Score

ADMIS

Hong Kong|Above 20 years|

Hong Kong|Above 20 years| https://www.admis.com.sg/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Macao 2.66

Macao 2.66Contact

Licenses

Licenses

Licensed Entity:ADMIS Hong Kong Limited

License No. ACP509

Single Core

1G

40G

1M*ADSL

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

Hong Kong

Hong KongUsers who viewed ADMIS also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

admis.com.sg

Server Location

United States

Website Domain Name

admis.com.sg

Server IP

99.83.237.141

admis.com.hk

Server Location

Hong Kong

Website Domain Name

admis.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

54.182.1.12

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| ADMIS Review Summary | |

| Founded | 2010 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

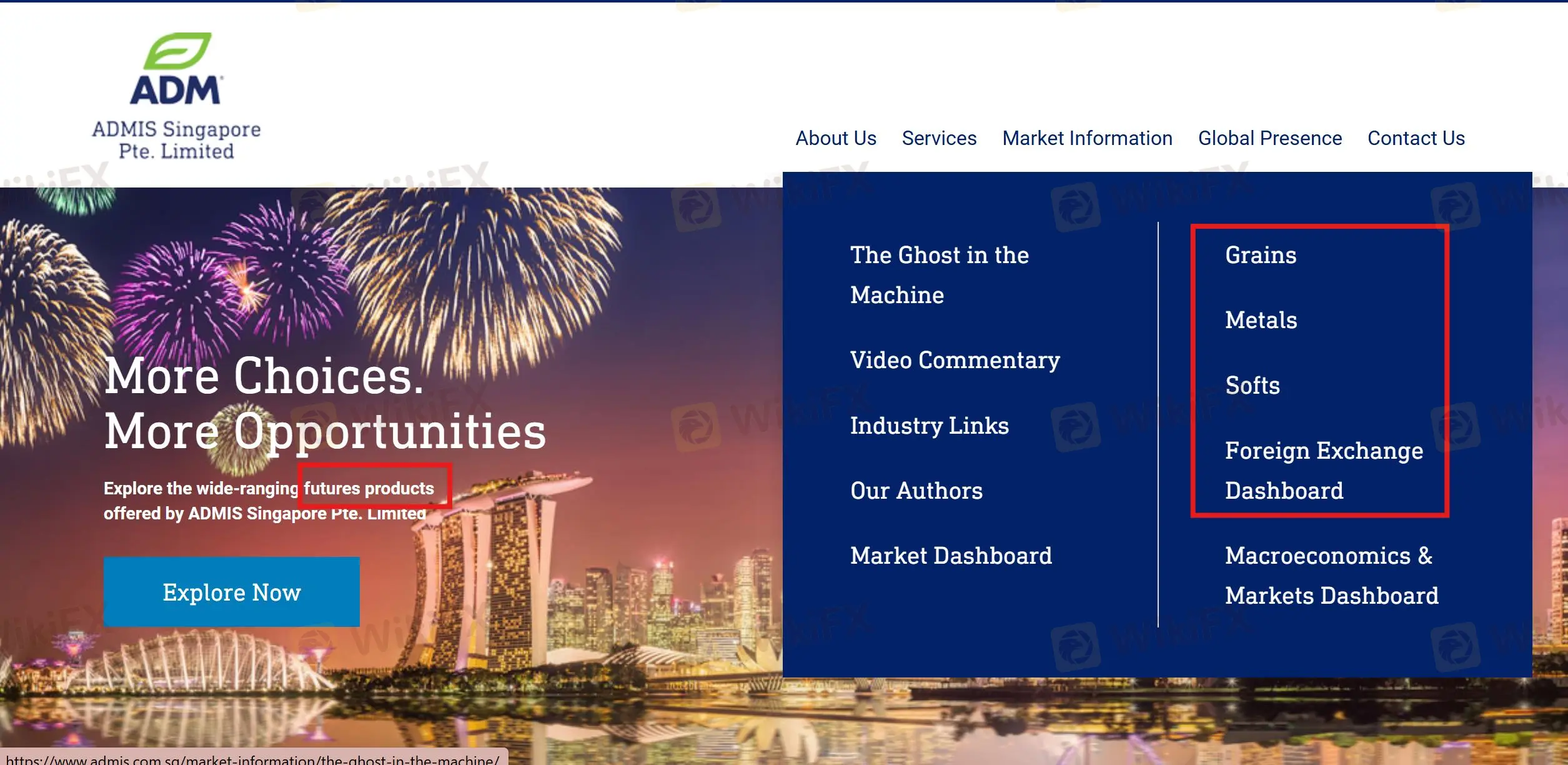

| Market Instruments | Futures on grains, metals, softs, and forex |

| Demo Account | / |

| Leverage | / |

| Trading Platform | CQG, TT |

| Min Deposit | / |

| Customer Support | Tel: +65-6632-3000 |

| Email: sales@admis.com.sg | |

| Address: 230 Victoria Street Bugis Junction Towers #11-06 Singapore 188024 | |

ADMIS was registered in 2010 in Hong Kong, which is a broker specializing in futures trading. It uses CQG and TT as its trading platforms, and it is regulated by SFC. However, it does not reveal much information about account and trading details.

Pros and Cons

| Pros | Cons |

| Long operation time | No physical office |

| Unclear fee structure | |

| No MT4 or MT5 | |

| Unknown payment options |

Is ADMIS Legit?

Yes, ADMIS is regulated by Securities and Futures Commission of Hong Kong (SFC).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | ADMIS Hong Kong Limited | Dealing in futures contracts | ACP509 |

WikiFX Field Survey

WikiFX field survey team visited ADMIS's regulatory address in Hong Kong, but we did not find its physical office.

What Can I Trade on ADMIS?

ADMIS provides a wide range of futures products. Besides, it offers market information related to grains, metals, softs, and forex.

Trading Platform

ADMIS uses CQG and Trading Technologies (TT) as its trading platforms, and it does not suppot MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| CQG | ✔ | PC, web | / |

| Trading Technologies | ✔ | PC, web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Keywords

- Above 20 years

- Regulated in Hong Kong

- Dealing in futures contracts

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now