Overview of Goldmar

Goldmar is a forex broker that offers trading in various financial instruments such as forex, commodities, indices, and cryptocurrencies. The company is based in the United Kingdom and was founded in 2016. Being a relatively new entrant to the market, Goldmar aims to provide its clients with a user-friendly trading platform and competitive trading conditions. The broker offers the MetaTrader 5 trading platform, which is a popular platform among traders due to its advanced charting capabilities, automation features, and a wide range of trading tools.

In terms of account types, Goldmar offers three different account types, which differ in terms of the minimum deposit amount, with the minimum deposit to start a basic account from $250 dollars or the equivalent amount.

Is Goldmar legit or a scam?

Disappointingly, Goldmar is not currently regulated by the UK's Financial Conduct Authority (FCA) or any other regulated authority. This means that the broker is not subject to the strict regulatory oversight that FCA-regulated brokers are required to follow. While this may offer more flexibility for the broker to offer services to a wider range of clients, it also raises concerns about the safety and security of client funds, as well as the overall transparency and fairness of the broker's practices. As an unregulated broker, Goldmar may also have limited options for dispute resolution and client compensation in case of any issues or disputes.

Therefore, it is important for potential clients to carefully consider these factors before deciding whether or not to trade with an unregulated broker like Goldmar.

A thorough check on the Financial Conduct Authority (FCA) website has revealed that Goldmar is not listed among the regulated forex brokers. The absence of Goldmar's name on the FCA website raises concerns about the broker's credibility and trustworthiness, as the lack of regulation means that the broker is not bound by strict guidelines that ensure the safety of traders' funds and fair trading practices.

Pros and Cons of Goldmar

When considering Goldmar as a potential trading platform, it is important to weigh both the advantages and disadvantages. While Goldmar may offer some appealing features such as a variety of trading assets and a user-friendly trading platform, it is also important to keep in mind that the lack of regulation can be a significant drawback. Potential clients should carefully consider trade-offs and make an informed decision based on their personal priorities and trading goals.

It is also important to note that while Goldmar may offer attractive features in certain areas, there may be other brokers that offer more competitive pricing, better customer support, or a wider range of trading instruments. Ultimately, traders should do their research and carefully compare the features and services offered by various brokers to determine which one is best suited for their individual needs and preferences.

Market Instruments

Goldmar offers a wide range of trading instruments to cater to the needs of different traders. Clients of Goldmar can trade in popular financial instruments such as forex, indices, commodities, and shares. This variety of trading instruments can provide opportunities for traders to diversify their portfolio and potentially maximize their profits. However, it is important to keep in mind that trading different financial instruments comes with varying levels of risk, and traders should carefully consider their investment goals and risk tolerance before trading any of these instruments with Goldmar.

Account Types

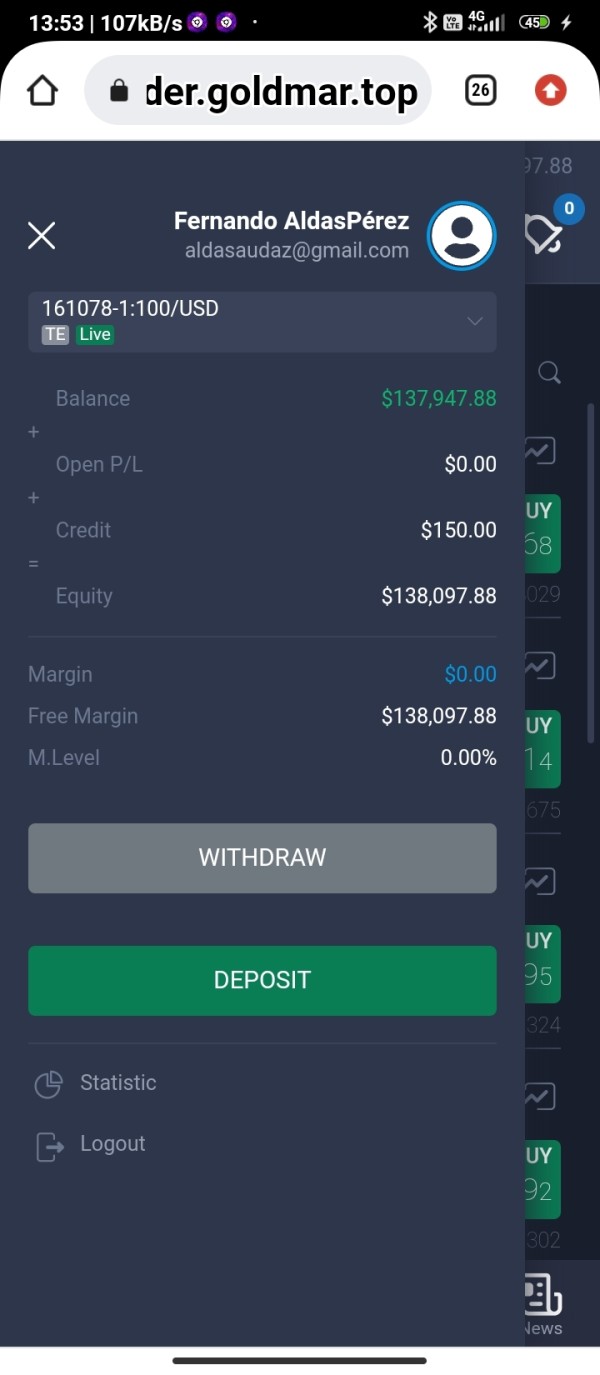

Goldmar offers its clients three types of trading accounts, with name of each account unspecified (let's name them A, B, C). The A account requires a minimum deposit of $250 and offers a maximum leverage of 1:100, spreads from 0.1 pips, and access to all tradable assets. The B account requires a minimum deposit of $2,500 and provides additional features such as higher leverage of up to 1:200, spreads from 0.3 pips, a dedicated account manager, and access to exclusive webinars and trading signals. The C account is designed for high net worth individuals who deposit a minimum of $25,000 and offers a maximum leverage of 1:500, spreads from 0.5 pips, a personal account manager, and additional exclusive benefits.

Leverage

Goldmar offers a maximum leverage of 1:500 for forex trading, which is considered to be a high level of leverage. This means that traders can open positions that are up to 500 times the size of their account balance. While high leverage can increase potential profits, it also increases the potential risk of losses. Therefore, traders should be cautious when using high leverage and use risk management strategies to protect their capital. Goldmar also offers lower leverage options for traders who prefer lower risk levels.

Spreads and Commissions (Trading Fees)

Goldmar offers floating spreads to its clients, which vary depending on the account type and the trading instrument. The broker does not charge any commissions on trades. Instead, the spreads act as the primary trading fee, which means that traders will pay a small difference between the bid and ask price of an asset when entering or exiting a position. The spreads can start from as low as 0 pips for some account types and trading instruments, which is considered competitive in the industry. However, it's important to note that the spreads may widen during times of high market volatility, which can increase trading costs.

Non Trading Fees

Goldmar does not charge any additional non-trading fees, which is a positive aspect for traders. This means that there are no fees for deposits, withdrawals, or account maintenance. However, it is important to note that fees may be incurred through the payment service provider used for transactions. It is recommended to check with the payment service provider for any fees before initiating transactions.

After checking the official website of Goldmar, it appears that they do not provide clear information regarding inactivity fees.

Trading Platforms

Goldmar offers a web-based trading platform, which can be accessed through any modern web browser. However, it does not offer the popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms. Instead, traders can use the broker's proprietary web-based platform, which features a user-friendly interface, a range of technical analysis tools, and real-time market data. The platform is also customizable and can be accessed on multiple devices, including desktops, laptops, tablets, and smartphones. However, traders who prefer to use MT4 or MT5 may need to look elsewhere.

Deposits and Withdrawals

Minimum Deposit

When it comes to minimum deposit requirements, Goldmar sets its bar slightly higher than the industry standard. While some brokers may require as little as $1 or $10 to start trading, Goldmar has set its minimum deposit requirement at $250. This may be a bit of a hurdle for beginners or traders on a tight budget, but it could also be seen as a sign that Goldmar caters to a more serious and professional clientele.

Here is a table comparing the minimum deposit required by Goldmar with IC Markets and FP Markets:

Goldmar provides several options for deposit and withdrawal, including Visa, Mastercard, Maestro, and bank transfers. While the options may not be as extensive as some other brokers, they are still widely used and trusted methods of payment.

One potential drawback to Goldmar's deposit and withdrawal options is that they do not offer e-wallet options such as PayPal or Skrill. These options are often favored by traders due to their speed and convenience. However, it is worth noting that bank transfers may take longer to process, so traders should plan accordingly.

Another consideration when it comes to deposits and withdrawals is the fees associated with each method. While Goldmar does not charge fees for deposits or withdrawals, it is possible that the payment providers themselves may charge fees. It is important for traders to check with their respective payment providers to determine any applicable fees.

Customer Support

Goldmar provides customer support through multiple channels, including email, phone, and live chat. Their support team is available 24/5, from Monday to Friday, to assist clients with any issues or questions they may have.

The broker also has a FAQ section on their website, which covers a range of topics, including account management, trading platforms, and funding methods. This can be a helpful resource for clients who prefer to find answers on their own.

However, the lack of 24/7 support may be a drawback for some traders who may need assistance outside of regular business hours.

Educational Resources

Unfortunately, Goldmar does not provide any educational resources to its clients. This means that if you are a beginner or someone who wants to learn more about trading, you will have to look elsewhere for educational material.

Conclusion

In conclusion, while Goldmar offers a decent range of trading instruments and user-friendly trading platforms, it falls short in some important areas such as regulation and educational resources. Traders who prioritize regulation and access to educational materials may want to consider other options.

FAQ

A: No, Goldmar is not regulated by the Financial Conduct Authority (FCA) in the UK or any other reputable financial regulatory body.

A: The minimum deposit required to open an account with Goldmar is $250, which is slightly higher than the industry standard.

A: Goldmar offers the popular MetaTrader 4 (MT4) trading platform.

A: Goldmar offers deposit and withdrawal methods such as VISA and Mastercard, Maestro, and bank transfer.

A: No, Goldmar does not provide any educational resources for traders.

A: Yes, Goldmar offers a demo account for traders to practice trading without risking their own funds.

A: Goldmar offers customer support via phone, email, and live chat on its website. However, the quality of customer support has been reported to be poor by some traders.