Score

NYGCM/NYFX

United States|5-10 years|

United States|5-10 years| https://nyfx.com/

Website

Rating Index

Contact

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesAccount Information

Users who viewed NYGCM/NYFX also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

nygcm.com

Server Location

United States

Website Domain Name

nygcm.com

Server IP

172.67.161.230

nyfx.com

Server Location

United States

Website Domain Name

nyfx.com

Server IP

172.67.69.62

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Prach SAK

Chairman of the Board

Start date

--

Status

Employed

NYFX CO., LTD.(Cambodia)

INTERSPACE/NYFX FINANCIAL SERVICES INC

Dos Process Agent

Address

61 BROADWAY, ROOM 805, NEW YORK, NY, 10006

INTERSPACE/NYFX FINANCIAL SERVICES INC.(New York (United States))

Prach SAK

Director

Start date

--

Status

Employed

NYFX CO., LTD.(Cambodia)

Company Summary

| Company Information | Details |

| Company Name | NYFX |

| Registered In | United Kingdom |

| Regulation Status | Unregulated |

| Years of Establishment | 2-5 years |

| Trading Instruments | Forex, Commodities, Indices, Stocks, Bonds |

| Account Types | Variable, Fix, ECN, VIP |

| Minimum Initial Deposit | $10 USD |

| Maximum Leverage | Up to 1:1000 |

| Minimum Spread | Starting from 1.4 pips |

| Trading Platform | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Customer Service | Email, live chat, telephone |

Overview of NYGCM/NYFX

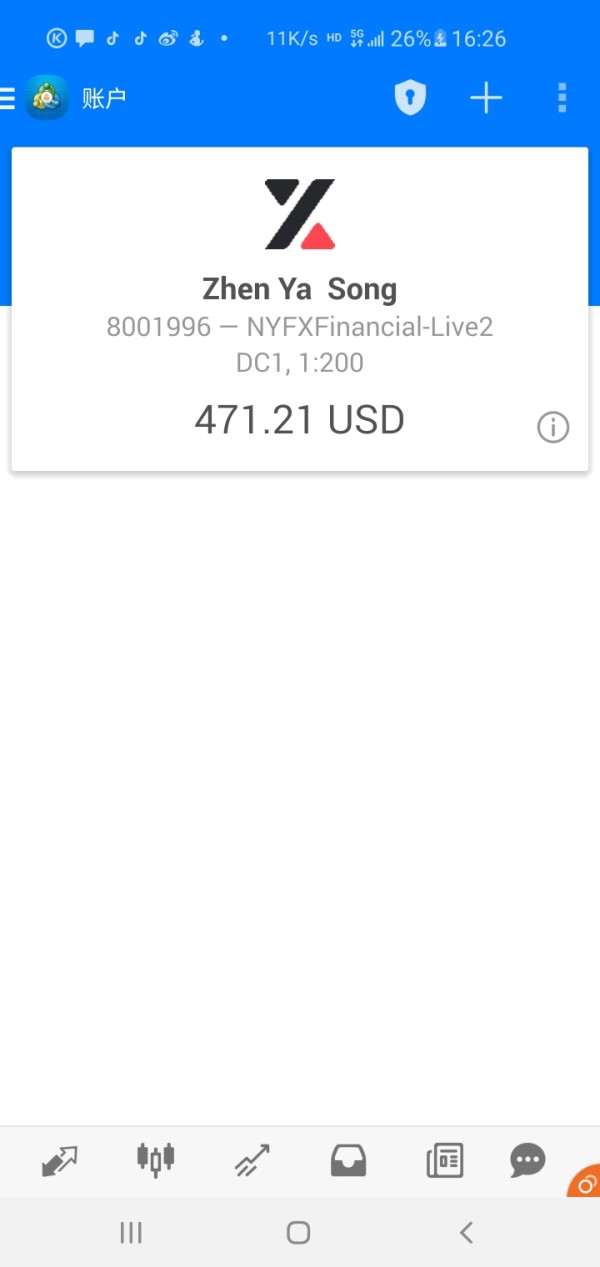

NYFX is a trading platform based in the United Kingdom, operating in an unregulated environment for the past 2-5 years. The platform offers a diverse range of trading instruments, including Forex, Commodities, Indices, Stocks, and Bonds, catering to a wide array of trading preferences. NYFX provides multiple account types, from Variable to ECN and VIP, with minimum initial deposits of $100, allowing traders of various experience levels to participate.

With leverage of up to 1:1000 and variable spreads based on account types, NYFX aims to accommodate a broad spectrum of trading strategies. The platform is accessible through the popular MetaTrader 4 (MT4) and MetaTrader 5 trading platforms and offers various customer service channels, including email, live chat, and telephone support.

However, it's important to note that NYFX operates without regulatory oversight, which may pose potential risks to traders.

Is NYGCM/NYFX Legit or a Scam?

The regulatory status of NYFX, particularly concerning the United Kingdom's Financial Conduct Authority (FCA) and Cambodia's State Secretariat of Civil Aviation (SERC), appears to be irregular and potentially unregulated.

Firstly, the broker's claim of being regulated by the UK's FCA under license number 764353 is questionable and suspected to be a clone or fraudulent representation. The FCA is a reputable regulatory authority known for its stringent oversight of financial services providers, and any suspicion of a clone license raises significant concerns about the broker's legitimacy and adherence to regulatory standards.

Secondly, the reference to Cambodia's SERC with license number 032 indicates that the broker may have had a license in the past, but the official regulatory status now appears to be “Revoked.” This suggests that the broker's operations may have exceeded the permissible business scope or failed to comply with regulatory requirements in Cambodia.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unregulated |

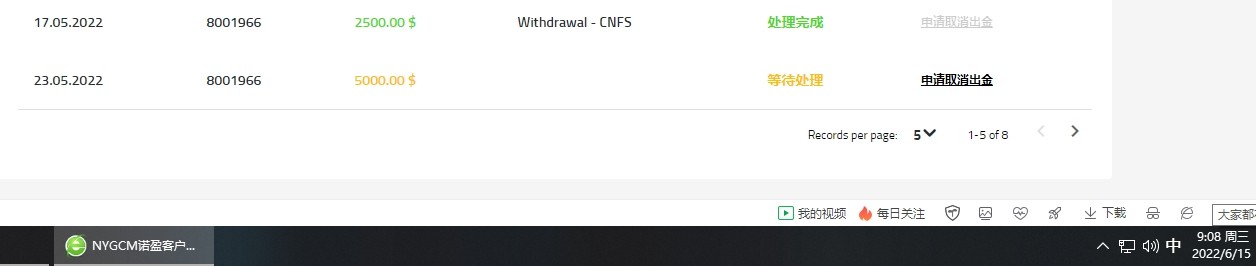

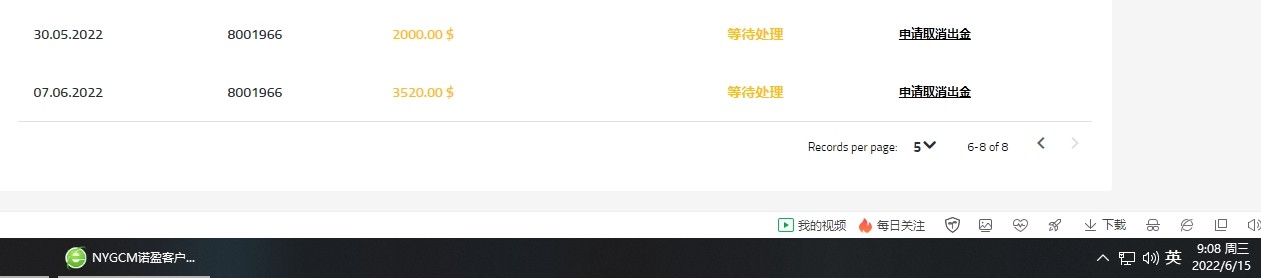

| Low Minimum Deposit | Withdrawal Restrictions |

| Leverage Options | Complaints and Risk Warnings |

Pros:

Diverse Market Instruments: NYFX offers a wide range of tradable instruments, including forex, commodities, indices, stocks, and bonds, allowing traders to diversify their portfolios effectively.

Low Minimum Deposit: With a minimum initial deposit as low as $10, NYFX provides accessible account options, welcoming traders with varying capital levels.

Leverage Options: The broker offers flexible leverage options across different asset classes, empowering traders to choose the level of risk they are comfortable with.

Cons:

Unregulated: NYFX operates without regulatory oversight, which can expose traders to higher risks due to the absence of safeguards typically provided by regulated brokers.

Withdrawal Restrictions: Traders must navigate withdrawal restrictions without the protection of regulatory guidelines, potentially leading to more complex and risky transactions.

Complaints and Risk Warnings: NYFX has received a notable number of complaints in recent months, raising concerns about its service quality and the associated risks of trading with the broker.

Market Instruments

NYFX offers an extensive selection of over 40 tradable currency pairs in the forex market, including major, minor, and exotic currencies, providing access to the world's largest and most liquid financial market. Additionally, the platform extends trading possibilities to commodities, including metals like gold and silver, energy resources, and soft commodities.

For those interested in broader market trends, NYFX offers indices trading, encompassing spot and futures products linked to various global indices. This feature allows traders to track and capitalize on the performance of specific markets or sectors.

Furthermore, NYFX provides access to stocks from both the US and European Union (EU) markets, enabling traders to participate in the equity markets and potentially benefit from company performance and market sentiment.

Lastly, for traders seeking a more conservative approach, NYFX includes bonds among its tradable instruments, offering stability and income generation opportunities.

Account Types

NYFX caters to the diverse needs and preferences of traders by offering a range of distinct account types, each designed to accommodate varying trading styles, risk appetites, and initial investment capabilities. These account types provide flexibility and customization options to meet the specific requirements of traders.

Variable Account: NYFX's Variable account type is suitable for traders with a preference for flexible spreads. With a minimum initial deposit of just $10, this account offers accessibility and allows traders to adapt to changing market conditions.

Fix Account: The Fix account type is another option for traders, offering fixed spreads that can be advantageous for those seeking price stability. It also starts with a minimum deposit requirement of $10, making it accessible to a broad range of traders.

ECN Account: Designed for traders who demand direct access to market liquidity and tighter spreads, the ECN (Electronic Communication Network) account requires a minimum deposit of $1,000. This account type is ideal for those who prioritize order execution speed and minimal slippage.

VIP Account: The VIP account is tailored for experienced and high-volume traders. With a higher minimum deposit requirement of $1,000, it offers competitive trading conditions and additional features, catering to the needs of professional traders.

| Account Type | Minimum Initial Deposit | Leverage | Spreads | Features |

| Variable Account | $10 | Up to 1:1000 | Variable spreads | Suitable for flexible traders. |

| Fix Account | $10 | Up to 1:1000 | Fixed spreads | Ideal for traders seeking price stability. |

| ECN Account | $1,000 | Up to 1:100 | Tighter spreads | Designed for direct market access and faster execution. |

| VIP Account | $1,000 | Up to 1:50 | Competitive spreads | Tailored for experienced and high-volume traders. |

How to Open an Account?

Opening an account with NYFX is a straightforward process. Here's a general overview of the steps you might expect:

Registration: Begin by visiting NYFX's official website and locating the “Open an Account” or “Sign Up” button. You will be required to provide personal information, including your name, contact details, and a valid email address.

Account Type Selection: Choose from the available account types based on your trading preferences and budget. Keep in mind the varying minimum deposit requirements for each type.

Identity Verification: As part of regulatory compliance and security measures, you may need to provide identification documents. This typically includes a government-issued ID and proof of address, such as a utility bill.

Deposit Funds: After your account is verified, you can fund it. NYFX offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Ensure you meet the minimum deposit requirement for your chosen account type.

Trading Platform Selection: NYFX provides traders with the choice of using the popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms. Select the one that suits your trading style and preferences.

Start Trading: Once your account is funded, you can access the trading platform, analyze markets, and execute trades. Be sure to manage your risk and use appropriate risk management tools.

Leverage

Leverage is a potent tool in trading, and NYFX offers varying levels of it, tailored to different asset classes and trading strategies. In the realm of forex, NYFX provides traders the option to access leverage of up to 1:1000, allowing them to control larger positions relative to their initial capital, potentially amplifying both profits and losses.

For commodities trading, leverage of up to 1:200 empowers traders to engage in markets such as precious metals and energy products with enhanced buying power. Indices trading comes with leverage of up to 1:100, while stock trading offers up to 1:50 leverage. Bonds trading provides the option of leverage up to 1:10. However, traders should exercise caution and use leverage judiciously, considering their risk tolerance and overall trading strategy, as it can significantly magnify both gains and potential losses.

Spreads & Commissions

NYFX's spreads vary depending on the type of account you choose. Variable and Fix account spreads start from 1.4 pips for EURUSD, while ECN and VIP accounts may offer tighter spreads. It's worth noting that for some account types, commissions are factored into the spreads for forex trading.

Understanding the cost structure is essential for effective trading, as spreads and commissions can impact your overall profitability.

Trading Platform

NYFX provides traders with a robust and versatile trading platform, offering a choice between MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their user-friendly interfaces, comprehensive charting tools, and an array of features suitable for traders of all levels, from beginners to seasoned professionals.

MetaTrader 4, the industry-favorite, provides traders with customization options, automated trading capabilities via Expert Advisors (EAs), a suite of technical analysis tools, and mobile accessibility for on-the-go trading.

On the other hand, MetaTrader 5 offers an advanced version with additional timeframes, an integrated economic calendar, Depth of Market (DOM) features, and an extended range of technical indicators.

Both platforms are available across various devices, including web, desktop, Android, and iOS, ensuring traders have the flexibility to choose the platform that aligns best with their trading needs and preferences.

Customer Support

NYFX places a strong emphasis on providing accessible and responsive customer support to assist its traders effectively. Should you have any questions, require assistance, or encounter any issues, our support team is readily available to assist you.

You can reach out to us through various means, including English phone support at +442035142506 for personalized assistance, QQ at 2850292759 for alternative communication, and email support at support@nyfx.com for written inquiries and prompt responses to your concerns. At NYFX, we prioritize your trading experience and aim to provide the support you need when you need it.

Risk Warning

It has come to our attention that the number of complaints received by WikiFX against this broker has escalated to a concerning total of 22 within the past 3 months. This significant volume of complaints is indicative of a potentially high-risk situation that traders should be acutely aware of.

These complaints may encompass various issues, including but not limited to irregularities in trading activities, difficulties with fund withdrawals, and questionable business practices. Such a pattern of complaints raises substantial doubts about the broker's integrity and reliability.

In light of this, we strongly urge all traders and prospective investors to exercise extreme caution when dealing with this broker. It is crucial to conduct thorough research, verify regulatory credentials, and consider alternative brokers with established reputations in the industry.

FAQs

Q: Is NYFX regulated by any financial authority?

A: No, NYFX operates in an unregulated environment, which means it lacks oversight by financial regulatory authorities.

Q: What are the available account types on NYFX?

A: NYFX offers a range of account types, including Variable, Fix, ECN, and VIP, catering to different trading preferences.

Q: What is the minimum initial deposit required to open an account with NYFX?

A: The minimum initial deposit varies depending on the account type, with options ranging from $10 to $1,000.

Q: Does NYFX provide access to the MetaTrader trading platforms?

A: Yes, NYFX offers access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned trading platforms known for their versatility.

Q: What is the maximum leverage available for trading with NYFX?

A: NYFX provides leverage of up to 1:1000 for Forex instruments, with varying leverage for other asset classes.

Q: Are there any restrictions on fund withdrawals with NYFX?

A: Traders should be cautious when making withdrawals to maintain a sufficient margin ratio, as open positions may impact the withdrawal amount.

Q: How can I contact NYFX's customer support?

A: NYFX offers multiple customer service channels, including email, live chat, and telephone support, to assist traders with their inquiries and concerns.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Cambodia Common Financial Service License Revoked

- Suspicious Overrun

- High potential risk

Comment 25

Content you want to comment

Please enter...

Comment 25

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1085063115

Hong Kong

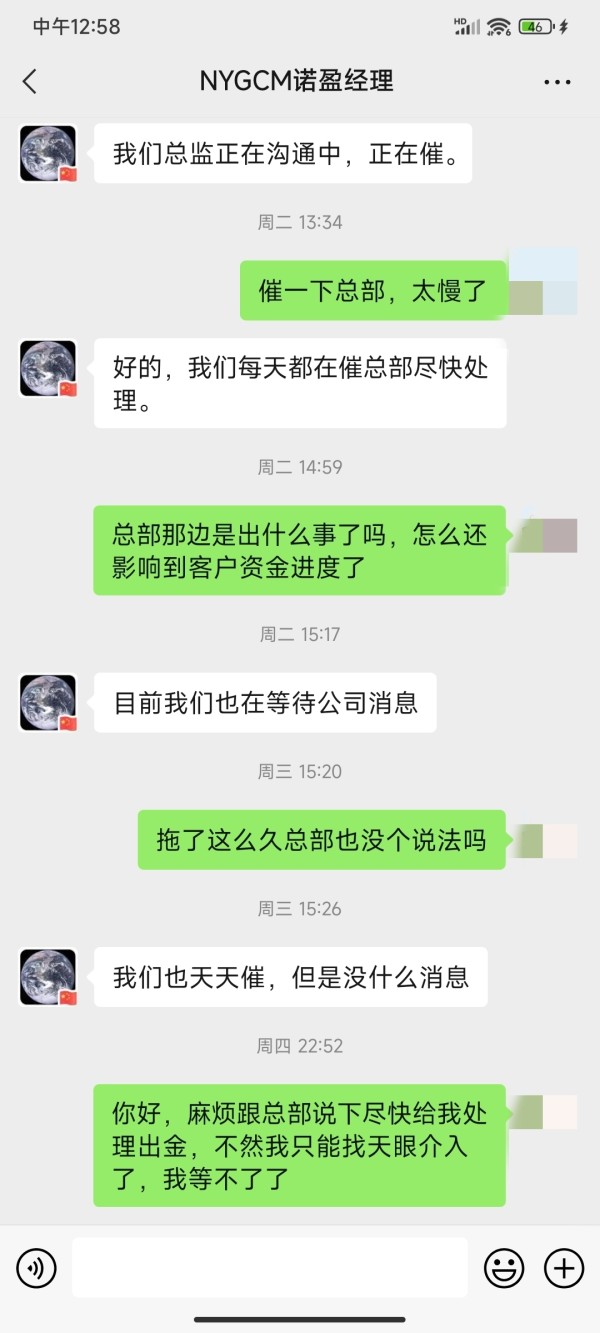

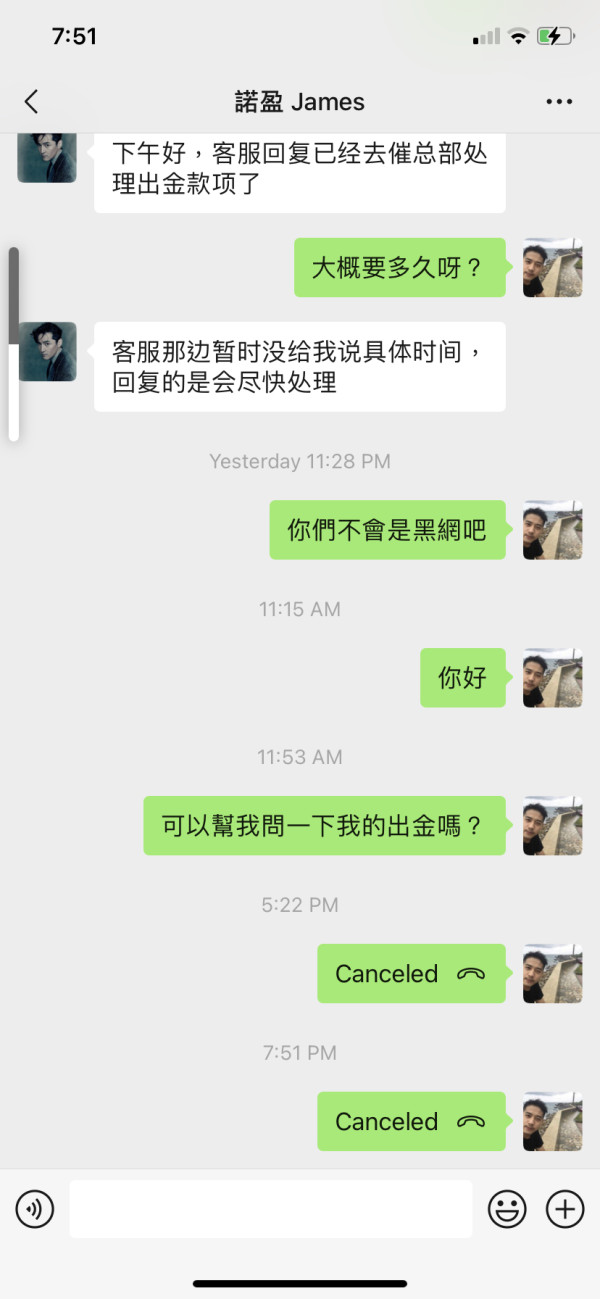

You cannot escape even you change your name. Delay the withdrawla at the beginning. Then, cannot withdraw. No updates from headquarter. Just say that they will deal with it. It is delaying for time.

Exposure

2022-06-15

温柔的小太阳

Hong Kong

I apply for a long time, but it has not been processed. Unable to withdraw

Exposure

2022-06-02

Bandon Shao

Taiwan

I have been trading for six months, and the withdrawal of 1,000 yuan at the beginning of the month is very smooth and normal. When there is a need for funds to withdraw all, the website has been waiting for processing. Email customer service and contacting the account manager have not responded, please pay attention! Please the platform help to contact them!

Exposure

2022-06-01

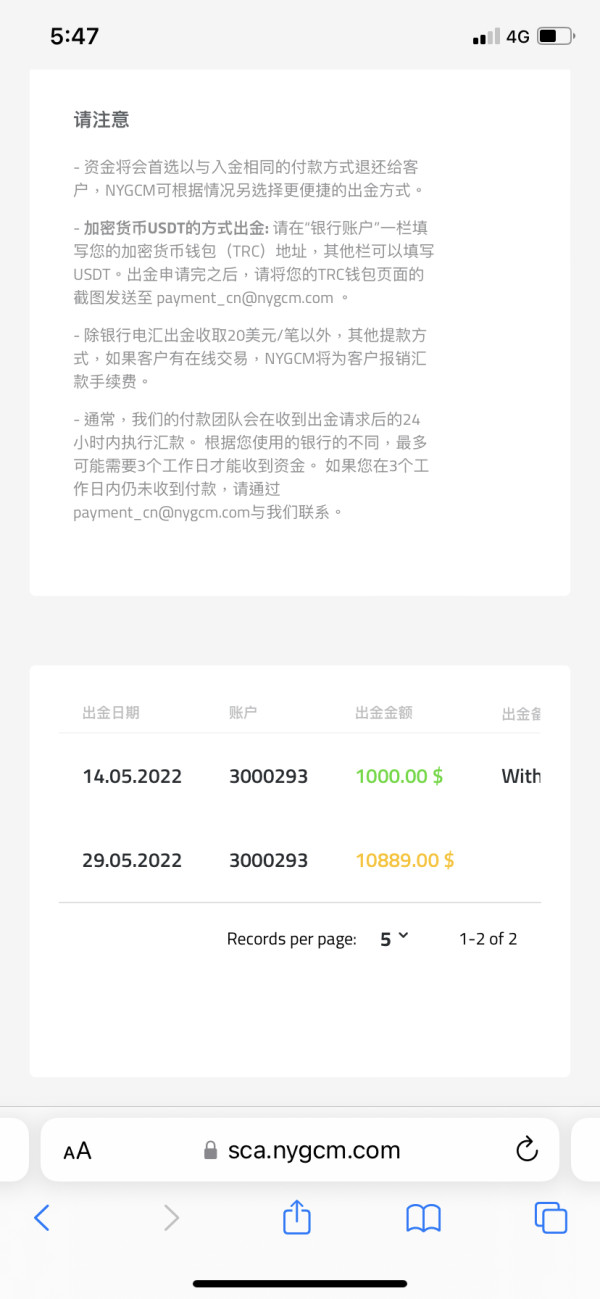

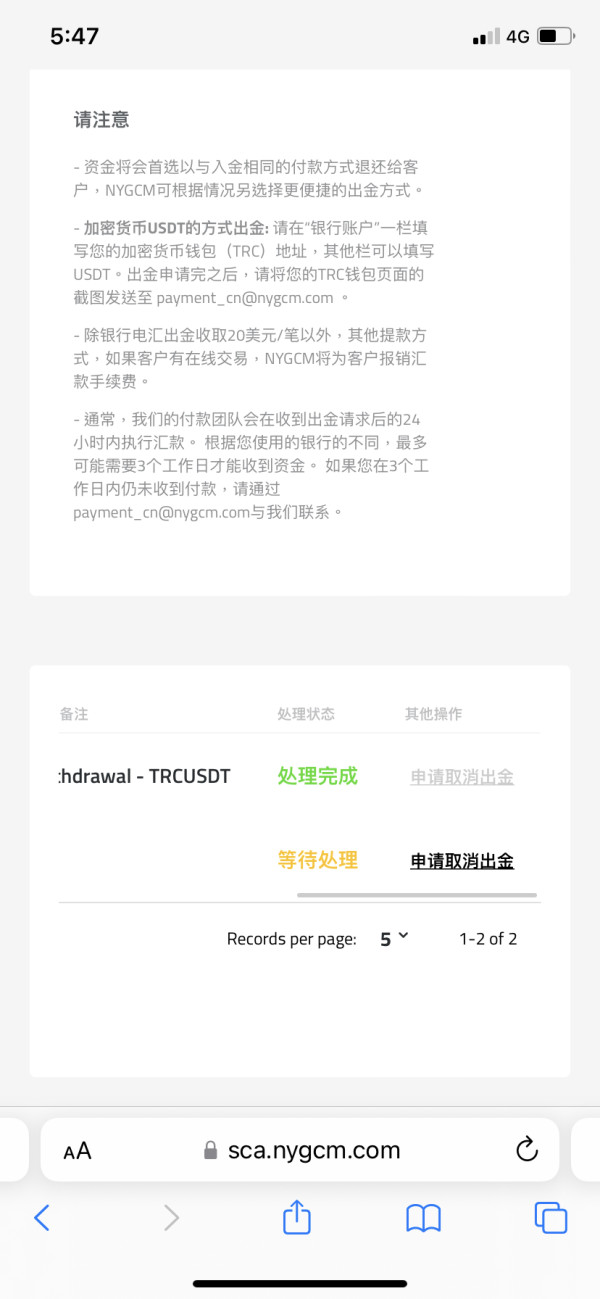

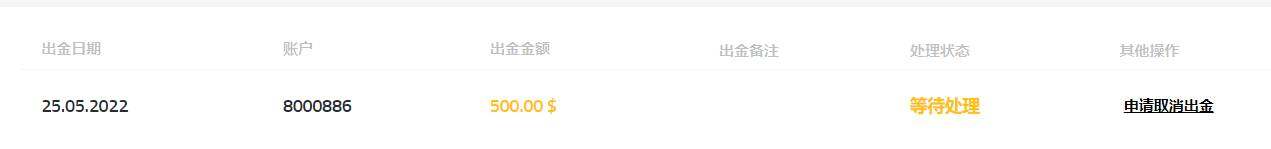

FX3729882445

Hong Kong

I applied for withdrawal on May 25, 2022, but it has not been addressed now. Fraud platform.

Exposure

2022-06-01

职业外汇交易

Hong Kong

The withdrawal application submitted on March 24 has not yet been approved. NYGCM submitted a 6-month installment. I disagree, because most of them only gave two or three installments and then stopped giving them. There are many examples of this. Or give a 50% bonus so that I can only allow losses and not make profits, otherwise I will not give it. This is no different from a demo account. I will definitely not agree. I also put forward 3 plans: 1: Accept it in 2 installments. 2: Accept the discount, and only withdraw 80% of the gold. 3: Accept 50% bonus but allow me to swipe the order, the rebate must be more than the principal of the trading account, and I must agree to the commission to let me withdraw. No response from NYGCM so far

Exposure

2022-04-24

FX3929978432

Vietnam

Unable to withdraw from April 2021 on this platform. It even did not allow entering the order.

Exposure

2021-11-02

Kyle Loh

Malaysia

I gained lots of profits but my orders was stopped at 1778.66 without any reasons. I was very annoyed.

Exposure

2021-09-19

FX1868688628

Vietnam

NYFX promised that they would pay on May 31 while they haven't.

Exposure

2021-06-17

FX2142961960

Singapore

NYFX promised that I could get my withdrawals on May 31, 2021 while I haven't receivedt he money

Exposure

2021-06-12

FX2149626138

Hong Kong

Do not help me handle the issue

Exposure

2021-05-29

Thuy Anh

Vietnam

Unable to withdraw

Exposure

2021-05-13

柳99958

Hong Kong

The first time I withdrew money on the platform, the withdrawal has been pending for half a month, and I have been making excuses. It will be a holiday, a personnel change, and a meeting. Anyway, I'm very busy, and I don't have time to withdraw money. . .

Exposure

2021-05-12

FX1494777942

Vietnam

Unable to withdraw

Exposure

2021-05-12

恩特

Hong Kong

My order is set with TP and stop-loss. It is clear that the profitable order was turned into a loss due to system reasons. Contact customer service, and the customer service returned the order to me at a high level the next day, which made me suffer a serious loss, and the profitable order became a serious loss

Exposure

2021-05-11

恩特

Hong Kong

The profit order, they caused me to lose thousands of dollars due to the system. There is evidence to prove it, and I hope to return it to me.

Exposure

2021-05-10

恩特

Hong Kong

The order with stop-profit and stop-loss was obviously several hundred gold. Because of their system, the order turned into a loss. I contacted customer service, but the customer service did not refund me the profit, and the order was refunded to me the next day. Cost me thousands of dollars

Exposure

2021-05-09

恩特

Hong Kong

The stop loss point was at 1780.99, and the highest position was at 1778.66. The profitable order in my hand was closed by the system. I don't know what happened.

Exposure

2021-05-08

Thuy Anh

Vietnam

I have withdrawn from May 6, 2021, but still have not been approved. Many people are in the same situation as me.

Exposure

2021-05-08

恩特

Hong Kong

My 1778-point short order was in hand at the time, and it had a floating profit of more than 100 US dollars. As a result, no operation order was inexplicably stopped. The highest point was 1778.66. My stop loss was 1780.7. There was no compensation for the profitable order, which resulted in a loss. serious. The follow-up verification was a system problem. As a result, the platform problem did not give me a refund. Instead, the empty order was returned at a high position the next day, resulting in serious losses. The customer service did not give an explanation. There is no apology. I don't understand whether the slippage is serious or maliciously making investors lose money.

Exposure

2021-04-29

FX6267231620

Hong Kong

Add the fraud’s WeChat unconsciously. The fraud claimed on WeChat Moments that they could help customers arbitrage by the platform bug. And the profit can be 5-8 times. The operation is so easy. The process went so quickly and I can’t catch up so I lost over 80,000. But they kept asking me to invest. At that time, I realized that I was cheated.

Exposure

2021-03-11