Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is CCF Markets?

CCF Markets, founded in 2022 and registered in China, is a trading platform that offers a variety of trading instruments across different asset classes. However, it is important to note that CCF Markets currently lacks valid regulation and is not overseen by any government or financial authority, which introduces a level of risk when investing with them.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

CCF Markets Alternative Brokers

There are many alternative brokers to CCF Markets depending on the specific needs and preferences of the trader. Some popular options include:

Equiti - A trusted global broker specializing in online trading of forex, commodities, and indices, offering cutting-edge technology, superior execution, and comprehensive market analysis.

Eightcap – Atrusted broker that offers competitive trading conditions, including tight spreads, flexible account options, and a user-friendly trading platform, making it a top choice for both beginner and experienced traders looking for a seamless trading experience.

TD Ameritrade - A well-established brokerage platform with a range of trading tools and resources for investors of all levels.

Is CCF Markets Safe or Scam?

CCF Markets currently has no valid regulation and there are reports of scam and unable to withdraw, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky.

If you are considering investing with CCF Markets, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Market Instruments

CCF Markets offers a variety of trading instruments across different asset classes, including futures, indices, shares, metals and energy.

Futures contracts are available for trading on various commodities such as crude oil, natural gas, gold, silver, and agricultural products.

CCF Markets provides access to trading popular global indices like the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, DAX, and more.

Traders can buy and sell shares of major companies listed on global stock exchanges, including tech giants, banks, pharmaceuticals, and more.

Precious metals like gold, silver, platinum, and palladium can be traded through CCF Markets, allowing investors to take advantage of price fluctuations.

CCF Markets also offers trading opportunities in the energy sector, including oil, natural gas, and other energy commodities.

Accounts

CCF Markets offers different types of trading accounts to cater to different needs of traders:

For experienced traders, CCF Markets offers the option to classify as a professional trader. By doing so, traders can forego some of the legal safeguards provided to retail clients, such as leverage limitations. However, negative balance protection is still provided. It's important to note that this account type may not be available to all traders and is subject to eligibility criteria.

Exclusive VIP trading accounts are designed for high-net worth traders. These accounts come with additional benefits and features, including discounted market spreads (up to 30% off), the use of a free Virtual Private Server (VPS) for enhanced trading performance, and reduced commissions (up to 30% off) on trades.

Leverage

CCF Markets offers a maximum leverage of 1:100 to traders. Leverage in trading refers to the use of borrowed funds (in this case, provided by the broker) to increase the potential returns from an investment. With a leverage ratio of 1:100, for every unit of capital invested by the trader, the broker will provide an additional 100 units of borrowed funds. This means that traders can control a larger position in the market with a smaller initial investment.

In all, it is worth noting that while high leverage brings high returns, it is also accompanied by high risks. It is always recommended that everyone choose leverage carefully.

Spreads & Commissions

CCF Markets does not provide specific information regarding spreads on their accounts, they assert that they do not charge any commissions on trades.

Spreads refer to the difference between the buying and selling prices of a financial instrument. Typically, brokers may offer different spreads depending on the market conditions and the specific financial instrument being traded.

By not charging commissions, CCF Markets may factor in their costs and potential revenue within the spreads offered on the trading platform. This means that clients can trade without incurring additional fees specifically labeled as commissions.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

CCF Markets provides its clients with the popular trading platform called MT5 (MetaTrader 5). MT5 is a comprehensive and user-friendly platform that offers advanced trading features and tools for both beginner and experienced traders.

MT5 offers a wide range of charting and technical analysis tools. Traders can utilize multiple timeframes, custom indicators, and drawing tools to analyze market trends, identify potential entry and exit points, and make informed trading decisions. The platform also supports the use of trading robots, known as Expert Advisors (EAs), which can automatically execute trades based on predefined strategies.

Furthermore, MT5 has a mobile application, allowing traders to access their accounts and trade on the go using their smartphones or tablets. This mobile trading capability ensures that traders never miss out on market opportunities, even when they are away from their desktop computers.

See the trading platform comparison table below:

Trading Tools

CCF Markets provides a range of trading tools to enhance the trading experience for its clients. These tools include an Economic Calendar, a Holiday Calendar, and Market News.

The Economic Calendar is an essential tool for traders as it provides information on upcoming economic events, such as central bank meetings, economic releases, and other important announcements. It displays the date, time, and expected impact of each event, allowing traders to anticipate potential market volatility and opportunities. With this tool, traders can stay updated on key events that may affect their trading strategies and positions.

The Holiday Calendar is another useful tool offered by CCF Markets. It provides information on public holidays and trading session schedules for various countries and financial markets. This helps traders plan their trading activities and adjust their strategies accordingly, considering any potential disruptions in market liquidity and trading volumes during holiday periods.

Market News is a crucial tool that keeps traders informed about the latest developments and news in the financial markets. CCF Markets provides access to real-time market news, including economic indicators, geopolitical events, corporate announcements, and other factors influencing market movements. By staying informed about market news, traders can make more informed trading decisions and adapt their strategies to changing market conditions.

Deposits & Withdrawals

CCF Markets provides various deposit and withdrawal options to cater to the diverse needs of its clients. Clients can deposit funds into their trading accounts using bitcoin, Ethereum, UnionPay, wire transfer, tether, DOGECOIN, mastercard, VISA, and NETELLER.

