Oil Q2 Forecast: How Will Crude Oil Prices Budge Between Weak Growth, Undersupply?

摘要:Can the downward pressure on crude oil prices from weakening global demand be offset by the stimulative measures from OPEC+ cuts, and from US-imposed sanctions on Iran and Venezuela?

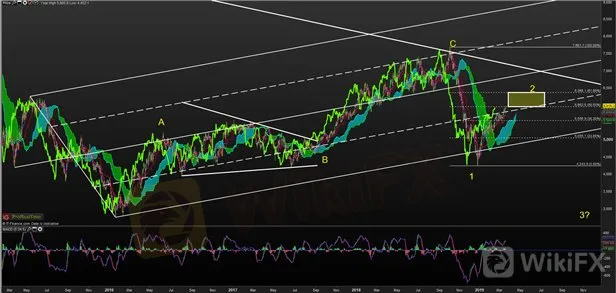

Since the start of the year, crude oil prices have enjoyed an almost 30 percent increase but have still not recovered from the 40 percent drop in Q4 2018. Increasing concerns about weakening global growth – especially out of powerhouse economies such as China and the US – may undercut the sentiment-linked commoditys upside momentum if underlying demand for it is eroded.

However, crude oil prices may receive a boon from politically-based factors. The most recent OPEC+ meeting that was supposed to take place in April was cancelled, with investors now waiting for the June session. Officials are expected to be in support of deep cuts. The US is also reimposing sanctions against Iran, which may undercut supply and boost prices.

See the complete Q219 Oil Forecast as well as outlook for other major currencies, equities, and gold.

---Written by Tyler Yell, CMT and Dimitri Zabelin, Analysts for DailyFX.com

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

什麼是美元指數,哪些因素影響美元指數走勢?

外匯投資中如何規避黑平台風險 | 外匯天眼帶你從牌照監管識破黑平台風險

BIW Management遭英國FCA示警、平台資訊疑造假,恐為外匯詐騙券商

交易認知變成實踐,必須要有「悟」的過程!

速報:知名外匯券商FXCM福匯出現仿冒詐騙平台,註冊、入金前請務必比對網址

EAST投資詐騙手法全揭露!誆稱投資3萬獲利4100%,藉口資金卡住騙繳費

XS平台驚爆詐欺客戶?無預警撤銷獲利、凍結帳戶,違規操作頻傳問題多

Doo Prime 2月份交易量超過1340億美元

匯率計算