简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Understanding the U.S. Dollar/Canadian Dollar (USD/CAD) Exchange Rate

Abstract:USD/CAD is the abbreviation for the U.S. dollar versus Canadian dollar (USD/CAD) currency pair. The quote for the USD/CAD currency pair defines how many Canadian dollars or quote currency are needed to purchase one U.S. dollar, the base currency.

What Is USD/CAD?

USD/CAD is the abbreviation for the U.S. dollar versus Canadian dollar (USD/CAD) currency pair. The quote for the USD/CAD currency pair defines how many Canadian dollars or quote currency are needed to purchase one U.S. dollar, the base currency.

For example, a USD/CAD exchange rate of 1.25 means that $1 equals $1.25 - or conversely, $1.25 equals $1.

Trading the USD/CAD currency pair is also known as trading the “loonie,” the name for the Canadian one-dollar coin, its namesake bird. The USD/CAD is one of the most liquid and actively traded pairs in the forex market.

USD/CAD Trading Hours

The forex market is available 24 hours a day, but UK trading, in particular, tends to get active from 8:00 AM and taper off from 5:00 PM. Of course, there will be times during the day when this currency pair experiences higher volumes-typically around major market announcements.

History of USD/CAD

The US dollar needs no introduction and is paired with all the main world currencies. It dates back to 1792 when the United States Congress created the US dollar as the country's currency. It serves as legal tender in a number of countries and is it still regarded as the worlds unofficial reserve currency.

Back in the early 1850s, Canada began its departure from the colonial pound and transitioned to a decimalised Canadian dollar. It‘s often referred to as the ’Loonie. The Canadian dollar used to be pegged to the USD but since 1970, it has been a free floating currency controlled by the Bank of Canada.

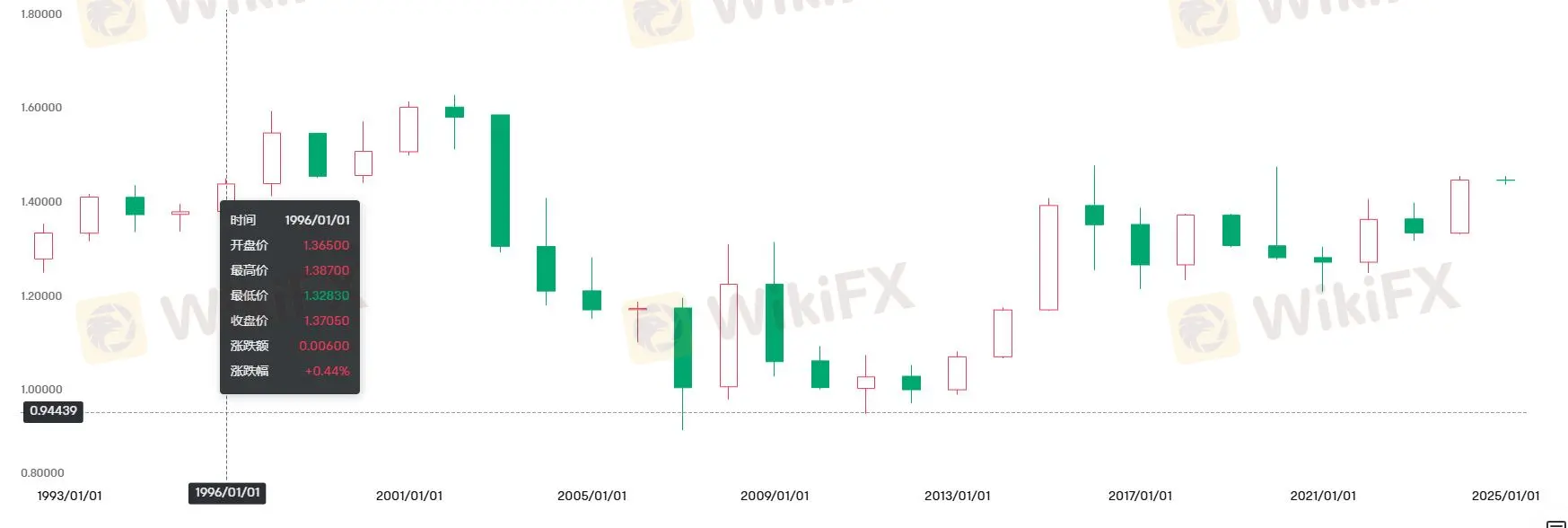

Historic exchange rate USD to CAD:

Key Concepts for Trading USD/CAD CFDs

Understanding these basic concepts is essential to proficient risk management when engaging in USD/CAD trading.

- Contract Size: This is the amount of base currency you control in a USD/CAD trade.

A standard contract size is equal to 100,000 units of the base currency. For example, when trading the USD/CAD currency pair in standard contract size, you are trading $100,000 worth of US dollars.

Mini contract size is equal to 10,000 units of the base currency.

A micro contract size is equivalent to 1,000 units of the base currency.

- Margin: This is a measure of how much control you have over the size of the contract, over and above what your initial deposit would normally allow. Using 30:1 leverage, you can control a $100,000 position in a USD/CAD trade with a balance of $3,333.

By using leverage to trade larger contract sizes, you can magnify small fluctuations in the exchange rate, thereby increasing the potential for profit and loss.

- Spread: This is the difference between USD/CAD's current bid price (the bid price) and its current ask price (the ask price). It is one of the costs of executing a USD/CAD buy or sell transaction.

- Pip: A pip is the smallest price change in an exchange rate, usually 0.0001 for a USD/CAD pair, and the value of a pip change is denominated in the quote currency (Canadian dollar). For example

When trading in a standard contract size, each pip movement is equal to C$10.

When trading in a mini contract size, each pip movement is equal to C$1.

When trading in the Micro contract size, each pip movement is equal to C$0.1.

How to Trade USD/CAD CFDs

Individuals can trade USD/CAD through a foreign exchange contract, or they can also trade a contract for difference (CFD) on a specific currency pair and speculate on the price difference.

A CFD is a financial instrument, usually traded between a broker and an investor, where one party agrees to pay the other party the difference in the value of the security between the beginning and end of the trade. You can take a long position (speculating that the price will go up) or a short position (speculating that the price will go down). This is considered a short-term investment or trade, as CFDs tend to be used in a limited timeframe.

What Are the Drivers Affecting the USD/CAD Exchange Rate?

A variety of fundamental factors influence the supply and demand for the USD and CAD, and thus the volatility of their exchange rates. They include:

- Commodity prices

Canada plays a significant role in the production of oil, minerals, wood products and grains, and therefore its currency is categorised as a commodity currency.

Given the Canadian economy's dependence on oil, the value of the Canadian dollar is closely linked to the price of crude oil. As a result, changes in oil prices have a direct impact on both the economy and the currency.

Higher oil prices result in increased dollar revenues for Canadian exporters. Increased dollar inflows strengthen the Canadian dollar, leading to a bearish USD/CAD exchange rate. Conversely, plummeting oil demand and energy prices cause the Canadian dollar to weaken. As a result, fewer U.S. dollars flow into Canada, making USD/CAD more attractive to buyers looking for a stronger U.S. dollar rather than a weaker Canadian dollar. An example of this scenario is the 2020 oil price crash as the Canadian dollar depreciated against various currencies.

- Spreads

The spread between the Federal Reserve and the Bank of Canada is a major factor in the direction of the USD/CAD exchange rate. For example, when the Fed strengthens the U.S. dollar through open market interventions, the USD/CAD exchange rate tends to rise because it needs more Canadian dollars to buy a stronger U.S. dollar. Conversely, an interest rate hike by the Bank of Canada could push up demand for the Canadian Dollar, strengthening it against the US Dollar and thus weakening the USD/CAD exchange rate.

- Economic Indicators

Major economic data reports can have a direct impact on the USD/CAD exchange rate, thus determining its movement in the forex market. They include:

Consumer Price Index (CPI):

Controlling inflation is a top priority for the Bank of Canada and the Federal Reserve. They rely heavily on the Consumer Price Index (CPI) report to adjust monetary policy. Therefore, it is an important tool for currency traders to judge the trend of the USD/CAD pair.

Gross Domestic Product (GDP):

This is the most comprehensive indicator of a country's economic activity; a positive GDP indicates economic growth, while a negative GDP indicates economic contraction.

Balance of Trade:

As with other commodity-dependent economies, the USD/CAD is closely linked to changes in the volume of trade between its exports and imports.

Other key economic data that affects the USD/CAD exchange rate include Non-Farm Payrolls (NFP), Producer Price Index, ISM Manufacturing and Non-Manufacturing data, Ivey's Purchasing Managers' Index (PMI), Retail Sales, and Unemployment Rate.

Frequently Asked Questions

What are the peak trading hours for USD/CAD?

The USD/CAD price is more volatile during the overlap of the London and New York market sessions, between 12:00 pm and 16:00 GMT, when almost all major US and Canadian news is released.

What trading strategies are used when trading USD/CAD?

Some USD/CAD trading strategies are day trading and swing trading. This may involve using trendlines to identify trends, identifying support and resistance levels, and breakout trades.

What are the characteristics of USD/CAD price action?

USD/CAD price action tends to consolidate for a period of time and then rise quickly.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator