简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

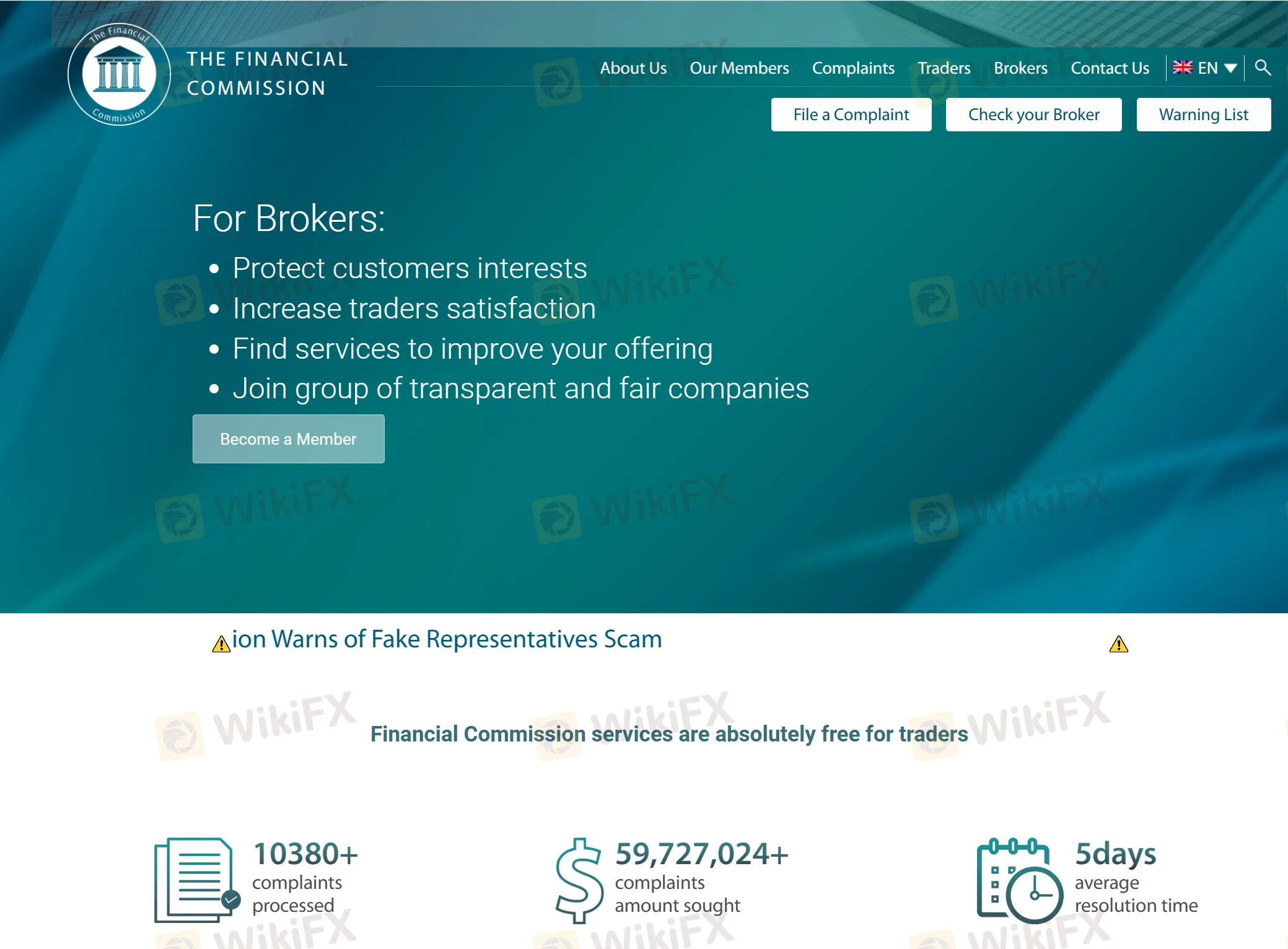

Is The Financial Commission a governmental regulator?

Abstract:With the rise of online trading platforms, the need for robust oversight has never been more critical. Enter "The Financial Commission," a company that has garnered attention for its mission to expose scam brokers. However, a closer examination reveals complexities and considerations that investors should be aware of before placing blind trust in its pronouncements.

With the rise of online trading platforms, the need for robust oversight has never been more critical. Enter “The Financial Commission,” a company that has garnered attention for its mission to expose scam brokers. However, a closer examination reveals complexities and considerations that investors should be aware of before placing blind trust in its pronouncements.

Founded with the goal of safeguarding investors from fraudulent practices, The Financial Commission operates independently of governmental regulatory bodies. While its intentions may be commendable, it's essential to recognize the limitations inherent in its role. Unlike official regulators empowered by legislation, The Financial Commission lacks the authority to enforce compliance or impose sanctions on errant brokers.

Central to understanding The Financial Commission's efficacy is its methodology for identifying and exposing scam brokers. The company employs its own set of criteria, which may not necessarily align with industry standards or represent a consensus within the market. Consequently, there is a degree of subjectivity involved in its assessments, raising questions about the objectivity and reliability of its revelations.

Moreover, it's crucial for investors to exercise discernment when interpreting the findings published by The Financial Commission. While the company endeavors to provide valuable insights, its determinations may not carry the same weight as those made by established regulatory bodies. Investors should view its revelations as one of many sources of information and not as a definitive verdict on a broker's legitimacy.

In navigating the complexities of the financial industry, regulatory exposure in the private sector can offer guidance but should not be solely relied upon. Investors must conduct thorough due diligence, drawing upon a variety of reputable sources, including governmental regulators, industry experts, and independent reviews.

Ultimately, while The Financial Commission plays a role in exposing scam brokers, it's essential for investors to maintain a critical perspective. While its efforts are commendable, they should be viewed as complementary rather than a substitute for official oversight. In the quest for a trustworthy trading experience, prudence and vigilance remain investors' most potent allies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

In the age of digital finance, the promise of financial freedom through trading has never been more alluring. Social media is flooded with advertisements for trading academies claiming to turn beginners into expert traders in weeks, offering ‘guaranteed’ profits and ‘exclusive’ strategies. However, behind the glossy marketing lies a sinister reality as many of these so-called academies are nothing more than elaborate scams designed to exploit unsuspecting traders.

How Global Events Shape Currency and Gold Markets

In the fast-paced world of forex trading, timely and accurate information is paramount. Global events—whether political, economic, or social—can trigger rapid shifts in currency values and gold prices. This article examines how forex news drives market dynamics and offers insights on how traders can navigate this ever-changing landscape.

The Rise of Algorithmic Trading in Forex Markets: Opportunities and Risks

Over the past decade, the integration of technology into financial markets has revolutionized forex trading. Algorithmic trading, driven by complex mathematical models and real-time data, has become a cornerstone of modern trading strategies. This article explores the transformative impact of algorithmic trading on forex markets, as well as the opportunities and risks it presents.

A Must-To-Watch Top Trading Pairs This 2025

Discover the top trading pairs to watch this week, including Bitcoin, Euro, USD, and more. Market trends, key resistance levels, and price movements analyzed.

WikiFX Broker

Latest News

How to Avoid Risks from Scam Brokers in Forex Investment

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Currency Calculator