Overview

ZRF, founded in 1995 with a registered capital of 500 million RMB, operates within a diverse scope, encompassing commodity futures brokerage, financial futures brokerage, futures investment advisory, and asset management. The company holds membership in major Chinese futures exchanges, including the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, Guangzhou Futures Exchange, and Shanghai International Energy Exchange, and it is also a trading and clearing member of the China Financial Futures Exchange. Headquartered in Shanghai, ZRF maintains over twenty branch offices across China, spanning regions such as Beijing, Shandong, Zhejiang, Inner Mongolia, Sichuan, Jiangsu, Anhui, Hunan, Guangdong, Guangxi, Shanxi, Hebei, Liaoning, Chongqing, Fujian, and Yunnan. Additionally, it operates a risk management subsidiary, Huixin Rongzhi Capital Management Co., Ltd., within the Shanghai Free Trade Zone. As a subsidiary of China National Agricultural Development Group, ZRF leverages its robust shareholder background and group synergies while embracing a corporate culture rooted in the ethos of “hard work pays off.” The company is committed to evolving into a comprehensive futures and derivatives service provider that garners customer satisfaction, employee pride, and societal respect.

Regulation

Regulated.The trading and regulation of ZRF (Zhong Rong Futures), a financial derivative product linked to the Chinese Renminbi (RMB), is overseen and governed by the China Financial Futures Exchange (CFFEX). CFFEX plays a pivotal role in establishing the rules, monitoring market activity, and ensuring the smooth operation of ZRF contracts, which are designed to provide investors with a tool for hedging against currency fluctuations involving the Chinese Renminbi. This regulatory framework maintained by CFFEX not only promotes transparency and fairness in the trading of ZRF but also contributes to the stability and integrity of China's financial markets, further bolstering confidence among both domestic and international participants seeking exposure to Renminbi-related financial instruments.

Pros and Cons

ZRF (Zhongrong Huixin) Financial Services is a prominent financial institution in China, offering a diverse array of financial services, including futures brokerage, advisory, and asset management. The company benefits from its membership in major Chinese futures exchanges, providing clients with direct access to these markets. ZRF also operates a risk management subsidiary to enhance portfolio risk assessment.

However, the company faces challenges such as limited international presence and dependency on market conditions, which can be volatile. Complex fee structures on various Chinese exchanges require careful consideration. While ZRF maintains a strong focus on customer satisfaction and offers robust trading platforms, it operates in a competitive industry, necessitating continuous innovation and adaptation to remain competitive. Overall, ZRF's strengths lie in its comprehensive services and commitment to client relationships, but it must navigate challenges inherent to the financial industry.

Services

ZRF offers a comprehensive range of financial services within the realm of futures and derivatives trading. Here's a detailed description of its services:

Commodity Futures Brokerage: ZRF facilitates the trading of various commodity futures contracts on behalf of its clients. This includes agricultural commodities, metals, energy products, and more. They provide market access, execution services, and advisory support to help clients navigate the complexities of commodity futures markets.

Financial Futures Brokerage: ZRF specializes in financial futures, allowing clients to trade derivatives tied to financial instruments such as stock indices, interest rates, and currencies. This service enables investors to hedge against financial market risks or speculate on price movements.

Futures Investment Advisory: ZRF offers expert advisory services to guide clients in making informed investment decisions within the futures and derivatives markets. Their team of experienced professionals provides market analysis, risk management strategies, and personalized investment recommendations tailored to individual client needs.

Asset Management: ZRF manages client portfolios in the futures and derivatives markets, aiming to maximize returns while mitigating risks. They employ various investment strategies, including algorithmic trading, hedging, and diversification, to help clients achieve their financial goals.

Membership in Major Exchanges: As a member of prominent Chinese futures exchanges like the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, Guangzhou Futures Exchange, and Shanghai International Energy Exchange, ZRF offers clients direct access to these markets, ensuring timely execution of trades.

