Overview of ModMount

ModMount is a brokerage firm offering a range of trading services and account types. They provide access to various trading instruments, including indices CFDs, Forex trading, cryptocurrency CFDs, stocks CFDs, and commodities CFDs. Traders can utilize advanced analytical tools, customizable market alerts, and trading history analysis. ModMount offers multiple account types with different features, leverage, spreads, and commissions. The broker emphasizes customer support through email, live chat, and phone. They provide the ModMount WebTrader platform, which offers a user-friendly interface and access to over 350 CFDs. Additional trading tools include the ModMount Economic Calendar and the Chart Analysis Widget.

Regulation

The Seychelles Financial Services Authority (FSA) is the regulatory body responsible for overseeing financial services in the Seychelles. The regulation associated with license number SD119 is considered an offshore regulation. It also has a CYSEC suspicious clone license.

Market Instruments:

ModMount offers a variety of trading instruments to cater to different investment preferences and strategies. Here is a description of the market instruments available:

- Indices CFDs: ModMount allows traders to speculate on the price movements of various stock indices. Indices are baskets of stocks that represent a particular area of the market or an entire industry.

- Forex Trading: ModMount offers trading opportunities in the foreign exchange market (Forex). Forex trading involves buying and selling currency pairs, capitalizing on the volatility and fluctuations in exchange rates.

- Cryptocurrency CFDs: ModMount enables trading in cryptocurrencies through CFDs. The cryptocurrency market is known for its volatility, providing opportunities for traders to speculate on price movements.

- Stocks CFDs: ModMount provides the option to trade CFDs on stocks of well-known companies, including giants like Google, Microsoft, Tesla, Zoom, and Mercedes.

- Commodities CFDs: ModMount offers trading in commodities through CFDs. Commodities, such as gold, oil, and agricultural products, are influenced by various factors such as political events, economic flows, and weather conditions.

Account Types:

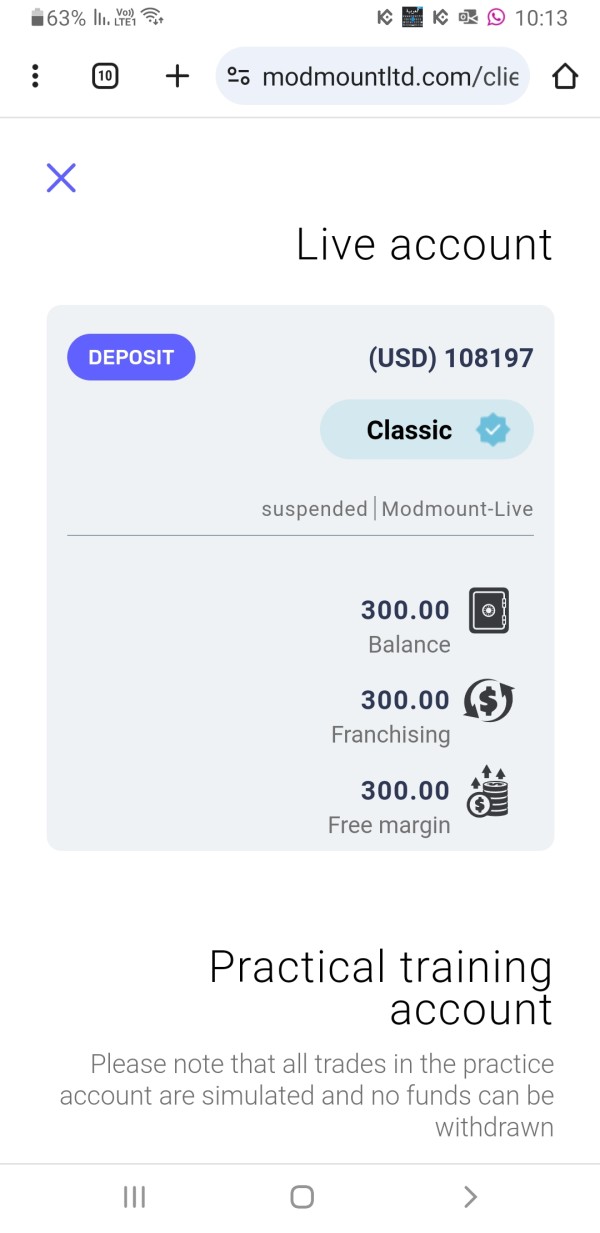

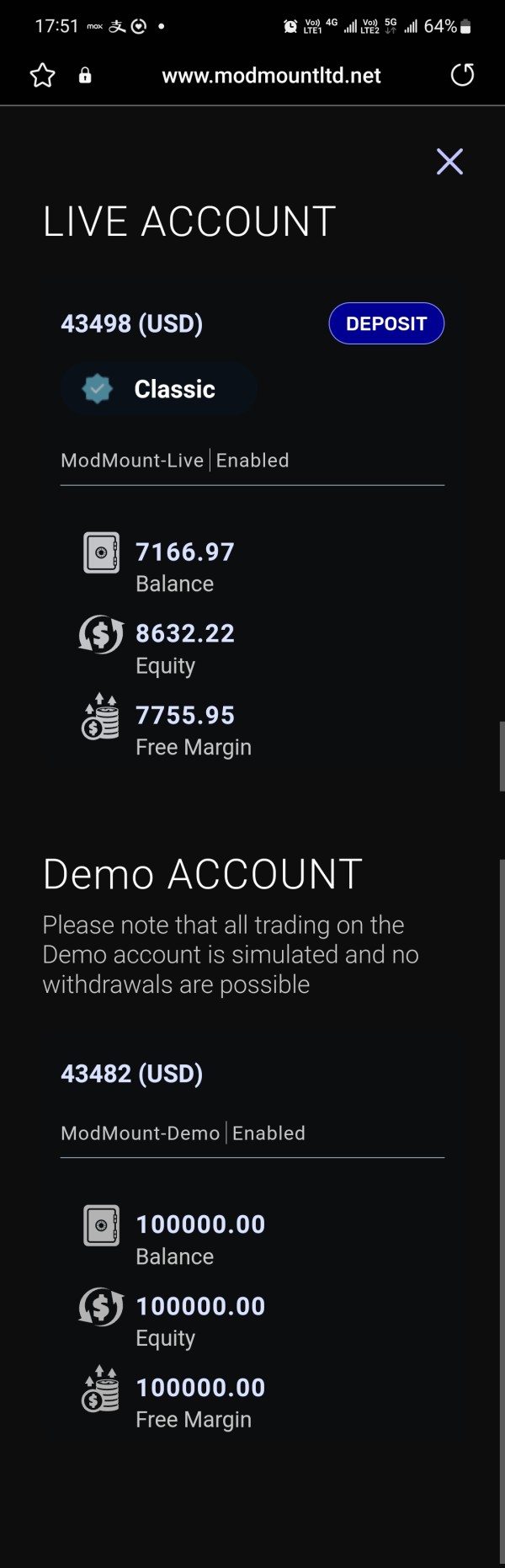

Classic Account

The Classic Account offered by the broker provides traders with unmatched trading flexibility. It offers zero commissions on deposits, allowing traders to maximize their investment. With access to over 350 CFDs on various assets, traders can diversify their portfolio and explore different market opportunities. The account also offers a maximum Forex leverage of up to 1:400, enabling traders to amplify their trading positions. Dedicated multilingual support ensures that traders receive assistance in their preferred language. The account features an average execution speed of 0.08, allowing traders to react quickly to market movements. Flexible spreads and advanced analytical instruments further enhance the trading experience. The Classic Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Silver Account

The Silver Account provides traders with a flexible trading environment in the vast international arena. Similar to the Classic Account, it offers zero commissions on deposits and access to a wide range of CFDs on various assets. With a maximum Forex leverage of up to 1:400, traders can take advantage of market opportunities with increased trading power. Dedicated multilingual support ensures that traders receive prompt assistance. The account offers an average execution speed of 0.08, allowing for quick order execution. Traders can benefit from flexible spreads and utilize advanced analytical instruments to make informed trading decisions. The Silver Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Gold Account

The Gold Account is designed for experienced traders who want to hit the international market with confidence. It provides access to over 350 CFDs on assets, allowing traders to diversify their investment portfolio. With a maximum Forex leverage of up to 1:400, traders can optimize their trading positions. The account features an average execution speed of 0.06, ensuring fast order execution. Flexible spreads starting from 0.05 pips provide competitive trading conditions. Traders can utilize the advanced analytical instruments to conduct comprehensive market analysis. The Gold Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Platinum Account

The Platinum Account offers premium trading conditions for traders who want to confront the market's challenges. It provides access to over 350 CFDs on various assets, enabling traders to diversify their portfolio. With a maximum Forex leverage of up to 1:400, traders can take advantage of increased trading power. The account offers a deposit commission of 0% and dedicated support, ensuring a high level of service. Traders can enjoy an average execution speed of 0.08 for quick order execution. Advanced analytical instruments assist in making informed trading decisions. The Platinum Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

VIP Account

The VIP Account is tailored for traders who seek to seize the market's obstacles with the aid of VIP trading terms. It offers low commissions on deposits, enabling traders to optimize their trading costs. With access to over 350 CFDs on assets, traders can diversify their investment portfolio. The account provides a maximum Forex leverage of up to 1:400, allowing traders to amplify their trading positions. Dedicated multilingual support ensures personalized assistance. The account offers an average execution speed of 0.08 and flexible spreads. Advanced analytical instruments assist in making informed trading decisions. The VIP Account supports popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more.

Leverage

The broker offers various leverage levels for different trading instruments. Here is a description of the maximum trading leverage provided by the broker:

- FX: For all account types (Classic, Silver, Gold, Platinum, and VIP), the maximum trading leverage for Forex (FX) trading is up to 1:400. This means that traders can amplify their trading positions up to 400 times their initial investment.

- Silver & Gold (Metals): The maximum trading leverage for Silver and Gold (Metals) trading varies across account types. Traders with Classic, Silver, Gold, Platinum, and VIP accounts can leverage their trades up to 1:200.

- Indices: For trading indices, the maximum trading leverage offered by the broker is up to 1:200 across all account types. This leverage allows traders to have increased exposure to index price movements.

- Commodities: Similar to indices, the maximum trading leverage for commodity trading is up to 1:200 for all account types. Traders can take advantage of leverage to participate in the commodity market with a fraction of the capital required for full ownership.

- Stocks/Equities: Regardless of the account type, the maximum trading leverage for stocks or equities trading is up to 1:5. This leverage level is typically lower compared to other instruments, reflecting the inherent risks associated with individual stocks and the need for prudent risk management.

Spreads & Commissions:

The broker offers a variety of trading accounts with different spreads and commissions to cater to the diverse needs of traders. For the popular currency pair EUR/USD, the spreads range from 2.5 pips in the Classic and Silver Accounts to as low as 0.9 pips in the VIP Account. This means that traders can choose an account type that aligns with their trading preferences and budget.

Similarly, for GBP/USD, the spreads vary from 2.8 pips in the Classic and Silver Accounts to 1.4 pips in the VIP Account. Traders can select the account that suits their trading style and desired trading costs. The USD/JPY currency pair also presents different spreads, ranging from 2.8 pips in the Classic and Silver Accounts to 1.4 pips in the VIP Account.

In addition to currency pairs, the broker also provides opportunities for trading commodities such as Crude Oil. The commission for Crude Oil trading is $0.14 per contract in the Classic and Silver Accounts, decreasing to $0.10 per contract in the VIP Account.

Deposit & Withdrawal:

Deposits

At ModMount, the minimum deposit amount is 250 EUR/USD/JPY. This minimum deposit requirement allows traders to fund their accounts and start trading. Signing up without depositing is possible, but traders will only be able to trade using a demo account. This allows individuals to familiarize themselves with the platform and practice trading strategies without risking real money.

ModMount accepts deposits in three currencies: EUR, USD, and JPY. Traders can choose the currency that is most convenient for them when depositing funds into their accounts.

The broker offers multiple deposit methods to accommodate traders' preferences. Traders can deposit funds using Credit/Debit Cards, Wire Transfer, or APMs (Alternative Payment Methods).

