Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

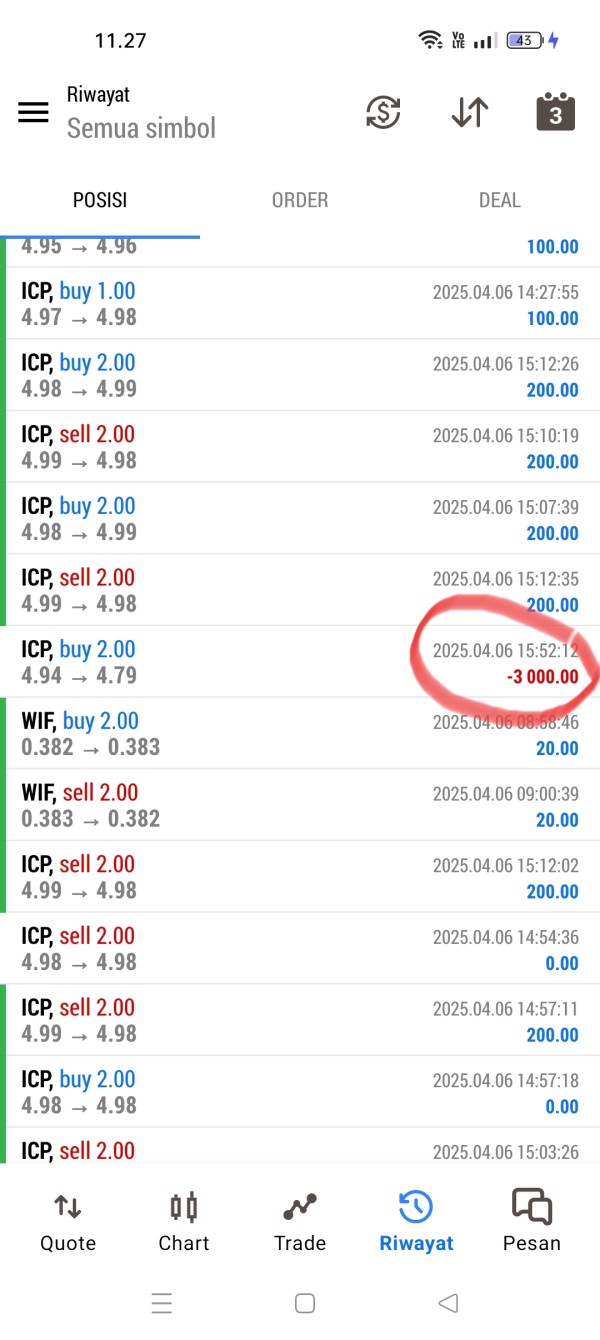

FX3393854561

Indonesia

suddenly widened the spread and wiped out all my profits. This broker is really unfair.

