简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How Can WikiFX Help Scam Victims?

Abstract:In the decentralized foreign currency market, it is easy for retail traders to become victims of scammers, especially brokers in disguise. Many are usually left in hopelessness and despair without knowing what to do next, especially when their broker(s) cut off communication.

Forex scams can have significant and long-lasting impacts on their victims, both financially and emotionally. Here are some of the impacts that victims of forex scams may experience:

Financial Losses: Forex scams can result in significant financial losses for victims. Scammers may convince victims to invest a large amount of money in fake trading schemes or managed accounts, only to disappear with the funds. Victims may also lose money through false trading signals, where they make poor investment decisions based on fraudulent information.

Emotional Distress: Victims of forex scams may experience emotional distress, including feelings of shame, embarrassment, anger, and depression. Many victims may feel a sense of betrayal and distrust towards the financial system and the people involved in the scam.

Legal Issues: Victims of forex scams may also face legal issues in their efforts to recover their lost funds. This can include dealing with legal fees, pursuing legal action against scammers or companies involved in the scam, or navigating the complexities of international law.

Damage to Reputation: Victims of forex scams may suffer damage to their reputation and credibility, especially if they are seen as knowledgeable investors or professionals in the financial industry. This can result in difficulties in securing future investment opportunities or job prospects.

As the impacts of forex scams can be devastating for their victims financially and emotionally, individuals need to be aware of the risks of forex scams and take measures to protect themselves from falling victim to these fraudulent activities.

If you have (unfortunately) been scammed by forex scammers, here are some steps that you can take:

Contact your bank or credit card company: If you made a payment to scammers using your credit card or bank account, contact your financial institution immediately and report the fraud. They may be able to help you recover some or all of the funds.

File a complaint with the regulatory agency: If the forex scammer is registered with a regulatory agency, you can file a complaint with them. The regulatory agency may be able to take action against the scammer or provide you with information on how to recover your lost funds.

Report the scam to law enforcement: Contact your local law enforcement agency and report the scam. They may be able to investigate the matter and take legal action against the scammer.

Seek legal assistance: Consult with a lawyer who specializes in investment fraud. They can advise you on the legal options and help you pursue legal action against the scammer.

Educate yourself: Educate yourself on how to avoid forex scams in the future. This can include learning how to identify common forex scams and being cautious when dealing with individuals or companies that promise high returns on investment.

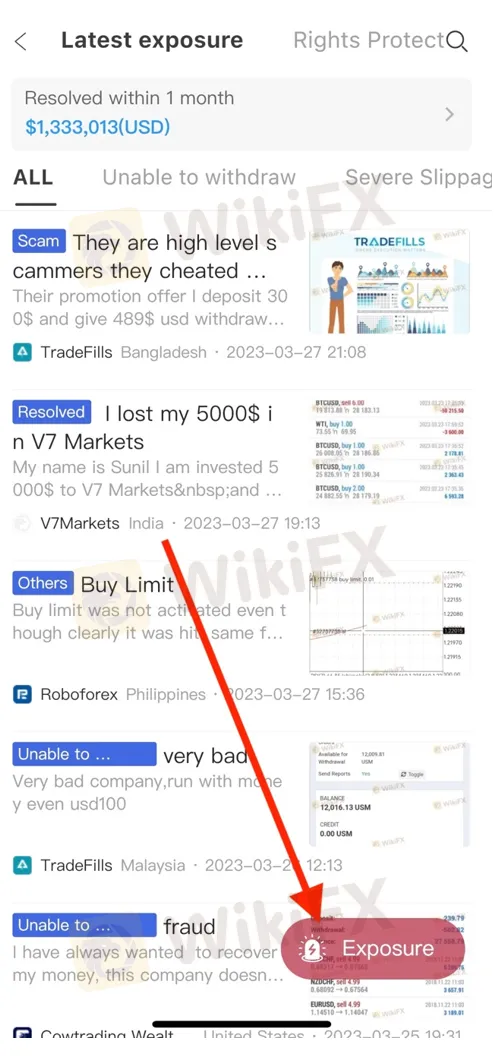

Get in touch with WikiFX through our Exposure page: https://exposure.wikifx.com/en/revelation.html

WikiFX is not just a global forex broker regulatory inquiry app, but we also play the role of a mediator in resolving disputes for trading clients that do not receive fair treatment from their forex brokers.

To date, WikiFX has helped over 13,400 people resolve their dispute cases. Within just a month, WikiFX had successfully resolved issues that amounted to 1.3 million USD – without any charges!

