简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2016, Lirunex Limited (Lirunex) operates as an online brokerage specializing in the trading of exchange-traded CFDs, distinguishing itself through a commitment to competitive spreads.

Lirunex offers a diverse range of tradable assets, including currency pairs, share CFDs, cryptocurrency CFDs, energies, commodities, metals, and global indices.

Additionally, the company provides social trading services designed to help money managers and traders enhance efficiency, boost profitability, and generate passive income through copy trading, PAMM, MAM, and portfolio management.

Furthermore, Lirunex features an Introducing Broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the platform.

It is important to note that, at present, Lirunex does not extend its services to the United States, North Korea, Congo, Libya, Afghanistan, Cuba, Maldives, Mali, Syria, Sudan, South Sudan, Yemen, Somalia, Belarus and Venezuela.

Types of Accounts:

Lirunex offers four account options: the LX-Standard Account, LX-Prime Account, LX-Pro Account, and LX-Cent Account. Please refer to the attached image below for detailed information on each account.

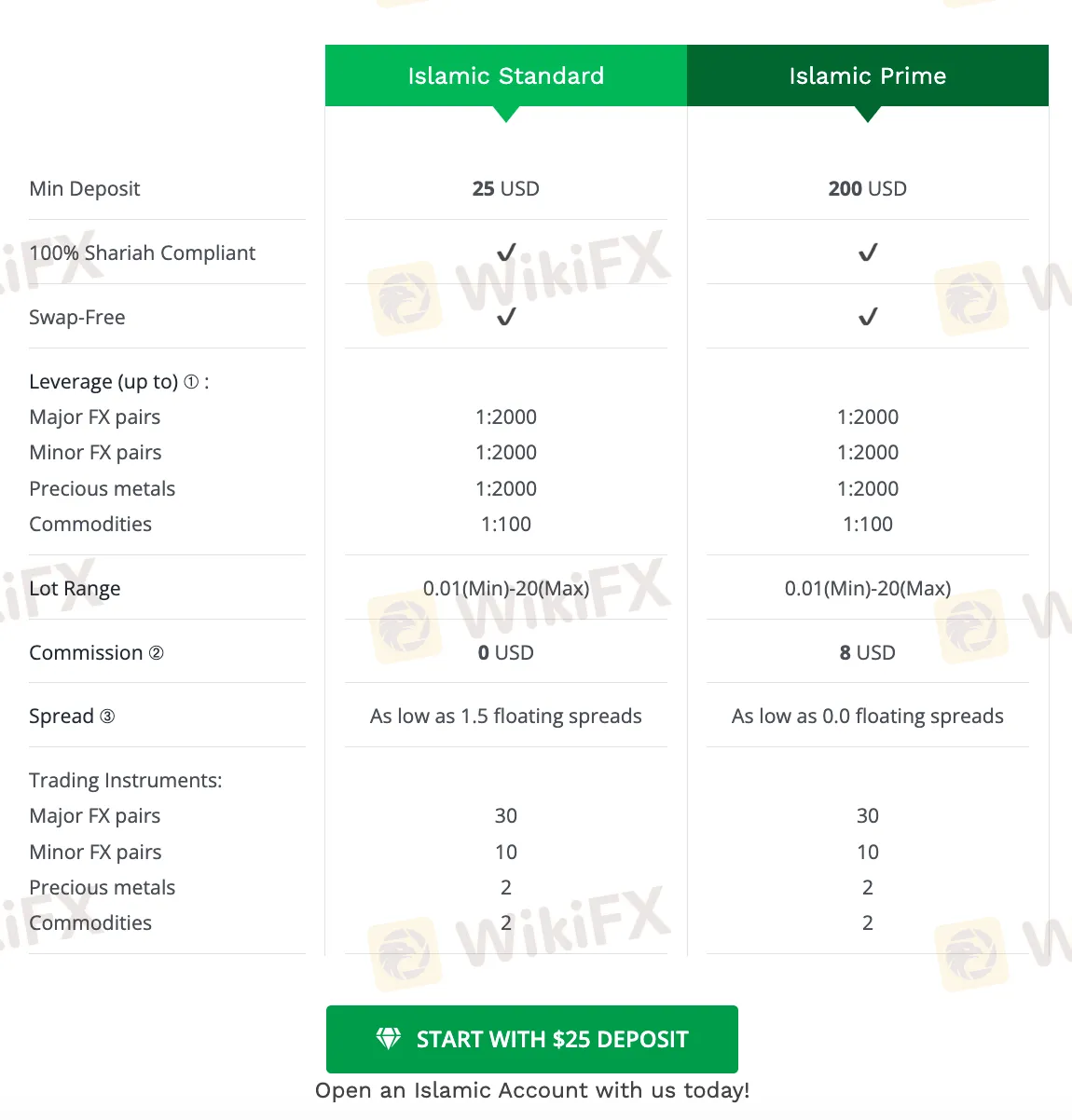

Additionally, there are two types of Islamic swap-free accounts available for Muslim clients, as illustrated in the image below.

Deposits and Withdrawals:

Lirunex offers a variety of payment options, including bank transfers, credit cards (Visa and Mastercard), AliPay, Perfect Money, cryptocurrencies, and other methods. While Lirunex states that it does not impose any commissions or fees for deposits and withdrawals, it is important to note that any charges applied by third-party providers are the responsibility of the trading client.

The company is committed to processing all requests within 24 hours from Monday to Friday, 9:00 AM to 3:00 PM (GMT+8). Transactions initiated during the weekend will be processed on the next working day.

The time required for funds to reflect in the account depends on the chosen withdrawal method. Detailed specifications for each deposit and withdrawal method can be found in the images below:

Trading Platforms:

Lirunex provides three trading platforms:

- The MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 is an advanced trading platform offering a comprehensive suite of features and tools for precise trading analysis. With one-click trading, quick order execution, VPS hosting, and up to four pending order types along with trailing stops, it provides a highly customizable interface with thousands of online tools to plug in. The platform supports fully customizable and in-depth charts, in-depth trading history, and allows users to build or import Expert Advisors (EAs), enabling the automation of trading strategies.

- The MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macro-economic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

- The Lirunex Trading Application is a mobile platform designed to facilitate trading activities. It includes features such as forex signal copying, a real-time economic calendar, and a range of trading tools. The app provides access to global trading opportunities and enables users to monitor their trading performance.

Research and Education:

Lirunex offers free educational resources to support traders on its Lirunex Forex Education page.

Customer Service:

Lirunex provides customer service support in multiple languages, including Chinese, Vietnamese, and Bahasa Indonesia. Clients can reach out Lirunex through email at support@lirunex.com or by submitting an inquiry via the broker's question form.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Lirunex a WikiScore of 8.12 out of 10.

Upon examining Lirunex‘s licenses, WikiFX found that the broker is regulated by France’s Autorité des Marchés Financiers, Cyprus‘ Securities and Exchange Commission, Malaysia’s Labuan Financial Services Authority, and Spains Comisión Nacional del Mercado de Valores.

WikiFX has also verified the legitimacy of these licenses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

How Reliable Are AI Forex Trading Signals From Regulated Brokers?

Discover how reliable AI Forex trading signals are and why using a regulated broker boosts their effectiveness. Learn key factors to evaluate accuracy and enhance your trading.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator