简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Sinks After Powell Speech and Yellen Testimony, Will US Dollar Rebound?

Abstract:The S&P 500 sank 1.6% on Wednesday in the aftermath of March’s Federal Reserve interest rate decision and accompanying press conference from Chair Jerome Powell.

S&P 500, US DOLLAR, JEROME POWELL, JANET YELLEN – ASIA PACIFIC MARKET OPEN:

The S&P 500 sank 1.6% in the aftermath of the Fed rate decision

Chair Jerome Powell tried pouring cold water on rate cut bets

Meanwhile, Janet Yellen testimony compounded risk aversion

Asia-Pacific markets appear to be bracing for volatility next

Asia-Pacific Market Briefing – Markets Reverse Gains on Fed Rate Decision

The S&P 500 sank 1.6% on Wednesday in the aftermath of Marchs Federal Reserve interest rate decision and accompanying press conference from Chair Jerome Powell. The central bank raised borrowing costs by 25 basis points, bringing the target range to 4.75% - 5%. Initially, markets welcomed the event as the statement noted that policymakers “anticipate” some extra firming might be appropriate.

That was cautiously downgraded from “ongoing increases” in the February statement, which was before Silicon Valley Bank collapsed earlier this month, triggering financial woes in the bank sector. But, markets turned after Jerome Powell noted that officials “just don‘t” see the case for rate cut this year. Since SVB’s bankruptcy, markets have been aggressively pricing in rate cuts this year.

A closer look reveals that median FOMC interest rate projections are still far more hawkish than what markets expect this year. Powell also stressed that if need be, they will raise rates higher than expected. The central bank also stressed that US banks are sound and resilient. Meanwhile, during Powells press conference, Treasury Secretary Janet Yellen was delivering testimony.

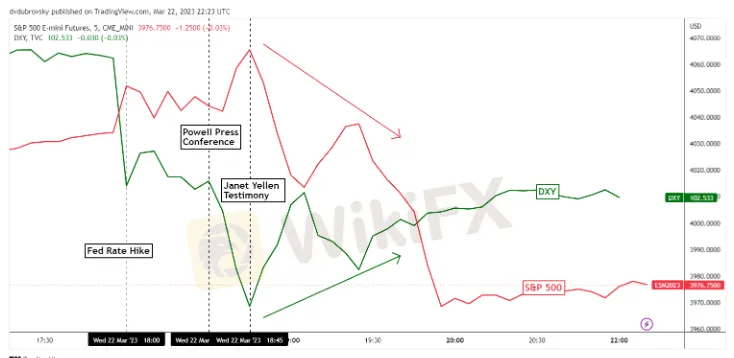

She noted that the government is not looking at offering “blanket” deposit insurance to stabilize the banking sector. This amplified selling pressure in regional banks, with First Republic Bank down over 15% by the end of the day. In the chart below, you can get a better idea of how price action evolved throughout these events and how the S&P 500 reversed and the US Dollar bottomed.

With that in mind, this is leaving Asia-Pacific markets vulnerable heading into Thursday‘s trading session. A lack of economic event risk is placing the focus on general market sentiment. As such, follow-through could dampen the mood for Japan’s Nikkei 225 and Hong Kongs Hang Seng Index. This may also offer some light for the US Dollar.

On the daily chart, the S&P 500 left behind a Bearish Engulfing candlestick. This followed what appears to have been a false breakout under a near-term falling channel from February. Further downside progress could open the door to resuming the downtrend. Immediate support is the 38.2% Fibonacci retracement level at 3938. Resistance is the 23.6% point at 4041.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

In the world of online trading, the promise of quick profits and seamless transactions often masks a darker reality. One of the most insidious tactics employed by fraudulent brokers is blocking withdrawals, that is a deliberate strategy designed to trap traders and investors into paying more money under false pretences.

Common Tactics Used in Online Trading Fraud Today

Know the top online trading scams of 2025, from fake apps to pump-and-dump tricks. Simple tips to spot and avoid them, keeping your money safe in this easy guide.

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

The Securities Commission Malaysia (SC) has updated its Investor Alert List for March 2025, warning the public about unlicensed investment schemes and fraudulent financial entities.

RM1.29 Million Lost in ‘C Baird VIP’ WhatsApp Scam

A 43-year-old company auditor and subcontractor in Malaysia became the latest victim of an elaborate investment scam after losing RM1.29 million to a fraudulent scheme promoted via WhatsApp.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

HTFX Spreads Joy During Eid Charity Event in Jakarta

How Will the Market React at a Crucial Turning Point?

Currency Calculator