- 關注

- 推薦

- 動態

- 商業

HDA先生

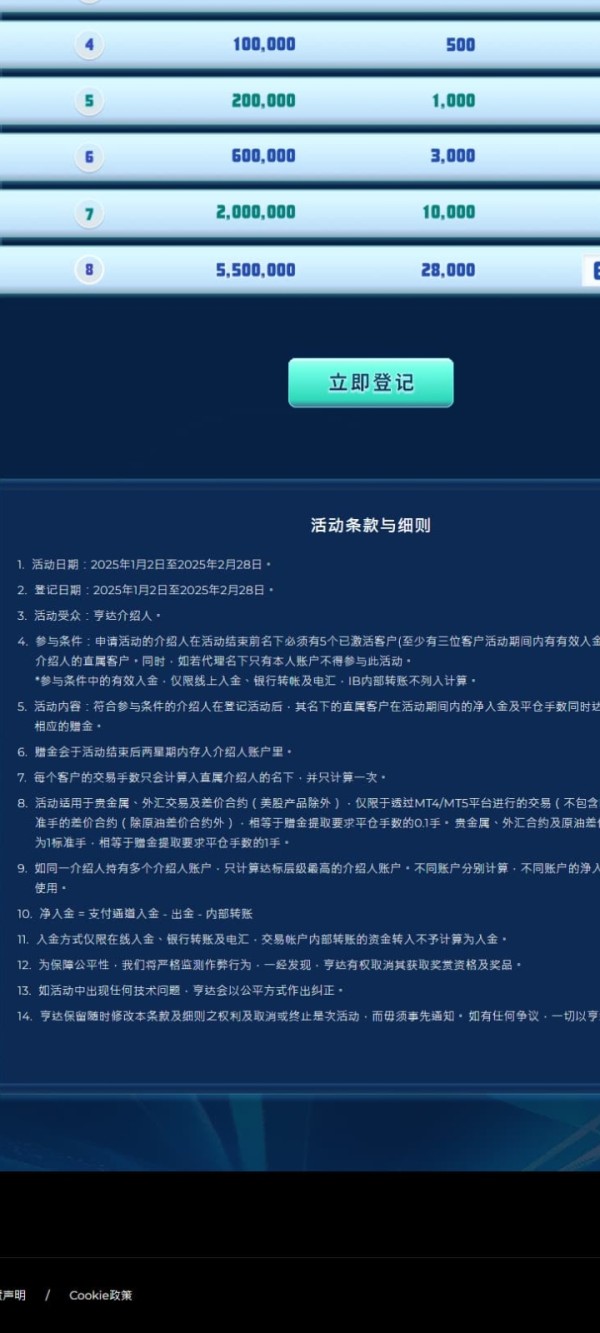

亨達國際,招IB,新年活動,最高獎勵66666美金

35年老平台,安全可靠

浮動點差,平倉即返

槓桿100-200-400倍自由選

支持銀聯,USDT,電匯入金

01-02

亨H達A生招代理

亨達國際誠招代理,共享2025年繁華

結算方式:平倉結算

EA交易:支持

外傭:支持

返佣手續費:支持

1、1990年成立,至今35年歷史,目前活躍在市場上時間最長的了,自然安全,穩定

2、總部位於香港,內地有實業(亨達水務),歡迎考察,有保障

3、12個國際監管牌照,19個國際城市有辦事處,

4、出入金便捷、安全,沒有sf凍結,無後顧之憂,

5、支持銀聯,USDT,電匯入金

6、交易環境順暢,支持盈利,不用擔心盈利不給出金,

7、最低交易0.01手,槓桿100-200-400倍自由選擇

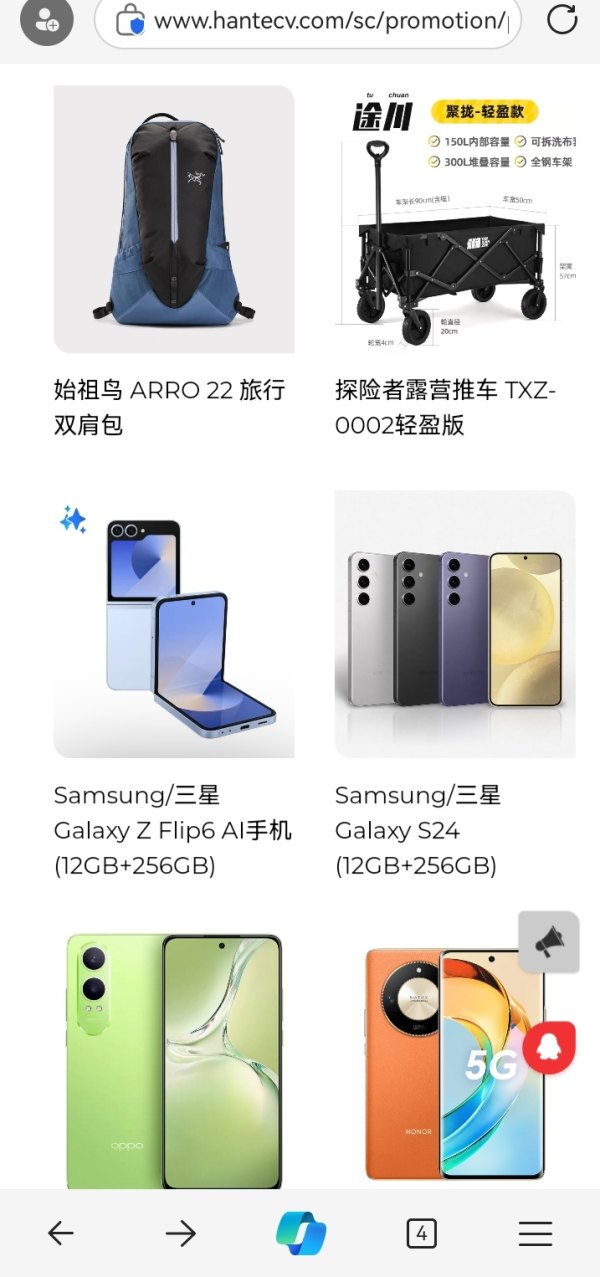

8、活動全年在綫,代理、客戶活動不斷,每次交易都在積累積分,永久商城隨時兌換

9、浮動點差,平倉即返,stp直通市場

2024-12-27

1

俄羅斯央行(CBR)

金融市場中偵測到非法活動跡象的實體名單 Grantassetfundbots

名稱、服務標記、品牌和其他識別手段 Grantassetfundbots 俄羅斯銀行發現的跡象 金融金字塔跡象 網站 grantassetfundbots.com 日期 2025.03.17

03-17

5

田雨 3217510752

強大單獨後台 佣金結算統計系統(亨達國際)

結算方式:平倉結算

EA交易:支持

外傭:支持

返佣手續費:支持

強大單獨後台 佣金結算統計系統(亨達國際)