When it comes to deposits, CCF Markets aims to process them promptly, usually within one hour. However, it's important to note that any processing delays caused by factors beyond CCF Markets' control are not the responsibility of the company.

Withdrawals typically follow a guideline in terms of processing times. CCF Markets can process withdrawal requests during the financial division's working hours, which are 7 a.m. to 4 p.m. UTC from Monday to Friday. Delays caused by external factors beyond the control of CCF Markets are not the company's responsibility.

It's important to keep in mind that if a withdrawal request is made without having engaged in any trading activity, there may be a cost associated with the request. This cost can be up to 2.6% of the requested amount.

For refunds, clients have a window of up to six months after the initial investment to submit a refund request. If the refund is submitted within this timeframe, no fees will be associated with it.

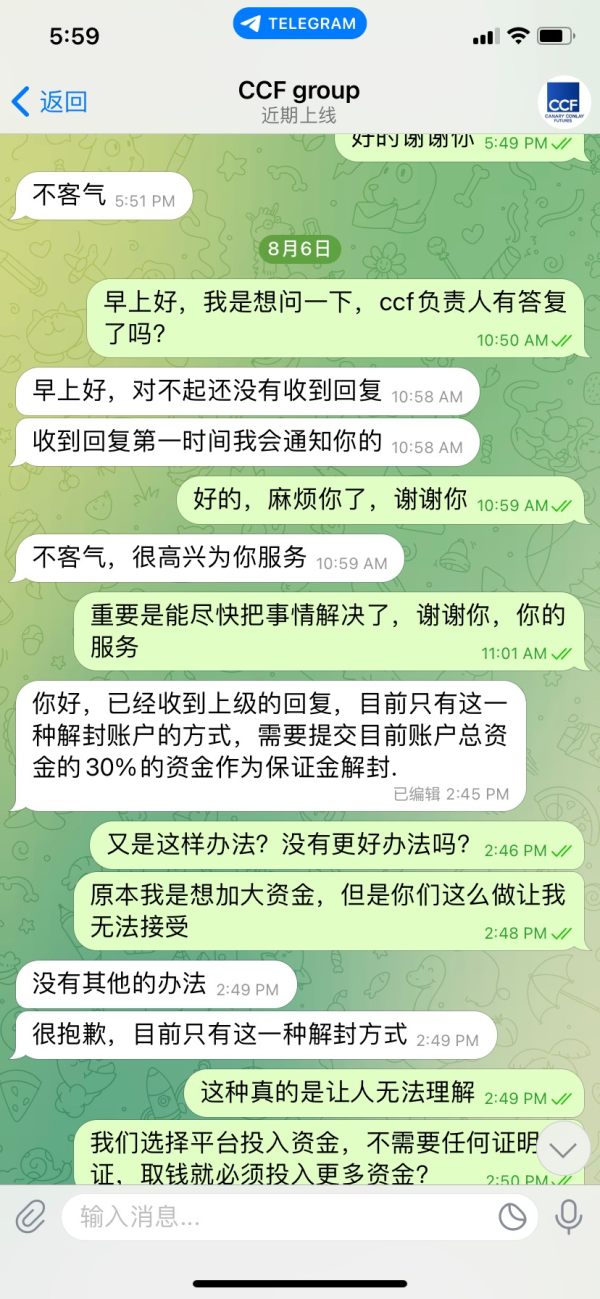

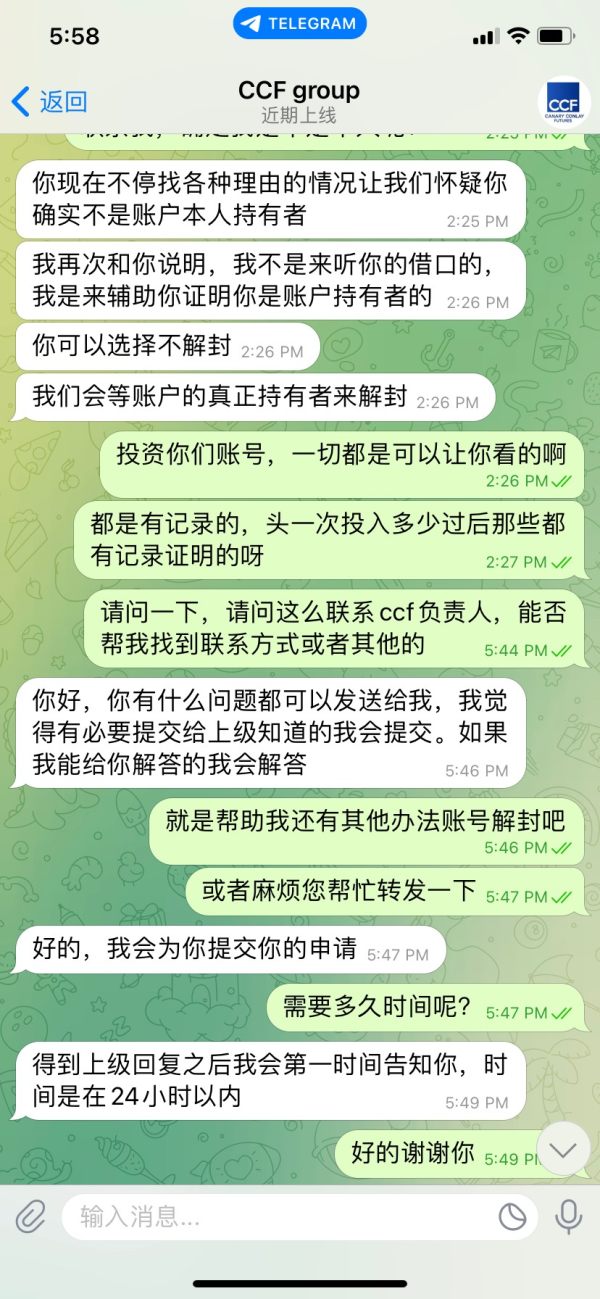

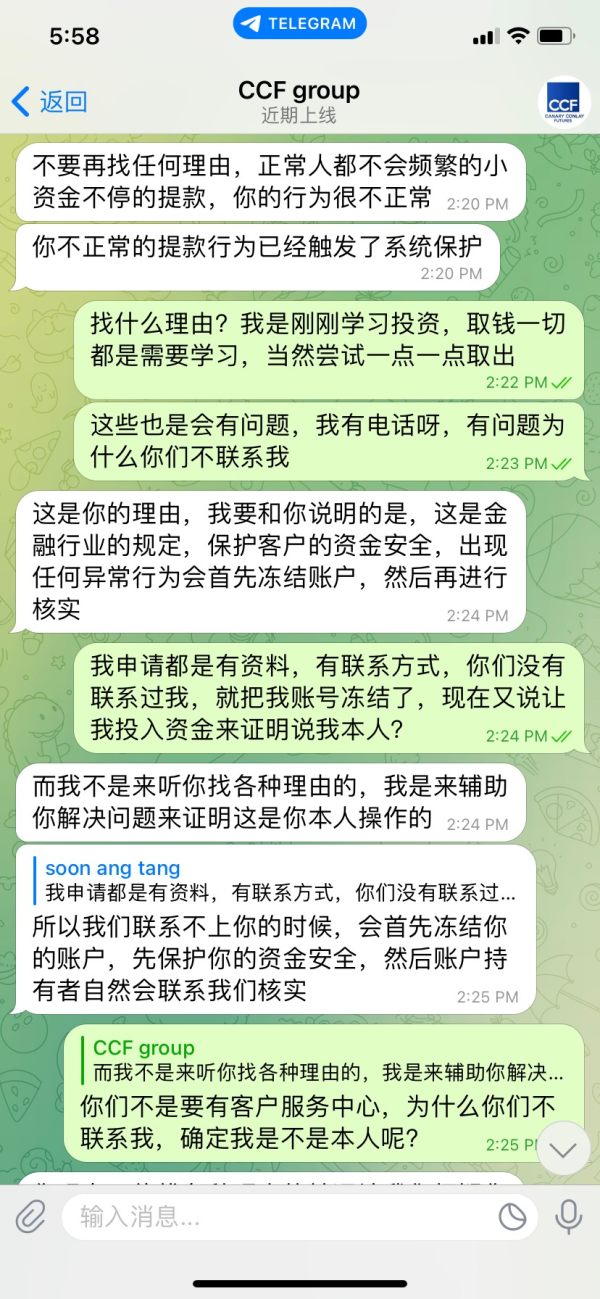

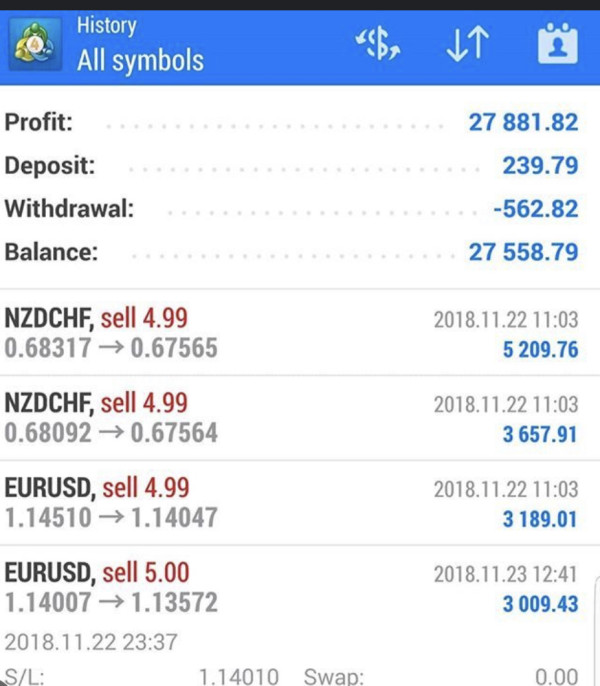

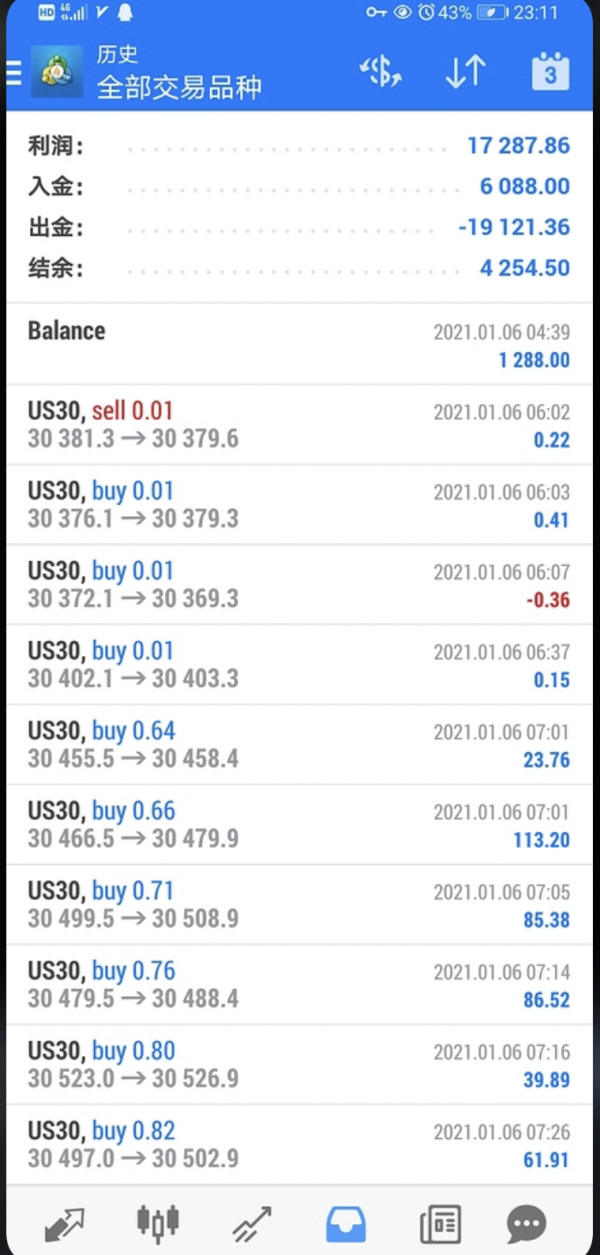

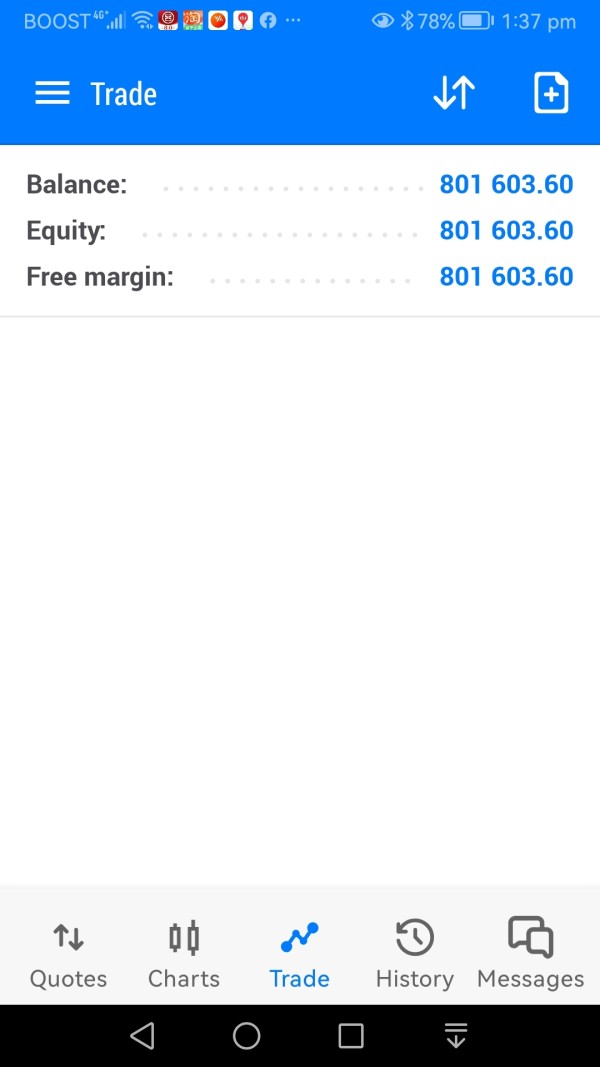

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Email: cs@ccfmarkets.com

CCF Markets offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

CCF Markets offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Whats more, CCF Markets provides a Frequently Asked Questions (FAQs) section on their website to assist their clients with commonly asked questions and provide relevant information. The FAQ section aims to address common queries and concerns that investors may have regarding the company's services, processes, and investment opportunities. By offering this resource, CCF Markets aims to provide transparency and clarity to their clients, helping them make informed decision.

Conclusion

In conclusion, CCF Markets currently lacks valid regulation and oversight from any government or financial authority. This raises concerns about the company's operations and increases the risk associated with investing with them. Reports of scams and difficulty in withdrawing funds further highlight the potential risks involved.

While CCF Markets offers a variety of trading instruments across different asset classes and uses the popular MT5 trading platform, traders should proceed with caution and conduct thorough research before engaging with this platform.

Frequently Asked Questions (FAQs)

