Score

CITY FOREX

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.cityforex.co.uk

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed CITY FOREX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

cityforex.co.uk

Server Location

United Kingdom

Website Domain Name

cityforex.co.uk

Server IP

217.146.86.164

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Company Name | CITY FOREX |

| Registered Country/Area | UK |

| Founded Year | 2005 |

| Regulation | Unregulated |

| Products | International payments, expense management, broker platforms and developer portal |

| Account Types | Business, Personal |

| Trading Platforms | None |

| Customer Support | +44 (0) 207 621 0090travelmoney@fairfx.com |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Cards |

| Educational Resources | Blog, Business expenses, Currency news, Economic calendar, Expense cards, Financial glossary, Global business |

Overview of CITY FOREX

CITY FOREX, founded in the UK in 2005, offers a wide range of financial services including international payments, expense management, and broker platforms.

Operating without regulation, it provides access to trading assets such as currencies and commodities. The trading platform offers multi-currency accounts and simplified business expenses.

However, the lack of transparency in fee structure and limited payment options are notable drawbacks.

Regulatory Status

CITY FOREX operates without regulation. This lack of oversight poses risks to customers. Without regulation, there's no guarantee of fair practices or protection of funds. Customers might face issues like fraud, manipulation, or inadequate customer support.

Pros and Cons

| Pros | Cons |

| Wide range of financial services | Limited payment options |

| Multi-currency accounts | Lack of transparency in fee structure |

| Simplified business expenses | Unregulated |

| Publicly listed company | |

| Commitment to environmental impact |

Pros:

Wide Range of Financial Services: CITY FOREX offers an extensive array of financial services such as international payments, expense management, and broker platforms.

Multi-currency Accounts: Users have the flexibility to hold and manage multiple currencies within their accounts. This feature enables businesses and individuals to conduct transactions in different currencies without the need for multiple accounts, reducing the complexity and cost associated with currency conversion.

Simplified Business Expenses: CITY FOREX simplifies business expense management by offering tools and solutions tailored to businesses' needs. This includes prepaid expense cards and streamlined expense tracking functionalities, allowing businesses to efficiently manage their expenses and maintain better control over their finances.

Publicly Listed Company: Equals Group Plc, the parent company of CITY FOREX, is publicly listed on the AIM market of the London Stock Exchange.

Commitment to Environmental Impact: CITY FOREX demonstrates a commitment to environmental sustainability by offsetting its carbon emissions through support for renewable energy projects. This initiative aligns with broader efforts to mitigate climate change and promote corporate social responsibility.

Cons:

Limited Payment Options: While CITY FOREX only supports bank transfers and card payments, it does not offer popular online payment platforms such as PayPal, Skrill, or Neteller.

Lack of Transparency in Fee Structure: CITY FOREX does not provide clear information on fees such as transaction charges, currency conversion fees, or account maintenance fees. Without transparent fee disclosure, users will find it difficult to assess the total cost of using CITY FOREX's services and compare them with other providers.

Unregulated: CITY FOREX operates without regulation from any financial authority, exposing users to potential risks associated with unregulated financial services.

Products

CITY FOREX mainly provides solutions for transferring funds globally, including:

International Payments: CITY FOREX offers a comprehensive solution for transferring funds globally, supporting transactions in over 140 currencies. This service facilitates easy international payments for businesses and individuals alike.

Expense Management: The platform provides tools for efficient expense management, particularly through prepaid expense cards. This feature is designed to streamline expense tracking and control, offering convenience and flexibility for users managing their financial obligations.

Faster Payments: With a focus on domestic transactions, CITY FOREX's faster payments service ensures swift and reliable fund transfers within the same country. This feature is valuable for businesses and individuals seeking timely settlement of financial transactions.