Exposure

In a week

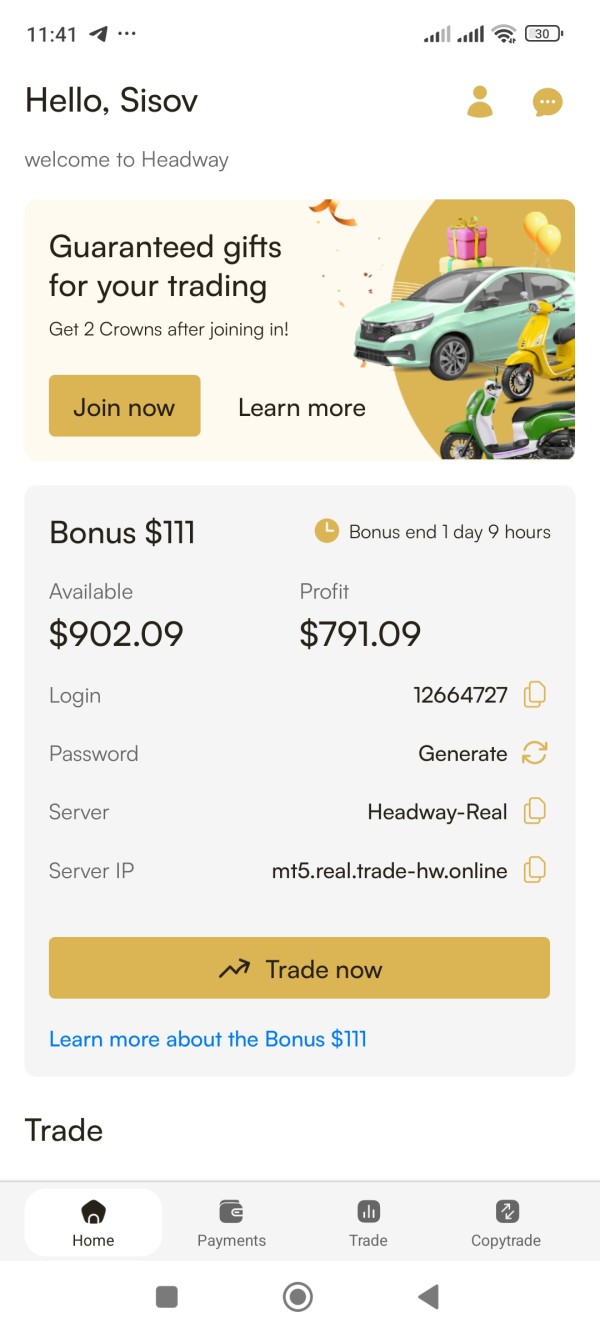

FX8401407202

Azerbaijan

Does anyone know how to withdraw the $111 bonus profit?

Exposure

01-08

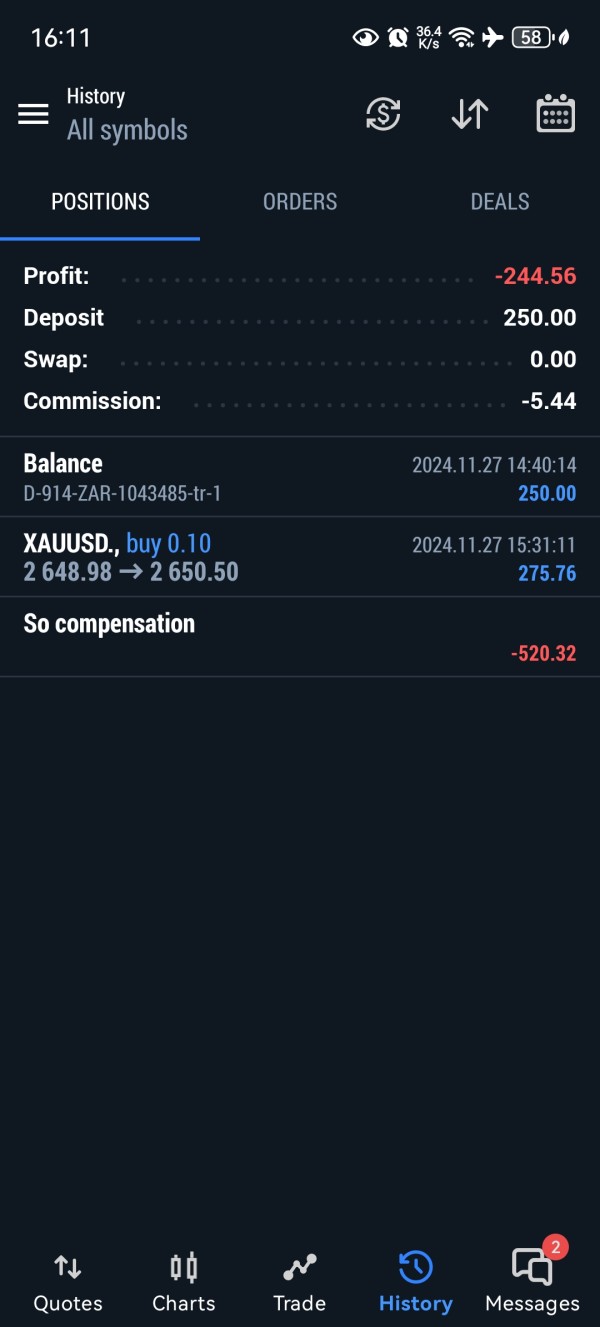

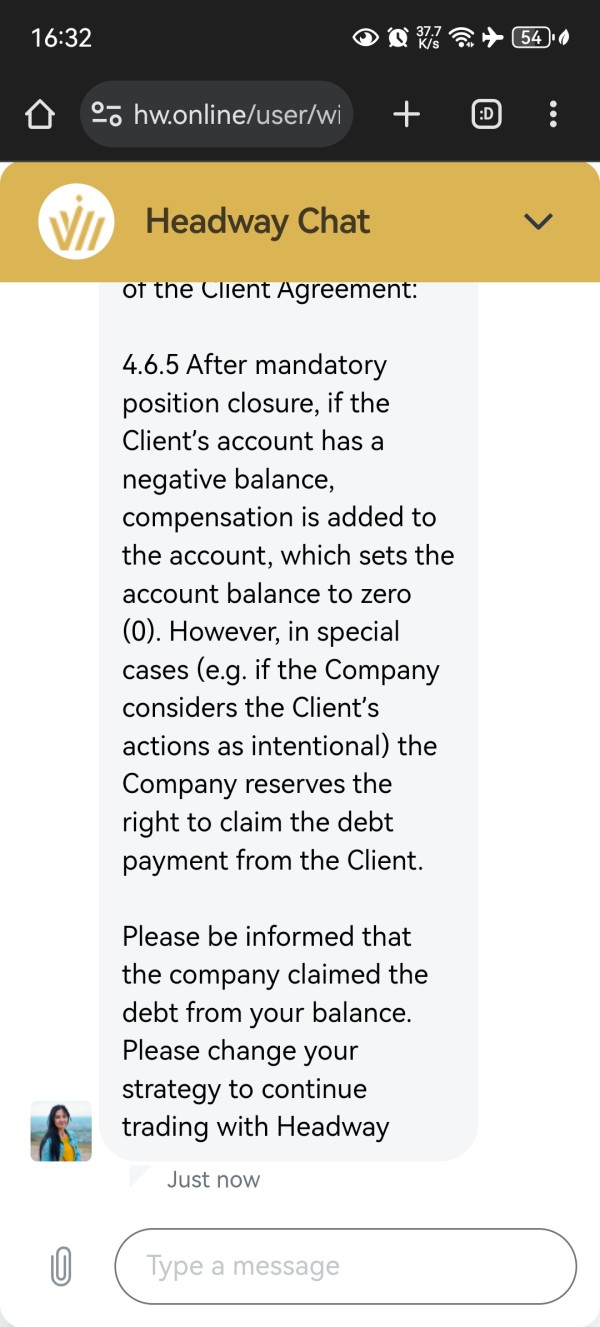

Malenga

South Africa

Stay away from this broker if you don't want to lose you money They took my funds after trying to withdrawal claiming that I'm owing then

Exposure

2024-11-27

Rabatefx

Indonesia

Be careful trading with broker Headway, the slippage is terrible. My account was automatically cut, even though I only had a position of 0.03 with a balance of $514, floating $414, and equity $100. It was immediately cut, resulting in a total loss of $1013. # Broker Headway is garbage

Exposure

2024-09-11

chika8335

Indonesia

Last night my account was made MC without clarity, I request assistance, I really don't accept this, my margin is still there but suddenly I MC, if I MC it should be in the position of the candle 5 minutes earlier I already MC, equity from the peak point is still there for 100 pips

Exposure

2024-08-16

artexe

Indonesia

Intentionally made MC. Even SL does not immediately function. This broker is crazy; SL is removed immediately and made MC. when complaints are unilaterally closed.

Exposure

2024-07-18

Rudi 3214

Indonesia

The USDT prize has not yet entered my account.

Exposure

2024-04-27

Jirayupentiya

Thailand

My money doesn't credit to my account. What should I do?

Exposure

2024-01-14

Álvaro Amir

Colombia

I haven't had any major issues with them, but there haven't been any wow moments either. Just kind of...average. The trading app offers basic charting tools, but for serious technical analysis, you might need to a more advanced app.

Neutral

2024-07-10

Fed Ex

Nigeria

My top broker Headway offers a welcome bonus and first deposit bonus, allowing them to explore the world of forex and have a great experience

Positive

03-27

FX4013450980

South Africa

This broker is good, you guys should read Terms & conditions.

Positive

03-10

FX1434269610

Kenya

A very nice broker nice spreads zero commission too And almost instant withdrawal and deposit

Positive

02-24

Qutancl

Belarus

Very easy and customer friendly platform. It's also cost effective and has access to multiple different investments which makes it unbeatable. The only downside is that there is no SIPP yet but I hope this will come soon. I would like to see a cost effective SIPP with option to invest from business account (ltd).

Positive

2024-06-21