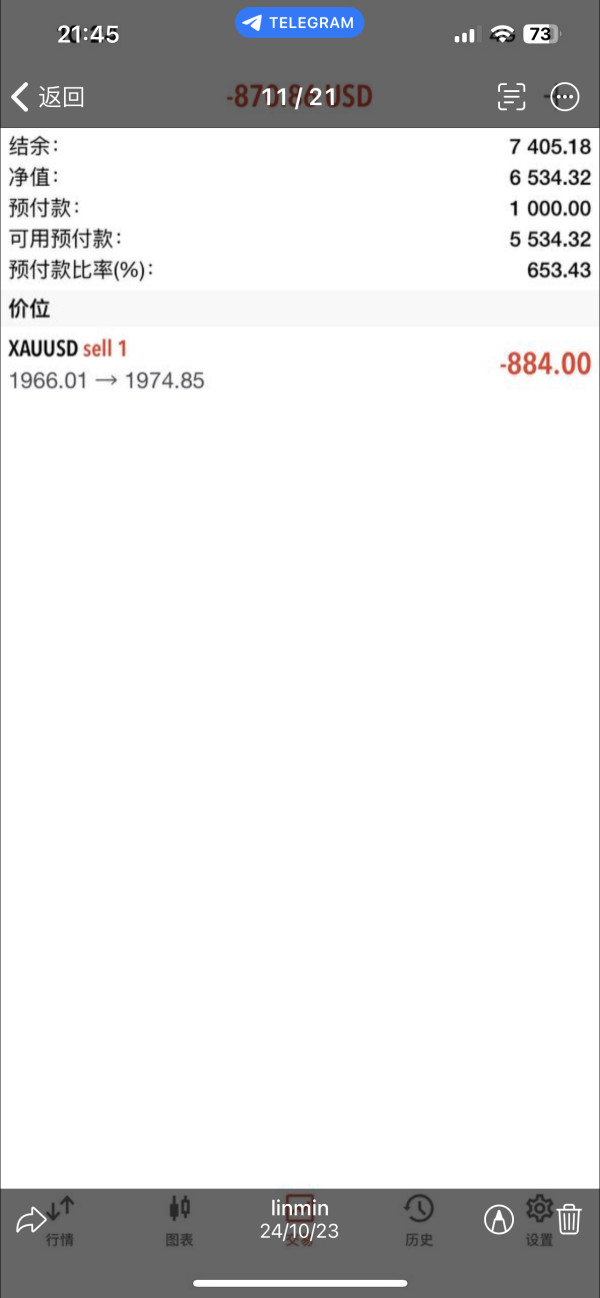

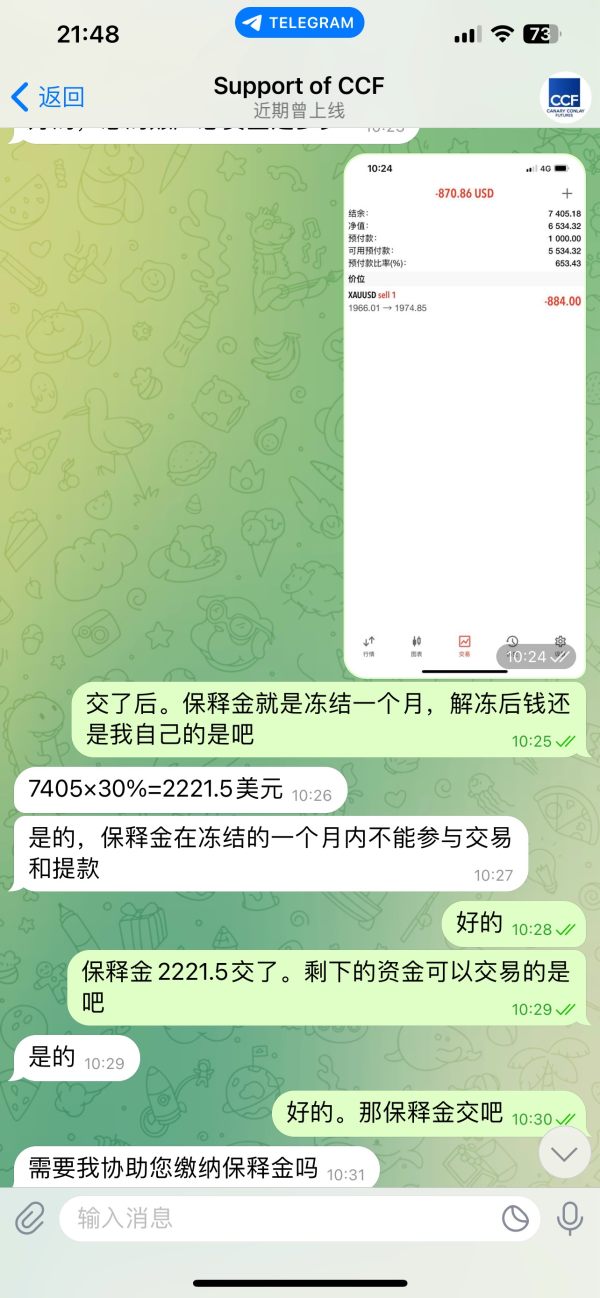

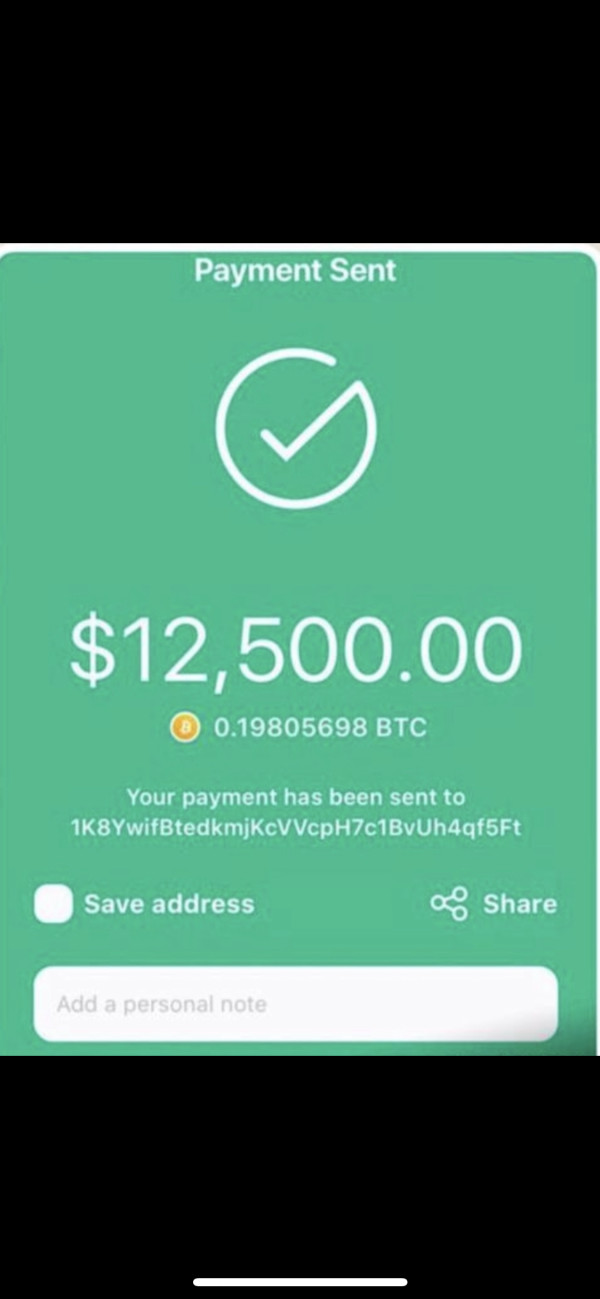

min

Italy

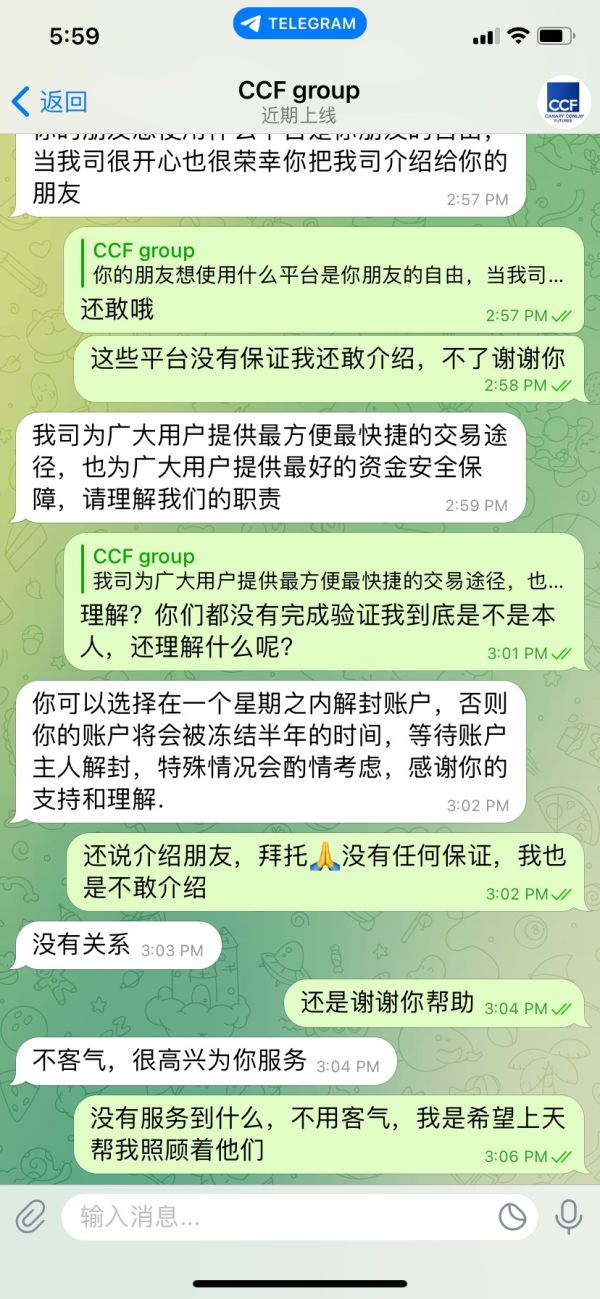

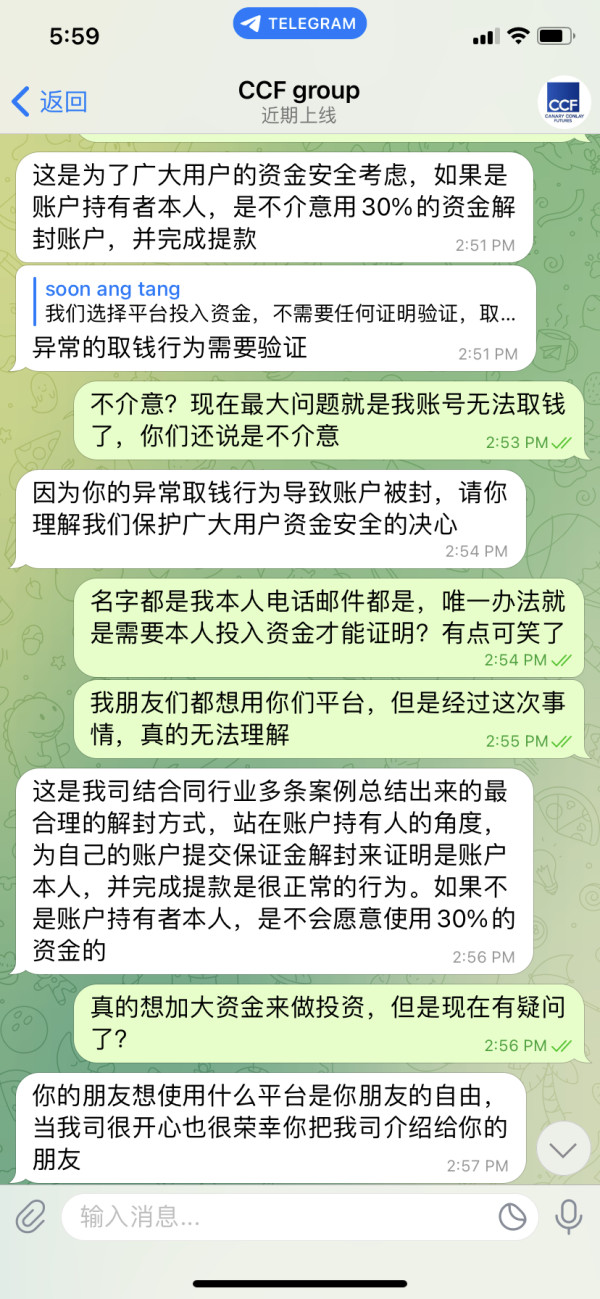

Black platform, you have to pay 30% margin when withdrawing money. Pay me back.

Exposure

2024-02-02

Fx58944378

United States

requires first getting through scam

Exposure

2023-08-26

使命召唤正能量

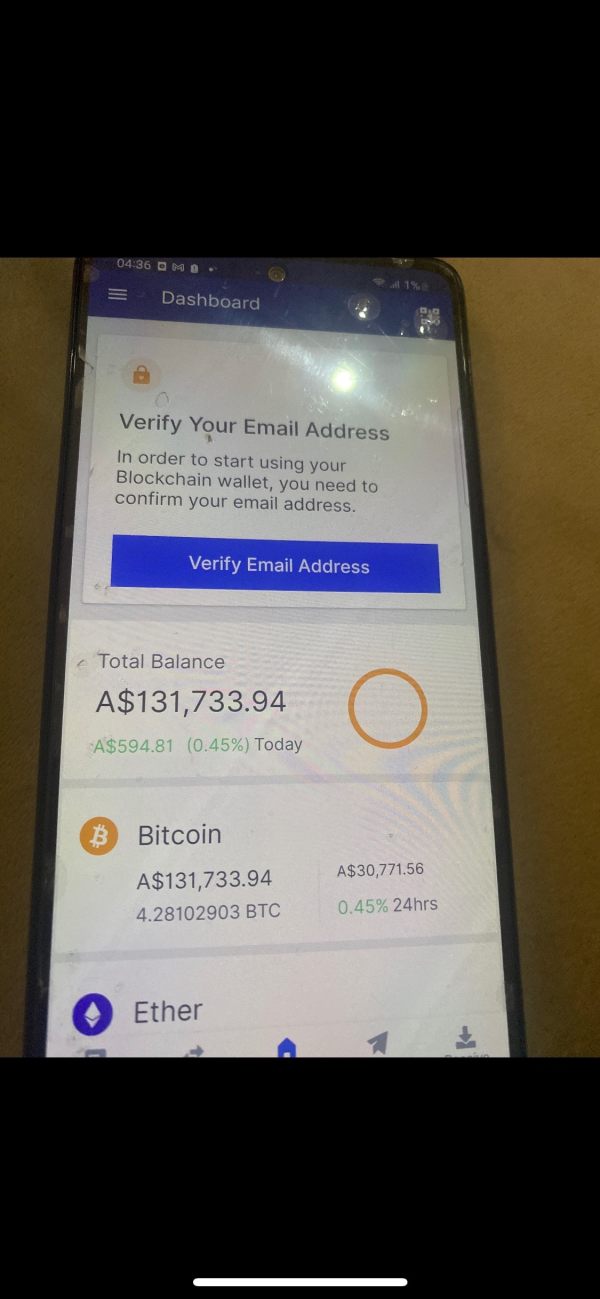

Australia

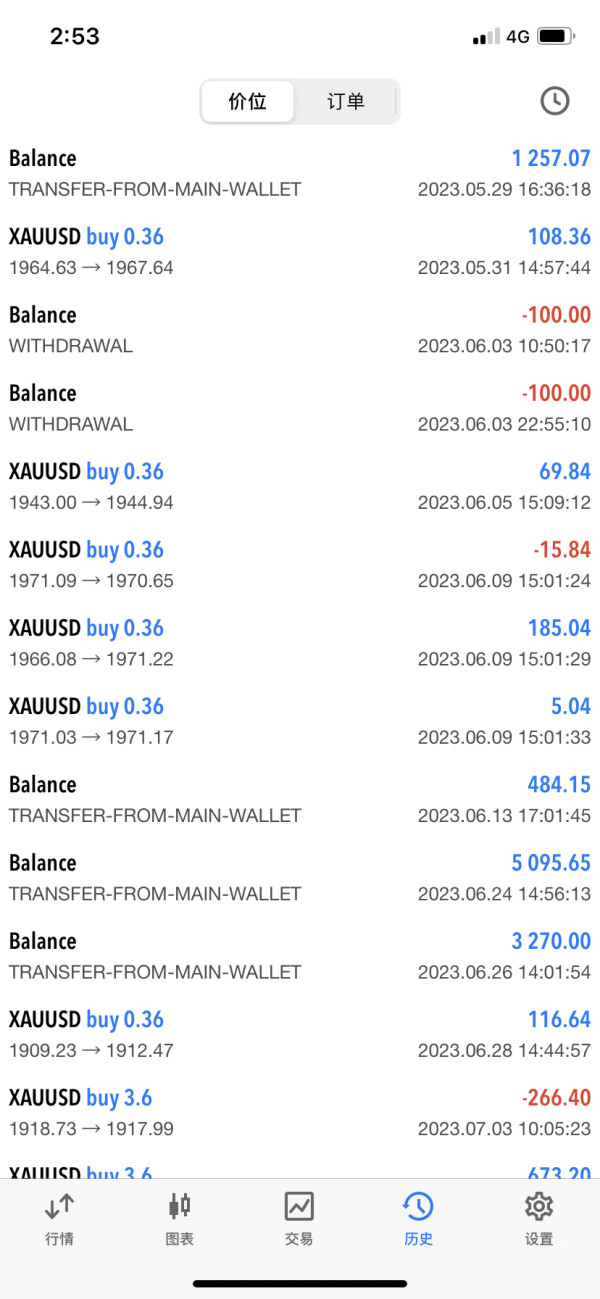

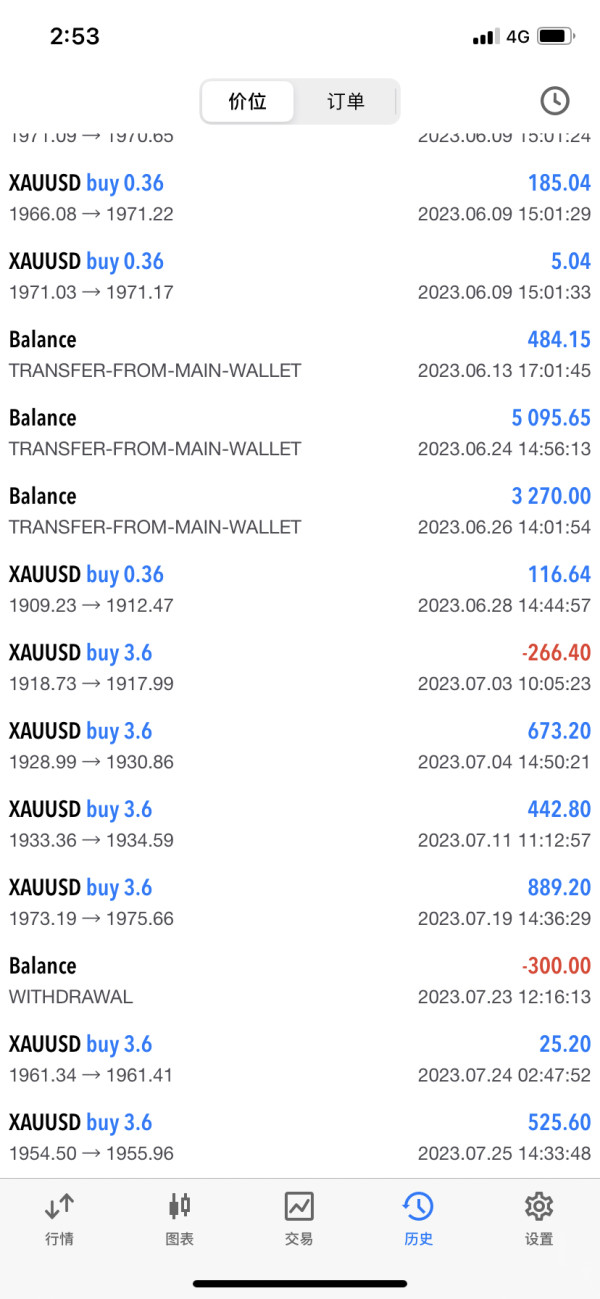

I have never had any investment experience, and I have too little knowledge of the platform, and I don't know anything about the platform. One day, someone said that we were destined and brought me to invest with him. At the beginning, the capital investment is $1257.07, and the leverage can be set to 0.36. This shows that there is a problem. Later, the principal was not enough to set 3.60, deliberately allowing me to make more profits. It's all a scam, a trap. When I learned about the platform, it was too late and I couldn't withdraw money at all. Be cautious, everyone, don't let these platforms be at the mercy of you, remember to be careful

Exposure

2023-08-18

FX244677432

United Kingdom

My investment journey turned nightmarish with CCF Markets, a deceitful company that promised exceptional returns. As their promises crumbled, I realized I had fallen victim to a scam, leaving me devastated and financially drained.

Exposure

2023-08-01

Stephen qing

Australia

Unable to withdrawal ,and also requires a deposit.No country of registration and no government regulation

Exposure

2023-07-17

W9213

Australia

Financial fraud! Fake mobile phone number, pig-butchering scam! This platform is designed to deceive Chinese in Australia!

Exposure

2023-07-14

Leoray2003

Australia

I want to report this platform, I was induced to deposit money, and now the money cannot be withdrawn.

Exposure

2023-07-12

W9213

Australia

Make friends online, induce me to invest in it! Promise high returns, close my account! Unable to withdraw money, financial fraud! Everyone must be careful! ! ! ! ! ! ! ! ! !

Exposure

2023-07-11