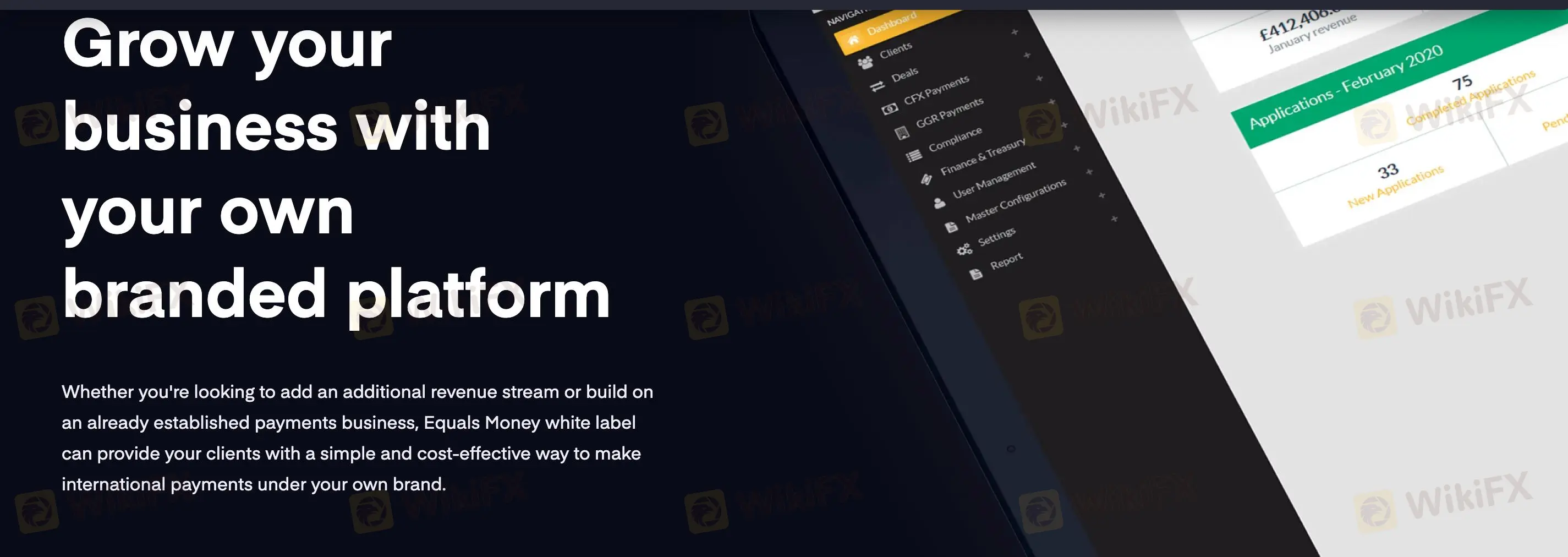

Broker Platform: CITY FOREX offers a white-label payment platform tailored for brokers. This solution enables brokers to provide their clients with a customized payment experience, enhancing their service offerings and operational efficiency.

Shared Cards: Additionally, CITY FOREX offers shared card solutions, which can be utilized for various purposes, such as corporate expense management or family budgeting. These shared cards provide a convenient way to manage and control spending across multiple users.

Account Types

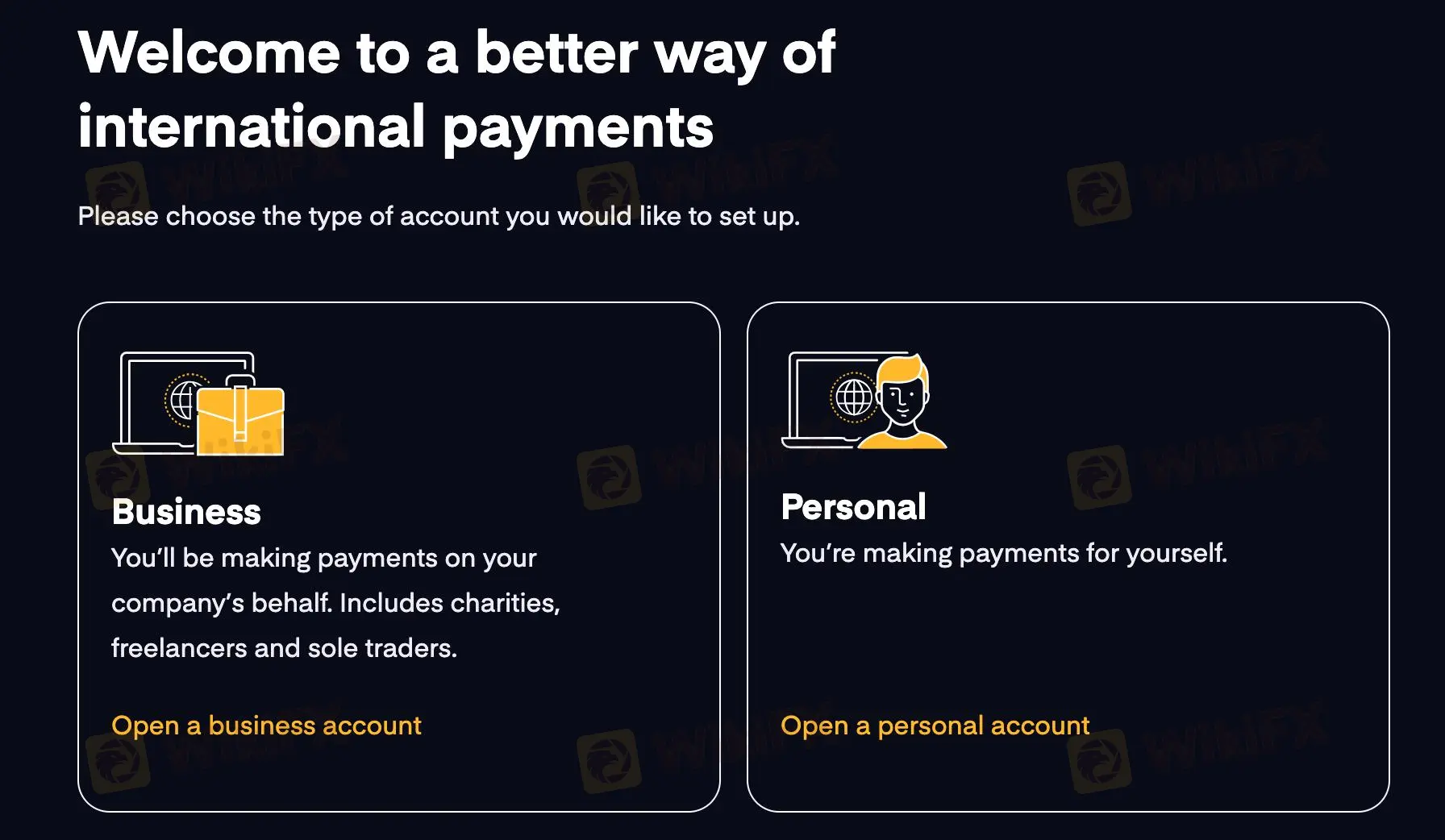

These are two account types offered by CITY FOREX.

Business Account: Designed for entities and professionals managing payments on behalf of their organizations, including charities, freelancers, and sole traders. This account type facilitates efficient management of business-related transactions, offering tailored solutions to meet the specific needs of businesses and professional entities.

Personal Account: Tailored for individuals making payments for personal purposes. Whether it's managing personal expenses or conducting individual transactions, this account type provides a convenient and user-friendly platform for managing personal finances and transactions.

How to Open an Account?

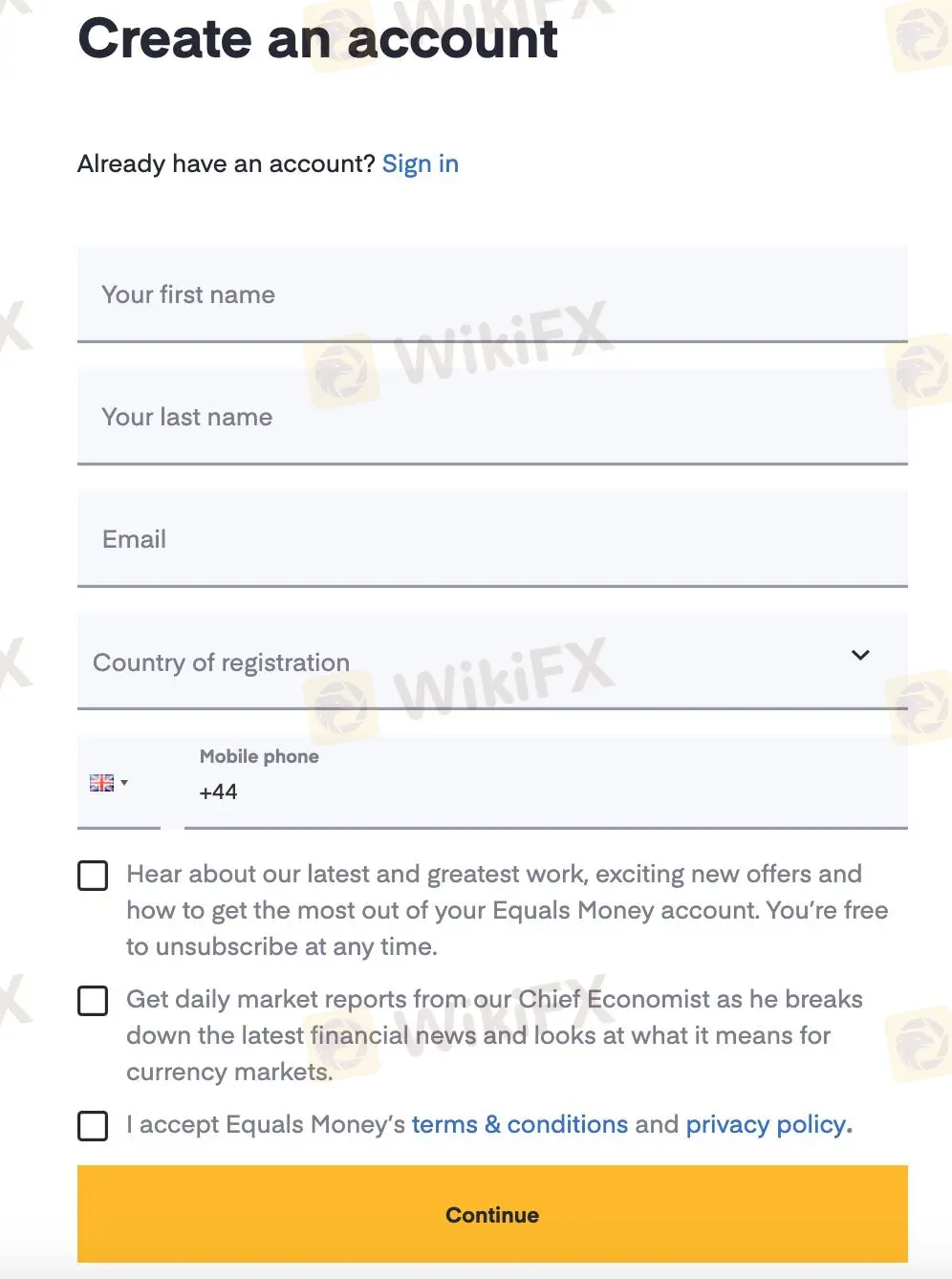

Visit CITY FOREX's official website and click the “Get started” button.

Choose the type of account you wish to open: “Business” or “Personal”.

Fill out the online application form with accurate personal or business information, including name, address, contact details, and relevant financial information.

Upload any required documents, such as identification (passport, driver's license) or business registration documents, to verify your identity or business entity.

Review the terms and conditions of the account agreement carefully and confirm your agreement.

Once the application is submitted, await confirmation from CITY FOREX regarding the approval of your account. Upon approval, you will receive further instructions on how to access and manage your account.

Deposit & Withdrawal

CITY FOREX primarily accepts bank transfers for payments, as indicated on its platform. While the website prominently displays the Mastercard logo, suggesting potential card payment options, other popular online payment platforms like PayPal, Skrill, or Neteller are not visibly featured.

Customer Support

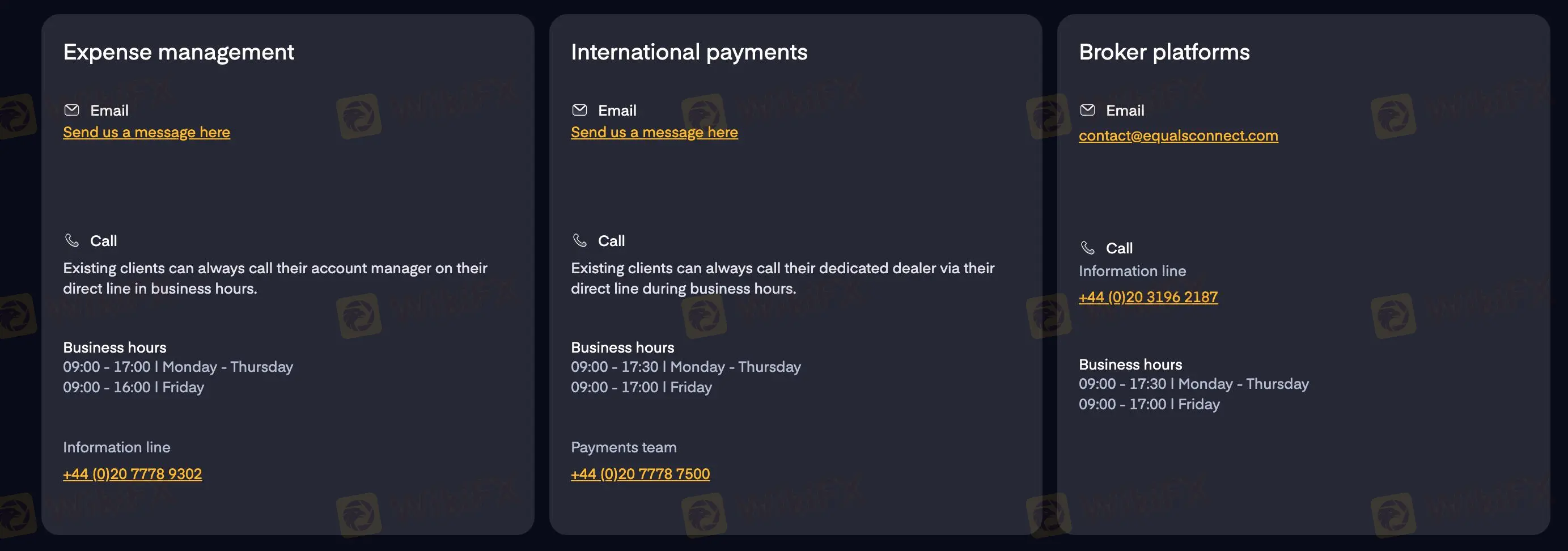

CITY FOREX offers dedicated customer support across its various services.

For Expense Management, customers can reach out via email or phone during business hours. The customer support team is available from Monday to Thursday, 09:00 - 17:00, and on Fridays from 09:00 - 16:00. You can contact the information line at +44 (0)20 7778 9302.

Similarly, for International Payments, the Payments Team can be contacted at +44 (0)20 7778 7500.

Finally, for inquiries related to Broker Platforms, customers can utilize email or phone to contact CITY FOREX. The information line is available during business hours at +44 (0)20 3196 2187.

Educational Resources

CITY FOREX provides a wide range of educational resources enhancing users' understanding of financial markets and transactions. Their resources cover various topics, including business expenses, currency news, and global economic events through an economic calendar.

Additionally, they offer insights into expense management with expense cards and a financial glossary to clarify complex terms.

Conclusion

In summary, CITY FOREX, founded in the UK in 2005, presents a wide array of financial services, including international payments and expense management solutions.

While its extensive product offerings serve various financial needs, the absence of regulation raises risks regarding user protection and transparency.

The platform's multi-currency accounts and simplified business expense features offer flexibility, yet the lack of clarity in fee structures and limited payment options remain notable drawbacks.

FAQs

Question: What services does CITY FOREX offer?

Answer: CITY FOREX provides international payments, expense management solutions, and broker platforms for businesses and individuals.

Question: Is CITY FOREX regulated?

Answer: No, CITY FOREX operates without regulation from any financial authority.

Question: What are the account types available at CITY FOREX?

Answer: CITY FOREX offers both business and personal account options.

Question: What payment methods are supported by CITY FOREX?

Answer: Customers can make payments through bank transfers or credit/debit cards.

Question: How can customers contact CITY FOREX for support?

Answer: Customers can reach CITY FOREX for assistance via email or phone during business hours.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now