DNA Markets Information

DNA Markets, established in 2023 in Australia, is a regulated trading platform under the Australian Securities & Investment Commission (ASIC). It offers a wide array of trading assets, including Forex, Commodities, Shares, Indices, and Cryptocurrencies.

The major advantages of DNA Markets include fast trade execution, competitive pricing with tight spreads, and access to over 800 financial instruments. However, it has limited educational resources and the spread competitiveness differs across different instruments.

Is DNA Markets legit or a scam?

DNA Markets is regulated by the Australia Securities & Investment Commission (ASIC) with the license type of Appointed Representative (AR). This regulatory status positively impacts traders on the platform as it signifies that DNA Markets operates within the framework of ASIC's regulations and standards. Traders can have confidence in the platform's commitment to maintaining a transparent and compliant trading environment.

However, it's important to note that there was a mention of a “Suspicious Clone” status associated with another entity, Focus Markets Pty Ltd, under the same regulatory agency. While this directly impacts DNA Markets, traders should ensure they are trading with the authorized and regulated entity, DNA Markets Pty Ltd, to enjoy the benefits of a regulated and secure trading environment.

Pros and Cons

Market Instruments

DNA Markets offers a wide range of trading assets across various categories. These assets include Forex, Commodities, Shares, Indices, and Cryptocurrencies.

In the realm of Forex, traders have access to a wide selection of currency pairs, including majors, minors, and exotic pairs. This extensive offering allows traders to engage in the foreign exchange market with flexibility and diversify their portfolios.

For those interested in Commodities, DNA Markets provides opportunities to trade in assets like precious metals (gold and silver) and energy resources (oil). These commodities are renowned for their role in global markets, making them attractive options for traders looking to capitalize on price movements.

The platform also offers trading in Shares, allowing traders to invest in leading companies from around the world. This category encompasses a variety of stocks, enabling traders to build a diverse stock portfolio and potentially benefit from the performance of these renowned companies.

Indices trading is available, offering exposure to the performance of entire markets or specific sectors. DNA Markets provide access to popular indices such as the S&P 500, NASDAQ, and more, making it possible for traders to speculate on broader market trends.

In the realm of digital assets, DNA Markets offers a selection of Cryptocurrencies. Traders can engage in the cryptocurrency market by trading popular options like Bitcoin, Ethereum, and other cryptocurrencies against traditional fiat currencies.

Account Types

DNA Markets offers two distinct account types: the Raw Account and the Standard Account.

The Raw Account type offers spreads starting from 0.0 pips, with a commission of $3 per side. This account requires a minimum deposit of $100 and allows a minimum trade size of 0.01. Users who prefer algorithmic trading will find this account suitable as Expert Advisors (EAs) are available. Please note that the condition of spreads from 0.0 pips applies exclusively to FX trading. This type of account is preferable for active traders who are looking for tighter spreads and are comfortable with a commission-based structure.

In contrast, the Standard Account features spreads beginning at 1.0 pips and operates without commission charges. Similar to the Raw Account, it requires a minimum deposit of $100 and permits a minimum trade size of 0.01. Availability of Expert Advisors (EAs) also applies to this account, offering flexibility for those utilizing trading automation. This account is well-suited for traders who prefer a straightforward cost structure without commissions, typically appealing to those new to trading or looking for a simple fee arrangement.

How to Open an Account?

To open an account with DNA Markets, please follow these explicit steps:

- Application Submission: Fill out a straightforward application form provided on the DNA Markets website.

- Document Upload: Verify your identity by uploading the required documents to your profile on the platform.

- Account Funding: Deposit a minimum of $100 into your account to activate it.

- Begin Trading: Start trading immediately with DNA Markets once your account is funded and verified.

Spreads & Commissions

DNA Markets provides two main types of accounts with distinct pricing structures to accommodate various trading preferences. The Raw Account features spreads that start from as low as 0.0 to 0.3 pips on major currency pairs such as EUR/USD. However, this account type charges a commission of $3 per standard lot traded. This option is more cost-effective for traders who trade frequently or in large volumes, as the narrower spreads can reduce transaction costs over time, despite the commission fee.

On the other hand, the Standard Account offers spreads beginning at 1.0 to 1.3 pips for the same currency pairs and does not charge any commission on trades. This appeals to less frequent traders or those who trade in smaller volumes, as the absence of commission fees simplifies the cost structure, making it easier for traders to calculate their trading costs upfront.

Trading Platform

DNA Markets offers its traders the choice between two well-established trading platforms: MetaTrader 5 and MetaTrader 4.

MetaTrader 5 (MT5) is a powerful and versatile platform known for its advanced features. It provides traders with access to a wide range of financial instruments, including Forex, commodities, indices, stocks, and cryptocurrencies. MT5 offers comprehensive charting tools, technical indicators, and analytical resources, making it suitable for both beginners and experienced traders. It also supports automated trading with the use of Expert Advisors (EAs).

MetaTrader 4 (MT4), on the other hand, is a well-established and widely used trading platform known for its simplicity and reliability. It offers trading in Forex and CFDs and provides a range of technical indicators and charting tools for analysis. MT4 is favored by many traders for its intuitive interface and ease of use. It also supports automated trading through EAs.

Both platforms, MT5 and MT4, have their strengths and appeal to different types of traders. While MT5 offers a broader range of assets and advanced features, MT4 is favored for its simplicity and ease of use. DNA Markets provides traders with the flexibility to choose the platform that best suits their trading style and preferences.

Deposit & Withdrawal

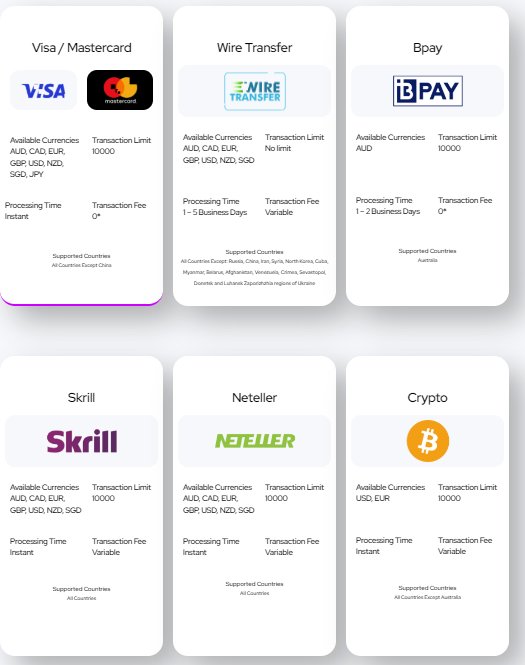

DNA Markets offers a diverse range of payment methods, ensuring that transactions can be conducted with ease and security.

Visa/Mastercard: Clients can make deposits using Visa or Mastercard in various currencies, including AUD, CAD, EUR, GBP, USD, NZD, SGD, and JPY. The platform offers instant processing of transactions with a maximum limit of $10,000 and no transaction fee. However, Visa/Mastercard deposits are not available to users in China.

Wire Transfer: Wire transfers are accepted in several currencies without any transaction limit, making it suitable for high-volume traders. The processing time for wire transfers is between 1 to 5 business days, and the fee varies depending on the bank and the country. This method is unavailable to users from several countries, including Russia, China, and others.

Bpay: Exclusive to Australian clients, Bpay allows deposits in AUD with a transaction limit of $10,000 and a processing time of 1 to 2 business days. There are no transaction fees for Bpay.

Skrill and Neteller: Both these e-wallet services support various currencies and offer instant processing with a limit of $10,000. However, the transaction fee is variable. They are accessible to users worldwide.

Crypto: Cryptocurrency payments in USD and EUR are also processed instantly with a limit of $10,000. The transaction fee is variable, and this method is not available to Australian users.

Customer Support

DNA Markets offers a range of customer support options for its users. Queries can be addressed through a dedicated contact form, which is designed for prompt assistance.

The platform also provides support via email at support@dnamarkets.com, ensuring an additional line of communication for user convenience. For immediate assistance, customers can reach out via phone at +442070825200. Recognizing the global nature of trading, DNA Markets extends multilingual support, allowing traders to receive help in various languages. Additionally, specialized support for sales and institutional inquiries is available, offering personalized solutions and services to meet the needs of different business clients.

Conclusion

DNA Markets equips its users with a robust support system, ensuring that traders of varying experience levels receive the necessary assistance. The decision to place servers strategically across the globe serves to enhance trade execution speed, providing a tangible benefit for those whose strategies hinge on timing. With competitive pricing and tight spreads, the platform offers a cost-effective trading experience. The vast selection of over 800 financial instruments affords traders ample opportunity for diversification and exposure to different markets. Additionally, the oversight by ASIC imparts a degree of reliability and compliance with financial regulations, offering traders a secure trading environment.

However, the execution speed of trades, while generally fast, can be affected by internet speeds and specific market conditions that could delay trade completions. The variability in spread competitiveness for different instruments means that cost efficiency is consistent across all trades. Moreover, traders seeking to expand their knowledge base will find the educational resources on the platform to be less comprehensive than desired, potentially requiring them to seek information elsewhere to supplement their learning.

FAQs

What types of accounts does DNA Markets offer?

DNA Markets offers Raw and Standard accounts, each with different pricing structures.

Are DNA Markets' trading servers fast?

Yes, DNA Markets' servers are strategically placed to provide fast execution of trades.

Can I trade various financial instruments with DNA Markets?

Yes, DNA Markets provides access to over 800 financial instruments.

Is DNA Markets regulated by any financial authority?

Yes, DNA Markets is regulated by the Australian Securities and Investments Commission (ASIC).

7058

Australia

DNA Markets promises to give quick responses and easy withdrawal. However, I'm keeping an eye on how they develop further, especially given some concerns around unexpected spikes and spread increases during trading. It's early days, so here's hoping they continue to improve and address these issues

Neutral

2024-06-21

Dreman

Peru

DNA Markets is great! They've got a lot of stuff to trade and the payments are easy and safe. Really like working with them.

Positive

2024-07-29

Aiko. Ishikawa

Turkey

Even with larger orders, I haven't experienced any significant price slippage. Liquidity seems good.

Positive

2024-06-28

FX2835765364

Israel

Customer service has been responsive and helpful, assisting me promptly with any issues. The onboarding process was straightforward. Overall, DNA Markets provides a reliable and user-friendly trading experience. Highly recommended for both new and experienced traders.

Positive

2024-05-21