Score

PGM

Australia|10-15 years| Benchmark A|

Australia|10-15 years| Benchmark A|https://pgm-fx.com/en/

Website

Rating Index

Benchmark

Benchmark

A

Average transaction speed (ms)

MT4/5

Full License

PrimeTimeGlobal-Live

Benchmark

Speed:AA

Slippage:D

Cost:AAA

Disconnected:A

Rollover:AAA

MT4/5 Identification

MT4/5 Identification

Full License

South Korea

South KoreaContact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 9 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Australia

AustraliaPGM Joins Wiki Finance Expo Dubai 2024

Since its inception in 2015, PGM has risen to become a leading global broker in the forex and CFD markets. As an industry pioneer, PGM leverages discerning market insights to offer a diverse and comprehensive range of trading products. From mainstream forex trading to will-received precious metals, the volatile energy markets, the fluctuating global indices, and the cutting-edge exploration of dig

United Arab Emirates

United Arab Emirates EXPO

EXPOPGM Joins Wiki Finance Expo Dubai 2024

Since its inception in 2015, PGM has risen to become a leading global broker in the forex and CFD markets. As an industry pioneer, PGM leverages discerning market insights to offer a diverse and comprehensive range of trading products. From mainstream forex trading to will-received precious metals, the volatile energy markets, the fluctuating global indices, and the cutting-edge exploration of dig

United Arab Emirates

United Arab Emirates EXPO

EXPOAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed PGM also viewed..

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Benchmark

Website

pgm-fx.com

Server Location

United States

Website Domain Name

pgm-fx.com

Server IP

156.244.13.236

pgmfx.com

Server Location

South Korea

Website Domain Name

pgmfx.com

Server IP

15.164.84.222

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| PGWReview Summary | |

| Founded | 1995 |

| Registered Country/Region | Melbourne, Australia |

| Regulation | ASIC |

| Market Instruments | FuturesCommoditiesPrecious metalsStocks indexForex exchange |

| Demo Account | ✅(STP account) |

| Leverage | Up to 1:400 |

| Spread | As low as 0.5 pips |

| Trading Platform | MT4 & MT5 |

| Min Deposit | $100 |

| Customer Support | Live chat |

| Email: cn.support@pgmfx.com | |

| Physical Address: INP MELBOURNE, Suite 103, 566 St kilda Road MELBOURNE VIC 3004 | |

PRIMETIME GLOBAL MARKETS Information

PGM was incorporated in Australia in 2015. Currently, PGM mainly provides CFD trading services such as foreign exchange, precious metals, energy, index products, and crypto currencies.

PGM supports the use of the MT4 and MT5 platforms and offers three types of accounts for traders to choose from.

Pros and Cons

| Pros | Cons |

| Multiple strict regulations | The high minimum deposit of ¥5000 for ECN Account |

| More than 10,000 trading products | |

| 400 times leverage | |

| 24/7 service | Delayed response |

| Dedicated servers for data security | |

| Negative Balance Protection | |

| Ultra-low spreadsSpread as low as 0.1pips |

Is PRIMETIME GLOBAL MARKETS Legit?

It is authorized and regulated by the Australian Securities & Investments Commission (ASIC), Regulation Number (AFSL) 470050.

What Can I Trade on PGM?

PGM says it offers 1,0000 + products, Primetime Global Markets allows you to invest in futures, foreign exchange, precious metals, commodities, and stock indices with just one account.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Commodities | ✔ |

| Precious metals | ✔ |

| Foreign exchange | ✔ |

| Stocks | ✔ |

| Options | ✔ |

| Indices | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

PGM offers three types of accounts for traders: CENT ACCOUNT, STP ACCOUNT, and ECN ACCOUNT. Minimum deposits range from $100 to $5000, and leverage can be up to 1:400.PGM supports trading 10,000+ CFDs.

When it comes to opening an account, PGM gives clear and easy steps. You may refer to:

PGM Fees

PGM offers competitive spreads and commissions across its different account types.

The CENT Account features a minimum spread of 2.2 pips for EUR/USD, making it suitable for beginners with smaller trading volumes and a focus on affordability.

In contrast, the STP Account presents tighter spreads, with a minimum of 1.6 pips for EUR/USD, appealing to traders seeking a balance between cost-effectiveness and functionality.

