简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX September Exposure: Brokers With Reported Complaints

Abstract:September's WikiFX report exposes questionable activities of online forex brokers, highlighting the importance of thorough research before investing. Learn about brokers receiving negative feedback and tips to ensure a safe trading experience. Stay informed and protect your investments.

Introduction

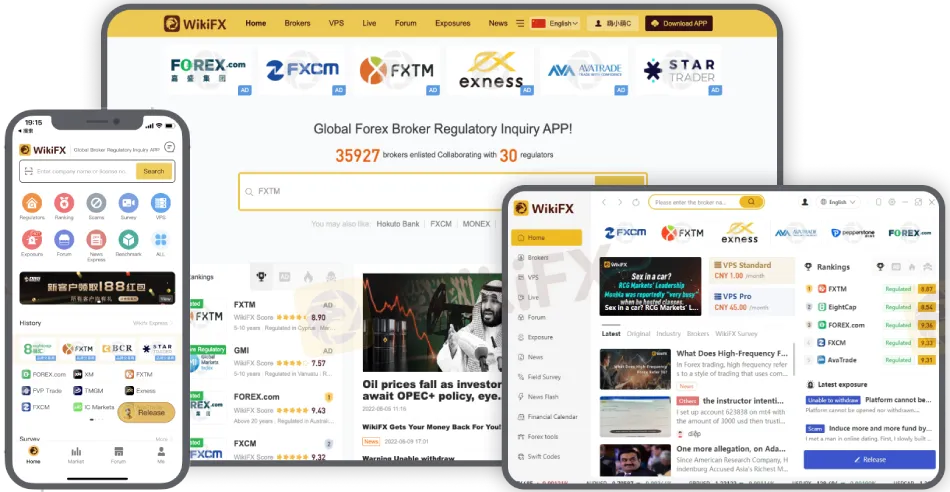

The online forex brokerage world is vast and intricate, brimming with numerous players that promise lucrative returns on investments. But, as with every investment avenue, there are potential risks, and one of them is falling prey to fraudulent brokers. WikiFX, a prominent app designed to verify the authenticity of online brokers, exposed several complaints in September, shedding light on brokers' dubious activities.

To the diligent people of the Philippines, please be warned: It's essential to do thorough research before investing in any online broker. Here's a look at some brokers who have garnered negative feedback this month.

List of Brokers

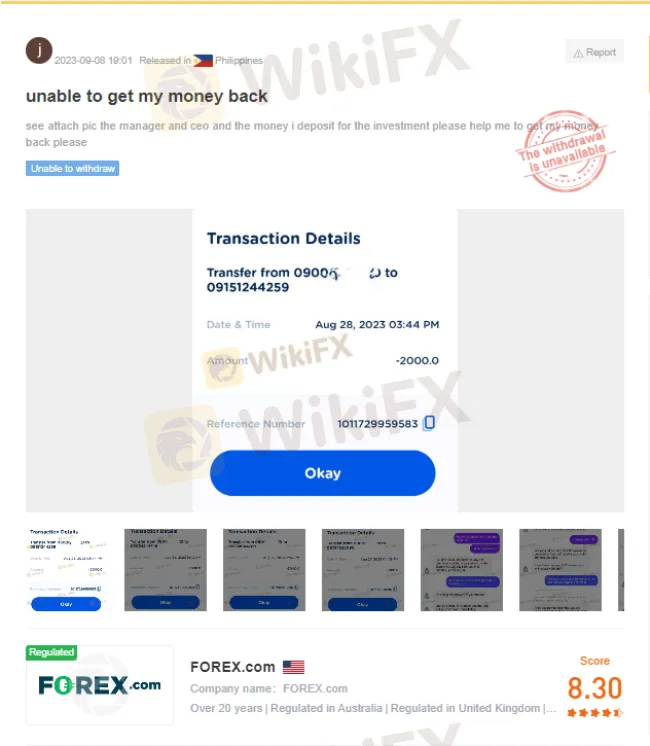

1. Forex.com

Case: Withdrawal Unavailable

The client made a distressing report that not only was withdrawal from their account unavailable, but also there was a lack of communication from the broker's manager and CEO. The plea was simple: “Help me get my money back.”

2. Coral FX

Case: Withdrawal Issue (Resolved by WikiFX)

A user reported a hitch while attempting to withdraw their funds. To add to the quandary, Coral FX demanded a substantial fee for processing the profits. Thankfully, with the intervention of WikiFX Support, the situation was resolved. However, the underlying concern is evident - the unforeseen charges imposed by the broker.

