Score

Tongda International

Hong Kong|2-5 years|

Hong Kong|2-5 years| http://www.tdgjvip.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Hong Kong

Hong KongUsers who viewed Tongda International also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

Website

tdgjvip.com

Server Location

United States

Website Domain Name

tdgjvip.com

Server IP

154.85.61.26

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 1-2 years |

| Company Name | Tongda International Investment Limited |

| Regulation | Lacks valid regulation |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 (Standard Account) |

| Spreads | Standard Account: Starting from 0.5 pips |

| Trading Platforms | Web Platform, Mobile Platform, API Platform |

| Tradable Assets | Futures, Options, Swaps, Forwards, Warrants |

| Account Types | Standard Account, Mini Account, Micro Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Not specified |

| Payment Methods | Wire transfers, credit cards, debit cards |

| Educational Tools | Learning Management System, Virtual Learning Environment, E-books |

Overview of Tongda International

Tongda International Investment Limited, based in China, is a broker offering various market instruments to its clients. The company provides futures contracts for assets like crude oil, gold, and stock indexes, as well as options contracts, swaps contracts, forwards contracts, and warrants. While Tongda International offers different account types to cater to traders of various experience levels, its legitimacy has been called into question due to a lack of valid regulation, which may pose potential risks to clients. The company has also received negative feedback regarding withdrawal issues, indicating a possible lack of transparency and reliability in its procedures.

Tongda International offers competitive spreads across its trading accounts, with the Standard Account featuring spreads starting from 0.5 pips. Traders can take advantage of leverage options, with ratios depending on the chosen account type. The company supports multiple methods for depositing and withdrawing funds, including wire transfers, credit cards, and debit cards, with a minimum deposit and withdrawal amount of $100. Tongda International provides traders with web-based and mobile trading platforms, as well as an API platform for connecting custom trading software.

In terms of educational tools, Tongda International offers a Learning Management System (LMS) and a Virtual Learning Environment (VLE) to support students' learning journeys. The LMS serves as a centralized platform for accessing course materials, submitting assignments, and tracking grades, while the VLE fosters collaborative learning through discussion forums, chat rooms, and online quizzes. The company also provides e-books covering various subjects, allowing students to explore topics at their own pace.

Overall, Tongda International's lack of valid regulation and negative feedback regarding withdrawal issues raise concerns about the company's transparency and reliability. Traders should exercise caution when considering this broker.

Pros and Cons

Tongda International offers a range of pros and cons for traders. On the positive side, it provides a variety of market instruments and different types of trading accounts to cater to various needs. The leverage options of up to 1:500 allow traders to amplify their positions in the market, and the competitive spreads starting from 0.5 pips are attractive. The availability of multiple deposit and withdrawal methods, along with web, mobile, and API platforms. Additionally, Tongda International offers educational tools for learning. However, there are some drawbacks to consider, such as the lack of valid regulation, which poses potential risks. The trading fees and conditions are vague, and there is limited information on spreads. Traders have reported difficulties and delays in withdrawing funds, and the absence of a demo account may limit the opportunity for practice. Furthermore, the main website is currently down, potentially causing inconvenience for users.

| Pros | Cons |

| Offers a variety of market instruments | Lacks valid regulation |

| Provides different types of trading accounts | Vague trading fees and conditions |

| Leverage up to 1:500 | Limited information on spreads |

| Spreads from 0.5 pips | Difficulties in withdrawing funds |

| Multiple deposit and withdrawal methods | Delays in the withdrawal process |

| Web, mobile, and API platforms available | No demo account available |

| Provides educational tools for learning | Main website is currently down |

Is Tongda International Legit?

Tongda International, a broker, lacks valid regulation, posing potential risks to its clients. It is crucial to exercise caution when dealing with this company.

Market Instruments

Futures

Futures contracts provided by Tongda International cover various assets, such as crude oil, gold, and stock indexes. These standardized contracts oblige the buyer to purchase the asset or the seller to sell it at a predetermined price on a specific future date.

Options

Options contracts allow the buyer the right, but not the obligation, to purchase or sell an asset at a specified price on or before a predetermined future date. Tongda International offers options contracts like call options and put options.

Swaps

Swaps contracts offered by Tongda International facilitate the exchange of future cash flows between two parties. These contracts include interest rate swaps, currency swaps, and commodity swaps, among others.

Forwards

Forwards contracts are also available through Tongda International, where two parties agree to exchange an asset at a predetermined price on a specific future date. Examples of forwards contracts include foreign exchange forwards and commodity forwards.

Warrants

Warrants, another market instrument provided by Tongda International, grant the holder the right to purchase a security at a predetermined price on or before a specific future date. Tongda International offers warrants such as equity warrants and index warrants.

