简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

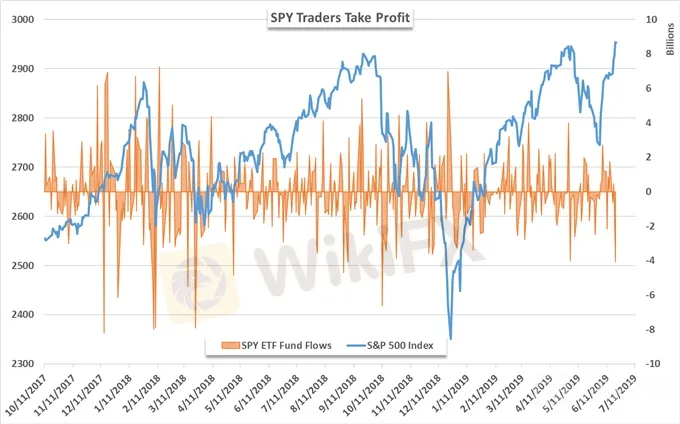

SPY ETF Notches Largest Outflow in 2019, HYG Finds Buyers

概要:After Fed Chairman Jerome Powell struck a dovish tone at Wednesdays FOMC meeting, the SPY ETF notched two days of substantial outflows while the riskier-HYG ETF experienced robust demand.

SPY & HYG ETF Flows:

SPY&HYG ETF流量:

The SPY ETF saw its largest intraday outflow since October on Thursday

SPY ETF自10月以来出现盘中最大流出周四

On the other hand, the HYG ETF registered a steady streak of inflows as the appetite for risk mounts

另一方面,随着风险偏好的增加,HYG ETF注入了稳定的资金流入

{3}

Interested in stock trading? Read about the relationship between volatility and future returns

{3}

{5}

SPY ETF Notches Largest Outflow in 2019, HYG Finds Buyers

{5}{6}

The SPY ETF saw roughly -$4 billion leave its coffers on Thursday as investors looked to take profit after the underlying S&P 500 tagged a record high. While it could be argued the outflow is indicative of waning demand, profit-taking is the more likely culprit as other risk asset-tracking funds saw considerable inflows following the dovish tone put forth by Fed Chairman Powell on Wednesday.

{6}

SPY ETF Fund Flows and S&P 500 Price Chart

SPY ETF基金流量和标准普尔500价格表

Data source: Bloomberg

数据来源:Bloomberg

Further, other broad-market tracking ETFs posted flows that were within range and largely insignificant. In aggregate, the SPY, IVV and VOO funds recorded roughly -$3 billion in outflows – with the latter two funds experiencing net inflows for the week. Meanwhile, the high-yield corporate debt ETF, HYG, notched a series of robust inflows.

此外,其他大盘跟踪ETF发布的流量在范围内且基本上无关紧要。总体而言,SPY,IVV和VOO基金的流出量约为30亿美元 - 后两个基金本周出现净流入。与此同时,高收益公司债券ETF,HYG也出现了一系列强劲的资金流入。

SPY, IVV, VOO ETF Fund Flows and S&P 500 Price Chart

SPY,IVV,VOO ETF基金流量和标准普尔500指数价格走势图

Data source: Bloomberg

数据来源:Bloomberg

Recording an inflow of $1 billion on Thursday, the HYG ETF added to its considerable capital haul for the week with a weekly net flow of $1.25 billion. As of Friday, the fund posted its largest weekly net inflow since early January when the fund received $1.8 billion in fresh capital. The flows are indicative of a risk-on attitude that would align with the continuation of relaxed monetary policy from the Federal Reserve. Similar sentiment was echoed in the JNK ETF.

记录流入10亿美元周四,HYG ETF本周增加了可观的资金,每周净流量为12.5亿美元。截至周五,该基金发布了它自1月初该基金获得18亿美元新资金以来每周最大净流入量。这些流动表明风险态度与美联储继续实施宽松货币政策相一致。类似的情绪在JNK ETF中得到了回应。

HYG ETF Fund Flows and S&P 500 Price Chart

HYG ETF基金流量和标准普尔500指数价格表

Data source: Bloomberg

数据来源:Bloomberg

JNK, which also provides exposure to high-yield corporate debt, currently boasts its longest streak of net inflows over the last year and a half. At 11 consecutive sessions, the consistent demand has seen $1.8 billion enter the fund. With the monetary policy path of the Federal Reserve seemingly locked in, investors have expressed a renewed appetite for riskier-allocations. Despite the outflows from SPY, the replenished demand for risk could signal investors willingness to continue the recent trend in the S&P 500.

JNK也提供高收益企业债务,目前拥有最长的净流入连续数过去一年半。连续11个交易日,持续需求已经达到18亿美元进入该基金。随着美联储的货币政策路径似乎被锁定,投资者已表达了对风险分配的新兴胃口。尽管SPY流出,但对风险的补充需求可能表明投资者愿意继续推动标准普尔500指数的近期走势。

JNK ETF Fund Flows and S&P 500 Price Chart

JNK ETF基金流量和标准普尔500价格表

Data source: Bloomberg

数据来源:Bloomberg

免責事項:

このコンテンツの見解は筆者個人的な見解を示すものに過ぎず、当社の投資アドバイスではありません。当サイトは、記事情報の正確性、完全性、適時性を保証するものではなく、情報の使用または関連コンテンツにより生じた、いかなる損失に対しても責任は負いません。

WikiFXブローカー

話題のニュース

WikiFX「3·15 外国為替権利デー」、ブラックリストを正式に発表

FX投資における悪徳業者リスクの回避~ライセンス規制からリスクを見抜く方法を解説

レート計算