简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

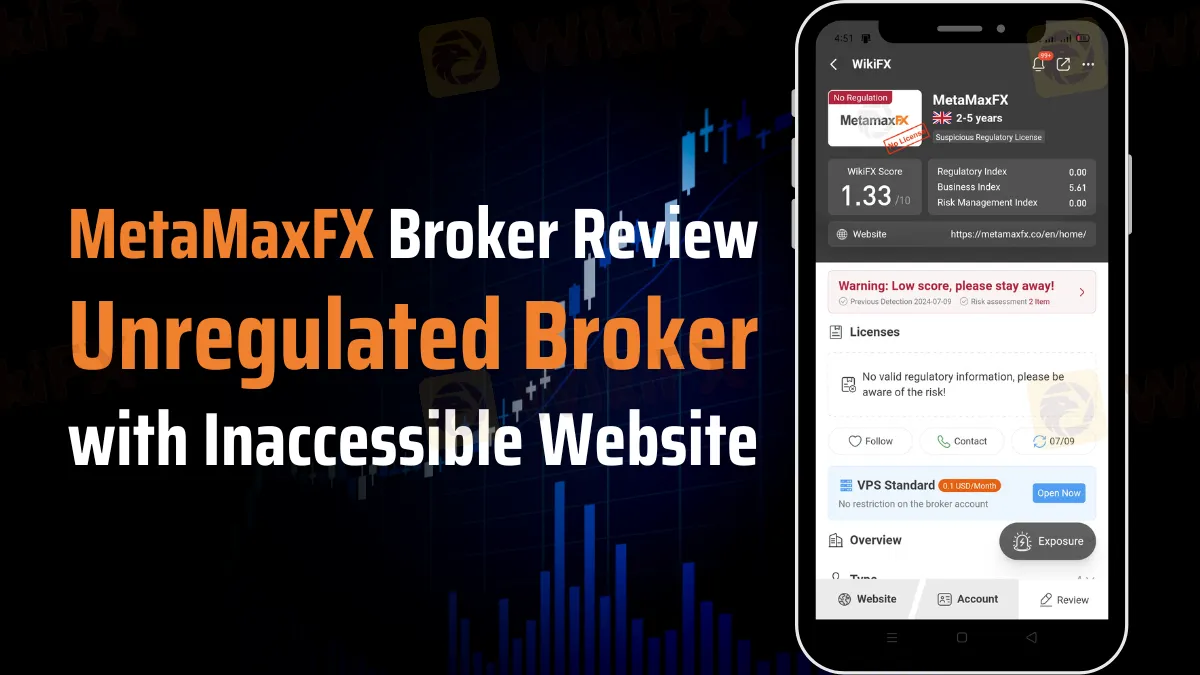

MetaMaxFX Broker Review: Unregulated Broker with Inaccessible Website

Abstract:MetaMaxFX, an unregulated broker based in the UK, offers little transparency with an inaccessible website. Learn more in this review.

MetaMaxFX presents itself as a brokerage firm based in the United Kingdom, claiming to offer various trading services. However, potential clients should approach this broker with caution due to significant concerns about its legitimacy and transparency.

Regulatory Status and Location

MetaMaxFX operates without regulation, which raises serious red flags for potential investors. Regulatory oversight provides essential protection for traders, ensuring that brokers adhere to strict financial standards and operational guidelines. The absence of regulation means clients have minimal recourse in case of disputes or financial malpractice.

Website Accessibility Issues

One of the most alarming aspects of MetaMaxFX is the inaccessibility of its official website, located at https://metamaxfx.co/en/home/. A reliable and transparent broker should maintain a functional website as a primary means of communication with clients. The inability to access their website suggests operational issues or potential attempts to evade scrutiny.

Contact Information and Customer Service

MetaMaxFX lists phone numbers, including +44 1312021660 and +52 3385262577. However, the reliability and responsiveness of their customer service remain questionable, especially given the inaccessible website.

Conclusion

Investing in MetaMaxFX poses significant risks due to its unregulated status, inaccessible website, and lack of transparent communication channels. Traders are strongly advised to consider regulated alternatives with proven track records of reliability and customer satisfaction.

In summary, MetaMaxFX fails to meet basic standards of transparency and regulatory compliance expected from reputable brokerage firms. Potential investors should exercise extreme caution and explore safer options in the competitive financial markets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crypto-to-Cash Transfers Now Available for UK and Europe

Crypto-to-Cash transfers are now available for UK and Europe users through the eToro platform, enabling them to transfer crypto-assets to their wallets and convert them into cash for trading and investment.

Fake Website Forex Scam, Arrests Two for Duping 100+ Investors

Chennai Cyber Crime exposes forex trading scam, arrests two men for cheating 100+ investors via fake websites. Beware of fraudulent investment schemes.

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

A $5 million fine and executive suspension spotlight systemic risk management failures—how did a licensed firm bypass safeguards for over two years?

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator