Note: Regrettably, the official website of Oinvest, namely https://www.oinvest.com/, is currently experiencing functionality issues.

What is Oinvest?

Oinvest, an online trading platform based in the United Kingdom, operates in an unregulated environment. Offering a range of market instruments including currency pairs, indices, commodities, precious metals, and stocks, Oinvest provides traders with leverage up to 1:400 for FX trading. Oinvest employs the widely utilized MetaTrader 4 (MT4) as its trading platform. Despite its unregulated status, the platform requires a minimum deposit of $250 to open an account. Customer support is available via phone and email.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

Pros of OInvest:

- Variety of market instruments: OInvest offers a range of market instruments, providing traders with diverse options for investment.

- Support for MT4: OInvest supports the widely used MetaTrader 4 (MT4) platform, which is popular among traders for its user-friendly interface and extensive features.

Cons of OInvest:

- Lack of legitimate forex license: OInvest operates without a legitimate forex license, raising concerns about the platform's regulatory compliance and oversight.

- Inaccessible website: Some users have experienced accessibility problems with the OInvest website, which may hinder the trading experience and raise questions about the platform's technical stability and reliability.

- Reports of scam and withdrawal issues: There are reports from users about encountering scam-related issues and difficulties with withdrawals, indicating potential reliability and trustworthiness issues.

Is Oinvest Safe or Scam?

Oinvest currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky. As there is no regulation, the people running the platform can pocket your money while bearing no responsibility for their criminal actions. They can disappear any time without notice.

Moreover, the fact that their official website is inaccessible raises concerns about the reliability of their trading platform. These factors contribute to a higher level of risk associated with investing in Oinvest.

Market Instruments

Oinvest provides a range of trading instruments, including currency pairs, indices, commodities, precious metals, stocks and shares.

- Currency pairs: Trading currency pairs involves speculating on the exchange rate between two currencies. This market is known as the forex (foreign exchange) market, which is the largest financial market in the world.

- Commodities: Commodities include physical goods such as oil, gold, silver, agricultural products, etc. Trading commodities allows investors to speculate on the price movements of these essential raw materials.

- Precious Metals: Precious metals like gold, silver, platinum, and palladium are often considered safe-haven assets. They can serve as a hedge against inflation and economic uncertainty.

- Indices: Indices represent a basket of stocks or other assets, measuring the performance of a specific market or sector. Trading indices allows investors to gain exposure to broader market movements without needing to invest in individual stocks.

- Stocks and Shares: Trading stocks and shares involves buying and selling ownership stakes in publicly listed companies. Stock trading can offer opportunities for capital appreciation through stock price movements and dividend income.

- Cryptocurrency: Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central authority. Popular cryptocurrencies include Bitcoin, Ethereum, Ripple, etc.

Account Types

Oinvest offers three live account types: Silver, Gold, and Platinum. To open an account, the minimum deposits is $250.

- Silver Account:

This is the basic account type offered by Oinvest.

Provides access to the Oinvest trading platform and various financial instruments such as forex, commodities, indices, and cryptocurrencies.

Offers basic customer support services.

- Gold Account:

The Gold account is designed for traders who want more advanced features and benefits.

Provides priority customer support services.

- Platinum Account:

The Platinum account is the highest-tier account type offered by Oinvest, catering to experienced traders or those with larger trading capital.

Offers the most comprehensive range of features and benefits, including personalized support from account managers, exclusive market analysis, and tailor-made trading strategies.

Leverage

Oinvest offers varying levels of leverage across different types of accounts to accommodate the diverse needs and risk appetites of traders.

In the standard account, traders have access to leverage of up to 1:200 for FX trading, 1:50 for Gold & Silver (Metals), Indices, and Commodities, and 1:20 for Stocks/Equities.

For those seeking even higher leverage, the Gold Account provides increased leverage of up to 1:400 for FX trading, 1:100 for Gold & Silver (Metals), Indices, and Commodities, and 1:40 for Stocks/Equities. This heightened leverage amplifies the potential returns further, but it also escalates the risks associated with trading.

The Platinum Account offers the highest level of leverage among Oinvest's offerings, with leverage of up to 1:400 for FX trading, 1:125 for Gold & Silver (Metals), Indices, and Commodities, and 1:50 for Stocks/Equities. This level of leverage provides traders with even greater potential returns but demands careful risk management due to the heightened exposure to market volatility.

Spreads & Commissions

Oinvest sets its spreads differently across these accounts.

In the SILVER account, for instance, Oinvest offers spreads such as 2.2 pips for EUR/USD, 2.8 pips for GBP/USD, and so forth for different currency pairs and commodities like gold and crude oil.

Moving up to the GOLD account, Oinvest tightens the spreads compared to the SILVER account, potentially offering traders more favorable conditions. For instance, the spread for EUR/USD decreases to 1.3 pips, which could result in lower transaction costs for traders operating within this account tier.

At the highest tier, the PLATINUM account, Oinvest further reduces spreads, providing traders with the tightest pricing available on the platform. With spreads as low as 0.7 pips for EUR/USD, traders operating within the PLATINUM account can potentially enjoy the most competitive trading conditions Oinvest has to offer. This tiered approach to spreads reflects Oinvest's commitment to providing varying levels of service tailored to different trading needs and preferences.

Regarding commissions, the specific details are not accessible due to the unavailability of the website. Despite the lack of specific information here, traders considering Oinvest should inquire about commission structures and any associated fees to make informed decisions about their trading activities.

Trading Platforms

Oinvest provides its clients with the popular MetaTrader 4 (MT4) trading platform, renowned for its user-friendly interface and comprehensive set of features. MT4 offers traders a versatile and customizable trading experience, catering to both novice and experienced traders alike.

One of the key advantages of the MT4 platform is its extensive charting capabilities, allowing traders to analyze markets using a wide range of technical indicators and charting tools. This empowers traders to make informed decisions based on market trends, patterns, and signals.

Additionally, MT4 supports automated trading through its Expert Advisors (EAs) functionality, enabling traders to automate their trading strategies and execute trades automatically based on predefined criteria. This feature is particularly beneficial for traders who wish to capitalize on market opportunities without the need for constant manual intervention.

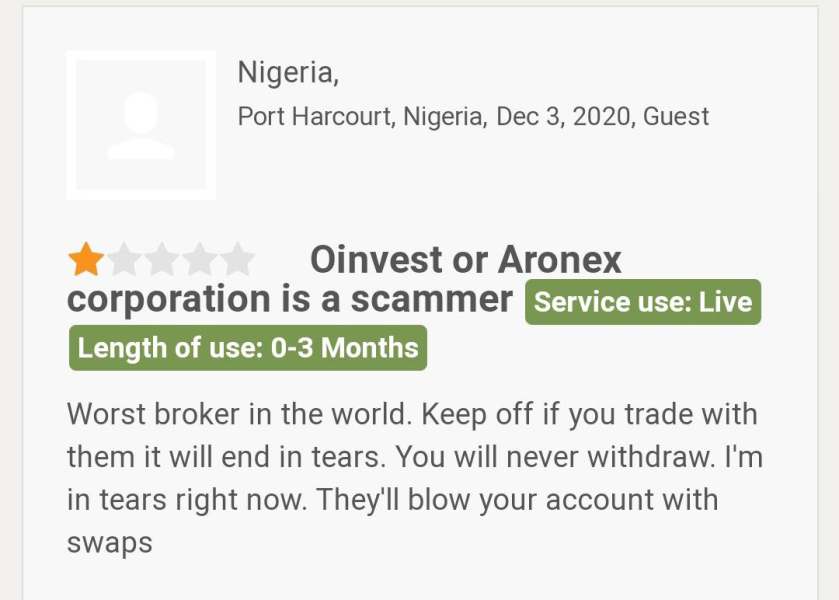

User Exposure on WikiFX

Please make sure to review the reports available on our website concerning instances of withdrawal issues and fraudulent activities. Traders should carefully consider the information provided and acknowledge the potential risks linked with trading on an unregulated platform. Prior to engaging in any trading activities, we recommend visiting our platform to access the relevant information. Should you encounter unscrupulous brokers or become a victim of their practices, we kindly ask that you notify us via the Exposure section. Your cooperation is highly valued, and our team of professionals will endeavor to aid you in addressing the matter.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: +44 2035196460/ +66 23284742/ +7 4950494260

Email: Support@oinvest.com, Docs@oinvest.com, support@oinvest.com

Conclusion

Oinvest presents itself as an online trading platform with a variety of market instruments and attractive trading conditions, such as flexible leverage, using the popular MT4 platform. However, its lack of a legitimate forex license and reports of scam and withdrawal issues raise significant concerns about its reliability and trustworthiness. Accessibility problems with the website further add to these concerns.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Mayaz Ahmad

Bangladesh

Oinvest has scammed a client by disallowing withdrawal and blowing his account.

Exposure

2021-06-29

FX1206580902

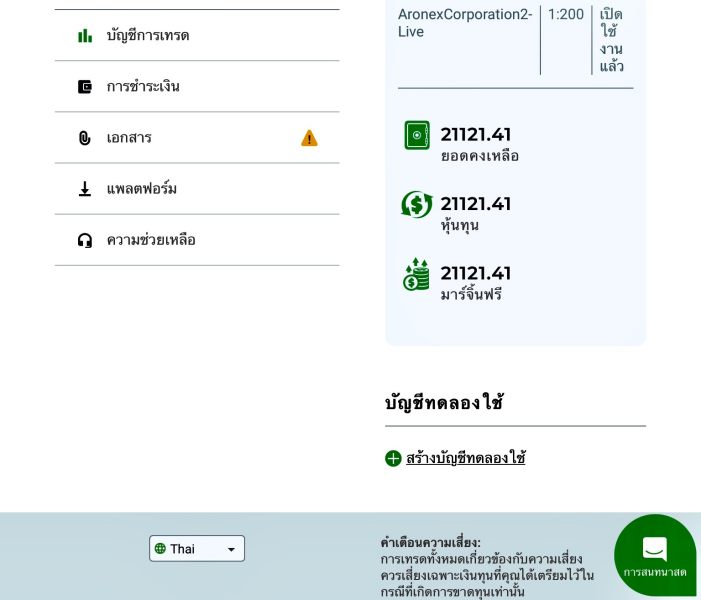

Thailand

I have been cheated. And I can't withdraw funds. My withdrawal has been pending for three weeks on grounds of technical problems

Exposure

2021-05-21

FX4129607604

Philippines

DONT F*ING PUT MONEY IN THIS BROKER. I am a beginner. I don't have experience on trading and lemme just tell you this. I just lost $5000 dollars on this broker. will encourage you to put many trades and when you have low margin level they will call you over and over again say that I need to put money again. Once you are done putting money they will just "okay I call you later" and dont give a damn about what you are going to lose.

Exposure

2020-11-30

FX2708763552

Philippines

Ashish.ra@oinvest.com asking a lot of funds without gain. Never allowed withdrawal.

Exposure

2020-10-23

P.A.

Thailand

I am trying to withdraw 13,000 USD since 25 Sep 20 and 8,121 USD since 29 Sep 20 but so far no success. Also no response from customer services today. Most rigid brokers allow us to withdraw funds within 2-3 days but this Oinvest is very fishy. Don’t even try to talk to any people from Oinvest.

Exposure

2020-10-05

MrTrader

Brazil

BE CAREFUL WITH 2INVEST AND OINVEST, THE BIGEST SCAMMERS.I made a deposit via Skrill, after opening the first operation I could see that they manipulate the market, it takes more than a second to open an operation where my ping to the server was 3ms. I then sent an email to LUIZ RIB where I warned him that this manipulation in the market was serious. They use plugins, manipulate prices and operations.Soon I asked for my withdrawal, where they denied and sent me a request for a bank letter to withdraw the funds that were made via SKRILL.In my view, this is money laundering, where when withdrawing, in the withdrawal policy, as well as on the website and the AML policy, the funds tend to be returned to the same deposit method.A fraudulent broker who tries to take advantage of customers. Besides being somewhat professional. Where I repeatedly informed that for personal reasons I could not answer calls (I have just had a surgery that I cannot speak about) and continue to insist on a call.Worst broker I've ever seen in my life. Regulated by the FSA, I have already sent all documents and evidence to the regulator.Now, taking the risk of losing the regulation, getting a very large fine, for 500 $? Really, 2Invest/Oinvest if I don't return my deposit via Skrill for good, I will have to go to court.

Exposure

2020-08-22

themoebassa

South Africa

I began trading with a company called Oinvest. My initial interaction was with Mr. Mehdi who ensured me his mentorship every step of the way. Ensuring that I would not lose any money, but I will only gain. I then signed up with the company on the 11 June 2020. The initial (minimum) investment amount was R3500 which I deposited into the companys account.Thereafter I was assigned to an account manager by the name of Havvi Lion. I began trading with Havvi’s leadership. The initial trades were made with small amounts which led to small amounts of profit. She then suggested I invest R25000 in order to make a larger profit. I transferred the amount (R25000) into the account and began trading, with her leadership. After a few days I had lost all the money that I invested(R28500). She then advised me to make a larger deposit of R50000 for me to protect my account and recover everything that I had lost. Due to my lack of knowledge and experience she took advantage of the situation and manipulated me into depositing larger amounts each time I lost to the market. Each time something went wrong or against my favour she would blame and insist it was my fault. She used my own emotions against me in order to scam me. I have since lost R471 000. She forced me to take a bank loan to protect whatever funds I still had left that were running on trades.

Exposure

2020-08-04

FX8529612728

Nigeria

Look at the overlord clause of OINVEST!

Exposure

2020-04-20

L.

New Zealand

I used to trade with Qinvest for three months. It took me three months to withdraw my money. My trading experience then was pretty pleasant. I can give it four stars based on its over performance.

Neutral

2023-03-06

Vithusan Vijeyaratnam

Australia

How strange that Oinvest's website says "CURRENTLY NOT AVAILABLE". However, after consulting my friend who is more professional in the foreign exchange industry, he told me that this is usually just a trick of scam forex companies, they have absconded with money, and the website will never be available.

Positive

2023-03-20