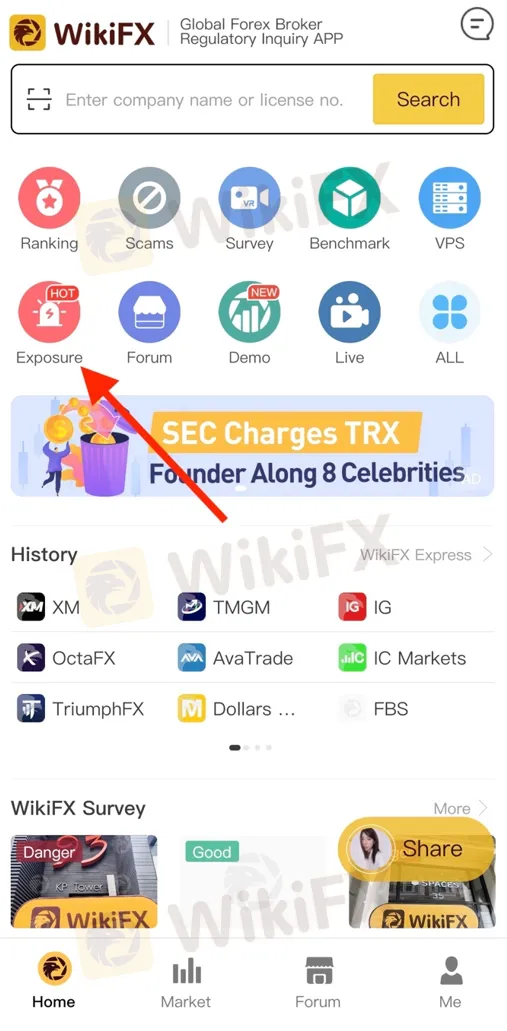

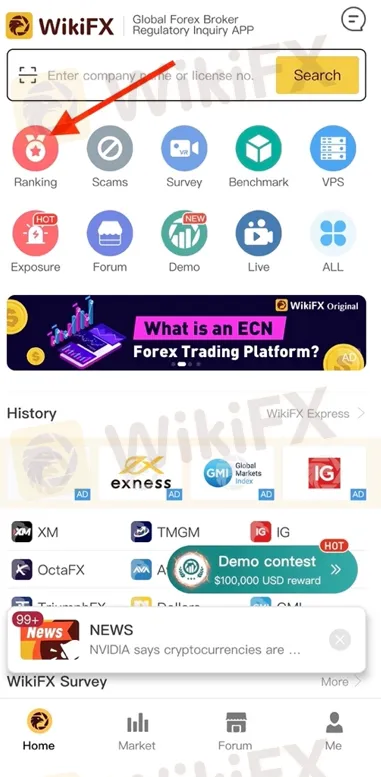

Download the free WikiFX mobile application on Google Play/App Store, then follow the steps as demonstrated below to report your case:

If you have any inquiries, don't hesitate to contact the WikiFX customer service team through the channels provided below. We would be glad to help you with anything related to your forex broker.

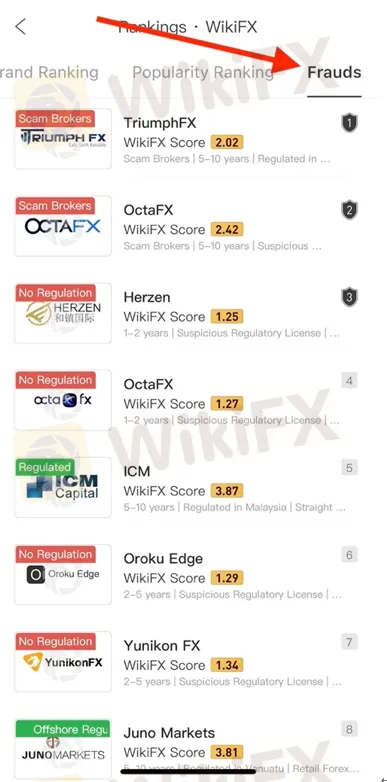

WikiFX also offers a “blacklist” of forex brokers that have been identified as potential scams. This list is based on customer feedback and information collected by WikiFX's research team. WikiFX hopes to help traders avoid falling victim to forex scams by publishing this information.

WikiFX provides educational resources for traders to help them identify and avoid forex scams. These resources include articles on common forex scams and tips on protecting yourself from fraudulent activities.

It is vital to take action immediately if you have been scammed by forex scammers. The longer you wait, the more difficult it may be to recover your lost funds. Remember to stay vigilant and protect yourself from falling victim to future scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

A finance manager in Malaysia lost more than RM364,000 after falling victim to an online investment scam that promised quick and high returns.

Experienced Forex Traders Usually Do This Before Making a Lot of Money

If you’ve ever wondered what sets successful forex traders apart from the rest, one thing is clear: experience teaches them never to rush into a trading relationship without doing their homework. Whether you're a seasoned trader or just starting out, the secret to long-term success in forex trading is a robust, well-informed decision when choosing a broker.

Broker Comparison: FXTM vs XM

Choosing the right broker is a critical decision for traders. This article compares FXTM and XM based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. We aim to present an unbiased overview so that you can choose the best broker suited to your needs.

What Can Forex Traders Learn from Ne Zha?

The animated blockbuster Ne Zha: Birth of the Demon Child tells the story of Ne Zha’s journey to defy fate and take control of his own destiny. Beyond being an inspiring tale filled with action and character growth, the film conveys profound life lessons - many of which resonate deeply with the world of forex trading.

WikiFX Broker

Latest News

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

The Rise and Risks of Forex Signal Apps: An In-Depth Analysis

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Currency Calculator