Trading and Clearing Services: ZRF serves as a trading and clearing member of the China Financial Futures Exchange, allowing clients to benefit from efficient trade execution and clearing services, which enhance the safety and integrity of their futures transactions.

Extensive Branch Network: With a network of over twenty branch offices across China, ZRF provides localized support to its clients, offering them a physical presence in various regions for consultations, account management, and educational events.

Risk Management Subsidiary: ZRF operates a risk management subsidiary, Huixin Rongzhi Capital Management Co., Ltd., within the Shanghai Free Trade Zone, which focuses on enhancing risk assessment and mitigation for its clients' portfolios.

Corporate Culture and Commitment: ZRF is part of the China National Agricultural Development Group, which provides strong backing and resources. The company adheres to the core values of “hard work yields rewards” and is dedicated to becoming a trusted partner in the futures and derivatives industry, prioritizing customer satisfaction, employee empowerment, and societal respect.

In summary, ZRF offers a holistic suite of services that cater to the diverse needs of investors and traders in the Chinese futures and derivatives markets. From trading execution to risk management and advisory services, the company is well-equipped to assist clients in navigating these financial markets effectively.

Market Instruments

Commodity Futures (64):

Commodity futures are standardized contracts that enable traders and investors to speculate on the future price movements of various physical commodities. The “64” in this context likely refers to a broad range of commodities encompassing agricultural, energy, and metal products. These contracts can include items such as:

Agricultural Futures: Contracts for agricultural products like corn, wheat, soybeans, cotton, and coffee.

Energy Futures: Contracts tied to energy commodities such as crude oil, natural gas, and gasoline.

Metal Futures: Contracts related to precious and industrial metals like gold, silver, copper, and aluminum.

Commodity futures serve multiple purposes, including hedging against price fluctuations and providing opportunities for traders to profit from price changes in these essential commodities.

Financial Futures (7):

Financial futures are contracts tied to financial instruments, allowing market participants to speculate on the future value of these assets. The “7” represents a variety of financial instruments, including:

Stock Index Futures: Contracts linked to stock market indices like the S&P 500 or FTSE 100.

Interest Rate Futures: Contracts based on interest rates such as the yield on government bonds.

Currency Futures: Contracts associated with foreign exchange rates between different currencies.

Financial futures serve as essential tools for risk management and portfolio diversification, enabling market participants to navigate financial market volatility.

Commodity Options (25):

Commodity options are derivative contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific quantity of a commodity at a predetermined price on or before a specified expiration date. The “25” suggests a diverse range of options contracts linked to various commodities, similar to those mentioned under commodity futures. Commodity options offer flexibility to traders and investors, allowing them to manage risk or speculate on price movements in commodity markets.

Financial Options (5):

Financial options, like commodity options, grant the holder the right to buy or sell a financial instrument at a set price within a defined time frame. The “5” signifies a selection of financial options linked to different assets, such as stock indices, interest rates, or currencies. These options provide valuable strategies for portfolio hedging, income generation, and risk management in the financial markets.

In summary, the mentioned market instruments encompass a wide spectrum of trading opportunities, ranging from agricultural products and energy commodities to financial instruments like stock indices and interest rates. Futures contracts offer a way to engage in both speculation and hedging, while options provide additional flexibility by allowing investors to choose whether to exercise their rights. The diversity of these instruments contributes to the depth and breadth of the global derivatives markets.

Fees

The fees associated with trading futures contracts on various Chinese exchanges are designed to cover the costs of facilitating these transactions and maintaining the integrity of the markets. These fees can vary significantly depending on the specific commodity or financial instrument being traded and the exchange on which the trading occurs.

Starting with the Shanghai Futures Exchange (SHFE), they employ a fee structure that includes both percentage-based fees and fixed fees. For example, trading silver (AG) incurs a fee of 0.015% of the transaction value, while aluminum (AL) carries a fixed trading fee of 9 CNY per contract. This diversity in fee calculation allows traders to choose contracts that align with their trading strategies and preferences. Additionally, it's important to note that the SHFE charges fees for contract registration, which can add to the overall cost.

