It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Worldclass Financial Intelligence

Pros:

Competitive spreads with low minimum deposit requirements.

High maximum leverage of 1:500 offered.

A variety of payment methods available for deposits and withdrawals.

Customer support available 24/7 via live chat.

MetaTrader 4 available for both desktop and mobile devices.

Cons:

Limited educational resources, with only an economic calendar available.

Limited selection of account types compared to other brokers.

Limited trading instruments available, with only indices, commodities, and cryptocurrencies offered.

No information provided on the regulation of the company.

Limited physical presence, with only a virtual address provided.

What type of broker is Worldclass Financial Intelligence?

STP, or Straight Through Processing, is a type of broker that directly sends their clients' orders to the liquidity providers or market makers without any intervention. As such, STP brokers are considered to have no dealing desk and can offer faster order execution. Worldclass Financial Intelligence is an STP broker, meaning that it does not trade against its clients and the prices are directly from the liquidity providers. However, it may charge higher spreads to cover the costs of sending orders to the liquidity providers and may have limited control over spread widening during periods of high volatility.

General information and regulation of Worldclass Financial Intelligence

Worldclass Financial Intelligence is an online trading brokerage that offers access to trade multiple financial instruments such as commodities, indices, and cryptocurrencies. The company provides a range of trading accounts with varying features, including competitive spreads, high leverage, and multiple funding options. With a user-friendly trading platform and 24/7 customer support, Worldclass Financial Intelligence aims to provide a seamless trading experience for its clients. The company is headquartered in St. Vincent and the Grenadines and is not regulated.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

Worldclass Financial Intelligence LLC offers a variety of trading instruments including commodities, indices, cryptocurrencies and other CFDs. The availability of such instruments allows traders to diversify their portfolio and explore different markets that are not typically available through other brokers. Trading volatile markets such as cryptocurrencies can also provide unique opportunities for traders to potentially profit from significant price movements. However, trading these instruments also carries a higher level of risk compared to traditional instruments, and certain commodities and cryptocurrencies are known for their volatile nature. It is important to note that the availability of certain instruments may be limited for some regions.

Spreads and commissions for trading with Worldclass Financial Intelligence

Worldclass Financial Intelligence LLC offers traders competitive pricing on their trading accounts, with low spreads and zero commission on their Standard and VIP1 accounts. However, traders opting for the VIP2 account will incur a commission of $7 per lot, which may not be suitable for some traders. While there are no deposit or withdrawal fees, the limited account options available may not suit all traders. The broker does not provide information on swap rates, which could be a disadvantage for those interested in holding positions overnight. Overall, Worldclass Financial Intelligence LLC offers competitive pricing and low costs for traders.

Trading accounts available in Worldclass Financial Intelligence

Worldclass Financial Intelligence offers three account types for its clients, with varying minimum deposit requirements, spreads, and commissions. The Standard account has a low minimum deposit requirement of $500 and does not charge any commission. VIP1 and VIP2 accounts offer more competitive spreads and high maximum leverage of 1:500, but require minimum deposits of $5000 and $20000 respectively. While VIP2 account charges a $7 commission per lot traded, both VIP accounts offer lower spreads than the Standard account. However, the limited information on other account features such as account management tools or trading platforms may be a disadvantage for some traders.

Trading platform(s) that Worldclass Financial Intelligence offers

Worldclass Financial Intelligence offers its clients the popular and reliable MT4 platform for both desktop and mobile devices. MT4 is a widely used platform among traders worldwide, offering a user-friendly interface with advanced charting and analysis tools. Additionally, the platform supports automated trading through expert advisors (EAs) and offers a variety of order types and execution modes. However, one of the main drawbacks of this platform is its lack of support for other platforms like MT5. The platform also has limited customization options and a limited range of available assets. Finally, traders using MT4 may have limited access to news and market data compared to other platforms.

Maximum leverage of Worldclass Financial Intelligence

Worldclass Financial Intelligence offers a maximum leverage of up to 1:500. High leverage can increase potential profits with smaller initial capital and allows for greater flexibility in trading strategies. It can also amplify gains on winning trades and result in higher returns on investment. However, it is important to note that high leverage can also lead to larger losses and requires strict risk management to avoid margin calls and account liquidation. Additionally, some regulated jurisdictions limit the availability of high leverage to protect traders from taking on excessive risk.

