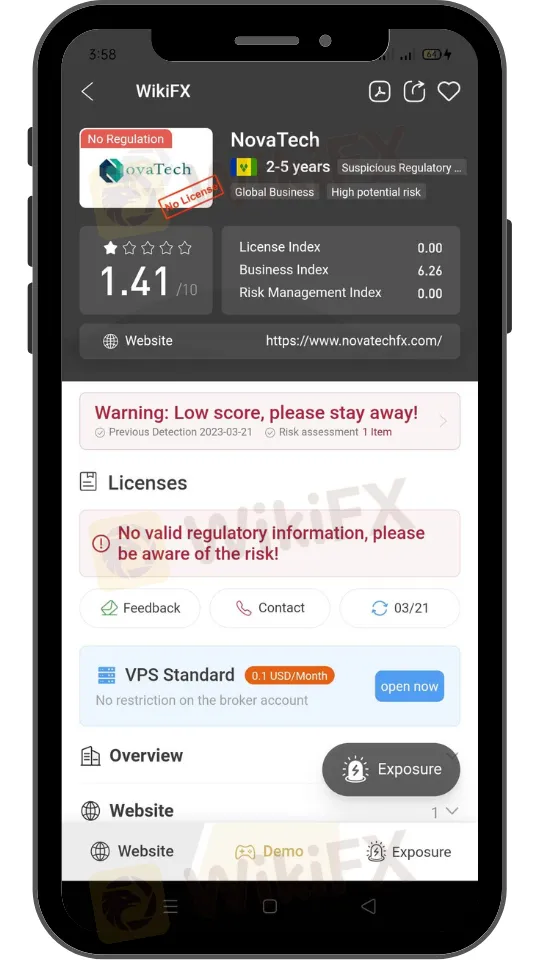

Unregistered Trading Platform Nova Tech Ltd Highlighted by Canadian Securities Regulators

Abstract:The public has been cautioned by the Canadian Securities Administrators (CSA) about Nova Tech Ltd (NovaTech), who claim that the business is not listed with any Canadian securities authority. As a consequence, NovaTech is not permitted to propose to deal in stocks or futures to anyone who resides in Canada

NovaTech may be in violation of provincial and territorial securities and derivatives law, including provisions related to unregulated trading and the illegal distribution of securities. The company appears to offer investment products and trading services through its website.

NovaTech announced a temporary freeze in trading account withdrawals for a period of 60 days on February 5, 2023. The reason for this freeze is unknown.

The Capital Markets Tribunal (Ontario) extended a cease trade order issued by the Ontario Securities Commission on March 2, 2023. The order requires NovaTech to temporarily cease all trading in any securities.

All individuals and businesses trading securities or derivatives, or providing investment advice in relation to securities and derivatives in Canada, including platforms facilitating trading of forex and crypto assets, must comply with applicable securities or derivatives legislation.

Investors should always check the registration of any person or business trying to sell them an investment or provide investment advice. This will help to ensure that they are dealing with legitimate, authorized individuals or businesses.

Canadian Securities Administrators' Role (CSA)

The Canadian Securities Administrators (CSA) is a group of financial officials from each of Canada's 13 provinces and regions. Its main responsibility is to supervise and control Canadian financial markets, ensuring that they are equitable, effective, and open.

The CSA works to safeguard clients by developing and implementing laws that support the securities industry's honesty, openness, and security. It also offers instruction and tools to assist clients in making educated choices.

The CSA's primary responsibility is to create and implement rules and laws for public businesses and stock agents. These laws cover financial filing obligations, transparency standards, and rules regulating market players' behavior. The CSA also checks conformance with these rules and, when appropriate, initiates disciplinary action.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

ThinkMarkets Expands Mobile Integration with TradingView

ThinkMarkets extends its services to TradingView's mobile app, enhancing access to markets with CFDs on currency pairs, stocks, and commodities.

Why Do Experienced Traders Care About Forex Spreads?

In Forex trading, even small fluctuations can make a significant difference, especially over the long term. One crucial factor that seasoned traders pay close attention to is the spread – the difference between the bid (selling) price and the ask (buying) price of a currency pair. While beginners may overlook its impact, experienced traders understand that spreads play a crucial role in trading costs, strategy selection, and overall profitability.

How Useful is Reviewing Last Year's Data for Trading Analysis?

Analyzing last year's trading data offers invaluable insights into market trends, helps refine trading strategies, and enhances decision-making for future trades.

Beginner 101: WikiFX’s Guide on How to Choose the Right Broker

For new traders entering the world of forex, choosing the right broker is one of the most crucial decisions they’ll make. A reliable broker can serve as a trusted partner, providing a platform that’s secure, transparent, and regulated. However, with thousands of options available, selecting the right broker can be overwhelming. That is why WikiFX is here to make things easy for you!

WikiFX Broker

Latest News

Beginner 101: WikiFX’s Guide on How to Choose the Right Broker

Why Do Experienced Traders Care About Forex Spreads?

ThinkMarkets Expands Mobile Integration with TradingView

Earn up to $500 with PU Prime

How Useful is Reviewing Last Year's Data for Trading Analysis?

Octa Survey Reveals: Most traders are engaged in charity

Bitcoin Surges Past $80,000 as Trump Backs Crypto in the USA

Currency Calculator