The China Financial Futures Exchange (CFFEX), on the other hand, predominantly employs percentage-based fees for its futures contracts. These fees are calculated based on a percentage of the transaction value and are often split between opening and closing positions. For instance, trading the CSI 500 Stock Index Futures (IC) incurs a fee of 0.0069% of the transaction value for opening positions and 0.069% for closing positions on the same trading day. Additionally, there is a flat registration fee of 1 CNY per contract. This structure is common in financial futures markets, allowing traders to tailor their positions with cost considerations in mind.

Moving to the Dalian Commodity Exchange (DCE), their fee structure includes fixed trading fees for various commodities like soybeans and corn. For instance, trading soybeans (a) incurs a fee of 6 CNY per contract, while trading corn (c) has a fee of 3.6 CNY per contract. These fees are relatively straightforward and provide traders with a clear understanding of their transaction costs. Additionally, DCE may also charge percentage-based fees for certain commodities, further diversifying the fee structure.

The Zhengzhou Commodity Exchange (ZCE) features a fee structure that combines percentage-based fees with fixed fees for different contracts. For example, trading cotton (CF) incurs a fee of 12.9 CNY per contract (24 CNY per contract for specific contracts). These fees are based on the transaction value. Additionally, commodities like soybean meal (M) have fixed trading fees of 4.5 CNY per contract. This combination of fee types allows traders to manage their costs effectively.

Lastly, the Shanghai International Energy Exchange (INE) charges fixed trading fees for certain contracts, such as 60 CNY per contract for medium-sulfur crude oil (sc). The INE also employs percentage-based fees for other contracts like natural rubber (nr), with a fee of 0.06% of the transaction value. This mix of fixed and percentage-based fees caters to the unique characteristics of energy and commodity markets.

In conclusion, the fees associated with trading futures contracts on Chinese exchanges are structured to provide flexibility and transparency for market participants. Understanding these fees is essential for traders and investors to make informed decisions regarding their trading strategies and positions. It's advisable for traders to stay updated on fee changes and consult the respective exchanges for the most current fee schedules.

Trading Platfroms

ZRF offers a variety of trading platforms tailored to the needs of different types of traders and investors. Here is an overview of some of their trading platforms:

Zhongrong Huixin Quick Period Client V2 (Supports Penetration Supervision):

Update Date: July 22, 2021.

Supports penetration supervision.

Compatible with IPv6 network environments.

Designed to provide arbitrage users with comprehensive features, including the combination of contracts, specified price orders, price and volume ratios, and overprice settings.

Features an automatic stop-loss and take-profit function that allows traders to set stop-loss points before opening positions, automatically generating corresponding stop-loss orders when the position changes.

Version: V2.93.

MD5: 6B07BCAF173AF8776704006699B2AB3F.

Zhongrong Huixin Chairman Quick Period Client V3 (Supports Penetration Supervision):

Update Date: August 6, 2021.

Supports penetration supervision and IPv6 network environments.

The “Quick Period” platform is popular among regular clients and offers various user-friendly styles to accommodate different trading preferences.

Features quick order placement functions and robust trading analysis and reporting capabilities.

Primarily designed for CTP Chairman.

MD5: 6B07BCAF173AF8776704006699B2AB3F.

WinShun Cloud Market Trading Software HD Version V6 (Supports Penetration Supervision):

Update Date: August 8, 2023.

This version is suitable for PC devices operating in IPv4 network environments.

WinShun Cloud Trading Software (wh6) is an intelligent trading software designed for individual investors, offering market data, analysis, and trading in one platform.

Features cloud-based trading technology, including cloud conditional orders, stop-loss/take-profit orders, and cloud backups.

Version: V6.8.552.

MD5: 4F5C472B650B35093100FB495C49D98A.

Zhongrong Huixin EasyStar Software (Supports Penetration Supervision):

Update Date: January 13, 2021.