For experienced traders looking for the lowest spreads, the ECN Account stands out with a minimum spread of 0.5 pips for EUR/USD, albeit requiring a higher minimum deposit.

PGM does not charge any account inactivity fees.

Trading Platform

PGM allows traders to trade with both MT4 and MT5 platforms on Windows Desktop, Google Play, Android APK, iOS mobile terminal, as well as the Web page (for MT4 only).

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows DesktopGoogle PlayAndroid APKiOS mobile terminalWeb page | Novice Trader |

| MT5 | ✔ | Windows DesktopGoogle PlayAndroid APKiOS mobile terminal | Skilled traders |

Deposit and Withdrawal

The minimum deposit requirement varies based on the chosen account type: 100USDfortheCENTAccount,300 for the STP Account, and $5,000 for the ECN Account.

But they didn't disclose the deposit and withdrawal methods on their official website.

Keywords

- 10-15 years

- Regulated in Australia

- Regulated in South Africa

- Institution Forex License (STP)

- Retail Forex License

- MT4 Full License

- Regional Brokers

- High potential risk

Comment 11

Content you want to comment

Please enter...

Comment 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

富安

Singapore

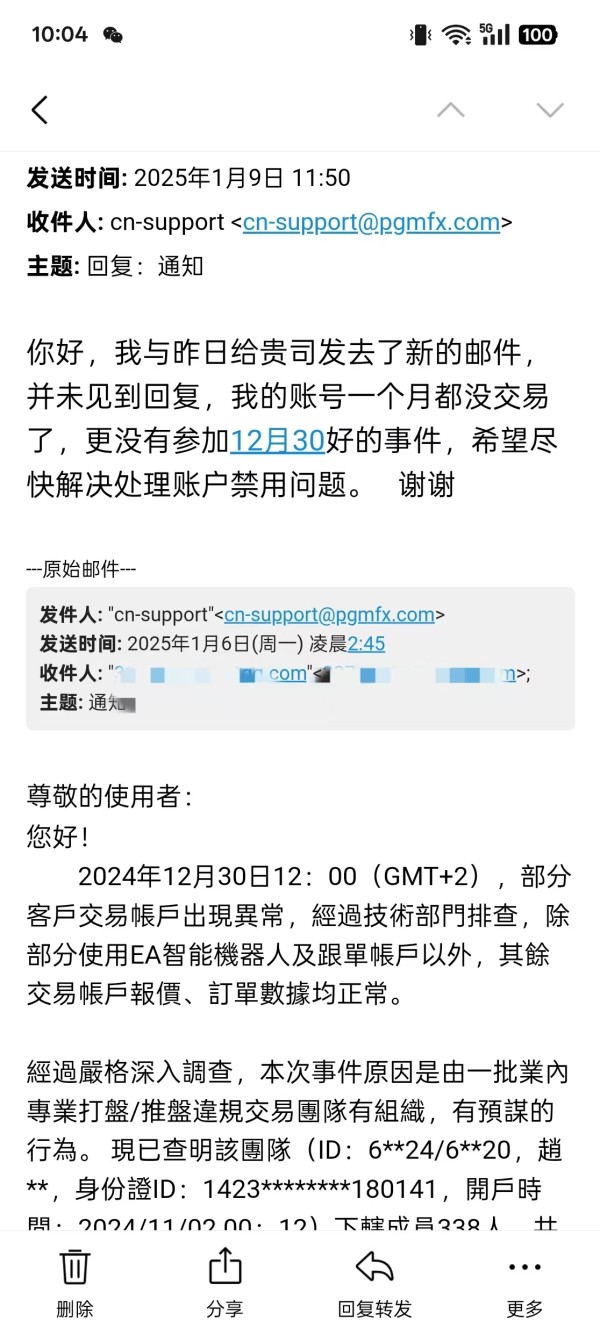

