简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best 6 Reversal Candlestick Patterns You Need To Know

Abstract: If you know a bit about forex trading, then you must have heard of candlestick charts, also known as K-line charts. Candlestick charts are a widely used technical analysis tool in the stock and forex markets, popular for their clear graphics and intuitive delivery of information. Among the many types of candlestick charts, there are some that are considered particularly important by investors because they can provide key market trend information and become a powerful tool for investment decisions. In this article, we will take an in-depth look at 6 Reversal Candlestick Patterns that will allow investors to better understand market dynamics.

If you know a bit about forex trading, then you must have heard of candlestick charts, also known as K-line charts. Candlestick charts are a widely used technical analysis tool in the stock and forex markets, popular for their clear graphics and intuitive delivery of information.

Among the many types of candlestick charts, there are some that are considered particularly important by investors because they can provide key market trend information and become a powerful tool for investment decisions.

In this article, we will take an in-depth look at 6 Reversal Candlestick Patterns that will allow investors to better understand market dynamics.

What are Candlestick Charts?

Candlestick charting is a way of displaying information about an asset's price movement and is one of the most popular components of technical analysis, enabling traders to quickly interpret price information from just a few price bars. It has three basic characteristics:

Shadow lines or shadow lines indicate the high and low prices during the day.

The main body, which represents the opening to closing range.

The colours reveal the direction of the market movement - green entities indicate rising prices and red entities indicate falling prices.

Candlestick charts are formed by up and down price movements. Whilst these price movements may sometimes appear random, they sometimes form patterns that traders use for analysis or trading purposes.

What is a Reversal Pattern?

A reversal pattern is a price pattern that marks a turning point between rising and falling prices. It suggests a potential change in the direction of price movement. For example, if the price is rising, the appearance of a reversal pattern means that the price may be about to fall. Similarly, if prices are falling and a top reversal pattern occurs, this could signal that prices are about to bottom out and begin to rise.

Pros and Cons of Reverse Candlesticks

| Pros | Cons |

| Early signals of trend change | Not always reliable: Reversal candles are unreliable and can generate false signals, leading to losses. |

| Easy to interpret | Can be subject to interpretation |

| Can be used with other technical indicators | May not always provide confirmation |

How Do Chart Reversal Patterns Occur?

Candle reversal patterns occur whenever there is a significant change in market momentum. For example, if the current momentum is bullish, causing prices to make higher highs, a change in momentum from bullish to bearish will eventually cause prices to fall and start making lower lows.

Similarly, if price is falling, indicating strong bearish momentum, whenever reversal candlesticks occur, they imply a change in momentum from bearish to bullish. As a result, prices will eventually bottom out and begin to rise, making higher highs.

Reversal patterns fall into two categories. A bearish reversal pattern occurs whenever price rises and starts to move lower, confirming a change in momentum from bullish to bearish. A bullish reversal pattern occurs whenever price moves lower and starts to rise, confirming a change in momentum from bearish to bullish.

Best 6 Reversal Candlestick Patterns

1. Hammer Candlestick and Shooting Star

Hammer:

The Hammer line has a long lower shadow, a short upper shadow, a smaller entity and is shaped somewhat like a hammer. If it appears in a downtrend, it may signal a reversal, indicating that the market is bouncing off the bottom.

Key points of the hammer:

The hammer line needs to appear in a downtrend and has the characteristics of a reversal.

The longer the lower shadow, the better, and the smaller the entity, the better.

The hammer line should ideally appear at a support level.

The appearance of the hammer line indicates that the market has found support at the bottom and buyers are gradually entering, pulling the market up.

Shooting Star:

A shooting star is a pattern consisting of two candlesticks, the first of which is a long black solid and the second is a short white solid, and the close of the second is higher than the solid of the first. The gap formed by the white entity in the middle of these two candlesticks is one of the characteristics of a shooting star.

