Score

Ahead

Hong Kong|2-5 years|

Hong Kong|2-5 years| http://ahead-fx.com/en/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Hong Kong

Hong KongUsers who viewed Ahead also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

ahead-fx.com

Server Location

United States

Website Domain Name

ahead-fx.com

Server IP

148.72.88.27

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Ahead Review Summary in 10 Points | |

| Founded | 2-5 years |

| Registered Country/Region | Hong Kong |

| Regulation | Unregulated |

| Market Instruments | Forex |

| Demo Account | Available |

| Leverage | Up to 1:200 |

| EUR/USD Spread | Variable |

| Trading Platforms | MT4 |

| Minimum Deposit | Not disclosed |

| Customer Support | Email, Address, Contact us form |

What is Ahead?

Ahead, a brokerage firm with its central operations based in Hong Kong, offers foreign exchange as a medium of financial trading. Nonetheless, it is important to highlight the fact that this broker is presently functioning without an authoritative regulatory endorsement by any recognized financial governing entities.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • MT4 platform | • Unregulated |

| • Demo account available | • Limited trading instruments |

| • Not accept clients from certain countries |

While Ahead does present some beneficial features such as the incorporation of the well-regarded MetaTrader 4 (MT4) platform known for its enhanced tools and user-friendly interface suitable for a range of traders, it also contains several notable drawbacks. Also, Ahead offers a demo account, which allows prospective traders to test and explore the platform's features and capabilities in a risk-free environment before venturing into live trading.

Chief among these is the absence of a regulatory body governing its operations. The absence of regulation introduces an additional risk, as there may be a lack of protections usually in place for traders' rights and fund security. The brokerage also has a narrow selection of trading instruments available, being limited to only forex, which narrows the avenues for portfolio diversification. Furthermore, Ahead follows a policy of non-acceptance from certain countries, which include but are not limited to the USA, Afghanistan, Burma, and Zimbabwe. This geographical limitation can constrain their customer base and potentially hinder potential investors based on their location.

Is Ahead Safe or Scam?

When considering the safety of a brokerage like Ahead or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: The operation of Ahead is a matter of concern given its lack of applicable regulation. This absence of a regulatory framework can cast doubts on the firm's credibility and operations, posing potential investors with the risk of executing their trades under undetermined safety standards.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedbacks from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: Ahead rioritizes their clients' security through the implementation of a robust privacy policy. This measure ensures the confidentiality and protection of personal information, providing clients the assurance that their data is being handled with utmost care and discretion, safeguarding against unauthorized access and potential breaches.

In the end, choosing whether or not to engage in trading with Ahead is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

Ahead's trading platform is notably dedicated to providing forex trading instruments exclusively. This offering can be beneficial to traders specializing in the forex market, providing a focused approach to their trading strategies. While this streamlined offering can facilitate a targeted approach for forex traders, it may simultaneously pose limitations for those interested in portfolio diversification. Traders looking for a variety of asset classes may find Ahead's single-instrument offering a restriction.

Accounts

AHEAD provides a seamless, hassle-free process for account opening for the Live trading account, eliminating the need for document submissions like ID proofs, promising prompt access to their optimal Forex trading environment. Once an account is opened, customers are granted immediate access to what AHEAD claims to be an efficient and superior Forex trading environment.

For those tentative about Forex trading or looking for a risk-free method to familiarize themselves with the platform, AHEAD offers the opportunity to engage in virtual trading through a demo account. Despite being a demo, it replicates the live trading functionalities, offering a realistic experience.

For those who prefer professional management of transactions, AHEAD provides a MAM account where professionals will handle all complex trading activities after you deposit your margin.

However, it's noteworthy that specific information about the minimum deposit for each account type isn't readily provided. Subsequently, traders are advised to directly contact the broker for detailed information regarding this.

Leverage

Ahead provides an attractive feature in the form of leverage of up to 1:200 for its traders. This means that for every dollar invested, traders have the potential to control $200 in the market. Hence, even with minimal initial capital, a trader can hold significantly larger positions. This high leverage can produce substantial returns on successful trades.

However, it should be noted that trading with high leverage also exposes traders to the equally significant risk of larger losses should the market move in an unfavorable direction. Therefore, while this high leverage provision can indeed become a powerful tool, traders still need to approach it with caution and understanding of the increased risk it brings.

Trading Platforms

Ahead provides its clients with the MT4 platform compatible across a range of devices including those running on Windows, iOS, and Android. This allows traders the convenience, mobility, and flexibility needed in the fast-paced world of forex trading.

By ensuring the platform is accessible on various devices, Ahead empowers traders to keep tabs on their investments, monitor market trends, and execute trades in real time, regardless of their geographical location. This attribute enhances the trading experience by providing consistent access to the financial market, thereby enabling quick decisions and actions in response to market fluctuations.

Customer Service

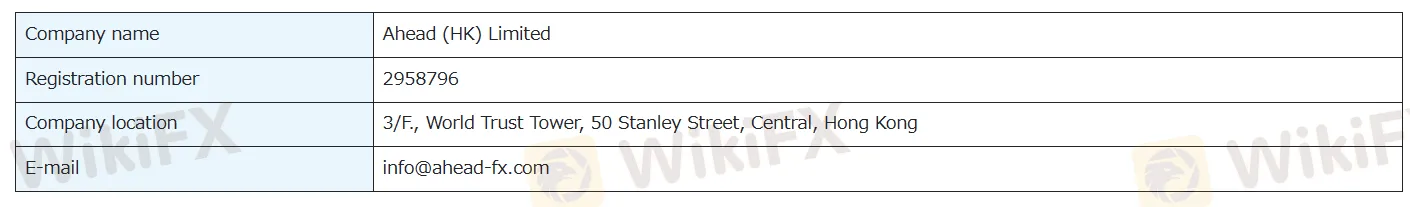

While Ahead provides its address, contact us form and Email as customer support channels, the absence live chat and phone support might limit the accessibility and responsiveness of their customer service.

Address: 3/F., World Trust Tower, 50 Stanley Street, Central, Hong Kong.

Email: info@ahead-fx.com.

Conclusion

To summarize, Ahead effectively markets itself as a global Forex broker based in Hong Kong, focusing solely on the Forex market. However, potential investors should exercise a degree of caution due to the broker's unregulated nature, which raises legitimate concerns regarding regulatory compliance and client fund security.

Hence, based on these considerations, prospective traders are recommended to consider other brokers that emphasize transparency, commitment to regulations, and high standards of professional conduct.

Frequently Asked Questions (FAQs)

| Q 1: | Is Ahead regulated? |

| A 1: | No. The broker is currently under no valid regulations. |

| Q 2: | Is Ahead a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners because its unregulated by any recognized bodies. |

| Q 3: | Does Ahead offer the industry leading MT4 & MT5? |

| A 3: | Yes, it offers MT4 platform on iOS, Android and Windows devices. |

| Q 4: | Does Ahead offer demo accounts? |

| A 4: | Yes. |

| Q 5: | At Ahead require, are there any regional restrictions for traders? |

| A 5: | Yes, Ahead does not offer service to residents of certain jurisdictions, including the United States, Afghanistan, Belarus, Burma, Central African Republic, Congo, Cuba, Egypt, Guinea, Iraq, Iran, Lebanon, Libya, Mauritius, North Korea, Pakistan, Somalia, Sudan, Syria, Venezuela, Yemen, Zimbabwe. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now