Supports penetration supervision and IPv6 network environments.

Designed for global derivatives trading, providing depth market data from more than ten domestic and foreign securities and futures exchanges.

Offers various order types and supports multiple account logins.

Compatible with CTP and ESUNNY systems.

Version: V9.3.

MD5: B6B113E8E7E40055EA843B4272ECBB39.

Zhongrong Huixin Futures App - Android Version (Supports Stock Index Options):

Update Date: June 2, 2023.

Supports penetration supervision and stock index options trading.

MD5: 31CF0BE25710A78E31989D13919FC5C9.

Zhongrong Huixin Bo Yi Master V6:

Update Date: June 21, 2023.

Version: V6.3.10.3.

Integrates market data and trading into one platform, offering 11 order types for versatile trading.

Enhances the synergy between trading and market data.

Introduces cloud conditional orders and arbitrage functionality.

MD5: 282E3BFE6C38C7A881F91A899988458B.

Zhongrong Huixin Futures Infinite Yi:

Update Date: April 10, 2023.

Supports cross-market trading for futures, options, and spot markets.

Provides customizable layout modes and efficient trading features such as infinite order placement, grid strategy, and more.

MD5: 2558DF793411C2CB0B8903EE2F8F0C8E.

Zhongrong Huixin Futures App - Apple iOS Version (Supports Penetration Supervision):

Updated on: June 2, 2023.

Supports various functions, including account opening, market viewing, and trading.

Users can download it from the App Store.

Requires iOS devices.

MD5: 31CF0BE25710A78E31989D13919FC5C9.

Zhongrong Huixin CTP Bo Yi Master (Supports IPv6 Network):

Updated on: February 22, 2022.

Supports IPv6 network environments.

Bo Yi Master is known for its clean interface, fast market data, powerful functionality, and comprehensive financial market data.

Offers market analysis tools and trading models.

No longer supports the XP operating system.

Version: V5.5.88.0.

MD5: 0DAC142AD11A8EC4597B0395BF77D166.

Wen Hua Ying Shun Cloud Trading Software (wh6) (Only Supports IPv6 Network):

Updated on: January 13, 2021.

Designed for individual investors, offering market data, analysis, and trading in one platform.

Incorporates cloud trading technology for enhanced trading experiences.

Version: V6.8.232.

MD5: 3DC5E90A89563E0B422BD73A69D877C1.

These trading platforms cater to a wide range of trading styles and preferences, providing traders with the tools and features they need to execute their strategies effectively. Each platform may have its own unique features and advantages, so traders can choose the one that best suits their trading goals and preferences.

Customer Support

ZRF provides customer support through various channels to assist its clients effectively. Here is a description of their customer support contact details:

Phone:

Contact Number: 021-51557588

This phone number is available for clients to call and seek assistance with any inquiries or issues related to their trading accounts, platforms, or other services.

Fax Number:

Email:

Email Address: zhglb@zrhxqh.com

Clients can reach out to Zhongrong Huixin through the provided email address for inquiries, account-related matters, or any other correspondence. Email support allows clients to have written documentation of their communication for reference.

FAQs

Q1: When was ZRF (Zhong Rong Futures) Financial Services founded?A1: ZRF Financial Services was founded in the year 1995.

Q2: Where is the headquarters of ZRF Financial Services located?A2: The headquarters of ZRF Financial Services is located in Shanghai, China.

Q3: What services does ZRF Financial Services offer?A3: ZRF offers a range of services including commodity futures brokerage, financial futures brokerage, futures investment advisory, asset management, and more within the realm of futures and derivatives trading.

Q4: What exchanges is ZRF a member of?A4: ZRF is a member of major Chinese futures exchanges including the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, Guangzhou Futures Exchange, and Shanghai International Energy Exchange, among others.

Q5: How is ZRF Financial Services regulated?A5: ZRF Financial Services is regulated by the China Financial Futures Exchange (CFFEX), which oversees and governs the trading and regulation of financial derivative products linked to the Chinese Renminbi (RMB), ensuring transparency and market integrity.

WikiFXMalaysia

Malaysia

I wanted to withdraw $1000 but had to deposit $100. My god!

Exposure

2021-10-15

WikiFXMalaysia

Malaysia

If someone provided signal on this platform, stay away from it because it was unable to withdraw. I lost $400 although I did not break any regulation. They cheated me. Someone tried to explain and convince you of the success of next withdrawal. But I still did not receive my money. Actually they cheated me.

Exposure

2021-10-13

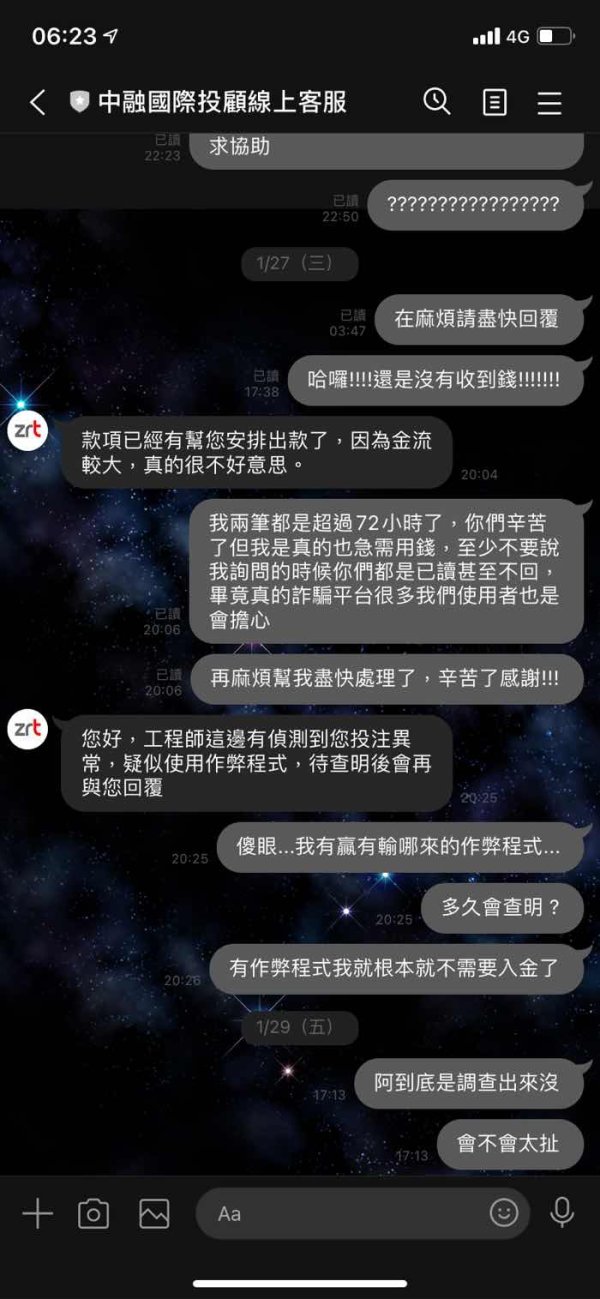

FX1708355520

Taiwan

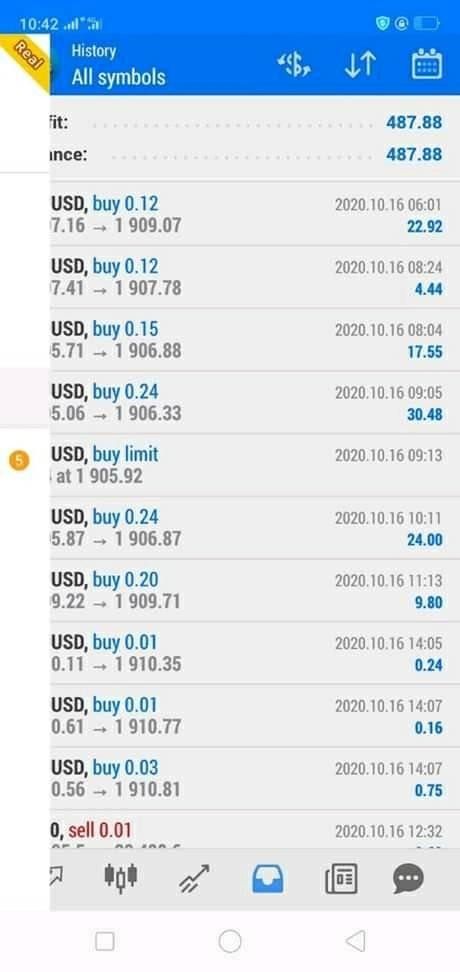

Slow withdrawal process.

Exposure

2021-02-21

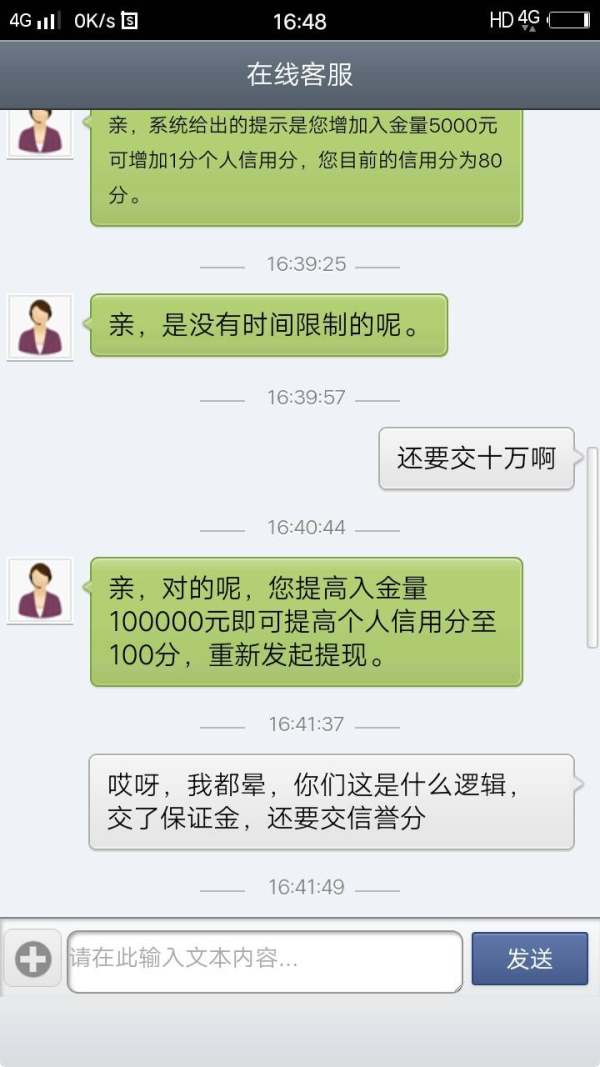

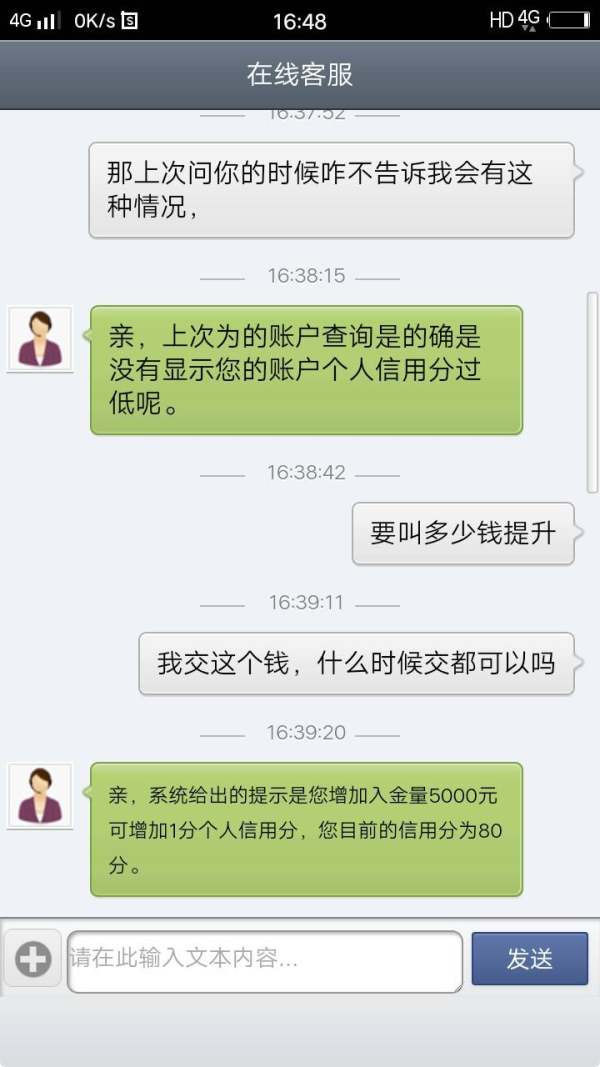

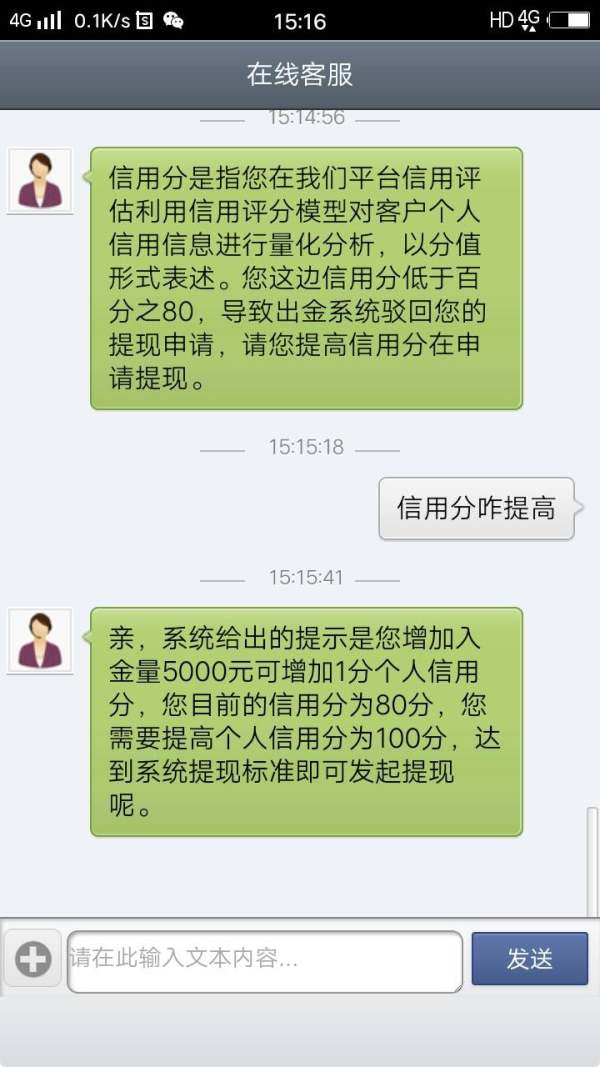

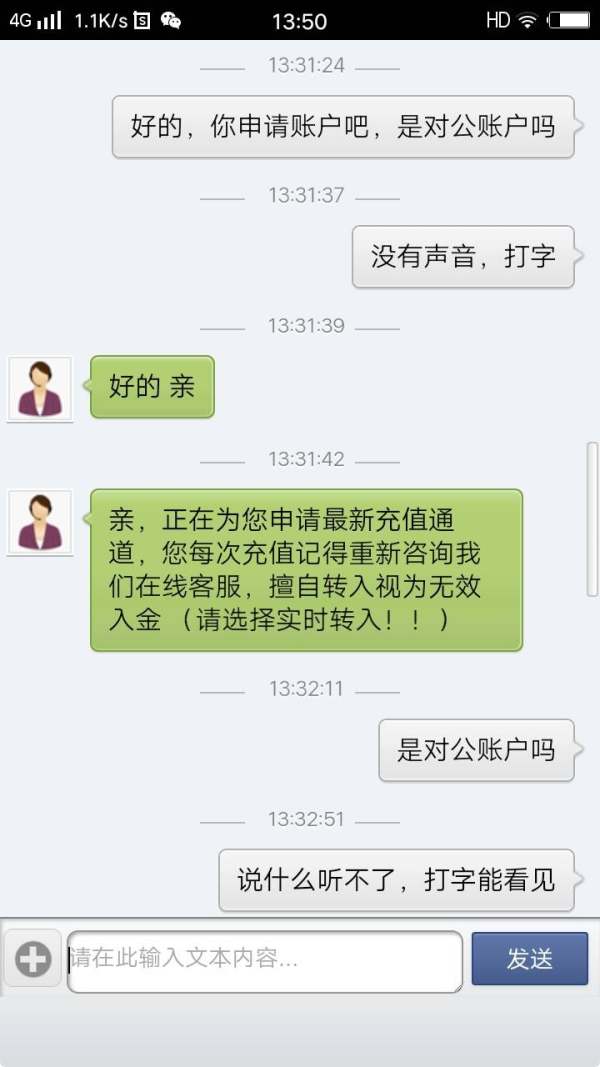

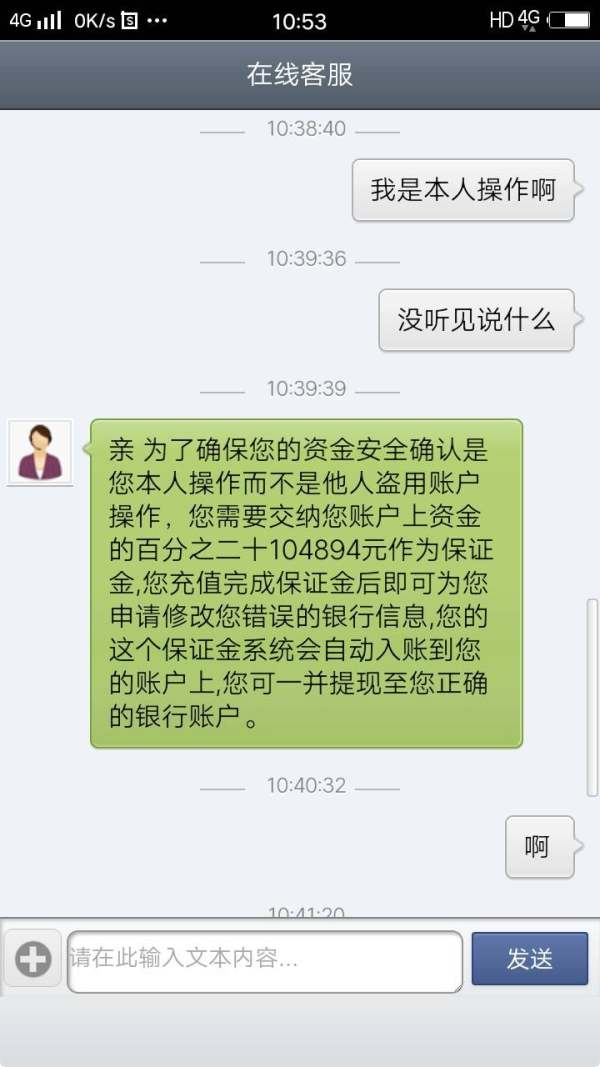

一切皆有可能63971

Hong Kong

After inveigled me to deposit fund, the platform gave no access to my withdrawal, asking for margin and credit-score raising money.

Exposure

2020-03-11