The appearance of a shooting star indicates that the market is experiencing seller pressure in an uptrend, and that the market is experiencing large swings during the day, despite the proximity of the opening and closing prices. The lower shadow of a shooting star indicates that buyers tried to push prices higher during the trading day, but ultimately failed to hold. This could signal a shift in market power and sellers may begin to dominate.

Investors need to wait for more confirmation signals after confirming the shooting star pattern to avoid false signals.

2. Engulfing Pattern

The engulfing pattern is an important reversal pattern that consists of two candlestick entities of opposite colours.There are bullish engulfing patterns and bearish engulfing patterns.

A bullish engulfing pattern consists of two candlesticks. The first is a small bearish candlestick, followed by a larger bullish candlestick that completely engulfs the previous candlestick.

There are three criteria for determining an engulfing pattern:

Firstly, the market must be in an identifiable upward or downward trend before the engulfing pattern appears, even if this trend is only short-term.

Secondly, the engulfing pattern consists of two candlesticks, where the entity of the second candlestick must completely cover the entity of the first candlestick; in the case of a bullish trend, the first candlestick would be a bear line and the second would be a bull line, and vice versa.

Thirdly, the colour of the second entity of the engulfing pattern must be the opposite of the colour of the first entity.

If the engulfing pattern has these characteristics, the likelihood that they constitute an important reversal signal is greatly enhanced.

In an engulfing pattern, the first day's entity is very small while the second day's entity is very large. An engulfing pattern usually occurs after an ultra-long-term or sharp market movement. If there is an ultra-long-term uptrend, it could mean that potential buyers have entered the market to buy long positions, resulting in a market that may not have enough supply of new long positions to continue to drive the market higher. And after a sharp market movement, the market may have gone too far and be vulnerable to profit-taking positions being closed.

3. Dark Cloud Cover

The dark cloud cover pattern indicates a possible reversal of the market's uptrend. A positive line on the first day represents a strong buyer's market, but a negative line on the second day suggests that sellers are entering the market, pulling the price back, and the negative close is less than half the price of the previous day's positive line, hinting at a strengthening of the sellers. This pattern suggests a possible short counterattack and investors should be aware that the market may be entering a downtrend.

Traders usually adopt a cautious strategy after confirming a dark cloud cover, such as waiting for further confirmation signals or adopting a defensive trading strategy to avoid potential downside risks.

Characteristics:

Day 1 is Positive: The specific pattern is based on a rising positive line, representing an uptrend.

Day 2 is Negative: The second day's negative line opens higher than the previous day's close, but ends up closing at less than half of the previous day's positive line, creating a covered negative line.

4. Morning Star

The Morning Star is a pattern consisting of three K lines that signals the bottom of the market and a turnaround.

First Candlestick (Negative): This is a negative line in a downtrend, indicating that the market is currently dominated by sellers.

Second candlestick (small or shadowed candle): This candlestick is usually smaller than the first negative candlestick and sometimes has a lower shadow, indicating that there is some uncertainty in the market and that the balance of power between buyers and sellers is beginning to emerge.

Third candle (positive): This is a positive line in an uptrend, indicating that buyers have taken control of the market and prices may rise.

At the end of a downtrend, the Morning Star K-line pattern usually appears stronger and is a clear signal of a trend reversal.

