Overview of KCM

KCM is a trading company founded in 2012 and is registered in Saint Vincent and the Grenadines. Despite being unregulated, it offers a range of trading options on its proprietary KCM trading platform, including CFDs, forex, commodities, indices, and stocks.

The firm requires a minimum deposit of $100 with spreads starting as low as 0 pips. They provide a personal account type for traders and also offer a demo account for potential clients to familiarize themselves with the platform. Customers can reach KCM's support via phone and email.

Deposits and withdrawals can be conducted through credit/debit cards or bank transfers, and for traders seeking insights, the company offers analytical educational resources.

Is KCM Trade Legit or a Scam?

KCM is unregulated, indicating it does not function under the purview of any recognized financial regulatory body. While the platform offers trading opportunities in assets like CFDs, forex, commodities, indices, and stocks, it may not conform to specific legal or ethical standards set for trading platforms in certain jurisdictions.

As such, potential investors are advised to tread cautiously. It is imperative to undertake thorough research or seek advice from a financial expert before engaging with unregulated entities.

The absence of regulation may pose challenges like difficulty in resolving conflicts, lack of compensation mechanisms if the platform goes bankrupt, and an increased vulnerability to deceptive practices.

Pros and Cons

Pros of KCM:

Diverse Trading Options: KCM offers a wide range of tradable assets including CFDs, forex, commodities, indices, and stocks.

Low Entry Barrier: With a minimum deposit of just $100 and spreads as low as 0 pips, KCM makes it accessible for many traders to begin trading.

User-Friendly Platform: KCM's proprietary trading platform can be an advantage for those looking for a unique and tailored trading experience.

Educational Resources: The company offers analytical educational resources, which can be beneficial for both novice and experienced traders.

Demo Account: The availability of a demo account allows potential traders to get a feel for the platform before committing real funds.

Cons of KCM:

Unregulated: The absence of regulation could pose potential risks such as challenges in dispute resolution and vulnerability to deceptive practices.

Lack of Oversight: Being unregulated means KCM doesnt adhere to a specific jurisdiction's trading guidelines, potentially exposing traders to unforeseen risks.

Potential for Financial Loss: Without access to compensation schemes in case of the platform's insolvency, users might be at a greater risk of financial losses.

Single Account Type: Offering only a personal account type might limit the flexibility for different types of traders or investment strategies.

Limited Customer Support Channels: While KCM offers phone and email support, the absence of live chat or 24/7 support might be a drawback for some traders.

Market Instruments

KCM furnishes traders with an array of market instruments, granting them the ability to engage in a multifaceted trading environment that spans multiple asset categories. Let's delve deeper into KCM's market instruments:

Forex (Foreign Exchange):

Currencies: KCM invites traders to the expansive world of forex, where they can engage with major, minor, and perhaps even exotic currency pairs, leveraging the volatility of the global currency markets to their advantage.

CFDs (Contracts for Difference):

Contractual Trading: KCM's platform enables traders to venture into the realm of CFDs, which allow them to speculate on the price movement of underlying assets without actually owning them, offering a distinctive way to capitalize on market fluctuations.

Commodities:

Broad Spectrum Resources: With KCM, traders can invest in an array of commodities, which may cover both hard commodities such as metals and energy, as well as soft commodities like agricultural products, creating avenues for diversified trading strategies.

Indices:

Market Indicators: Traders can harness the dynamics of major global stock indices, speculating on their movement and tapping into the broader market trends and shifts.

Stocks:

Equities Market: KCM provides a gateway into the stock market, granting traders the possibility to speculate on the performance of individual companies, thus adding another layer of potential investments.

Through KCM, traders are presented with diverse platforms to probe and invest across various financial markets. It's essential to underscore that venturing into these markets carries intrinsic risks.

Account Types

Kanak Capital Markets (KCM) offers three distinct account types to cater to the varied needs of traders:

Silver Account: The Silver Account at Kanak Capital Markets (KCM) offers an instant execution mode and allows traders to engage with assets such as Forex, Energy, and Stocks. It provides a high leverage of 500, requires a minimum deposit of $2,500, and has a stop out level set at 30%. Notably, this account type does not come with a Personal Account Manager.

Gold Account: KCM's Gold Account operates with market execution and encompasses tradable assets like Forex, Energy, and Stocks. The leverage stands at 500, and traders need to make a minimum deposit of $5,000 to activate this account. The stop out level for the Gold Account is 30%, and an added advantage is the inclusion of a Personal Account Manager to assist traders.

Platinum Account: The Platinum Account, a premium offering by KCM, follows market execution and provides access to Forex, Energy, and Stocks trading. With a leverage of 500, this account demands a significant minimum deposit of $50,000. The stop out is slightly lower at 20%, ensuring more safety for traders. To enhance the trading experience, this account comes equipped with a Personal Account Manager.

How to Open an Account?