2024-11-28

gh5479

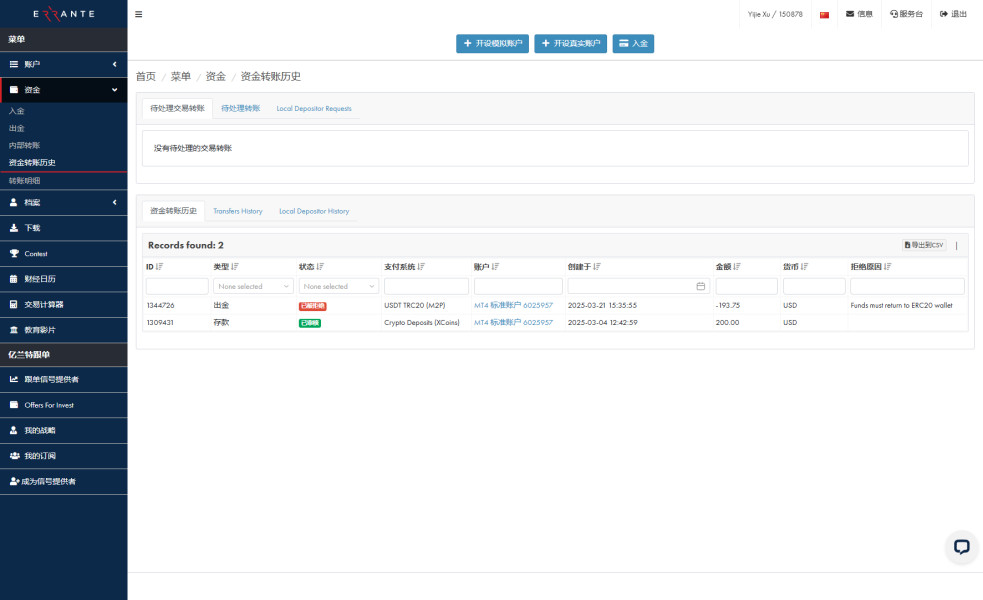

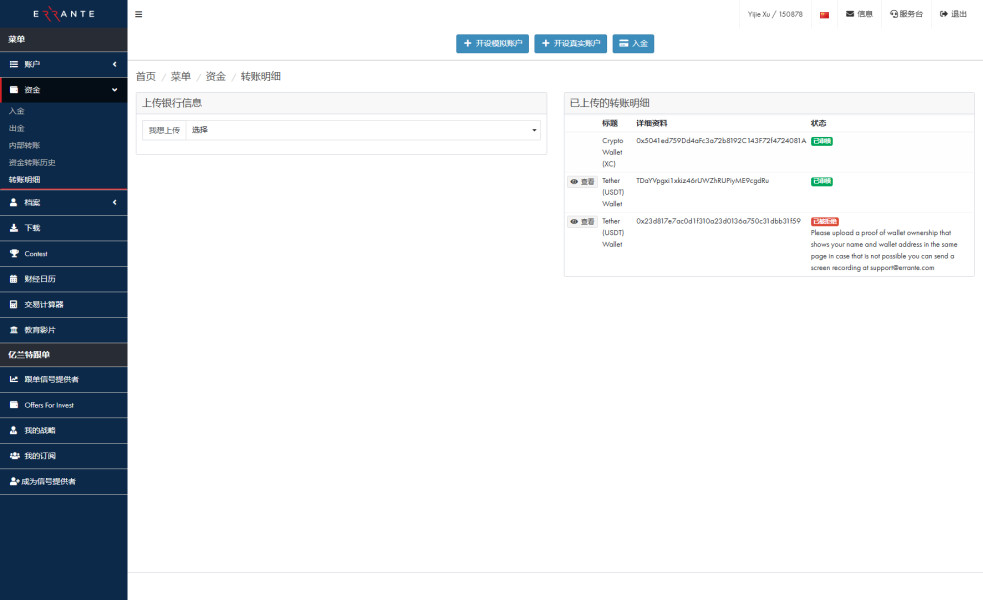

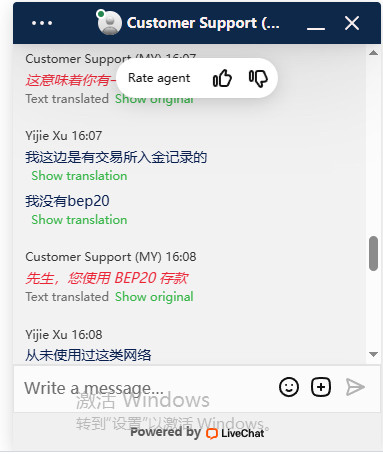

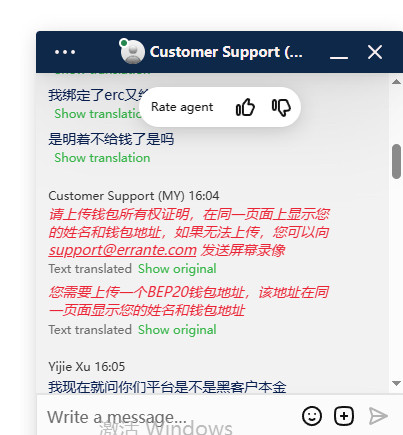

爆料 騙局平台,無法提取本金

這是一個典型的詐騙平台,只能存款而無法提款。我試圖使用TRC20網絡提款,但平台拒絕了我的請求,聲稱資金必須通過ERC20網絡退回。隨後,我連接了一個ERC20地址,但平台再次拒絕允許提款,要求我上傳交易所和錢包地址的名稱。當我向客戶服務詢問時,他們荒謬地聲稱我使用了BEP20網絡進行存款。我使用的是OKEx交易所進行存款,該交易所甚至不支持BEP20網絡。客戶服務的回應顯然是虛構的;他們聲稱我必須連接一個BEP20錢包地址才能進行提款。這純粹是一個詐騙平台。只能存款,無法提款。

03-24

2

66

8

Florencia Coruchini

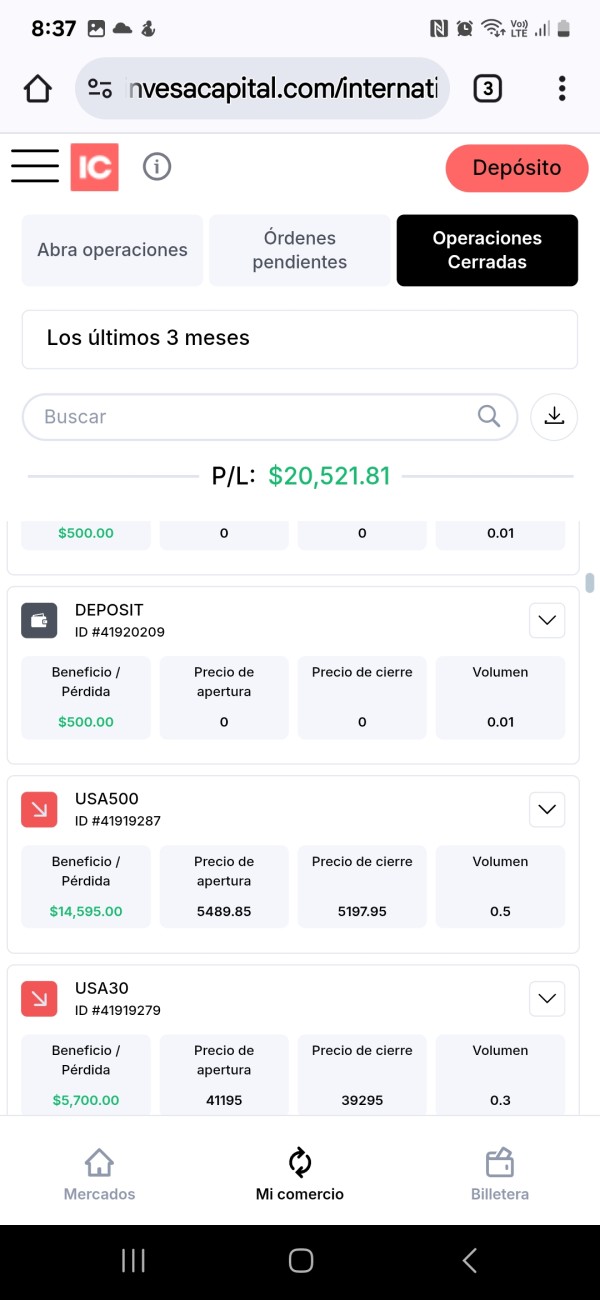

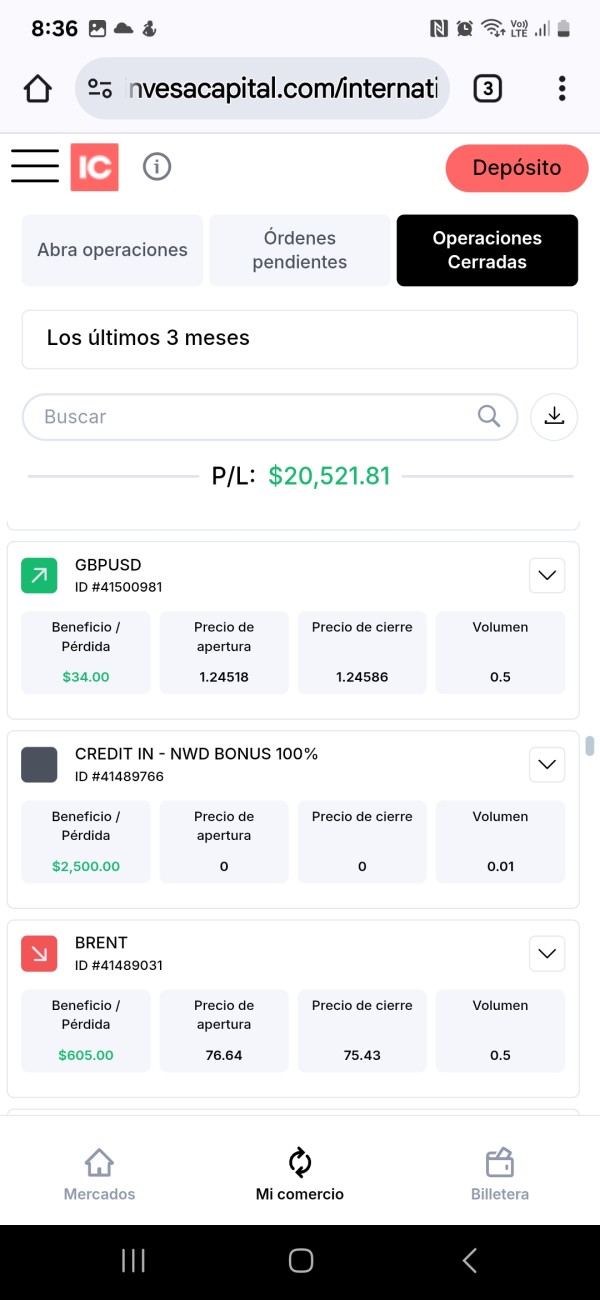

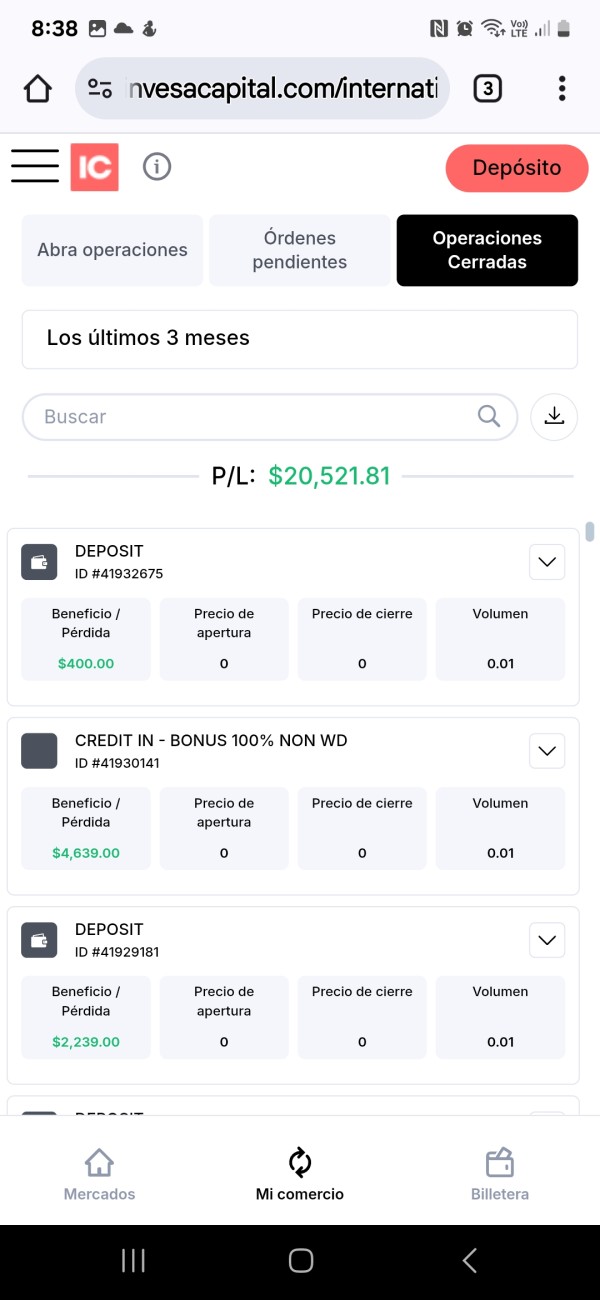

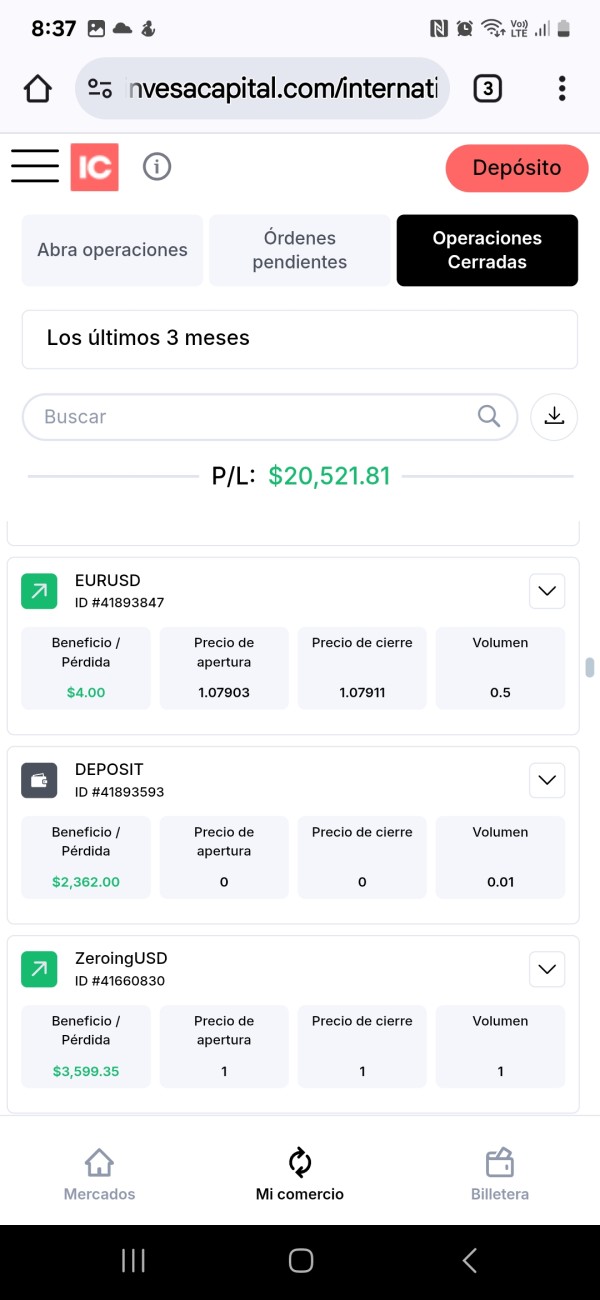

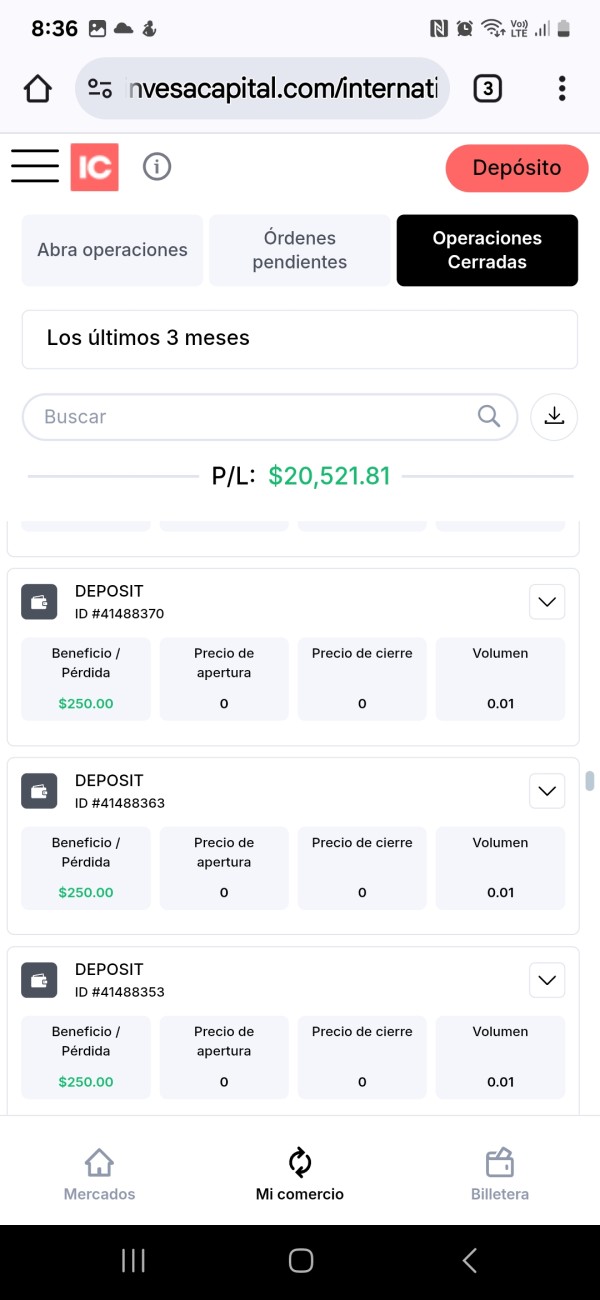

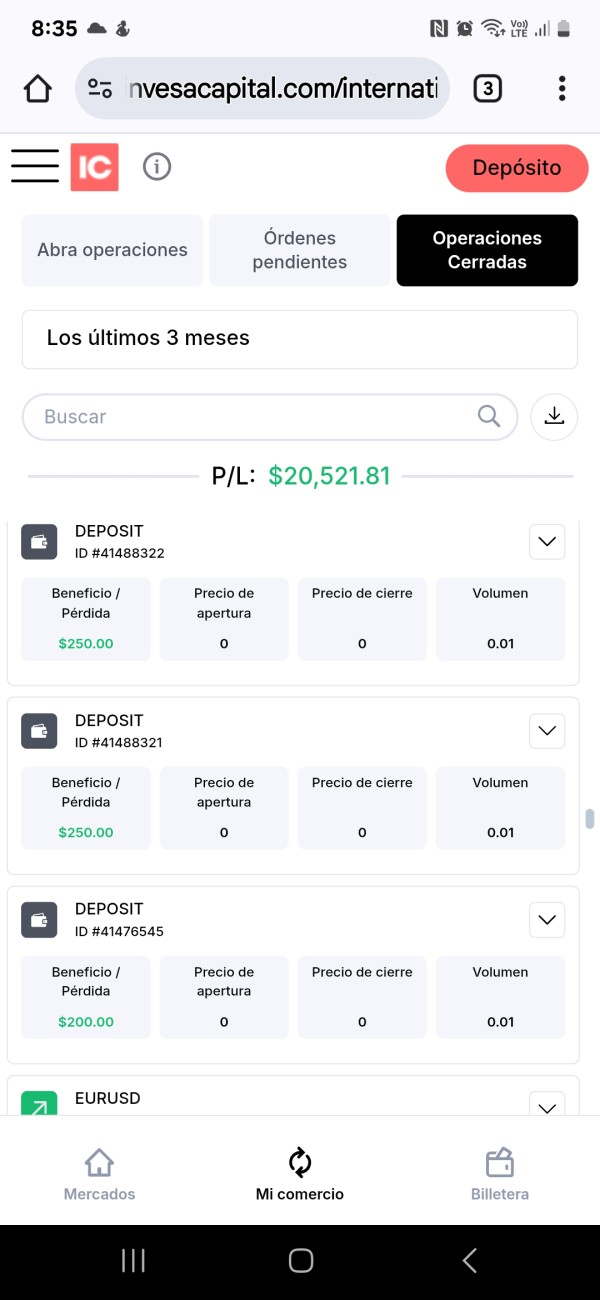

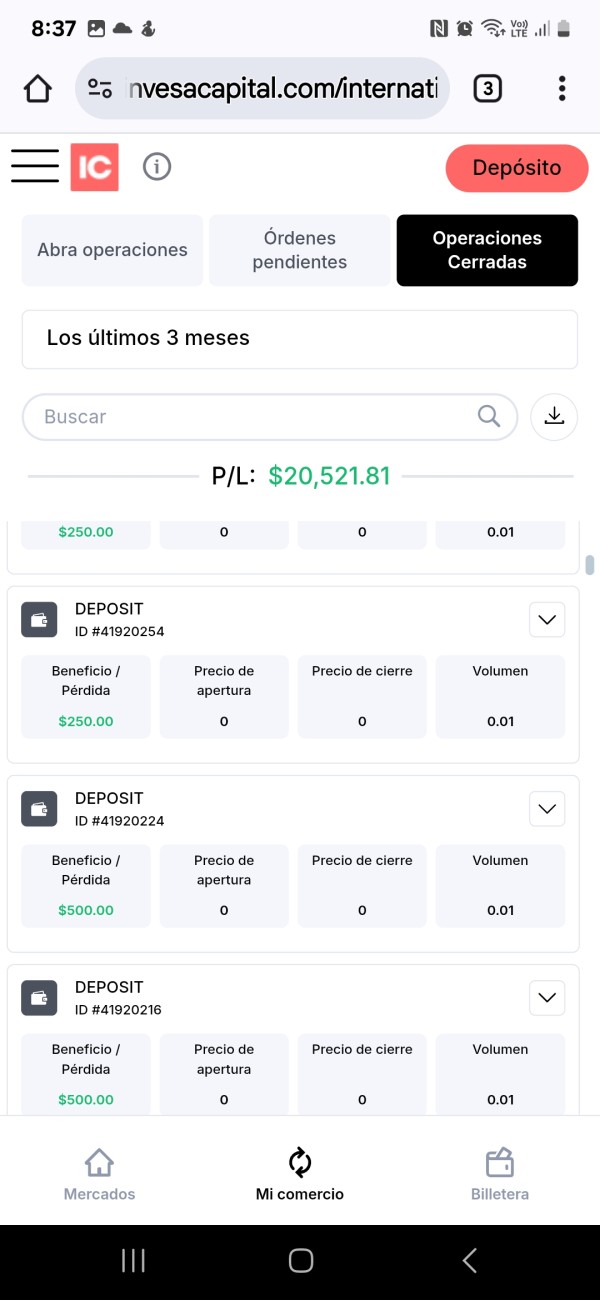

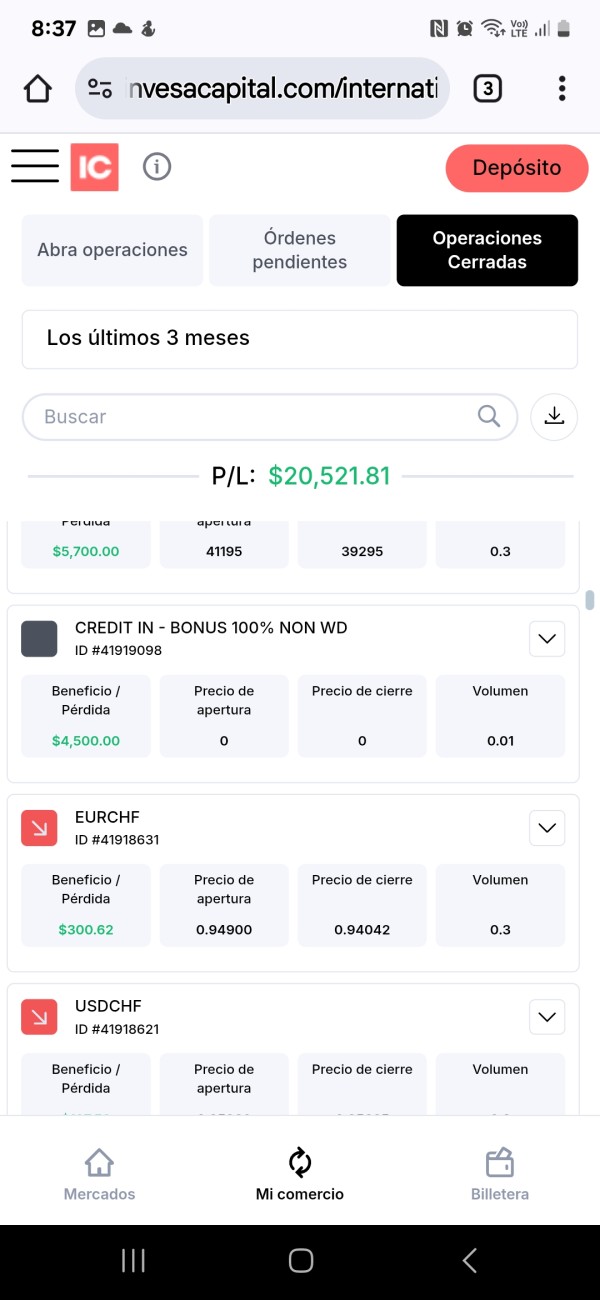

爆料 Invesa Capital 沒有退還我的錢。

他們一直讓我寄存款,聲稱是為了能夠退款。事實上,每天他們都有一個新的故事,讓我存入越來越多的錢,卻不退款。他們讓我使用信用卡,現在我既沒有信用額度,也沒有現金來償還。他們讓我陷入債務之中。

1週內

6

1

亨达市场部高级经理阿左

亨達,一家擁有三十餘年歷史的老平台,總部給最高條件,佣金平倉即返

歡迎諮詢

03-20

chunghoon oh

The reason I’m betting on a rise in the US10Y 2

This is a follow-up to the article I posted yesterday.