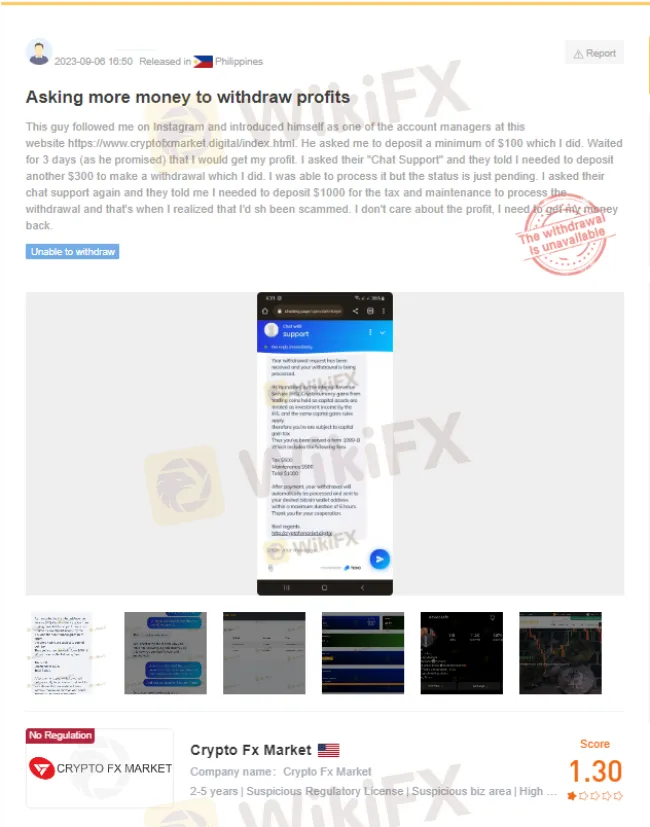

3. Crypto FX Market

Case: Additional Funds Needed for Withdrawal

Here, a client narrates their unfortunate experience with a broker found via Instagram. After making an initial deposit and being promised profits in a short span, the broker demanded more money under the guise of various fees to allow withdrawals. Every query to their chat support led to a demand for additional money. The client's realization? They'd been ensnared in a scam.

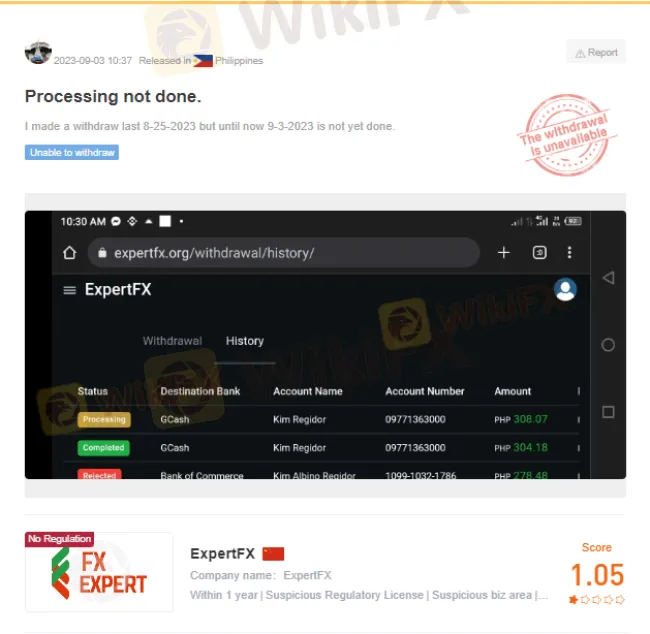

4. ExpertFX

Case: Withdrawal Delay

A user lamented about the prolonged delay in processing their withdrawal. A transaction initiated on August 25, 2023, still hadn't seen the light of day by September 3, 2023. Such elongated processing times can be incredibly distressing for investors.

Choosing the Right Broker

Every broker presents itself as the best, offering enticing incentives, rewards, and guarantees of high returns. But how do you differentiate between genuine offers and honey-traps? Here's where due diligence comes in. Before parting with your hard-earned money, take a moment to research the broker:

Reputation: Look for reviews and feedback from other users. Platforms like WikiFX catalog user experiences, providing invaluable insights into broker practices.

Regulatory Status: Ensure the broker is regulated by a recognized financial authority. Regulation not only adds legitimacy but also provides a recourse in case things go south.

Transparency: Genuine brokers maintain transparency in their operations. Hidden fees, sudden charges, and unexplained delays can be red flags.

Communication: Reliable brokers prioritize customer communication. If your broker is evasive or doesn't address your concerns, it's a sign to be cautious.

Remember, the world of online trading can be rewarding, but only when navigated wisely. By taking these initial steps of investigation and utilizing tools like the WikiFX App, you can protect your investments and avoid the pitfalls that many unsuspecting traders fall into. Equip yourself with knowledge, and your trading journey will be both safer and more profitable.

Conclusion

While these are just a few examples, they underscore the importance of vigilance when choosing an online forex broker. For those in the Philippines, or anywhere else for that matter, it's crucial to remember: Always verify a broker's license and regulatory status, ideally through reliable sources like the WikiFX App.

Be informed, stay safe, and protect your hard-earned money. The realm of online trading offers many opportunities, but it's vital to tread with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

President of Liberland Vít Jedlička Confirms Attendance at WikiEXPO Hong Kong 2025

Vít Jedlička, President and Founder of the Free Republic of Liberland, has confirmed his participation in WikiEXPO Hong Kong 2025, one of the most influential Fintech summits in the industry. The event will bring together global leaders, innovators, and policymakers to delve into the future convergence of technology and society.

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

Do This ONE Thing to Transform Your Trading Performance Forever

The story is all too familiar. You start trading with high hopes, make some quick profits, and feel like you've finally cracked the code. But then, just as fast as your gains came, they disappear. Your account balance dwindles, and soon you’re left wondering what went wrong. Worse still, fear and confusion creep in, making every new trade a stressful gamble rather than a calculated decision. If this cycle sounds familiar, you’re not alone.

This FREE App Is Helping Millions Avoid Financial Scams

Fraudulent brokers, Ponzi schemes, and deceptive trading platforms are on the rise, making it increasingly difficult to distinguish between legitimate and illicit financial services. Fortunately, there’s a powerful, free tool designed to help users identify and avoid scams before it’s too late—WikiFX.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator