Overview of VAST

Founded in 2018, VAST SCENERY COURT GROUP LIM, commonly known as VAST, is a UK-based forex and CFD broker that provides online trading services to clients globally. The broker offers trading on a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies, through the popular MetaTrader 4 trading platform. The company prides itself on offering competitive spreads, fast and reliable trade execution, and a range of trading platforms to suit the needs of different traders. VAST also provides a variety of account types and funding options, making it accessible to traders of all levels and backgrounds.

Besides, the broker aims to provide excellent customer support through a variety of channels, including phone, email, and live chat.

However, in fact, VAST appears to only offer trading in foreign exchange markets, limiting the range of instruments available for investment. This lack of diversity in investment options may be a turnoff for traders looking to expand their portfolios.Furthermore, the VAST website offers little information about the company's history, leadership, or trading policies. This lack of transparency may make some traders wary of working with the company. Lastly, VAST does not appear to offer much in the way of educational resources or training materials for traders. This could be a disadvantage for novice traders looking to learn more about the industry or develop their skills.

Pros & Cons

The following table provides an overview of the pros and cons of VAST Scenery Court Group Limited. It highlights the key strengths and weaknesses of the company, as well as the potential opportunities and threats for traders considering using their services. By weighing these factors, individuals can make an informed decision about whether or not VAST is the right broker for them.

Is VAST legit or a scam?

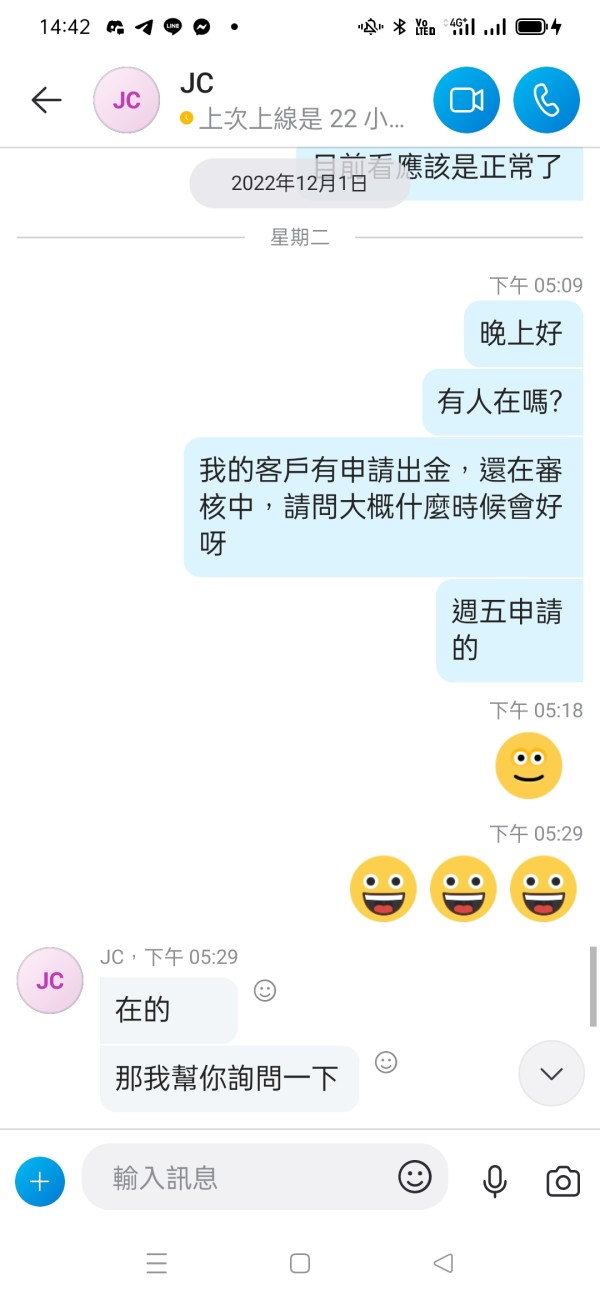

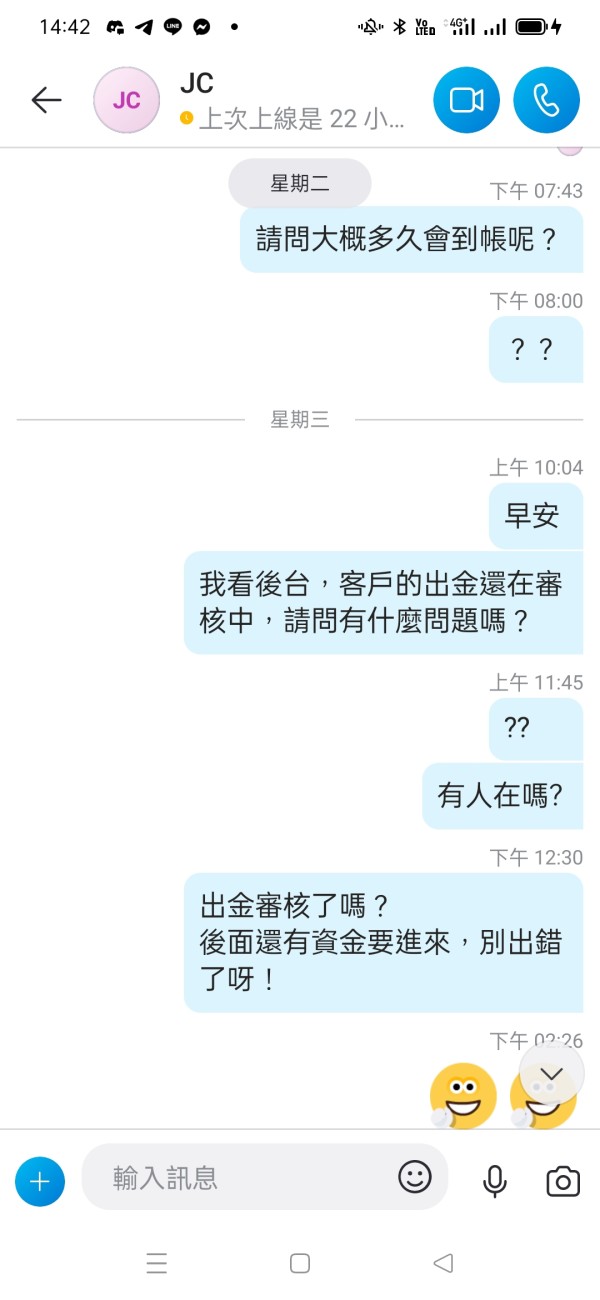

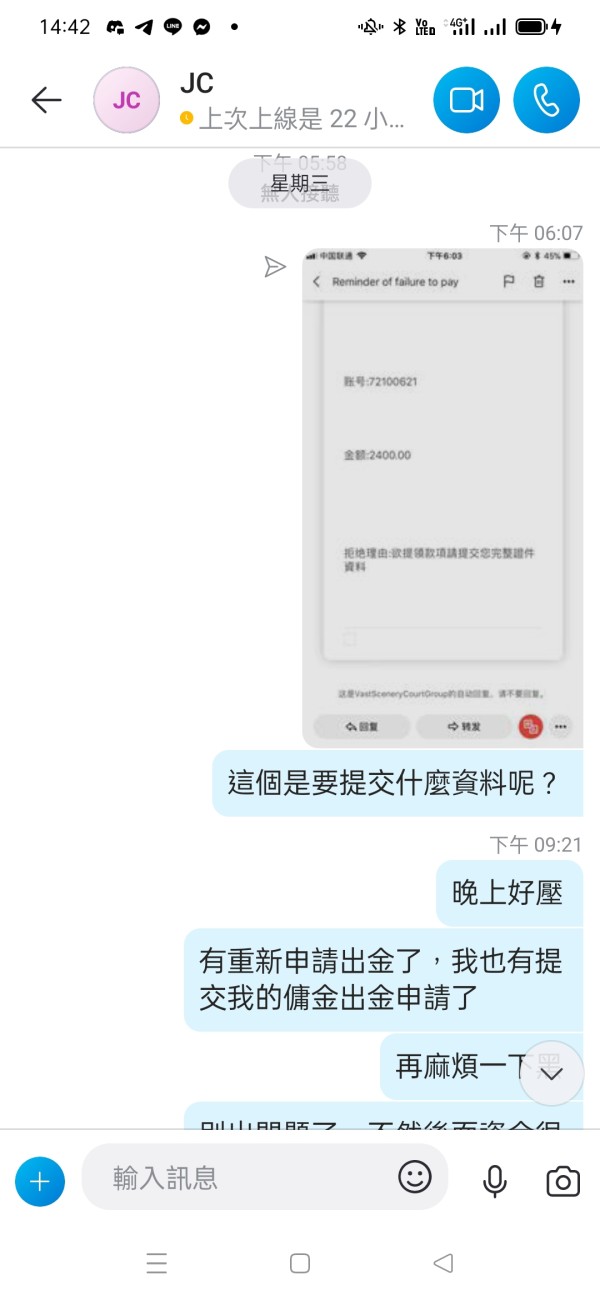

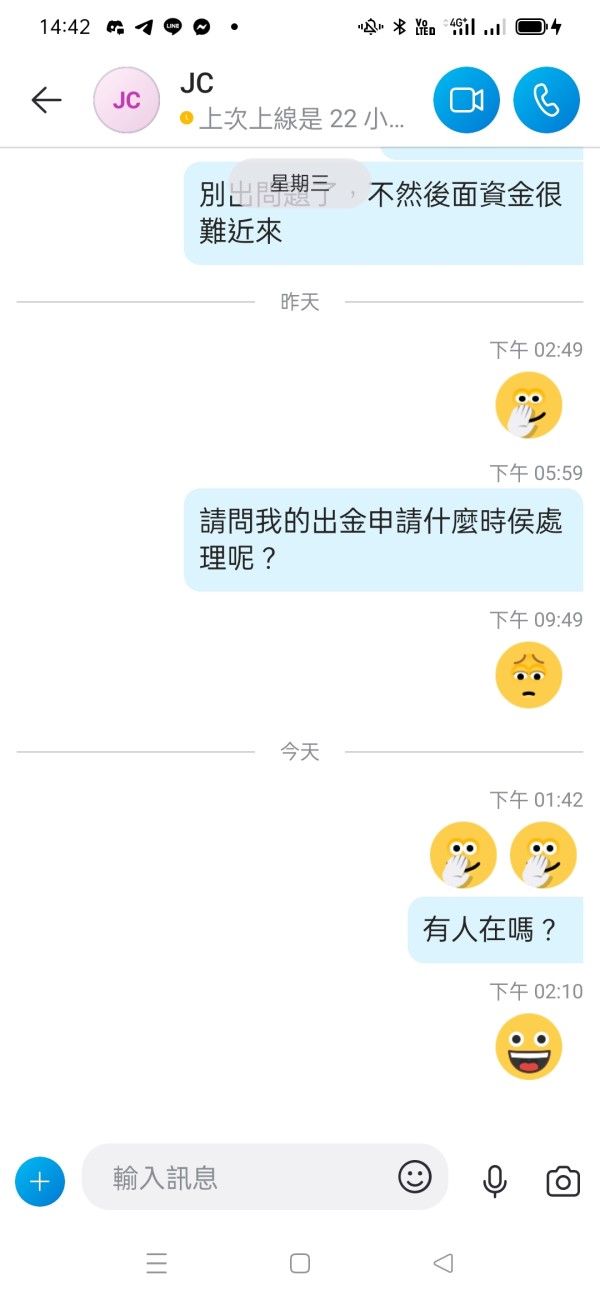

As VAST SCENERY COURT GROUP LIMITED is not a regulated entity, it is important for potential clients to exercise caution when considering this broker. The lack of regulation means that there is no oversight from a reputable authority to ensure that VAST operates fairly and transparently. Additionally, some online reviews have raised concerns about the legitimacy of the company, which should also be taken into consideration. It is important for individuals to conduct their own research and due diligence before deciding whether or not to use the services of VAST.

We can see clearly that although VAST is registered with the UK's Companies House, it is not regulated by any financial authorities or agencies, especially the FCA authority, which is a red flag.

Market Instruments

As per the information available on the VAST website, the broker offers its clients a range of financial instruments for trading. These instruments include:

Forex: VAST offers trading in more than 45 currency pairs, including major, minor, and exotic currency pairs.

Metals: Traders can also trade gold and silver with VAST.

Indices: The broker provides trading in a range of global indices, such as US30, UK100, GER30, and JPN225.

Energy: VAST offers trading in crude oil and natural gas.

Cryptocurrencies: The broker provides traders with the opportunity to trade cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

VAST Leverage

When it comes to leverage, VAST provides its clients with the opportunity to trade on margin with a maximum leverage of up to 1:500, which can magnify potential gains, but also increase the risk of significant losses. While leverage can provide traders with the opportunity to increase their market exposure and potentially generate higher returns, it's crucial to exercise prudence when using high leverage. The reason being, high leverage can magnify market volatility, resulting in significant gains or losses. If trades move against the trader, it could potentially lead to margin calls, making the trader liable for additional funds to cover their position.

VAST Account Types

VAST offers traders the choice between two account types: a demo account and a live account. The demo account allows traders to practice and test their strategies in a risk-free environment before they decide to commit real funds. On the other hand, the live account is designed for traders who are ready to dive into the markets with real money.

Opening a live account with VAST is made affordable for traders with a minimum deposit requirement of only $50. This competitive feature enables traders to gain access to the financial markets without breaking the bank. Compared to industry standards, VAST's minimum deposit requirement is significantly lower, which makes it an attractive option for novice traders who are just starting their journey in trading. Moreover, VAST's low deposit requirement provides an opportunity for traders to test the waters and experiment with their trading strategies in a live trading environment without having to commit a significant amount of funds.

Spreads & Commissions (Trading Fees)

VAST offers variable spreads on its trading instruments, which can fluctuate depending on market conditions. The spreads for major currency pairs start from 2 pips, which is competitive compared to other brokers in the industry. However, it's important to note that VAST charges a commission on each trade, which is added to the spread. The commission varies depending on the trading instrument, with some instruments having a higher commission than others.

Traders should consider both the spread and commission when calculating the cost of trading with VAST. The overall trading costs can add up, especially for high-volume traders.

Overall, VAST appears to maintain a degree of secrecy when it comes to disclosing its spreads, which may present a challenge for traders who value transparency and prefer to have a clear understanding of the costs associated with trading.

Looking for a comparison of spreads on popular trading instruments? Look no further! We've put together a table that shows the spreads offered by top-notch brokers such as VAST, FXTM, and XM on EUR/USD, GOLD, and BTC:

Non-Trading Fees

VAST charges non-trading fees that can contribute to their overall trading costs. While the broker does not charge any deposit or withdrawal fees, traders should note that some payment methods may incur fees from third-party providers. Additionally, VAST does not charge any inactivity fees, allowing traders to take a break from trading without worrying about additional costs.

On the other hand, VAST's overnight swap rates may be higher than those of other brokers, which can impact the cost of holding positions overnight. Traders should also be aware of the potential for currency conversion fees when making deposits or withdrawals in a currency other than their account's base currency.

Trading Platforms

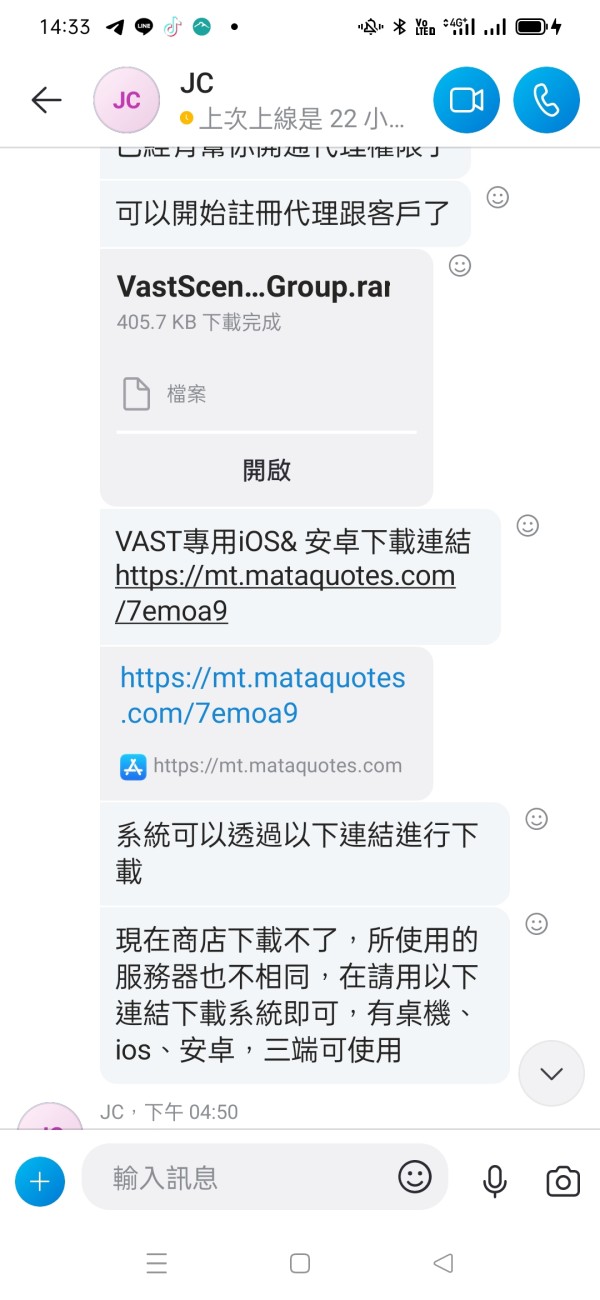

VAST offers two choices of trading platforms to cater to different types of traders. The most popular and widely used platform is MetaTrader 4 (MT4), which is known for its user-friendly interface and advanced charting capabilities. MT4 also has a large community of traders who have developed custom indicators and trading robots, which can be easily downloaded and used by VAST traders.

In addition to MT4, VAST also offers its own proprietary trading platform, which is web-based and can be accessed from any device with an internet connection. This platform offers a range of advanced trading tools and features, including one-click trading, real-time market news, and customizable trading indicators.

Explore the chart below to compare the trading platforms offered by VAST, FP Markets, and IC Markets:

Deposits and Withdrawals

When it comes to deposits and withdrawals, VAST's website does not explicitly state the payment methods it accepts. However, it is common for forex brokers to offer a range of payment options, including bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller.

While the lack of transparency on VAST's payment methods may be concerning some traders, it's important to note that deposit and withdrawal processes can vary depending on factors such as the trader's country of residence and the payment method they choose. Therefore, it's recommended that traders reach out to VAST's customer support for more information on payment options.

Furthermore, it's worth noting that deposit and withdrawal fees can also vary depending on the payment method and the broker. Some brokers may offer free deposits and withdrawals for certain payment methods, while others may charge fees. Therefore, it's important to consider these costs when selecting a broker and payment method.

Customer Support

When it comes to customer support, VAST provides a few channels through which traders can get in touch with their team. Traders can reach out to the broker's customer support team via phone or email, both of which are reliable and straightforward means of communication. However, some traders may find it inconvenient that VAST doesn't offer live chat support, which has become a popular and convenient way of getting assistance quickly in the forex industry.

Another potential drawback is that VAST's customer support is not available 24/7, which may be inconvenient for traders in different time zones. Additionally, the broker's website lacks a comprehensive FAQ section, only some basic FAQs listed, which may limit clients' ability to find answers to common questions on their own.

Educational Resources

Upon thorough examination of the information provided on VAST's website, it is evident that the broker does not offer an extensive array of educational resources for traders. In contrast to other brokers in the industry that provide a vast range of learning materials, VAST's educational resources seem to be limited to basic trading guides and market analysis articles. Unfortunately, there are no webinars, video tutorials, or interactive courses available to help traders enhance their knowledge and skills. This lack of educational resources could potentially be a disadvantage for novice traders who are seeking comprehensive guidance and support from their brokers.

Conclusion

In conclusion, VAST is a relatively new forex broker that offers some trading instruments, competitive leverage, and low minimum deposit requirements. The broker's trading platforms are easy to use and offer a variety of features that can cater to both novice and experienced traders. However, VAST's lack of transparency on spreads and non-trading fees, limited customer support options, and minimal educational resources may be a drawback for some traders. Overall, VAST may be a suitable choice for traders looking for a simple and accessible trading experience, but those seeking more comprehensive services may want to explore other options in the market.

FAQs

A: VAST is a forex and CFD broker that offers trading services in a variety of financial instruments, including forex, commodities, indices, and cryptocurrencies.

A: VAST offers the popular trading platform MetaTrader 4 (MT4) for desktop, web, and mobile devices.

A: VAST offers two types of trading accounts, a demo account and a live account. The minimum deposit for the live account is $50.

A: Yes, VAST offers leverage for trading, with a maximum leverage of 1:500

Q: What are the deposit and withdrawal methods available with VAST?

A: VAST does not disclose the payment methods available on its website. Please contact their customer support for more information.

Q: Does VAST offer educational resources for traders?

A: While VAST provides some basic trading guides and market analysis articles, there are no webinars, video tutorials, or interactive courses available.

Q: What customer support options are available with VAST?

A: VAST offers customer support via phone and email, but does not offer live chat support.