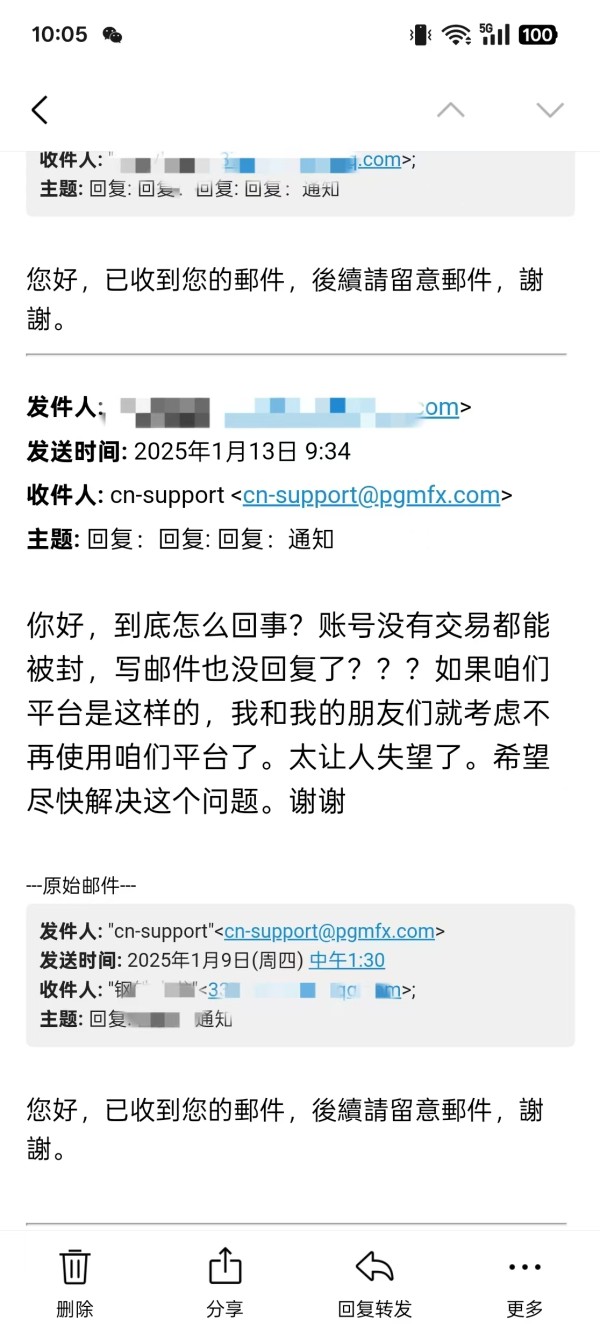

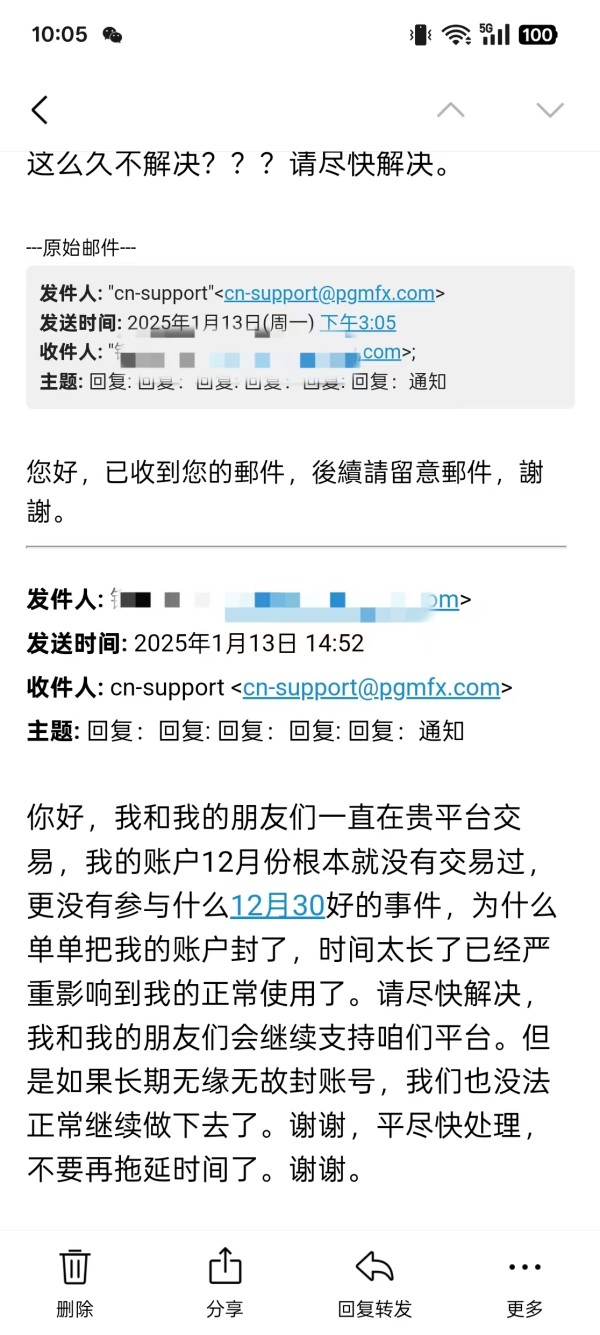

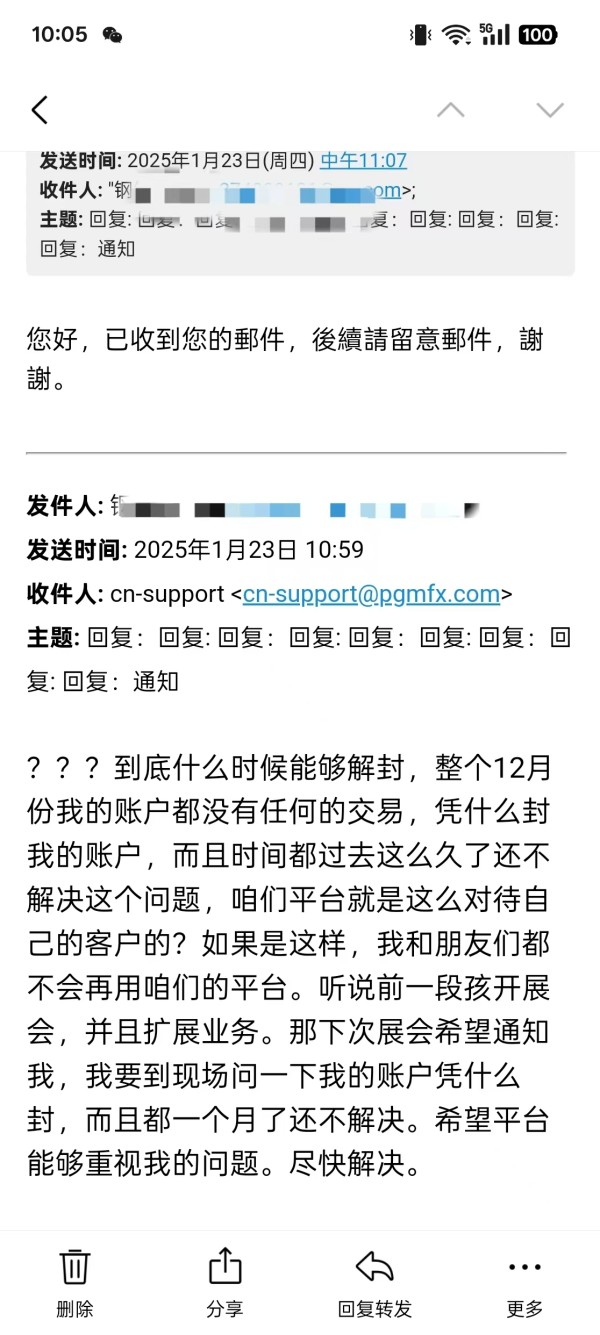

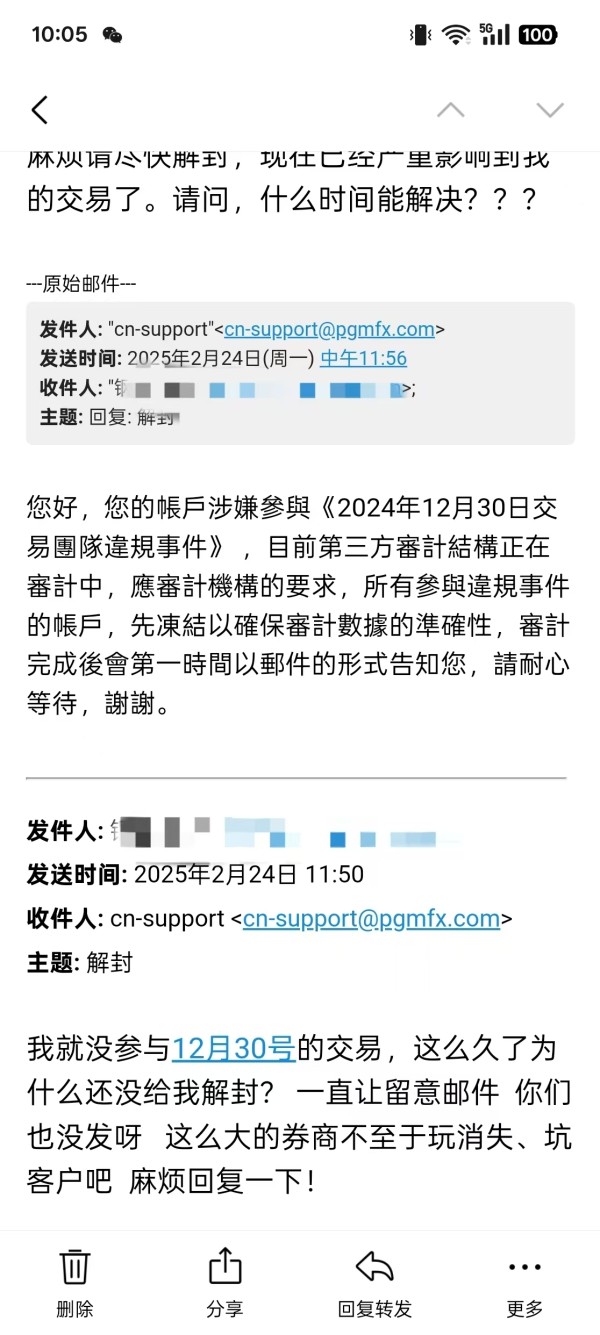

Platform for no reason to block the account, do not give the gold, return my hard-earned money!!!

Exposure

Two days ago

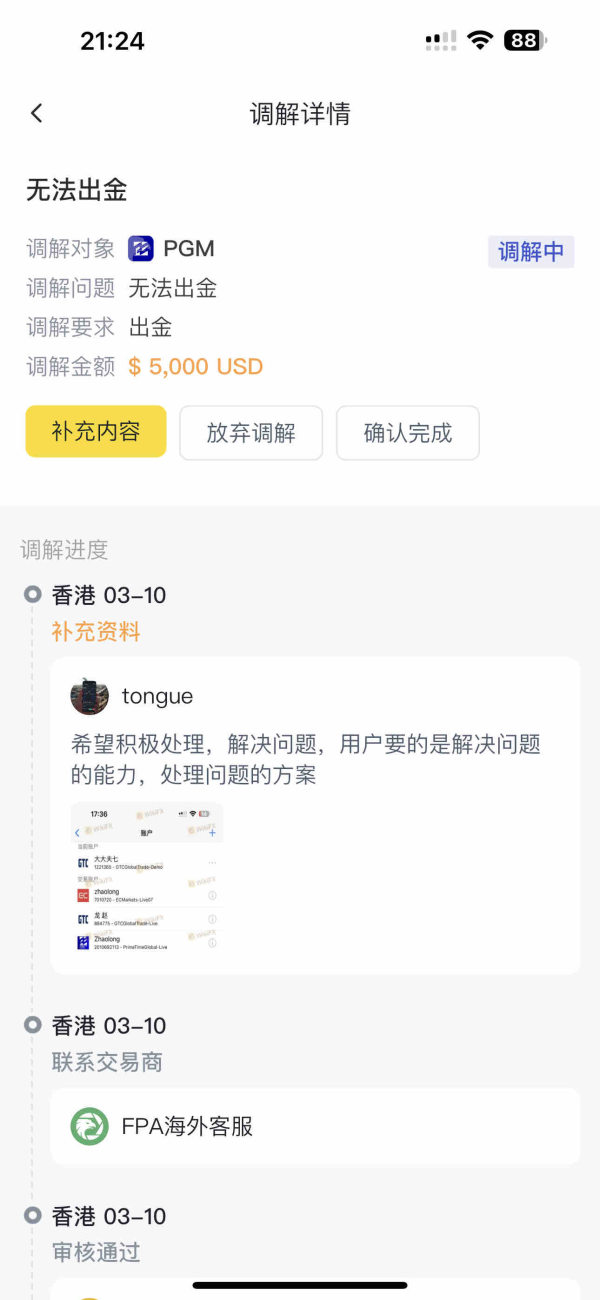

tongue

Malaysia

This is a scam platform where withdrawals are not allowed, and accounts are being disabled.

Exposure

03-24

FX7931863622

Malaysia

This broker accuses customers of violating trading rules whenever they make a profit. When asked to provide data or evidence, they fail to do so. What exactly constitutes a legitimate trade according to them? Even if a customer did violate rules, they should at least pay out principal amount. However, PGM refuses to return the principal; instead, they freeze your MT4 account and prevent you from logging in both on the platform and the backend. They just delay it!

Exposure

03-12

FX3246138922

Malaysia

Scam. Account frozen, no withdrawal allowed. Don't be fooled.

Exposure

02-18

FX3246138922

Malaysia

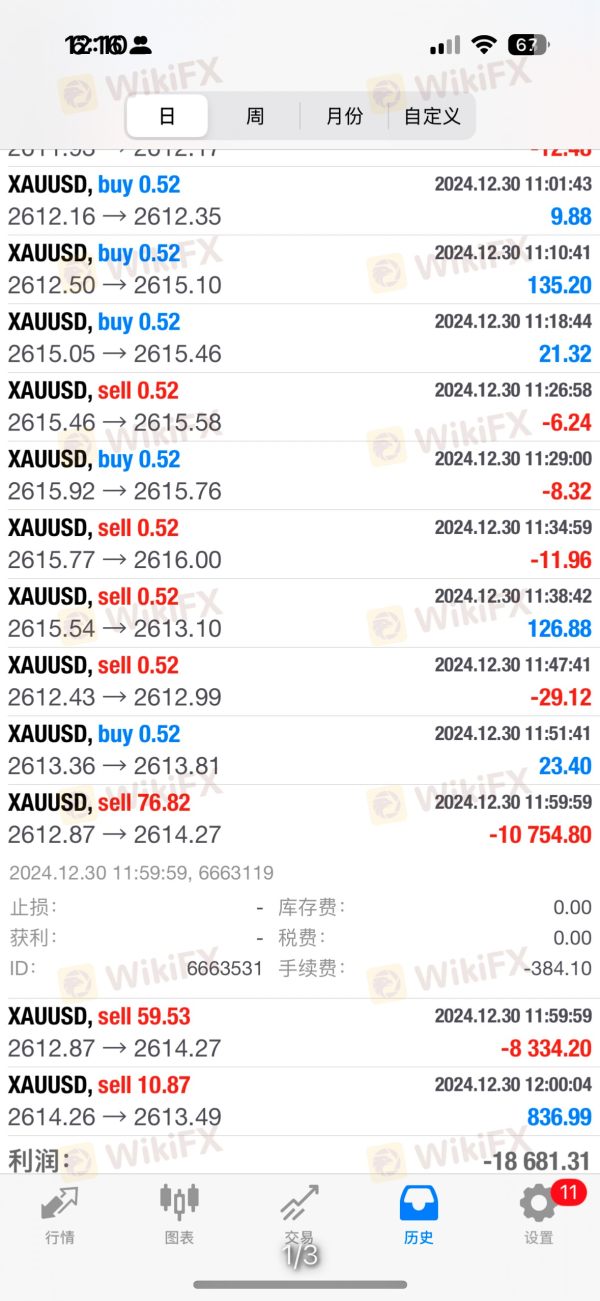

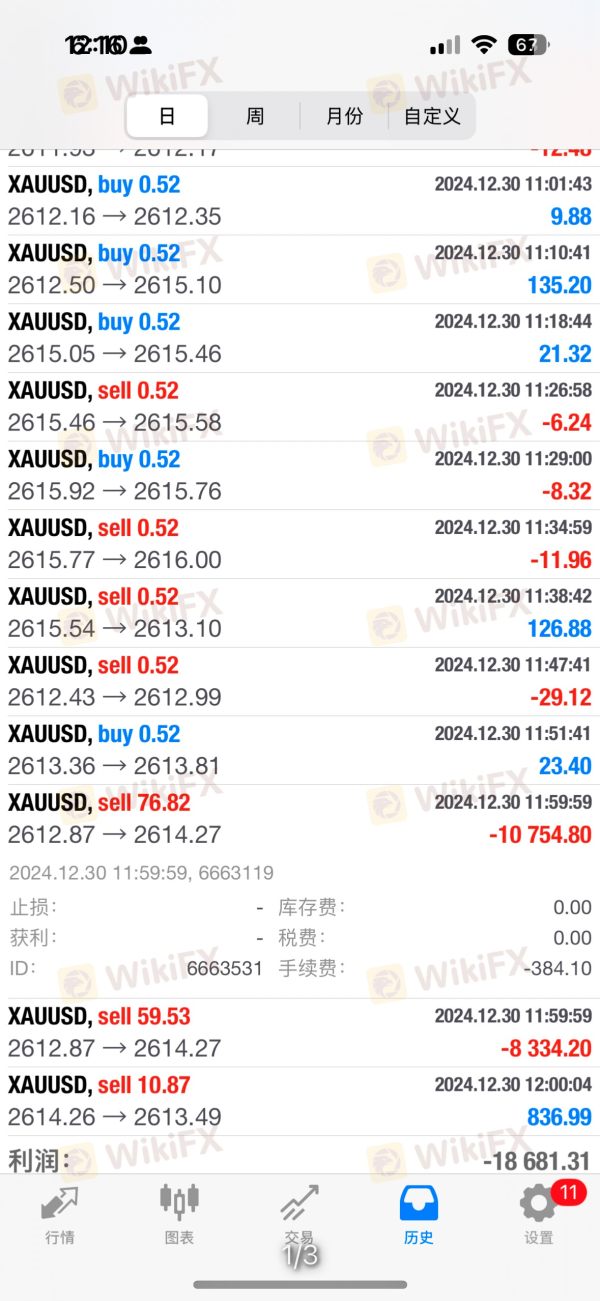

The platform is utterly corrupt! At the same time and at the same price point, my account managed to incur a loss of $18,000. It's outrageous that 50,000 USD could open 136 lots. Not only did they refuse compensation after the fact, but they also froze my account and prevented withdrawals! I demand immediate compensation and the release of my funds from the platform! Otherwise, they should not expect to continue doing business!

Exposure

01-19

FX3246138922

Malaysia

The broker is extremely dishonest. I copied the trades using the technical party they recommended, but due to issues with the technical party, my account suffered a significant loss. I traded 130 lots at once with $50,000, opening and closing positions at the same time and same price point, resulting in a loss of $18,000, which is absurd. Now, not only are they refusing to compensate, but they are also accusing us of violating rules, freezing the account, and denying withdrawals.

Exposure

01-06

FX3532467045

United States

On January 6, 2025, my position of $40,000 in PGM has been frozen. Currently, I am unable to log in to my account and unable to withdraw funds. This is an act of banditry and needs to be exposed.

Exposure

01-06

FX1523940462

Japan

We have been trading normally before. A few days ago, you said that there was a team attacking you. Why did you freeze our account because of the attack? This reason is too far-fetched. It's inexplicable that you are not allowing withdrawals. This is a black platform.

Exposure

01-06

FX7931863622

Malaysia

Using this broker for copy trading, on December 30, 2024, my account suddenly executed large volume trades with both the opening and closing times being identical! This led to losses, and currently, the remaining funds are being withheld by the broker who refuses to process withdrawals.

Exposure

01-06

meiling10276

Argentina

As soon as you have a problem, you will go round and round until you have told the story so many times you give up. They always respond positively but never try to help. All smoke and mirrors. They will come in here and say 'oh just contact us we can help', empty promises all day long.

Neutral

2024-07-19

FX1498588027

United States

The quick execution and low spreads are real pluses, and their customer service is always on point, ready to help whenever I need it. The platform is also very intuitive. So far, I'm quite satisfied with the overall experience.

Positive

2024-06-21