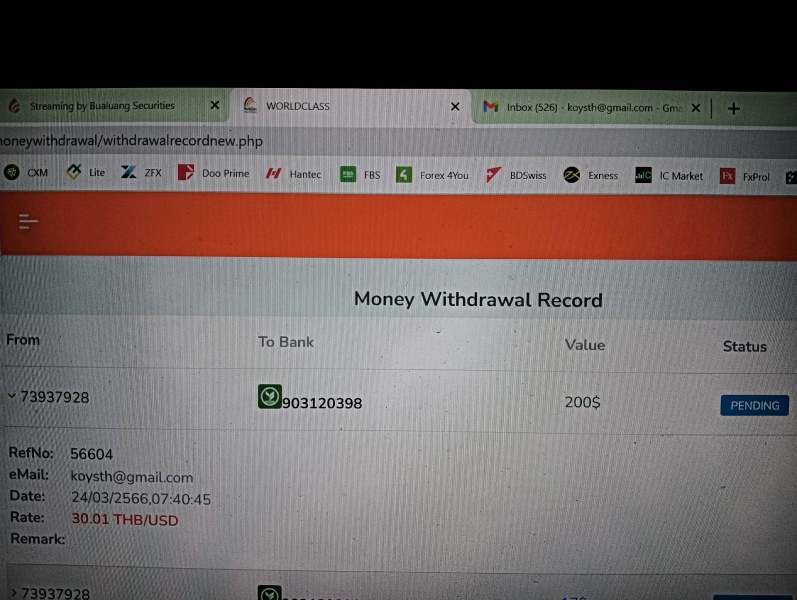

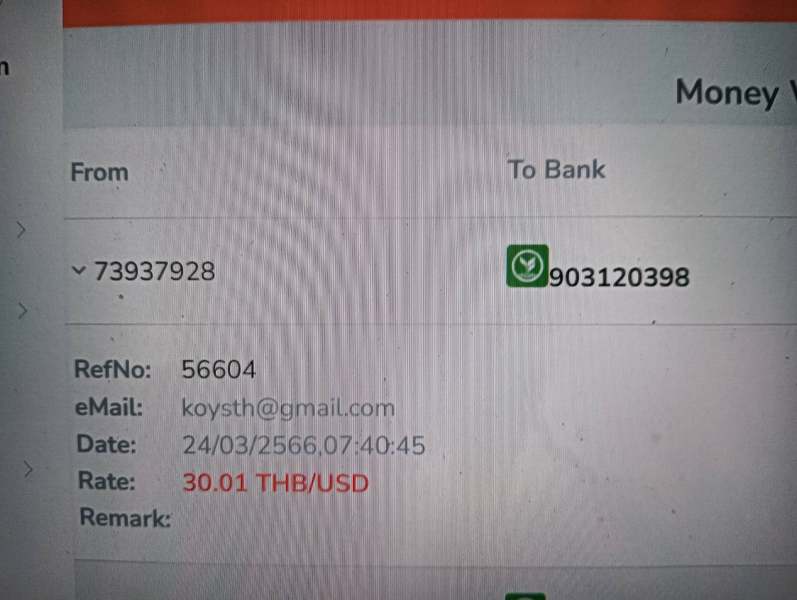

Deposit and Withdrawal: methods and fees

Worldclass Financial Intelligence offers various payment methods for clients to deposit and withdraw funds from their trading accounts. Clients can choose from 10 local transfer methods, 2 crypto methods, 2 credit card methods, and 1 wire transfer method. Depositing funds is quick and easy, with clients able to select the trading account they wish to deposit to and choose from available payment methods. However, some payment methods may incur additional charges, and exchange rates may be charged if depositing in a currency different from that of the bank funds. Withdrawals can be made by logging in to the client office, selecting the trading account, and entering the desired amount. The local bank transfer method is available for certain currencies (USD, EUR, THB, IDR, VND, MYR) , making it convenient for clients in those areas. It should be noted that the local depositor rate varies for every country.

Educational resources in Worldclass Financial Intelligence

Worldclass Financial Intelligence's educational resources are limited, with only an economic calendar available to traders. The economic calendar provides traders with important dates and times of upcoming economic events that may have an impact on the financial markets. However, the absence of other educational resources such as videos, webinars, or tutorials, means that traders have limited opportunities to improve their knowledge and skills. Additionally, Worldclass Financial Intelligence does not provide analysis or research tools that traders can use to make informed trading decisions.

