Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

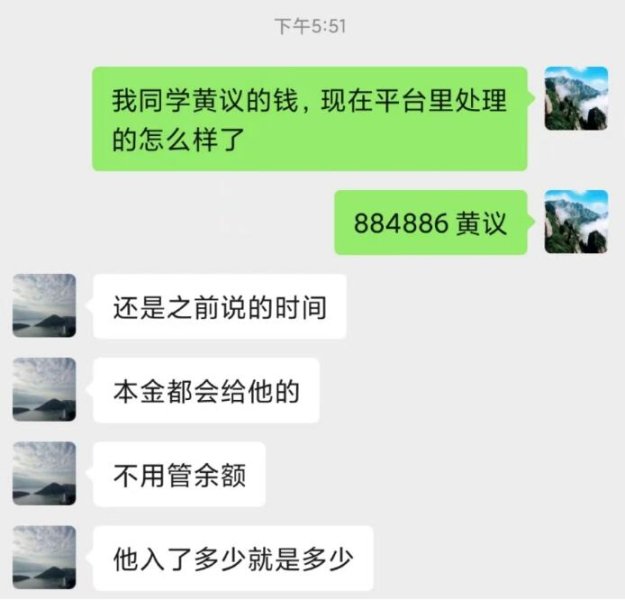

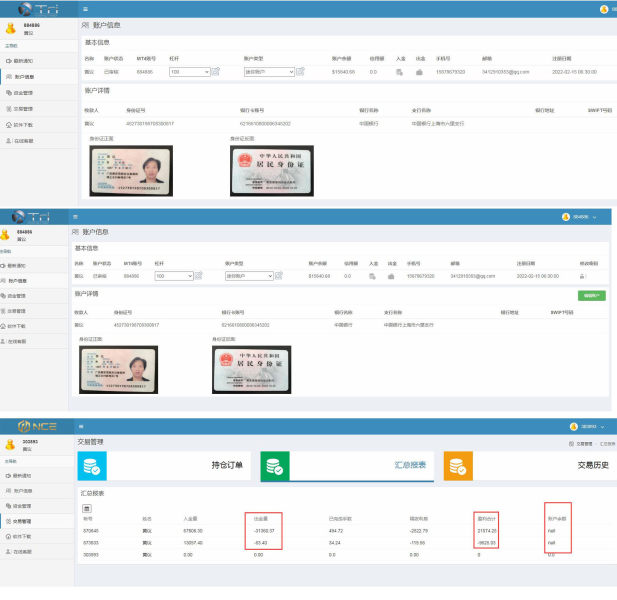

小白9945

Hong Kong

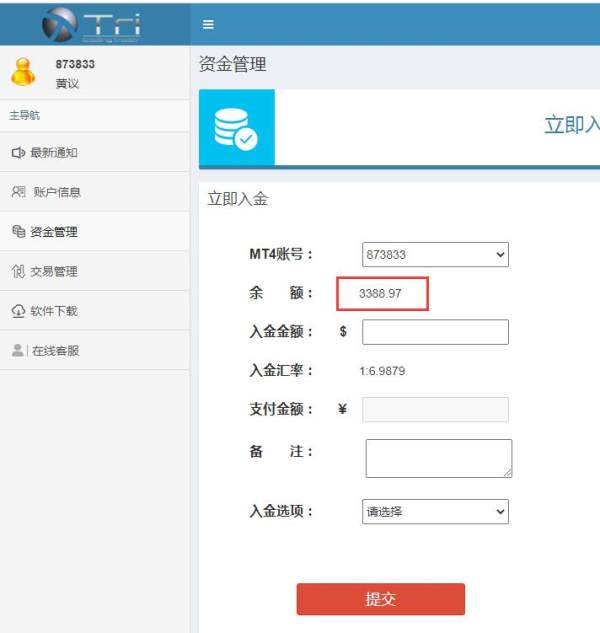

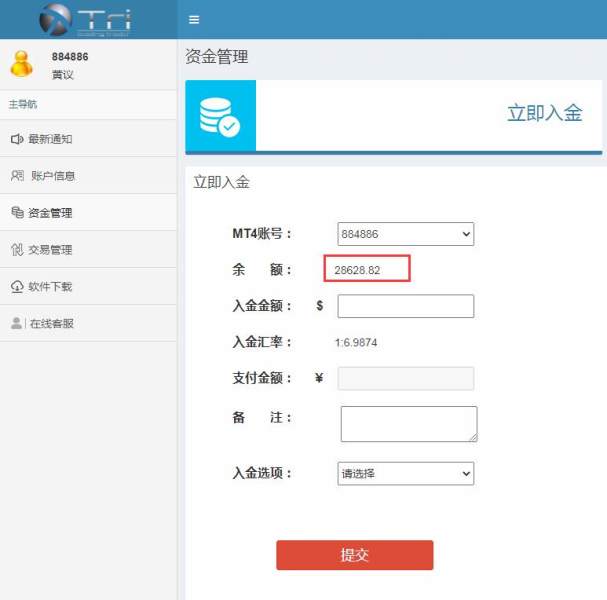

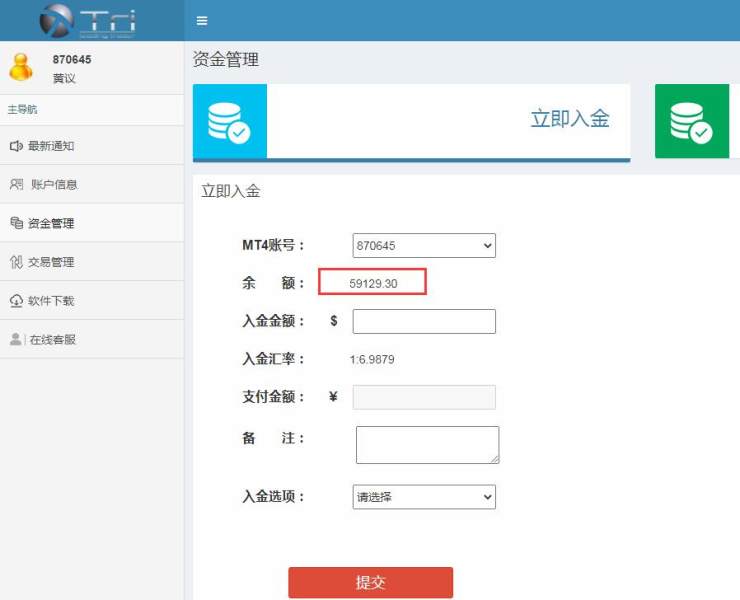

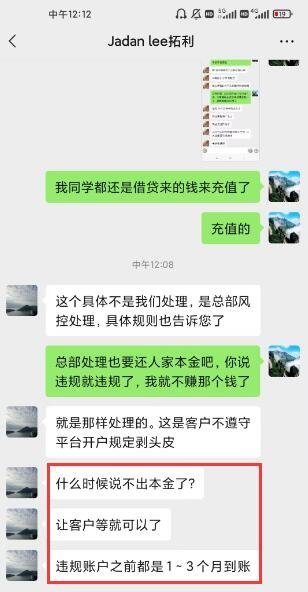

1. I have 3 accounts, Account 1: 870645, Account 2: 873833, Account 3: 884886. I have opened an account on the foreign exchange platform of TRI for nearly 5 years. In September 2022, the platform of TRI and the platform of NCE Aa the time of the merger, my three accounts were restricted from trading, and it has been half a year so far. 2. Before TRI was merged into NCE, my account had been depositing and withdrawing normally. When it was merged, my account was restricted for no reason. I couldn't trade or withdraw money, and no one notified me. 3. I did not have any violations. TRI said that I violated the regulations without any reason. Now there is no way to appeal, and my principal has not been returned to me. 4. After negotiating many times with the account manager, the account manager said that Toli would refund the principal within 1-3 months, but until now, Toli has not returned the principal to me. 5. I have given feedback many times. In November 2022, the NCE official email informed me that the platform will refund the principal as soon as possible, but so far there is no clear answer. 6. I have more than 70,000 US dollars in principal in my 3 accounts, and I demand TRI to return it immediately.

Exposure

2023-03-17

知足常乐13905

Hong Kong

Cannot log in MT4. The customer service does not reply or withdraw.