Opening an account with KCM can typically be broken down into a few fundamental steps. Here's a general guideline on how one might go about it:

Visit the Official Website: Begin by navigating to KCM's official website. Look for the “Sign Up” or “Open Account” button, which is usually prominently displayed on the homepage.

Fill Out the Registration Form:Upon clicking the sign-up button, you'll be directed to a registration form. Provide all the necessary personal details such as your name, email address, phone number, and any other required information.

Submit Verification Documents:For security and compliance purposes, many trading platforms require you to verify your identity. This might involve uploading scanned copies of identification documents like a passport, driver's license, or utility bill to confirm your residence.

Fund Your Account: Once your account is verified, you'll need to deposit funds to begin trading. Navigate to the “Deposit” section, select your preferred payment method (e.g., credit/debit card, bank transfer), and follow the on-screen instructions to add funds.

Start Trading:With your account funded, you can now access the KCM trading platform. Familiarize yourself with the interface, choose your desired market instruments, set up your trading parameters, and commence your trading journey.

Leverage

Kanak Capital Markets (KCM) offers a consistent leverage across its account types. Whether traders opt for the Silver, Gold, or Platinum account, they can access a substantial leverage of 500. This high leverage allows traders to control larger positions with a relatively smaller capital, potentially amplifying both potential profits and losses. As always, traders should exercise caution and understand the associated risks when utilizing such high leverage.

Spreads & Commissions

KCM advertises spreads “as low as 0 pips”, but it remains ambiguous whether this applies uniformly across all trading assets or is specific to certain ones. Spreads, representing the difference between the bid and ask prices, are crucial costs for traders.

While a zero-pip spread is enticing, especially for forex traders, its applicability to other assets is not explicitly mentioned.

Moreover, KCM hasn't provided detailed information on spread structures for different assets or any associated commission fees on their website. Given the importance of these factors in determining trading costs, traders are advised to exercise caution and thoroughly evaluate before making decisions.

Trading Platform

KCM offers a high-performance trading platform that is available for download and can be accessed from anywhere, anytime. This platform is versatile and accommodates a range of devices, including Android, App Store (iOS), and Windows operating systems.

The KCM trading platform emphasizes user adaptability and performance, enabling traders to engage with the financial markets seamlessly whether they are on the move or stationed at their desks. While specific features of this platform were not detailed, it's evident that the emphasis is on flexibility, efficiency, and accessibility.

Given its cross-platform compatibility, traders can expect a uniform trading experience with comprehensive tools and functionalities, irrespective of the device they use.

Deposit & Withdrawal

Kanak Capital Markets (KCM) offers a straightforward depositing process. Traders can fund their accounts by logging in, selecting 'Deposits', and following the given instructions. While several deposit methods are available, some might come with charges. KCM accepts bank transfers in currencies like USD, AED, EUR, GBP, and CHF without any fees, but one's bank might impose charges. Transfers should come from an account under the client's name. With a minimum deposit of $2500, KCM is accessible to many traders. It's essential to review KCM's policies and, due to its unregulated status, proceed with caution in all transactions.