Pros and Cons

| Pros | Cons |

| Provides access to a wide range of assets | Lack of flexibility in contract terms and conditions |

| Offers a variety of market instruments | Limited information on fees and charges |

| Enables potential profit from price movements | Potential for high-risk investments |

Account Types

Standard Account: The Standard Account offered by Tongda International is a basic account type with a spread and leverage of up to 1:500. It caters to both novice and experienced traders.

Mini Account: The Mini Account is an account type specifically designed for beginners. It features a low-cost structure with a spread of 1.5 pips and leverage of up to 1:200.

Micro Account: The Micro Account is tailored for traders who prefer to trade with smaller amounts of capital. It offers a spread of 2.5 pips and leverage of up to 1:50.

Pros and Cons

| Pros | Cons |

| Offers a range of account types for different trader levels | Lack of transparency in trading fees and conditions |

| Standard Account caters to both novice and experienced traders | Demo account unavailable |

| Mini Account provides a low-cost structure for beginners |

Leverage

Tongda International offers leverage options to its traders, with specific leverage ratios depending on the account type. The Standard Account provides leverage of up to 1:500, while the Mini Account offers leverage of up to 1:200. The Micro Account, on the other hand, provides leverage of up to 1:50. These leverage ratios allow traders to amplify their trading positions in the market.

Spreads

Tongda International offers competitive spreads across its range of trading accounts. The Standard Account features spreads starting from 0.5 pips, while the Mini Account offers spreads of 1.5 pips, and the Micro Account provides spreads starting from 2.5 pips.

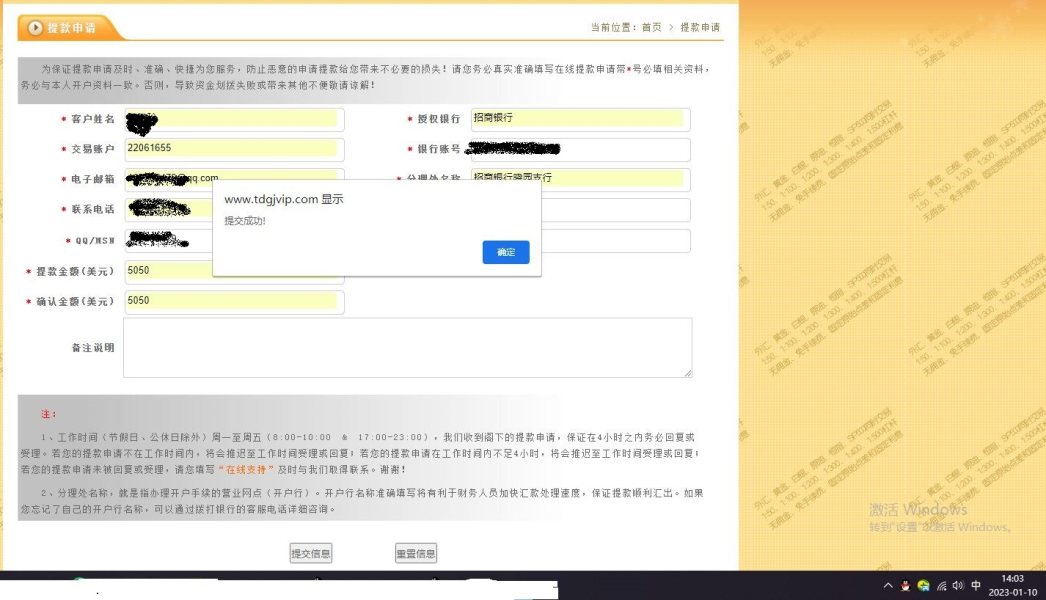

Deposit & Withdrawal

Deposit: Tongda International offers multiple methods for depositing funds, including wire transfers, credit cards, and debit cards. The minimum deposit amount is set at $100, while the maximum deposit amount is capped at $10,000. Deposits typically undergo processing within 1-2 business days.

Withdrawal: Tongda International facilitates withdrawals through various channels, such as wire transfers, credit cards, and debit cards. The minimum withdrawal amount is $100, and the maximum withdrawal amount is limited to $10,000. Withdrawals usually require a processing time of 3-5 business days.

Pros and Cons

| Pros | Cons |

| Multiple deposit methods available | Processing time for deposits is 1-2 business days |

| Various withdrawal channels provided | Processing time for withdrawals is 3-5 business days |

| Minimum deposit amount of $100 and maximum of $10,000 | Limited maximum withdrawal amount of $10,000 |

Trading Platforms

Web Platform: Tongda International offers a web-based trading platform accessible through any computer with an internet connection. It provides features such as real-time market data, charting tools, and order execution.

Mobile Platform: The mobile platform offered by Tongda International is a trading app designed for smartphones and tablets. It offers a user-friendly interface and includes features like real-time market data, charting tools, and order execution.

API Platform: Tongda International provides an API platform that allows traders to connect their own trading software to the company's trading systems. This platform offers options for traders to use their preferred tools and execute trades based on their customized strategies.

Pros and Cons

| Pros | Cons |

| Web-based platform accessible from any device | No alternative platforms available |

| Mobile platform for trading on smartphones/tablets | |

| API platform for connecting custom trading software |

Educational Tools

Tongda International provides educational tools to support the learning journey of its students. The Learning Management System (LMS) serves as a centralized platform for accessing course materials, submitting assignments, and tracking grades. Instructors can utilize the LMS to create and manage courses, monitor student progress, and provide valuable feedback. Additionally, the Virtual Learning Environment (VLE) offers web-based tools like discussion forums, chat rooms, and online quizzes, fostering collaborative learning and engagement among students. Tongda International also offers a diverse selection of e-books covering various subjects such as business, finance, technology, and languages, which can be accessed online or downloaded for offline reading. Furthermore, students have the opportunity to take online courses at their own pace, exploring topics of interest across disciplines like business, finance, technology, and languages.

Reviews

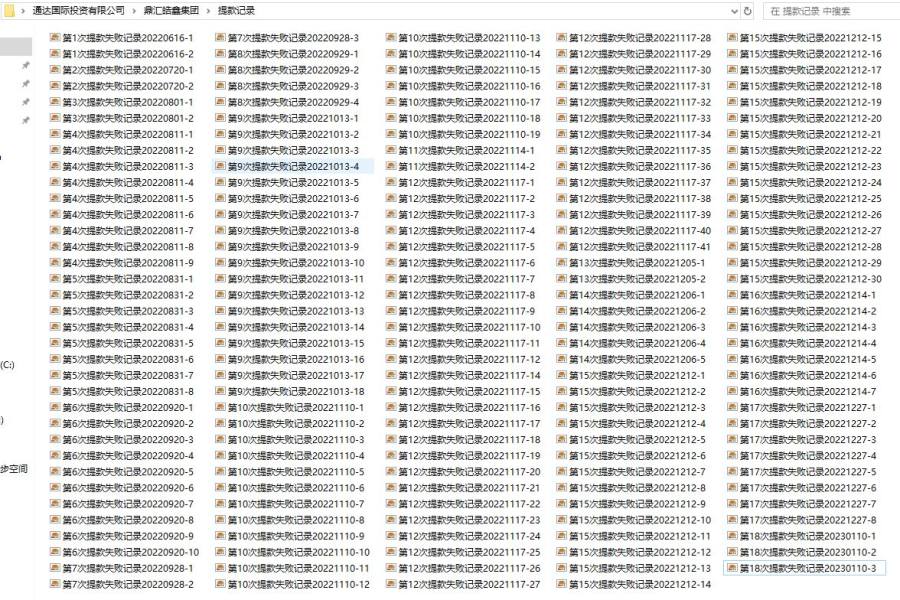

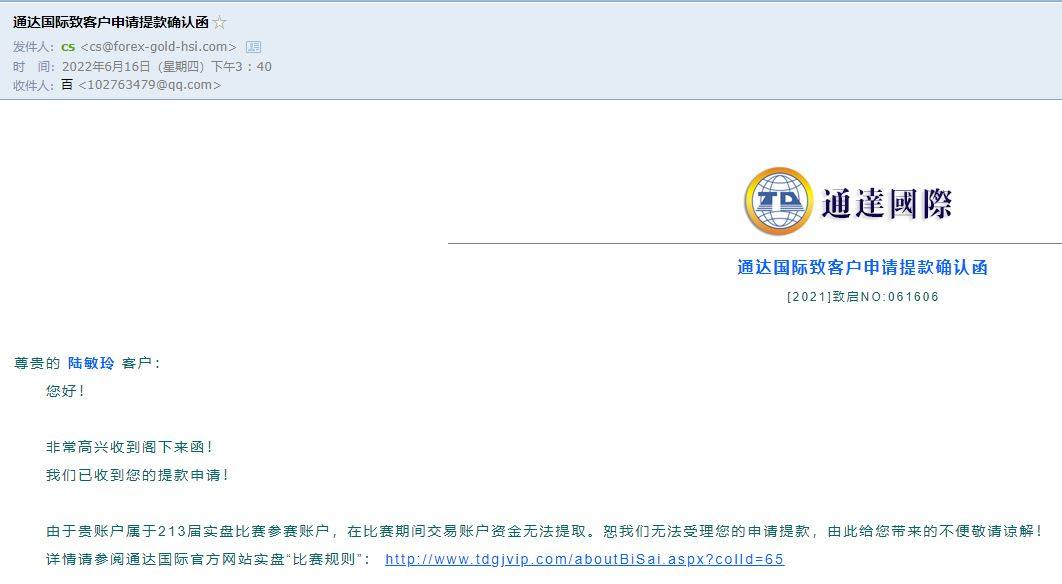

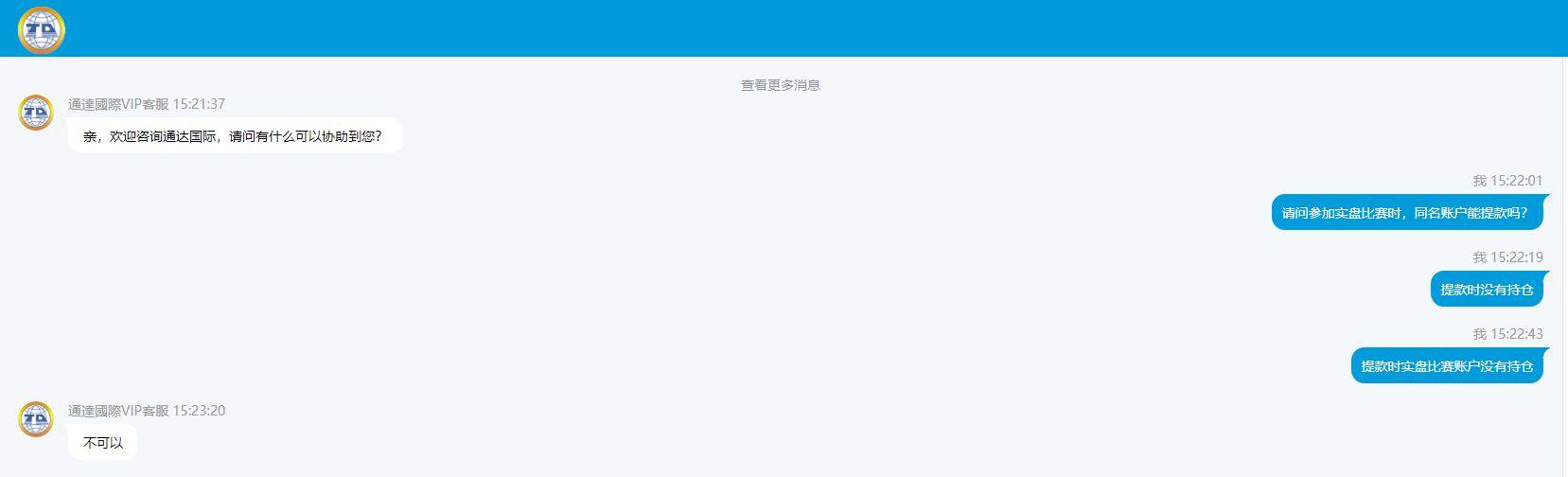

According to reviews on WikiFX, Tongda International has received negative feedback regarding withdrawal issues. Users have reported difficulties in withdrawing funds, with instances of failed withdrawals and delays in the process. Some complaints mention restrictions on withdrawals, such as being unable to withdraw while holding positions or within certain timeframes. These reviews indicate frustration and suspicion towards the company, suggesting a lack of transparency and reliability in Tongda International's withdrawal procedures.

Conclusion

In conclusion, Tongda International, while offering a variety of market instruments, account types, leverage options, and trading platforms, has some notable drawbacks. The company lacks valid regulation, which poses potential risks for its clients. Additionally, there have been negative reviews regarding withdrawal issues, including difficulties, restrictions, failed withdrawals, and delays, indicating a lack of transparency and reliability in Tongda International's withdrawal procedures. Therefore, caution is advised when considering Tongda International as a broker.

FAQs

Q: Is Tongda International a legitimate company?

A: Tongda International, a broker, lacks valid regulation, posing potential risks to its clients. It is crucial to exercise caution when dealing with this company.

Q: What market instruments does Tongda International offer?

A: Tongda International offers futures, options, swaps, forwards, and warrants as market instruments.

Q: What are the account types offered by Tongda International?

A: Tongda International offers Standard, Mini, and Micro accounts to cater to different types of traders.

Q: Does Tongda International provide leverage options?

A: Yes, Tongda International offers leverage options based on the account type, ranging from 1:50 to 1:500.

Q: What are the deposit and withdrawal methods at Tongda International?

A: Tongda International accepts wire transfers, credit cards, and debit cards for deposits and withdrawals, with processing times ranging from 1-2 business days for deposits and 3-5 business days for withdrawals.

Q: What trading platforms are available at Tongda International?

A: Tongda International offers a web platform, a mobile platform, and an API platform for traders to choose from.

Q: Does Tongda International provide educational resources?

A: Yes, Tongda International offers educational tools such as a Learning Management System, Virtual Learning Environment, e-books, and online courses.

Q: What are the reviews for Tongda International?

A: According to reviews on WikiFX, Tongda International has received negative feedback regarding withdrawal issues, suggesting a lack of transparency and reliability in its withdrawal procedures.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 3

Content you want to comment

Please enter...

Comment 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now