I believe that the U.S. 10-year Treasury bond yield will inevitably rise rapidly in the near future.

The Trump administration is set to impose tariffs on March 4th, and it's uncertain whether they will be able to reduce U.S. fiscal spending by $1 trillion.

Additionally, the Federal Reserve’s interest rate decision is coming up in March.

One reason why I have doubts about the monetary policies of central banks around the world is that they seem overly reliant on data when deciding interest rates.

In my personal opinion, central banks should avoid being too far ahead or behind but instead predict exactly one step ahead when making decisions about benchmark interest rates.

As we all might expect, the unemployment rate in the U.S. is likely to rise.

In February, there was a large-scale deportation of immigrants, and many federal government employees were laid off or are expected to be laid off soon.

As a result, the unemployment rate in March could reach 4.1~4.2%. Based on such data, there may be growing expectations that the Federal Reserve will cut interest rates in March.

I think this expectation is one of the reasons why the U.S. Treasury bond yield recently dropped to 4.3%.

Now, let’s assume that the Fed lowers interest rates on March 19th, relying solely on the rising unemployment data. What might happen?

Japan is scheduled to make its interest rate decision on March 20th, and inflation in Japan has been rising sharply.

There’s a very high probability that Japan will raise its benchmark interest rate on March 20th. Let’s assume that the Bank of Japan raises interest rates (while the U.S. cuts them).

If this happens, the U.S.-Japan interest rate spread could narrow to below 3.5%, which might lead to yen carry trade unwinding within about a week.

Under normal global economic conditions, risk-averse behavior triggered by yen carry trade unwinding would push funds into safe-haven assets like U.S. Treasuries, causing Treasury yields to fall.

However, if the dollar weakens against the yen, instead of funds flowing into U.S. Treasuries, capital might flow into other inflation-hedging assets like gold or oil.

(That’s why I mentioned in another post that I’m betting on rising gold and oil prices.)

Of course, this is all hypothetical, based on assumptions about what might happen. But considering these factors, I wanted to explain why I believe the U.S. 10-year Treasury bond yield will eventually rise.

To navigate the current complex global situation, I think a combination of policies—keeping interest rates steady, reducing fiscal spending, and cutting taxes—needs to be implemented.

02-28

7

亨-達國際-A生-招代理

選擇亨達,創造輝煌,誠招IB

1、1990年成立,至今35年歷史,陪我們一同成長的品牌,目前活躍在市場上時間最長的了,自然安全,穩定

2、總部位於香港,內地有實業(亨達水務),便於考察,有保障

3、12個國際監管牌照,正規運營,19個國際城市有辦事處,國際化運營

4、出入金便捷、安全,沒有sf凍結,為交易者避免麻煩

5、交易環境順暢,支持盈利,不用擔心盈利不給出金

6、活動全年在綫,代理、客戶活動不斷,每次交易都在積累積分,永久商城隨時兌換

2024-11-26

飛機: @daidai0313

美國MSB牌照·CEO

美國FINCEN MSB 首先需要註冊美國的公司或者基金會

“美國FINCEN MSB牌照介紹” 牌照簡介: 美國MSB牌照是由美國財政部監管,並頒發的一類金融牌照,主要收監管對像是金錢服務相關的業務與公司,包括了數字貨幣、虛擬貨幣的交易,ICO發行,以及外匯兌換,國際匯款等等的業務。 牌照優勢: 美國Fincen MSB,作為數字貨幣圈中,知名度最高的必拿牌照,最初獲得者就有火幣、幣安、Okex等眾多大型交易所。 1、全球知名度高 2、美國經營相關業務必須獲得授權 3、性價比高,相對其他知名數字貨幣牌照而言,費用低 4、牌照辦理週期短 5、適合交易所首次獲得的牌照 辦理條件: 美國FINCEN MSB 首先需要註冊美國的公司或者基金會,提供公司業務模型、三年發展規劃、KYC、律師推薦信、無犯罪記錄證明、完稅證明等內容(均可由達安企服一站式完成) 更多數字貨幣、外匯監管:美國MSB、澳洲AUSTRAC、瑞士VQF、迪拜VARA、澳洲AR、英國AR等牌照辦理

03-14

點擊加載更多