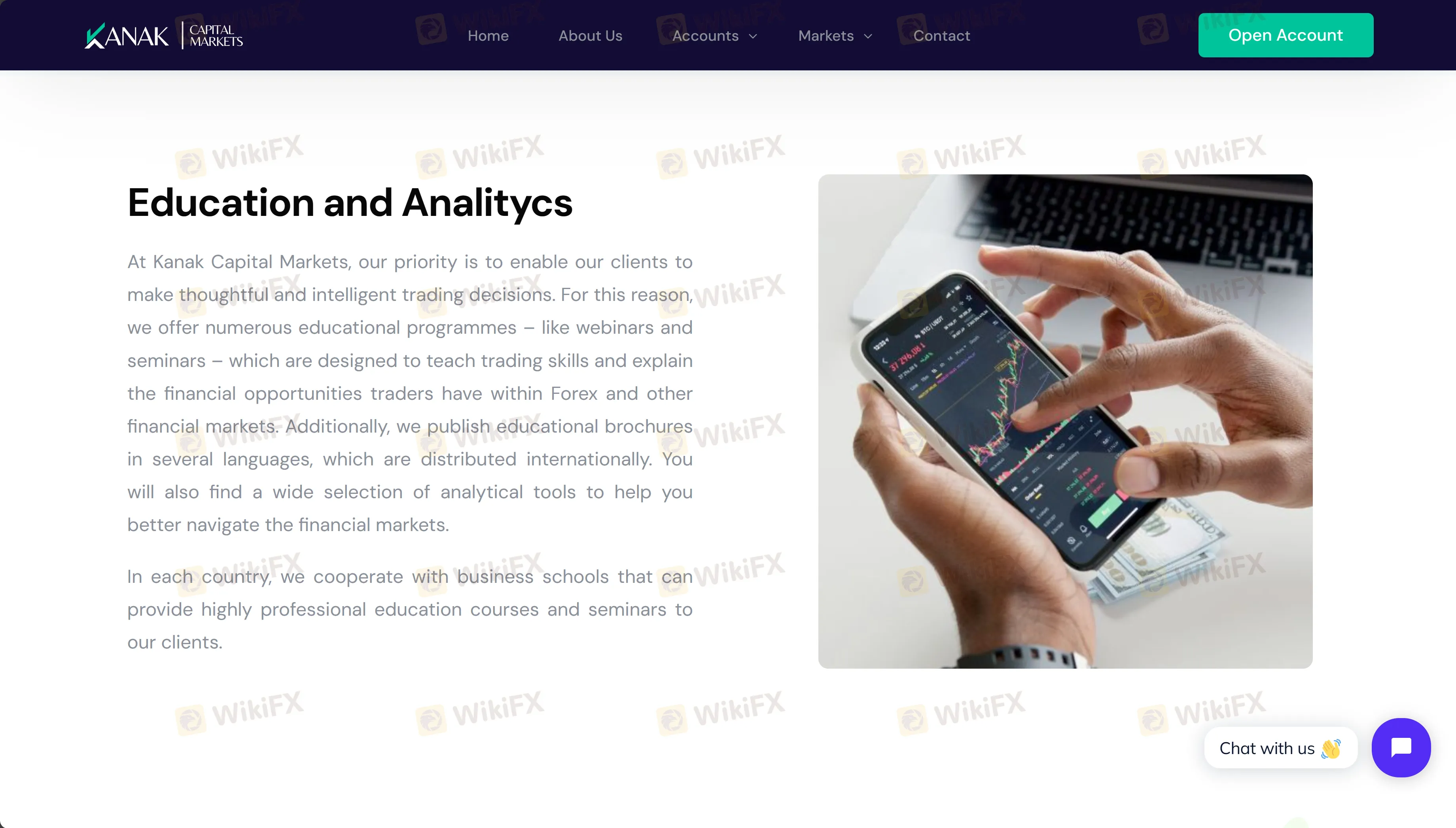

Educational Resources

Kanak Capital Markets (KCM) places a significant emphasis on educating its clients to foster informed and strategic trading decisions. They offer a range of educational programs, including webinars and seminars, specifically tailored to enhance trading skills and elucidate the financial prospects available in Forex and other markets. To further support traders globally, KCM disseminates educational brochures in multiple languages. Additionally, an array of analytical tools is available to aid traders in effectively navigating the financial markets. In various countries, KCM collaborates with esteemed business schools to deliver high-quality educational courses and seminars, ensuring clients receive a comprehensive and professional trading education.

Customer Support

Kanak Capital Markets LLC (KCM) has established a robust customer support infrastructure to cater to the needs and queries of both prospective and existing clients. One can reach out to their support team through email at info@kanakmarkets.com for inquiries regarding account details, trading activities, or any technical challenges.

Additionally, for those looking for immediate or direct assistance, KCM has provided a phone support line at +44 7397 943999. This facilitates real-time communication and allows for swift resolutions to any issues or concerns. As always, individuals are advised to approach with due diligence, especially considering the platform's specific jurisdiction.

Further details, resources, and updates can be found on the company's official website at https://kanakmarkets.com/, as well as their social media channels on Twitter, Facebook, Instagram, YouTube, and LinkedIn.

Conclusion

Kanak Capital Markets LLC (KCM) offers a comprehensive trading experience, emphasizing client education and robust customer support. With diverse communication channels, including email and phone, they ensure clients have ready access to assistance when required.

Additionally, their presence on multiple social media platforms suggests an effort to maintain transparency and engage with their user base actively. As with all trading platforms, potential users should conduct thorough research and due diligence before engaging, especially considering the platform's jurisdiction.

FAQs

Q: What trading instruments does KCM offer?

A: KCM provides trading opportunities in Forex, Energy, and Stocks, among other financial markets.

Q: How can I contact KCM's customer support?

A: You can reach KCM's support team through email at info@kanakmarkets.com or by phone at +44 7397 943999. They also have active social media profiles for additional engagement and support.

Q: What is the minimum deposit to start trading with KCM?

A: The minimum deposit varies depending on the account type. For the Silver account, it's $2500; for the Gold account, it's $5000; and for the Platinum account, it's $50000.

Q: Is Kanak Capital Markets LLC (KCM) a regulated platform?

A: KCM is registered in Saint Vincent and the Grenadines. However, it's essential to verify if KCM holds any specific regulatory licenses in the region or any other jurisdiction.

Q: What leverage does KCM offer to its traders?

A: KCM provides a leverage of up to 500x for its Silver and Gold account types. However, leverage can magnify both potential profits and potential losses, so traders should use it judiciously.