简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is FTX Really Giving Money Back?!

Abstract:As FTX, the cryptocurrency exchange, initiates the opening of its claim window amidst insolvency, it finds itself embroiled in controversy, facing user discontent over the alleged undervaluation of major crypto assets and triggering discussions about legal ramifications and financial restitution.

In the latest developments surrounding the once-prominent cryptocurrency exchange FTX, now undergoing insolvency proceedings, the platform has initiated the claims process for creditors seeking to recover their digital assets. However, FTX finds itself under scrutiny on social media, with users expressing discontent over the perceived undervaluation of major crypto assets in comparison to their current market prices.

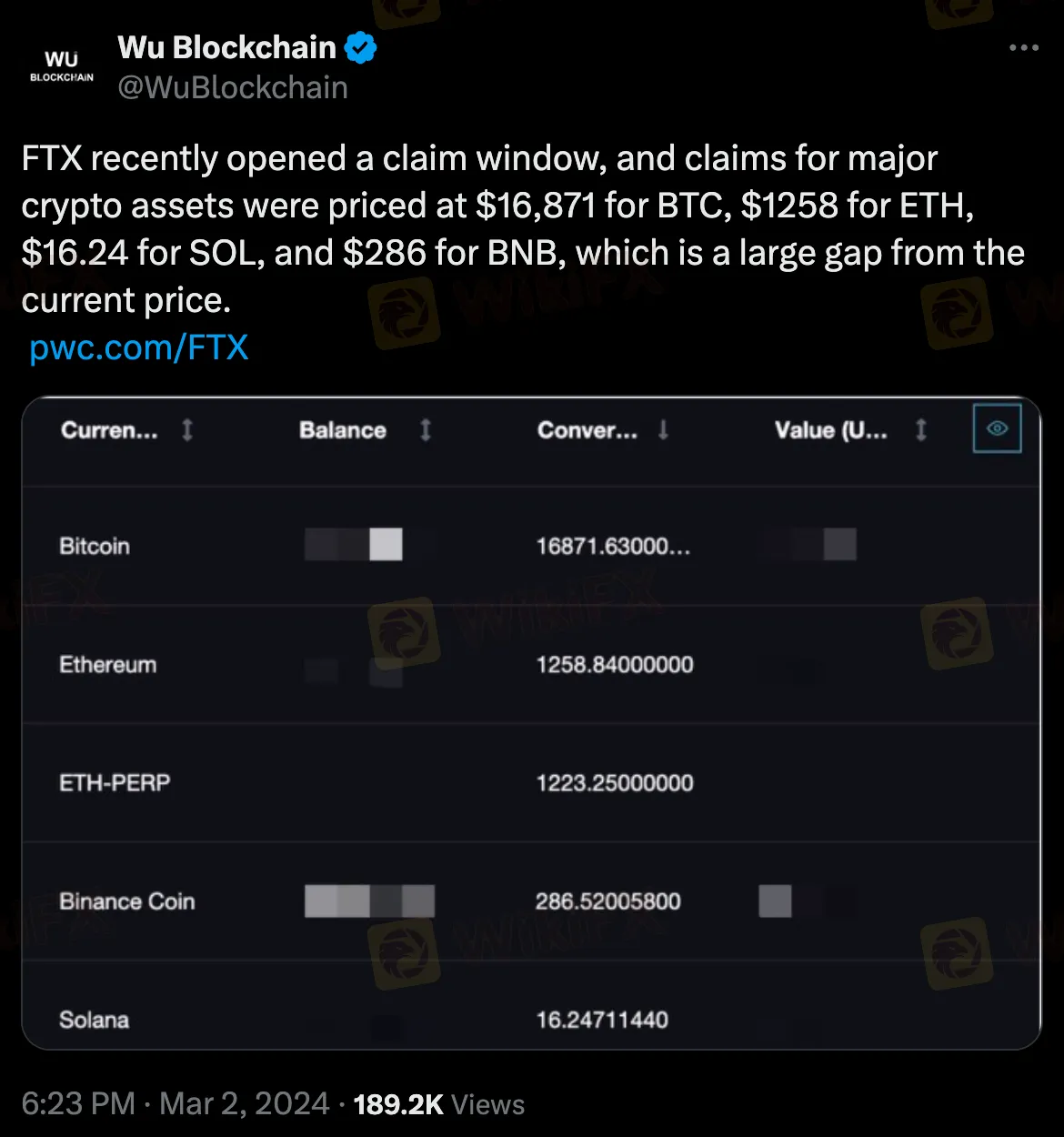

As reported by crypto journalist Colin Wu on March 2nd, FTX's claim window pricing has been set at $16,871 for BTC, $1,258 for ETH, $16.24 for SOL, and $286 for BNB.

These figures, notably below prevailing market rates, have sparked criticism and concerns among affected users, with accusations of wealth appropriation and calls for legal action against what some perceive as a scam.

FTX's bankruptcy plan is designed to reimburse customers based on crypto prices at the time of the exchange's filing for bankruptcy in November 2022. While FTX contends that U.S. bankruptcy law dictates claims to be valued using the filing date, dissenting voices argue that this approach undervalues cryptocurrencies that have experienced substantial appreciation since the market's low point in 2022.

PwC Partners, the court-appointed liquidators for FTX assets, issued an official statement addressing the situation. FTX Digital Markets is undergoing a Chapter 11 settlement with FTX Trading and related debtors, with the primary objective being the consolidation of assets from the estates of both entities. Creditors have been instructed to submit electronic claims by May 15, with an anticipated initial interim distribution through a claims portal managed by PwC expected in late 2024 or early 2025, with all eligible claims denominated in U.S. dollars. PwC has faced scrutiny from various quarters, with critics contending that the firm emerges as the primary beneficiary amid the prevailing tumult within FTX.