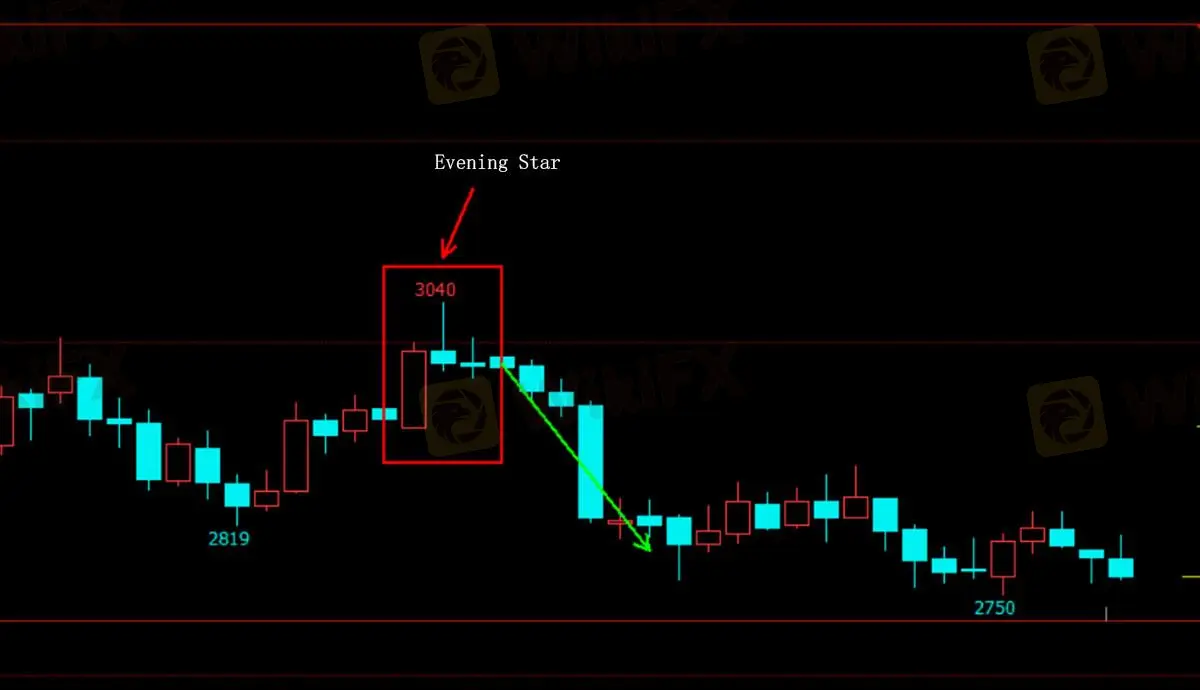

5. Evening Star

Similar to the Morning Star, the evening star is a K-line combination pattern that can be seen as a reversal form of the Morning Star. Unlike the Morning Star, the evening star usually occurs at the point where the uptrend is halted and often marks the top of a price phase.

6. Piercing Pattern

Contrary to the dark cloud cover, in a downtrend, a longer negative line is immediately followed by a longer positive line, and the closing price of the positive line is higher than the midpoint of the negative line.

It signals that the downtrend may be coming to an end and the market may reverse higher

Combining Candlestick Patterns with Other Indicators

To improve the accuracy of your trading signals, consider combining candlestick patterns with other technical indicators such as moving averages, Relative Strength Index (RSI) or MACD (Moving Average Convergence Divergence).

For example, moving averages or oscillators can provide additional context to candlestick patterns. This combination can significantly increase the probability of making accurate predictions and successful trades.

Combining Moving Averages, RSI and Candlesticks provides a clearer picture of market conditions.

Use Moving Averages - Combine simple or exponential moving averages to identify support and resistance levels, as well as to determine the direction of the overall market trend.

Applying Oscillators - Oscillators such as the RSI or MACD can help confirm signals implied by candlestick patterns, providing a second layer of validation.

Risk Management and Position Adjustment

Risk management is critical in trading. Place stop-loss orders to limit potential losses and size your positions according to your risk tolerance and specific trade setup. Never risk more than you can afford to lose.

FAQ

What are the limitations of the reversal candlestick technique?

The reversal candlestick technique, while providing timely warning signals and reflecting strong market sentiment, can be misleading due to its over-sensitivity.

What technical indicators can I combine with candlestick patterns?

Moving Averages

RSI (Relative Strength Index)

MACD (Moving Average Convergence Divergence)

What is the difference between a bullish and bearish reversal pattern?

- A bullish reversal pattern occurs when the market is in a downtrend

- A bearish reversal pattern the market is in an uptrend

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator