WikiFX, as an independent third-party information service platform, is dedicated to providing users with comprehensive and objective broker regulatory information services. WikiFX does not directly engage in any forex trading activities, nor does it offer any form of trading channel recommendations or investment advice. The ratings and evaluations of brokers by WikiFX are based on publicly available objective information and take into account the regulatory policy differences of various countries and regions. Broker ratings and evaluations are the core products of WikiFX, and we firmly oppose any commercial practices that may compromise their objectivity and fairness. We welcome supervision and suggestions from users worldwide. To report any concerns, please contact us: report@wikifx.com

No Regulation

Score

0123456789

.

0123456789

0123456789

/10

The WikiFX Score of this broker is reduced because of too many complaints!

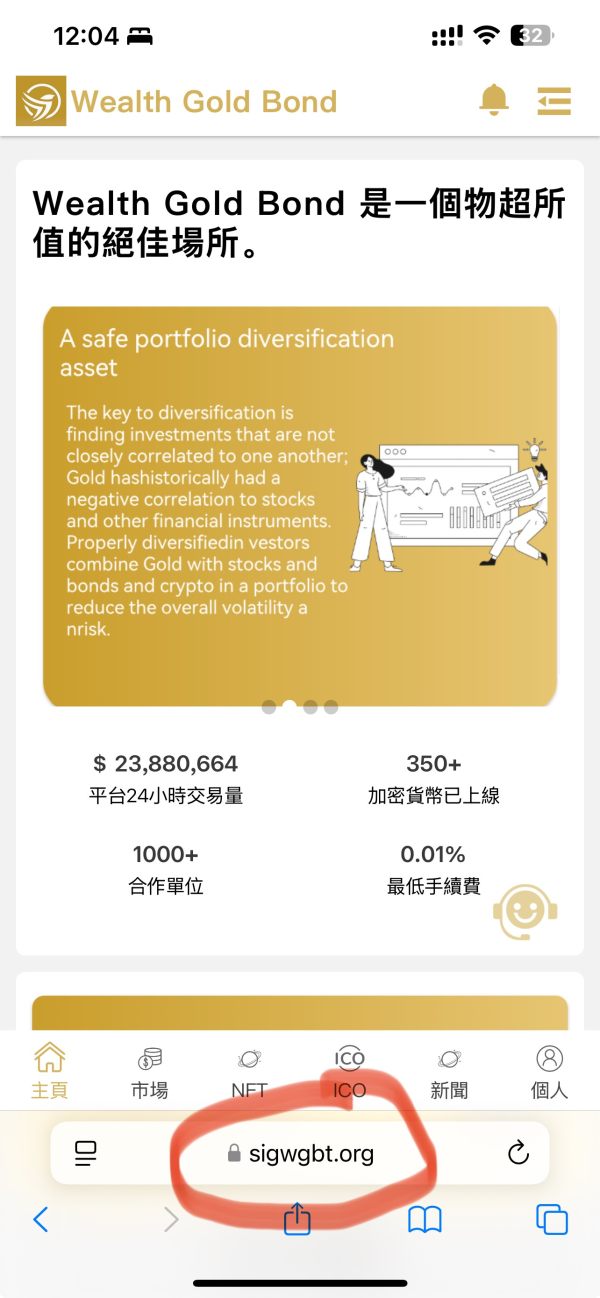

Wealth Gold Bond

United States|Within 1 year|

United States|Within 1 year|

Suspicious Regulatory License|

Suspicious Scope of Business|

High potential risk

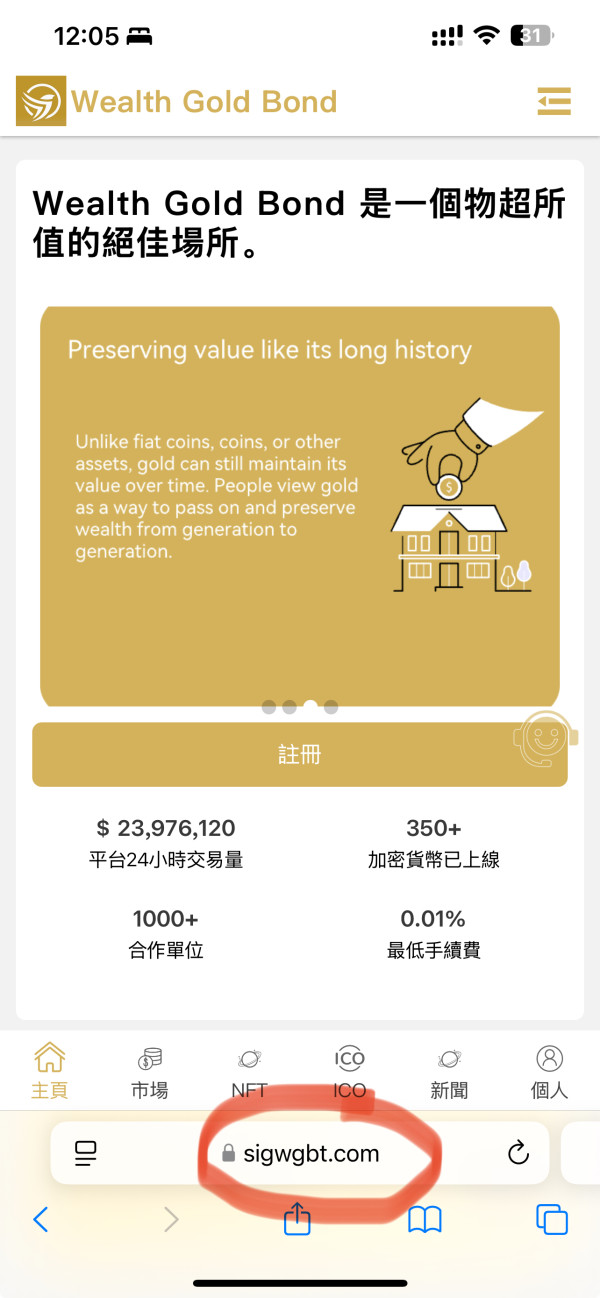

https://sigwgbt.org

Website

Rating Index

Contact

https://sigwgbt.org

The WikiFX Score of this broker is reduced because of too many complaints!

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Warning: Low score, please stay away!

2025-04-04

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

3

Basic Information

Registered Region  United States

United States

United States

United StatesOperating Period

Within 1 year

Company Name

Wealth Gold Bond

Company Website

6

Website

Comment

Users who viewed Wealth Gold Bond also viewed..

FP Markets

8.88

Score 15-20 yearsRegulated in AustraliaMarket Maker (MM)MT4 Full License

FP Markets

Score

8.88

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Official website

IC Markets Global

9.10

Score 15-20 yearsRegulated in AustraliaMarket Maker (MM)MT4 Full License

IC Markets Global

Score

9.10

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Official website

CPT Markets

8.63

Score 10-15 yearsRegulated in United KingdomMarket Maker (MM)MT4 Full License

CPT Markets

Score

8.63

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Official website

AvaTrade

9.49

Score 15-20 yearsRegulated in AustraliaMarket Maker (MM)MT4 Full License

AvaTrade

Score

9.49

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Official website

Website

sigwgbt.org

Server Location

United States

Website Domain Name

sigwgbt.org

Server IP

172.67.200.138

Comment 6

Scroll down to view more

Write a comment

Positive

Neutral

Exposure

Content you want to comment

Please enter...

Submit now

Comment 6

Write a comment

6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

H-tyacan4

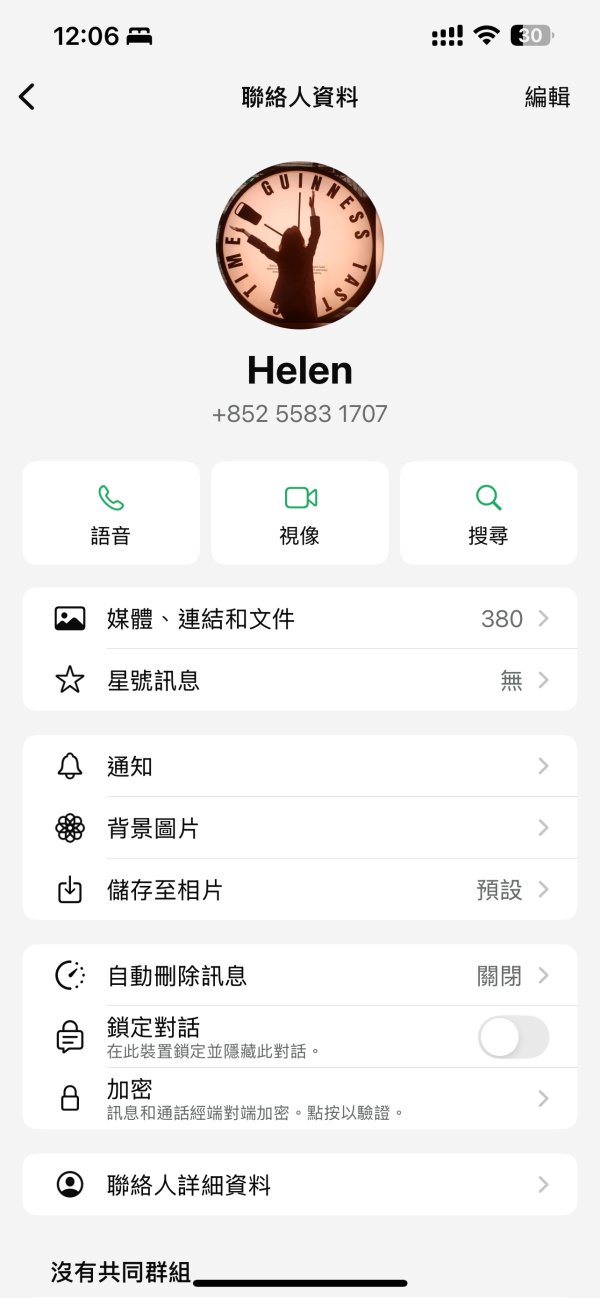

Hong Kong

This all started when a friend from WhatsApp introduced me to deposit money, but later I realized she mocked me while initially being very enthusiastic. Eventually, I discovered it was a pig butchering scam. I tried to slowly withdraw my money, but now I can't retrieve what's rightfully mine. I hope these people get the punishment they deserve soon. 😭 Remember this name, remember this website! Remember this pig butchering scam's WhatsApp, and please help me find my funds. 😭 I really have no options left now.

Exposure

02-17

H-tyacan4

Hong Kong

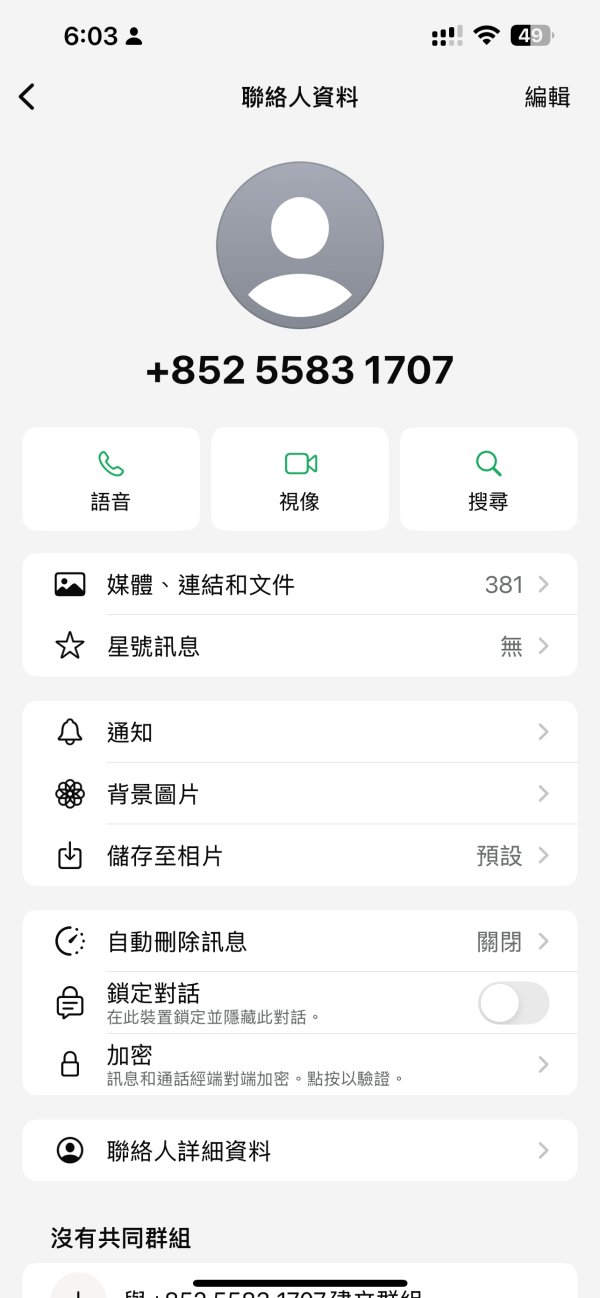

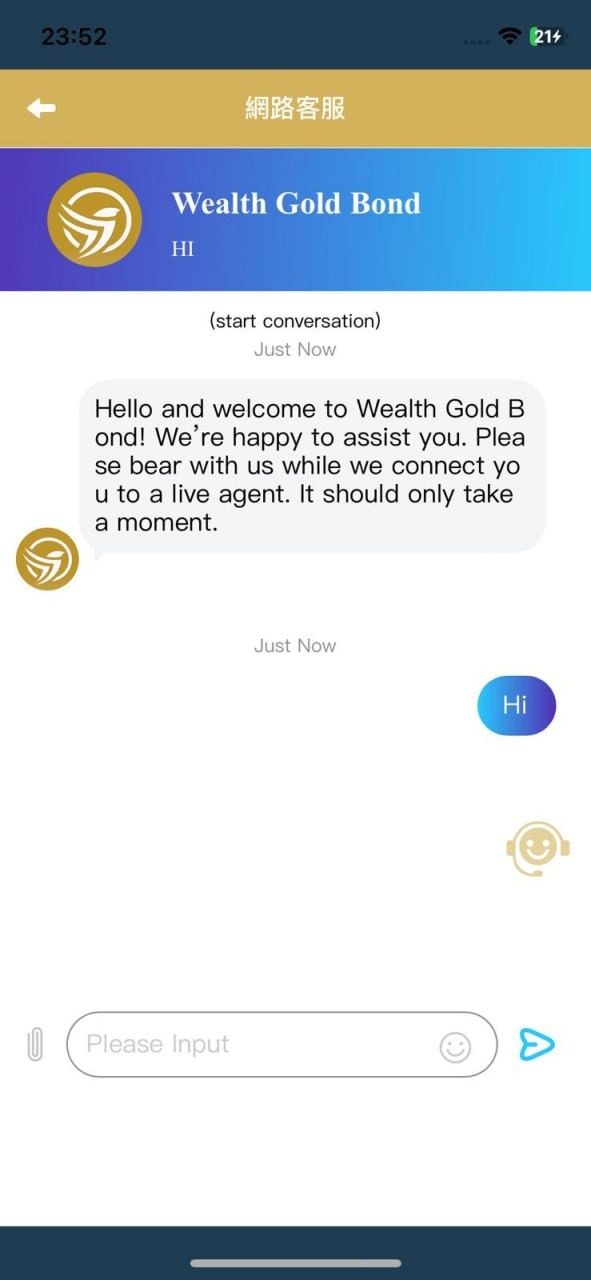

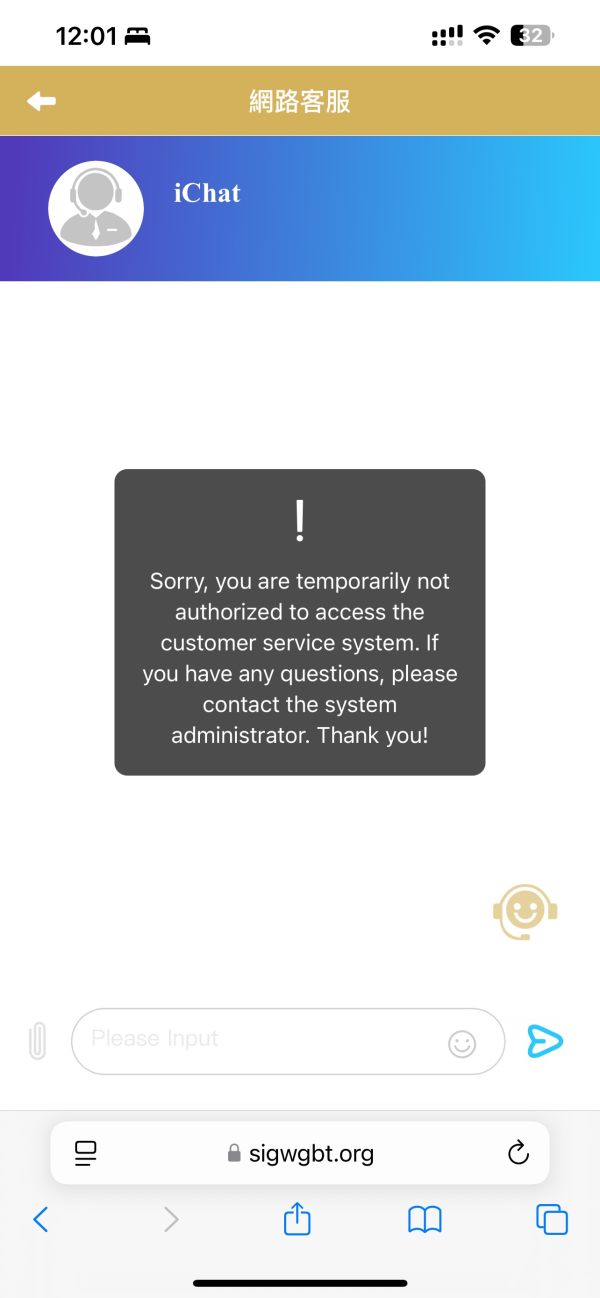

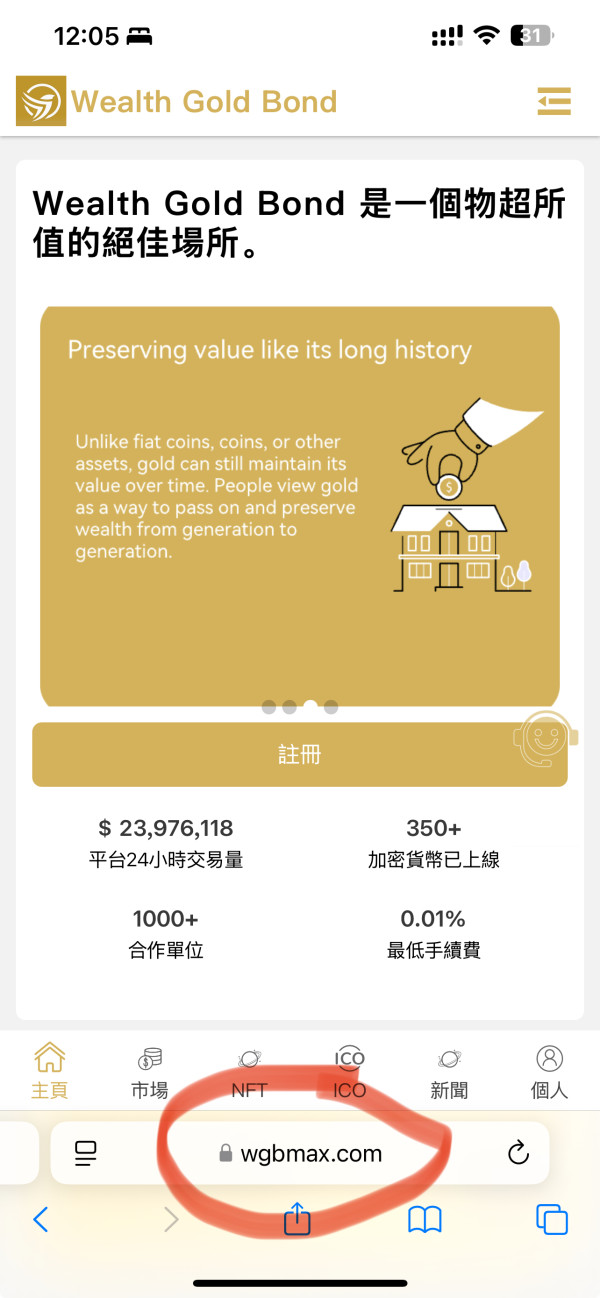

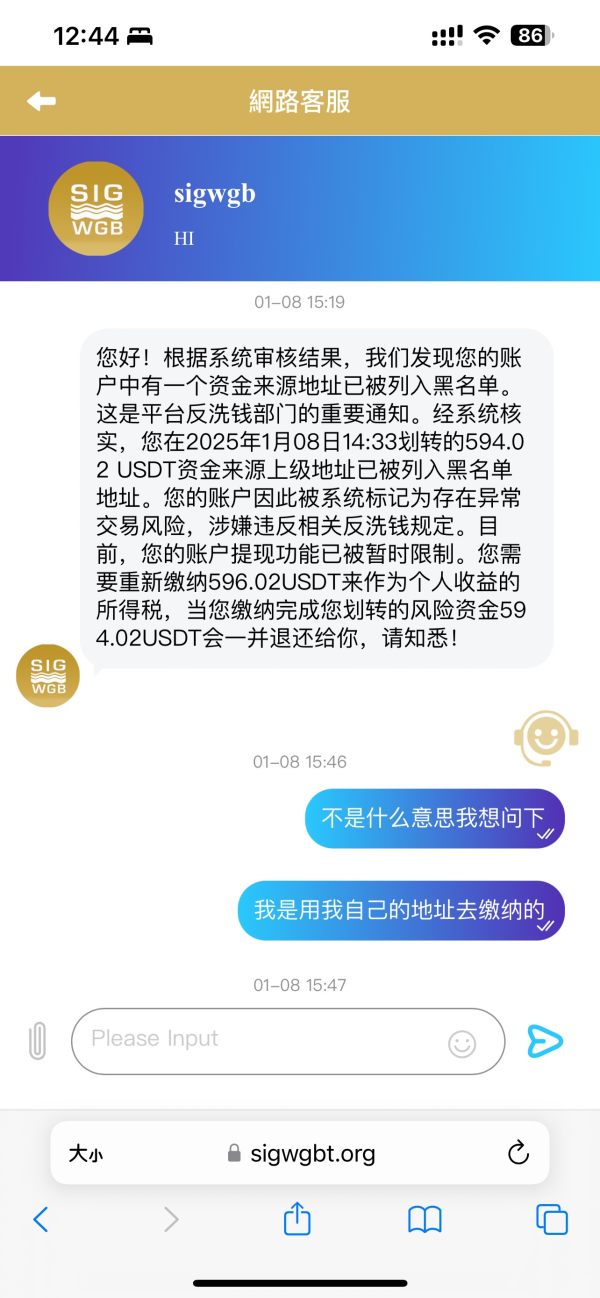

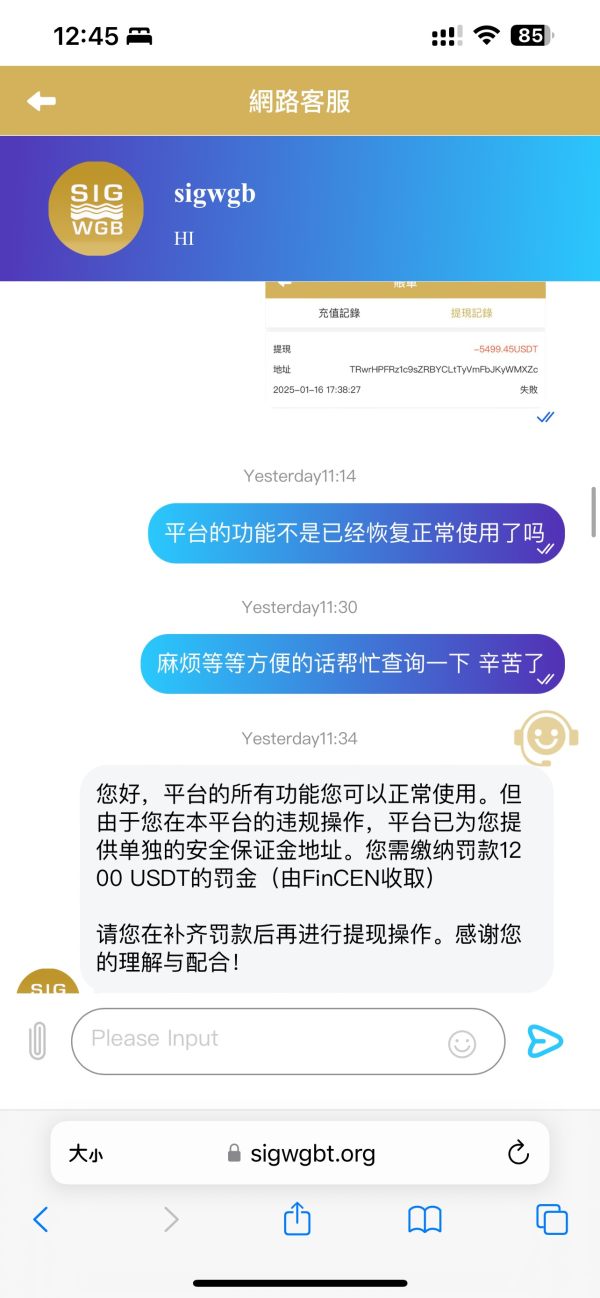

Previously, as shown in the image, I could contact the platform's customer service. However, today they are completely unreachable, and I suspect they are planning to abscond. Everyone should be cautious and avoid being scammed by this platform. They operate multiple websites, and all these sites are likely connected; there may even be more sites that we haven't yet discovered. Also, beware of pig butchering scams! The last image shows the scammer's contact. If there are more victims, please let's unite together.

Exposure

02-15

H-tyacan4

Hong Kong

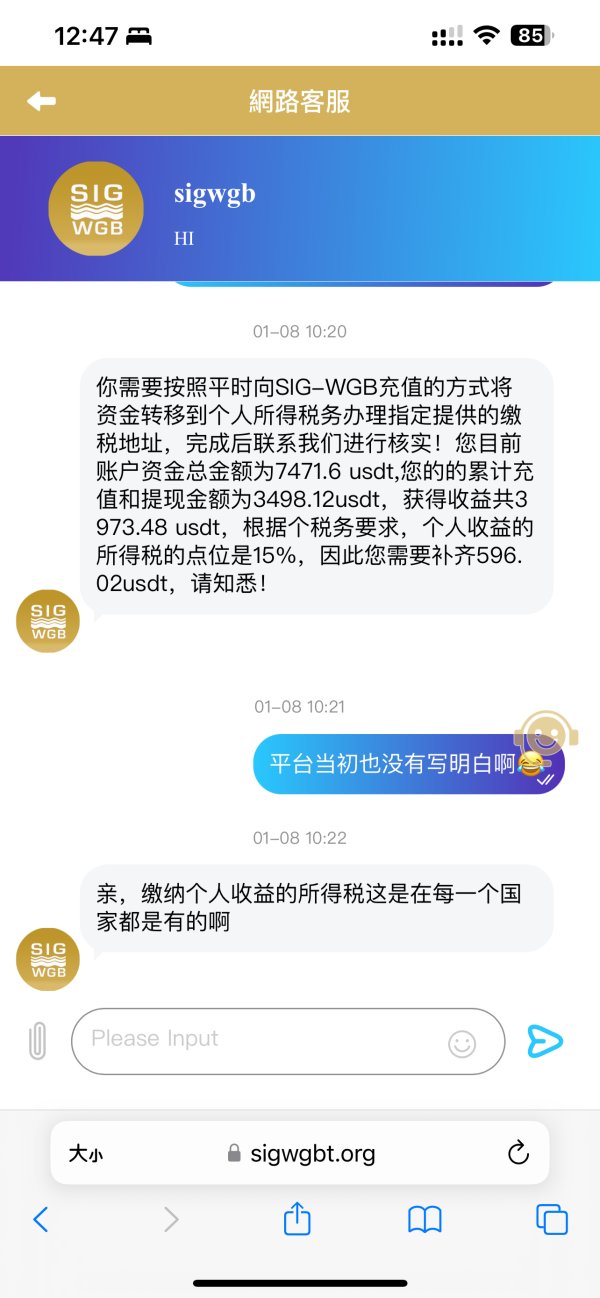

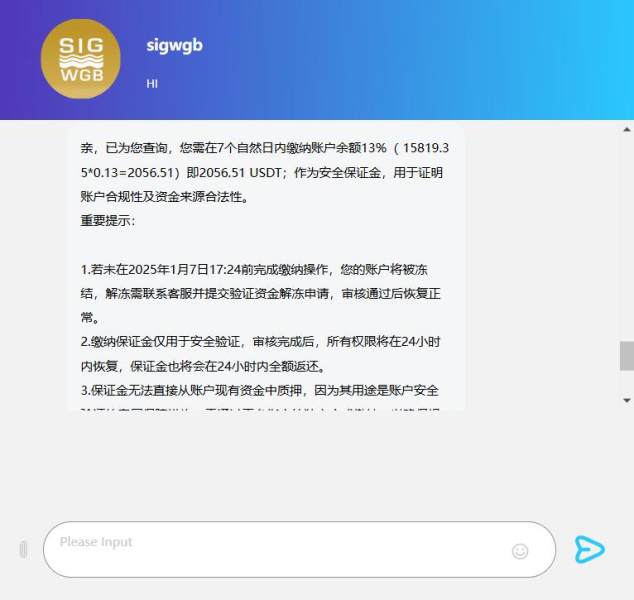

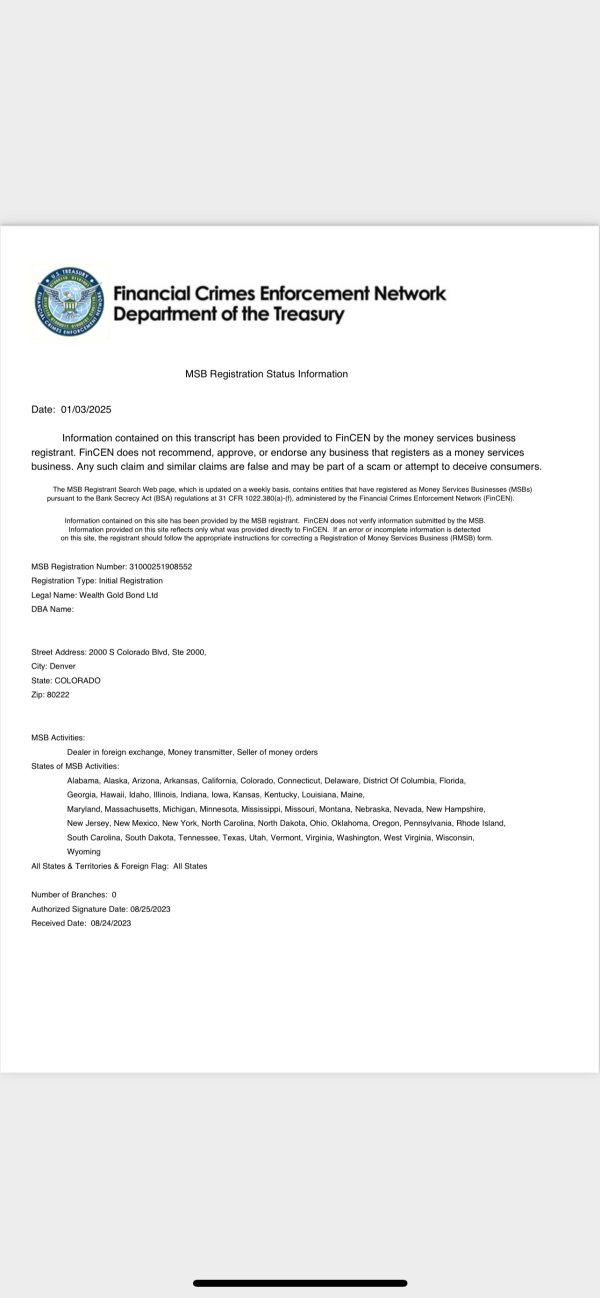

Initially, I was told that I had exceeded the number of trading operations and needed to deposit a margin. After paying the margin, when I applied for a withdrawal, they demanded tax payments. Upon my first payment, they claimed my funds had been mixed with a 'black address' and required me to pay again. After I complied, they then demanded a fine. It was one obstacle after another, making it impossible to withdraw funds. Even though the platform is FinCEN certified and can be verified on the FinCEN official website, withdrawals remain challenging. The platform claims to be a mid-level exchange regulated by the SEC, but its legitimacy is questionable.

Exposure

01-18

FX2421533694

Hong Kong

After depositing funds, traders either face margin calls or are required to make additional payments such as taxes, margins, and late fees. Regardless of your capital amount, there's always a risk of a margin call. Consider the scenario where the index plummeted from 2613 to 2113 in just half a second—how many traders involved wouldn't face a margin call? Crucially, during this time, the gold price on this platform was significantly detached from the international market rates.

Exposure

01-17

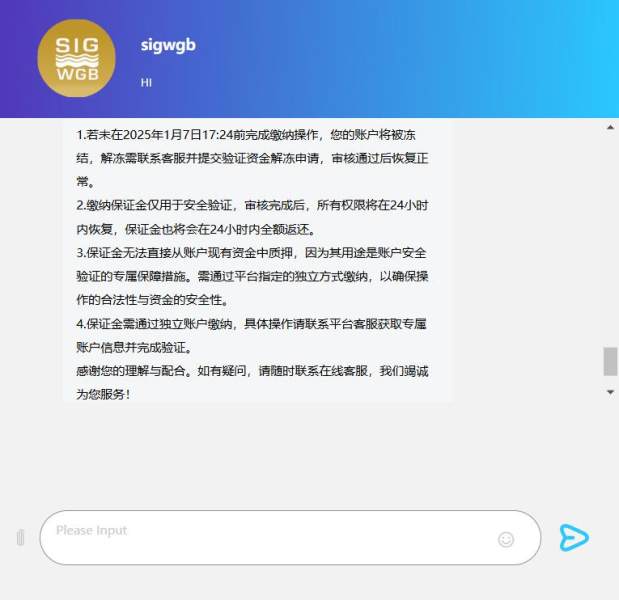

FX2421533694

United States

The platform exhibits several fraudulent behaviors: 1. Forced liquidations: The index dropped from 2613 to 2113 in one second, ensuring that anyone with long positions would be margin called. 2. Trading restrictions: The platform does not allow multiple trades per day without prior notice. When attempting to withdraw funds, users are informed of "violations" and required to deposit a 25% margin, which can be used for trading but remains in the user's account. 3. Immediate margin deposits cannot be withdrawn: Deposited margins are claimed to be under "account supervision" and hence non-withdrawable. 4. Tax on profits before withdrawal: If an account's profits reach 100%, a personal income tax must be paid before funds can be withdrawn, scheduled a week later. Subsequently, the platform lowers your credit score from 100 to 90, which they do not restore. Later attempts to withdraw prompt messages that the credit score is insufficient; customer service then quotes $10,000 USDT per point, requiring a payment of $100,000 USDT to process the withdrawal. Victims have reportedly invested between 1.8 million to 3 million RMB, ultimately losing everything in these schemes.

Exposure

01-17

Amy Zhao

Hong Kong

The merchant initially allowed me to deposit margin and withdraw funds. After I made the deposit, my account was unfrozen. However, when I tried to withdraw again, my account was frozen again and I was asked to deposit margin again, and the amount was doubled.

Exposure

01-14