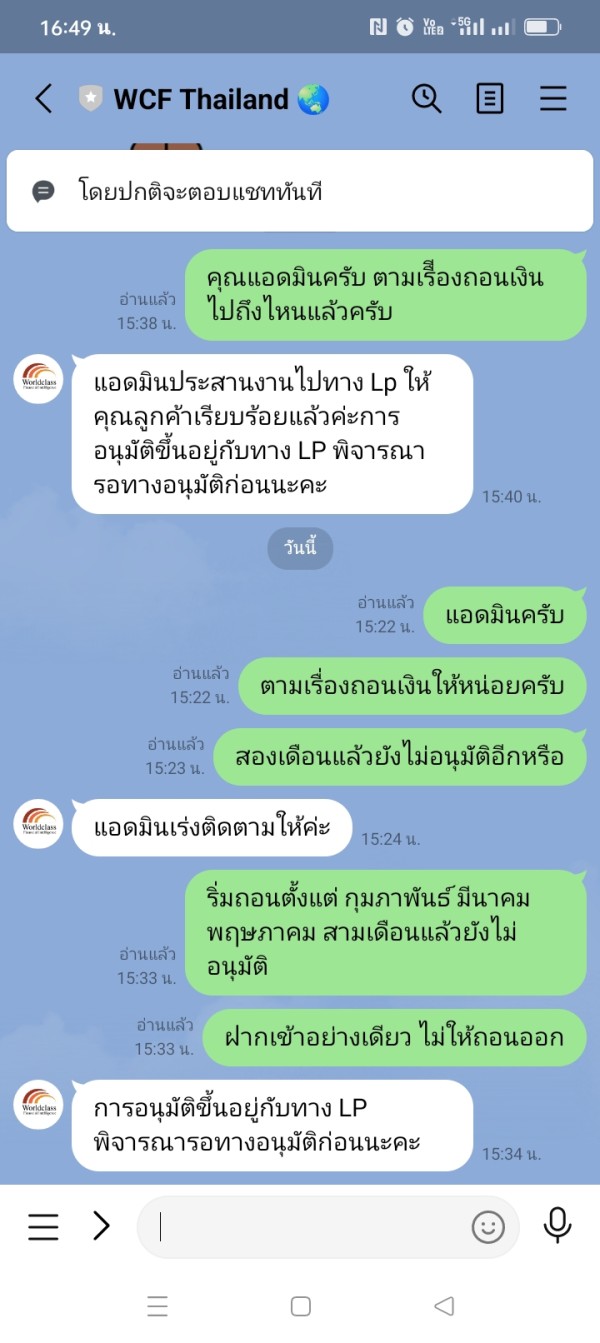

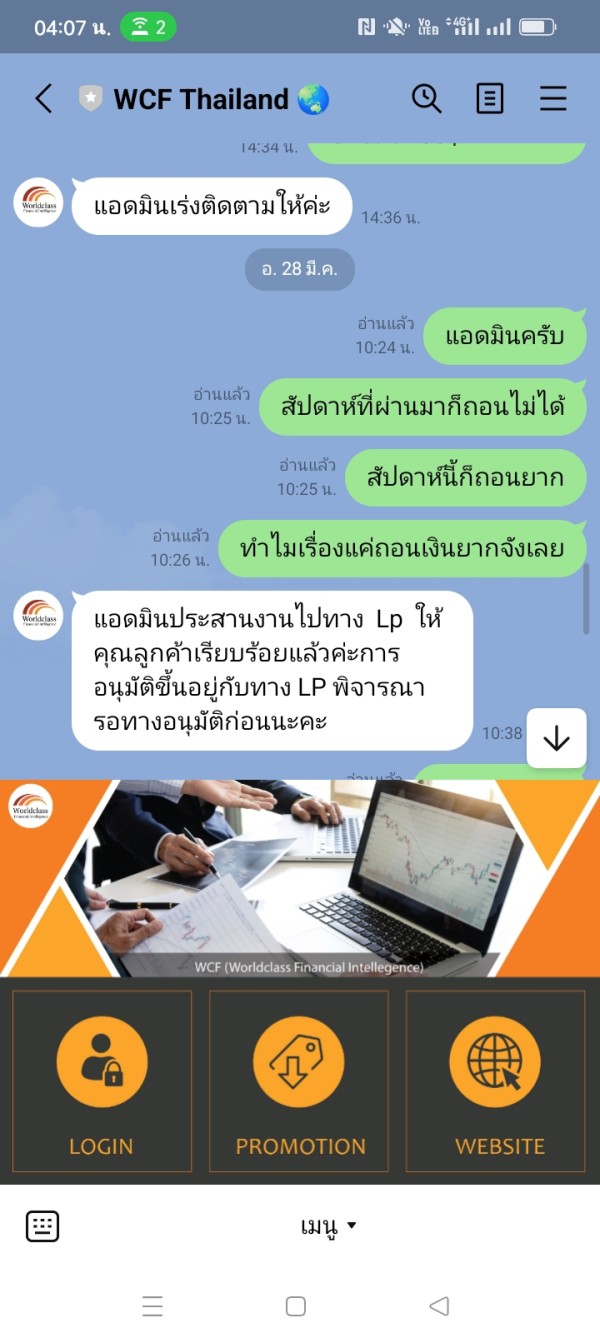

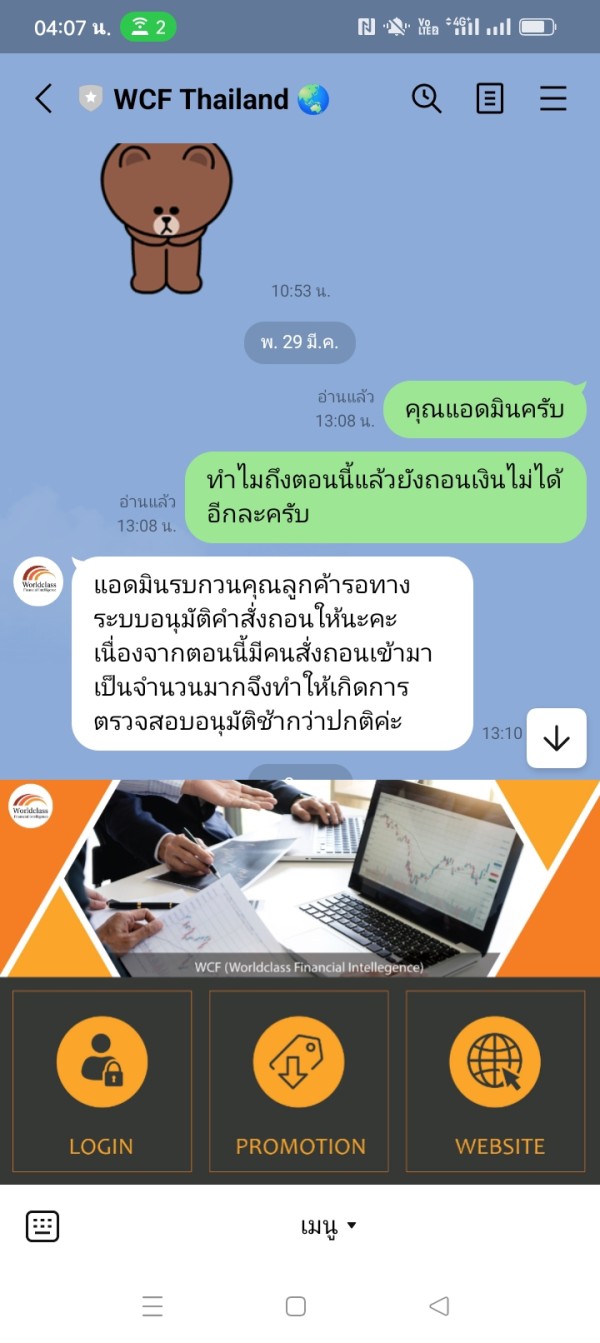

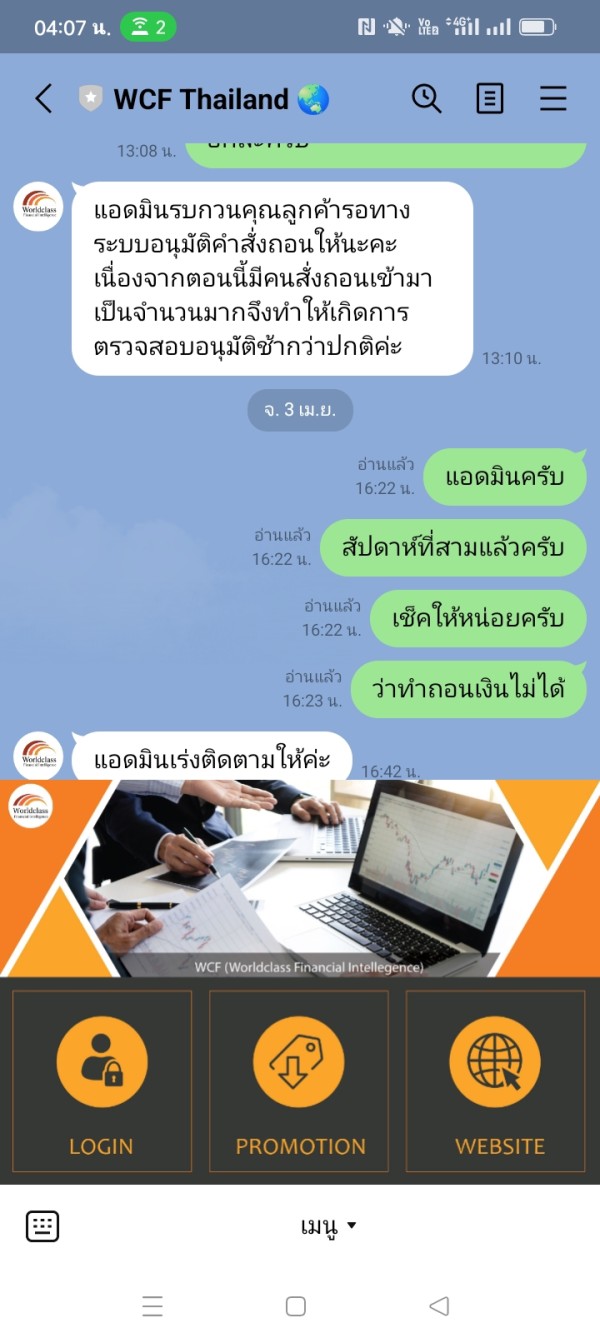

Customer service of Worldclass Financial Intelligence

Worldclass Financial Intelligence offers a decent level of customer care support to its clients. Customers can reach the support team via live chat or email, and the support team is available 24/7 through live chat. Additionally, email support is available, and the customer support team is also available on weekends. However, the broker lacks phone support, which may be inconvenient for some traders who prefer speaking with a representative over the phone. The broker also doesn't have a physical location in major financial centers, which may make it difficult for some traders to receive in-person support. Furthermore, customer support hours are limited during the weekdays. While the customer support team is responsive, there are limited options for customer support channels, and the broker offers support in limited languages.

Conclusion

Worldclass Financial Intelligence LLC is a CFD broker that offers a range of trading instruments, including indices, commodities, and cryptocurrencies. The company provides traders with access to the MetaTrader 4 platform for desktop and mobile devices, as well as a variety of account types and payment methods. They also offer competitive spreads, leverage of up to 1:500, and 24/7 customer support via live chat. However, the company is not regulated by any major financial authority, which may be a concern for some traders. Overall, Worldclass Financial Intelligence LLC may be a suitable choice for traders looking for a broker with a wide range of instruments and competitive trading conditions, but those who prioritize regulation and transparency may want to look elsewhere.

Frequently asked questions about Worldclass Financial Intelligence

Question: What trading platforms are available at Worldclass Financial Intelligence?

Answer: Worldclass Financial Intelligence offers the popular trading platform, MetaTrader 4, for both desktop and mobile devices.

Question: What is the maximum leverage offered by Worldclass Financial Intelligence?

Answer: Worldclass Financial Intelligence offers a maximum leverage of up to 1:500 for its clients.

Question: What are the available payment methods for depositing funds into a trading account?

Answer: Worldclass Financial Intelligence accepts local transfers, credit cards, wire transfers, and cryptocurrencies (BTC and USDT) for deposits.

Question: Is there a minimum deposit requirement at Worldclass Financial Intelligence?

Answer: Yes, the minimum deposit requirement for a standard account is $500.

Question: Does Worldclass Financial Intelligence charge commissions on trades?

Answer: yes, the VIP2 account charges commissions.

Question: What educational resources are available at Worldclass Financial Intelligence?

Answer: Worldclass Financial Intelligence provides an economic calendar as its only educational resource.