简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

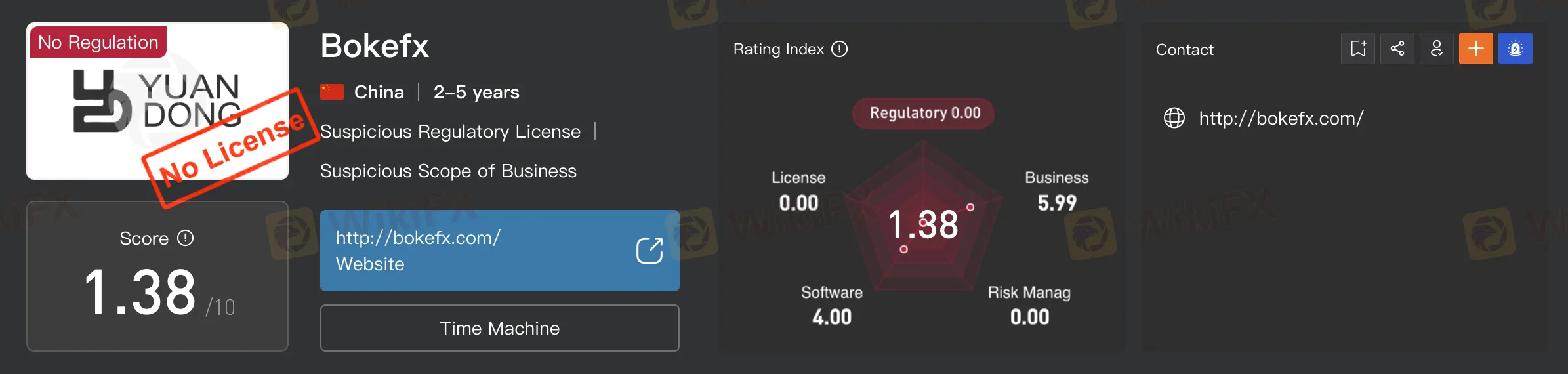

WikiFX Broker Assessment Series | Bokefx: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Bokefx. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Bokefx. Our aim is to equip readers with essential information needed to make informed decisions about utilizing this platform.

In the realm of online forex trading, identifying potential concerns is vital, and Bokefx has raised some notable issues. Marketed as an online forex broker, Bokefx lacks a crucial element – regulatory authorization. This sets Bokefx apart from reputable competitors, as it operates without the oversight necessary for a trustworthy online trading option.

The absence of regulatory authorization poses a significant problem. Regulatory bodies play a pivotal role in ensuring fair practices, setting standards, and facilitating issue resolution. Without this oversight, traders face potential risks of unethical practices with no proper recourse.

When assessing the legitimacy of a forex broker, the accessibility and reliability of its official website are paramount. Bokefx, however, adds to existing concerns by having its official website, bokefx.com, conspicuously unavailable. A reputable forex broker typically maintains a professional and easily accessible website, providing clients with a centralized platform for crucial information about services, policies, and regulatory compliance. The unavailability of Bokefx's website not only hinders potential traders from accessing vital details but also raises significant questions about the transparency of the broker's operations and the safety of clients' funds.

The sudden unavailability of Bokefx's website raises red flags, deviating from industry norms. Clients rely on brokers to deliver a secure and informative online environment, and the absence of Bokefx's website disrupts this essential aspect of the client-broker relationship. This unforeseen development heightens concerns about the broker's legitimacy, leaving clients uncertain about the safety and whereabouts of their funds. In the competitive forex trading landscape, where trust and transparency are paramount, Bokefx's missing official website cast doubt on its commitment to maintaining open communication and providing a secure trading environment for its clients.

Bokefx's status as an unlicensed and non-regulated online forex broker, coupled with the sudden unavailability of its website, serves as a clear warning to traders. Caution and thorough research are advised before selecting an online trading platform. In an industry where trust and transparency are of utmost importance, Bokefx's current circumstances underscore the significance of choosing brokers with a solid regulatory foundation and a commitment to clear communication and robust customer support.

Hence, WikiFX recommends that users exercise caution and consider exploring alternative brokers with a verified regulatory status from WikiFX's comprehensive database. Download your free WikiFX mobile app now!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The internet is inundated with advertisements and promotions from self-proclaimed trading gurus who promise to teach you how to become a successful trader and earn a substantial secondary income. These individuals often claim that their trading techniques can make you rich, even if you have zero experience. However, these assertions are typically false, and many people fall victim to these scams. This article aims to expose these fake trading gurus, explain how they operate, and provide tips on how to avoid being scammed.

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

WikiFX Broker

Latest News

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Gold Surges to New Highs – Is It Time to Buy?

Bitpanda Secures Full Broker-Dealer License in Dubai

Lost Money to Scam Recently?! This Article Could Help You!

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

CySEC Flags 5 Unlicensed Investment Websites – Investor Alert

Currency Calculator