In response to growing concerns, FTX issued a precautionary statement regarding its authorized investment manager, cautioning against unauthorized third parties attempting to bid on behalf of FTX Debtors. The exchange clarified that the sale of Digital Assets, mandated by a bankruptcy court order, falls solely under the jurisdiction of Galaxy Asset Management, the court-appointed investment manager. FTX emphasized that only Galaxy Asset Management holds the authorization to manage selling offers or buying requests.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bybit Shuts Down NFT Marketplace Amid Crypto Market Downturn

Bybit announces the closure of its NFT marketplace, citing efforts to streamline offerings. Discover the latest trends in the declining NFT market and its shift to utility-based growth.

Galaxy Digital Settles $200M in Luna Token Manipulation Case

Galaxy Digital pays $200M to settle Luna token manipulation probe by NY regulators, linked to TerraUSD’s 2022 crash, impacting crypto market stability.

Vanuatu Passes VASP Act to Regulate Crypto and Digital Assets

Vanuatu's new VASP Act regulates crypto businesses, enforcing strict licensing, AML/CFT compliance, and investor protections.

Blockchain Decentralization: Empowering a Trustless Future

In recent years, blockchain technology has rapidly evolved from a niche innovation behind Bitcoin into a transformative force across industries. At its core, blockchain decentralization refers to the distribution of authority and decision-making away from a central entity and into the hands of a distributed network of participants. This shift redefines how data is stored and verified and paves the way for trustless, transparent, and resilient systems that challenge traditional centralized models.

WikiFX Broker

Latest News

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Global Panic Builds as Forex Shifts into Risk-Off Mode

SEC Fines Velox Clearing $500,000 for SAR Failures

Shocking! Oil Prices Plunge Below $60

Singapore Authorities Warned Against WeChat, UnionPay, Alipay Impersonation Scams

WikiFX Forex Prediction Challenge

The Dark Side of Trading Gurus: Are You Following a Fraud?

Gold Prices Plunge: How Should Investors Respond?

Currency Calculator