Exposure

2022-09-15

FX8075119492

Hong Kong

MT4 cannot log in. It has been a week.

Exposure

2022-09-15

书生是也

Hong Kong

The platform has been unable to log in and trade for a day. It's been a day and the platform still crashed. Rubbish!

Exposure

2022-09-08

FX3658140439

Hong Kong

My account at TRI suddenly cannot be logged in. The customer service does not reply. The remaining balance cannot be withdrawn.

Exposure

2022-08-13

A小能手-信用卡贷款

Hong Kong

I can't get my money back, so I decide to expose the company, or I'll call the police.

Exposure

2022-07-01

天总会晴

Hong Kong

Too disgusting, the customer's can't withdraw, and I can't withdraw. Garbage platform

Exposure

2022-06-30

木雪千山

Hong Kong

I have been trading on the Tuoli platform, and many of them go to the official website, using mobile phones to trade. I was planning to withdraw money the day before yesterday, but found that the official website could not be opened. There are still funds in the trading account. Since the official website cannot be opened, I don’t know how to take it out.

Exposure

2022-06-22

FX5769850665

Hong Kong

On May 27th, I made a small order on the scam platform TRI. On the 5.31, when I was about to withdraw money, I could not open the account in the background, nor did I open the account. After I learned about it, I realized that the principal cannot be withdrawn and there is no reason for that. That's why I'm here to tell everyone not to come to this scammer's platform

Exposure

2022-06-17

追风49893

Hong Kong

The platform cannot log in for several days. It seems that they really abscond.

Exposure

2022-06-10

返佣帝国集团

Hong Kong

Trash platform that does not withdraw. You violate the regulations once you make profit.

Exposure

2022-06-10

FX2861636451

United Arab Emirates

Stay away, it's a scam. I had no problem depositing money to TRI, but at the moment when I asked for a withdrawal, they blocked my account for no reason. I have given all the information they ask me to unlock my AC count but they are still holding my money. Although I've got my money back now, it's only after I've used Assetsclaimback/ com, TRI, it's fraudulent. They just woke up and decided to block my account for no reason

Exposure

2022-06-10

FX57947855

United States

Stay away, It's a scam. I deposited money to TRI without any problems, but the moment I requested a withdrawal, they blocked my account for no reason. I have provided all the information requested from me to unlock my account, yet they were still holding my money. Although I have gotten my money back now, but this was only after I used the services of Assetsclaimback Legal Expert, TRI It's fraud to just wake up and decide to block my account for no reason.

Exposure

2022-06-10

追风49893

Hong Kong

You cannot withdraw when you lose. Needless to mention about withdrawal when you win! Deposit cannot arrive and no on deal with it. They just say that it is not arrvied even the bank said it is arrived. It is a pure fraud platform. Everyone wakes up! No way to earn money at this platform.

Exposure

2022-06-09

返佣帝国集团

Hong Kong

I still reply to you a few points: 1. Which customer has violated the rules, you can simply prevent the customer from withdrawing money. The illegal commissions defined by you (most of the transfers are transferred to the customer's trading account, which can be deducted. Don't deduct me. You can call for the loss of funds). Part of the cash is transferred to the customer, and the transfer record can be provided. Lose the agent. Ridiculous! ! ! . 2. There is no clear explanation for the specific violation, but the risk control feels that which customer is not pleasing to the eye is a violation. Or making money is illegal. (Which specific liquidity provider is unacceptable for which order number, you can provide all the evidence.) Your risk control department is not qualified or authoritative to issue custom violation judgments. "Collect all the so-called illegal orders and make them public. Otherwise, you are a complete gambling "killing pig"" 3. The illegal account defined by you will deduct my money? ? ? Are the funds in my trading account deducted? If you return the principal of my deposit, you can deduct it as you please. Please pay back my hard-earned money, my trading account lost more than 1 million RMB. (If the agent has no funds in the background, the funds in my trading account will be deducted. If I transfer funds to accounts other than the same name, how will you continue to deduct??? Bully our honest and loyal partners????) 4. My so-called email feedback, at that time, the transaction account of 877669 was more than 60,000 US dollars, and I was not forced to deduct the part. There is enough evidence to show that. (It was forced!) 5. The methods we take have never been smeared, rumored, or unreasonable. All remarks can be screenshots, confrontation, evidence collection, loss of millions, I will admit defeat. It belongs to our rights, and one cannot be less! "The thief shouts to catch the thief, shameless. The word "blackmail" is suitable for TRI

Exposure

2022-06-09

FX4216541651

Canada

I deposited 72 000 AUD on the 26.03.2022, the money arrived as they stated in a support ticket to me, however they kept requesting for more deposits to strengthen my portfolio but at some point i didn't have any more funds to put in so i asked for a little withdrawal from my profits. I specifically wrote to them that they can refuse to give me service and just transfer the money back to my bank or direct the money into the Binance account where I sent from. They refused all the options I provided.

Exposure

2022-06-09

天山飞侠

Hong Kong

Cannot open the official website nor fund account. People from TRI, anyone knows what to do?

Exposure

2022-06-08

返佣帝国集团

Hong Kong

877669 Zeng Dexing observes Password: Aa123456 Server: Tri-Real was victimized and deceived in TRI Tuoli, all matters and the process: (My name: Zeng Dexing, Tel: 18759892142, ID number: 350424199110012218, QQ: 1292810916, WeChat: 15797751711) The facts described are completely true. It can be connected with the platform side and the platform specialist. All my matters are cross-examined to ensure that there will be no rumors. I am the person in charge of Rebate Empire Group (Hong Kong) Co., Ltd. and its shareholder. The official website http://www.fydg888.com/enterprise QQ and telephone 400-6464-110 cooperate with about 200 brokers. TRI Tuoli started trading in 2019. The trading account is "877669/881019" and it is also an agent. The agent number is 800756, and the user name is Jiangxi Jiaxin Enterprise Management Co., Ltd. (The total amount of funds in the background is about 110 million RMB). The platform deducts the agent's back-office commission on the grounds of customer violations. Around December 2021, about 10,000 US dollars will be deducted (records can be retrieved). In March 2022, 2,542.7 US dollars will be deducted. From May 23, 2022 to the beginning of June, the total deduction amount: 30,986.45 US dollars. The total amount of deductions is: 1 10,000+2542.7+30986.45=43529.15 US dollars "We are a rebate network, part of the rebate is transferred to the so-called illegal customers, and part of the rebate is transferred to the customer in the form of bank card transfer. I can provide all the transfer records > As an agent, we worked hard to find customers, but we ourselves lost blood. We are also victims. Please check the facts carefully and provide us with a fair and pleasant environment for cooperation. If the agent backend has no funds to deduct the funds of the trading account (the trading account has lost more than 1 million RMB from 2019 to the present), the accumulated amount of the planned deduction of the trading account is: 27036.1 US dollars 1. We have repeatedly emphasized that which customer violates the rules, directly To deduct which customer's funds can be. 2. There is no clear explanation for the specific violation, but the risk control feels that which customer is not pleasing to the eye is a violation. Or making money is illegal. (Which specific liquidity provider is unacceptable for which order number, you can provide all the evidence.) 2. My own trading lost nearly 170,000 RMB, and my trading account was not disabled. (As a partner, there is such a cooperation????? We have nearly 100 million back-end funds, and we can earn enough interest after 2 years?????),,,,"TRI Tuoli boss knows In our company, please ask customer service/risk control/management and other departments to convey all the boss's affairs, and be sure to let the boss personally reply to the results of the matter. Our appeal is to return the loss of 43,529.15 US dollars, and the account with the loss of one million has been disabled, and I am also accepting compensation. If we don't deal with it, we will pay 5 times or 10 times the price to protect our rights and interests! ! ! We just wait for a word from the boss himself. 》

Exposure

2022-06-08

追风49893

Hong Kong

Is TRI absconded? The platform cannot be logged in. Cannot fund the account. There is still transaction. What can I do

Exposure

2022-06-07

追风49893

Hong Kong

Deposit fails to arrive account, I have generated an electronic receipt, but they say that they have not received it. I contacted the customer service of the bank here, contacted the account opening bank, and they all said that the money has been sent to the other party's account, but TRI said that they have not received it, which is extremely shameless. ! There are banking institution involving and they are still so rogue, it's not just a fraud platform, it's shameless!

Exposure

2022-06-06