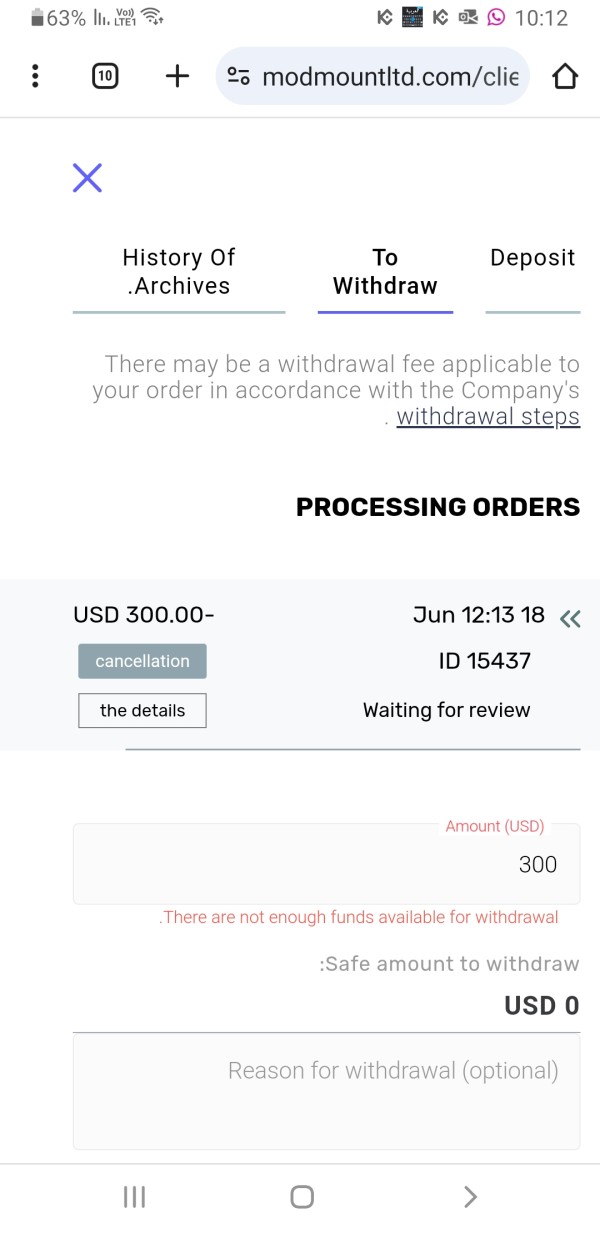

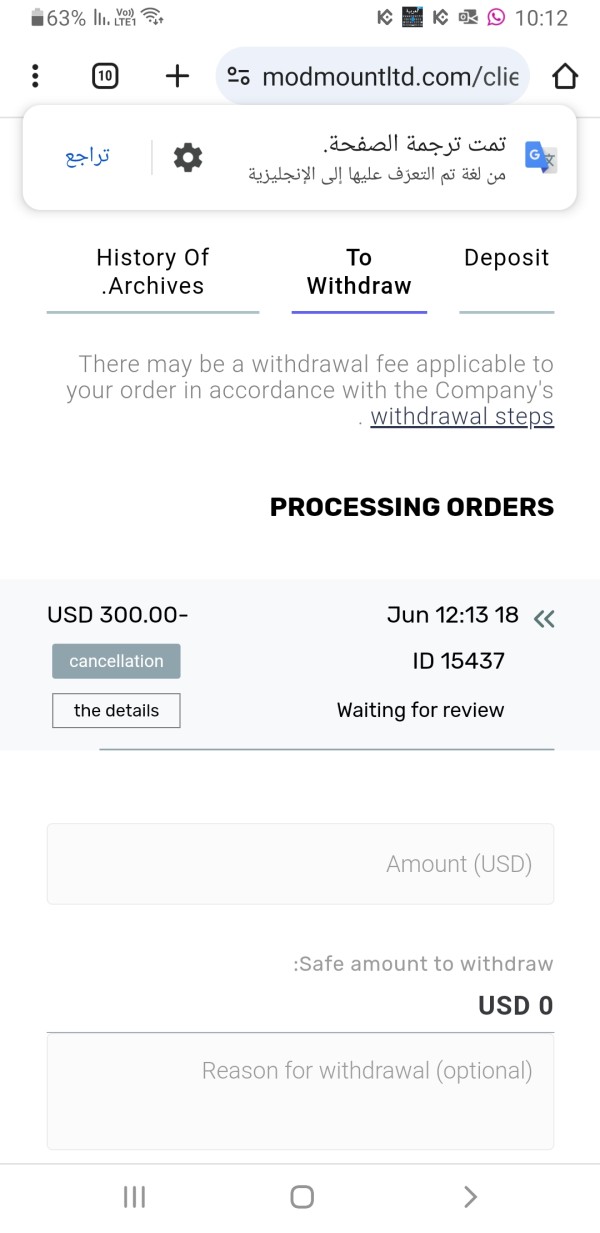

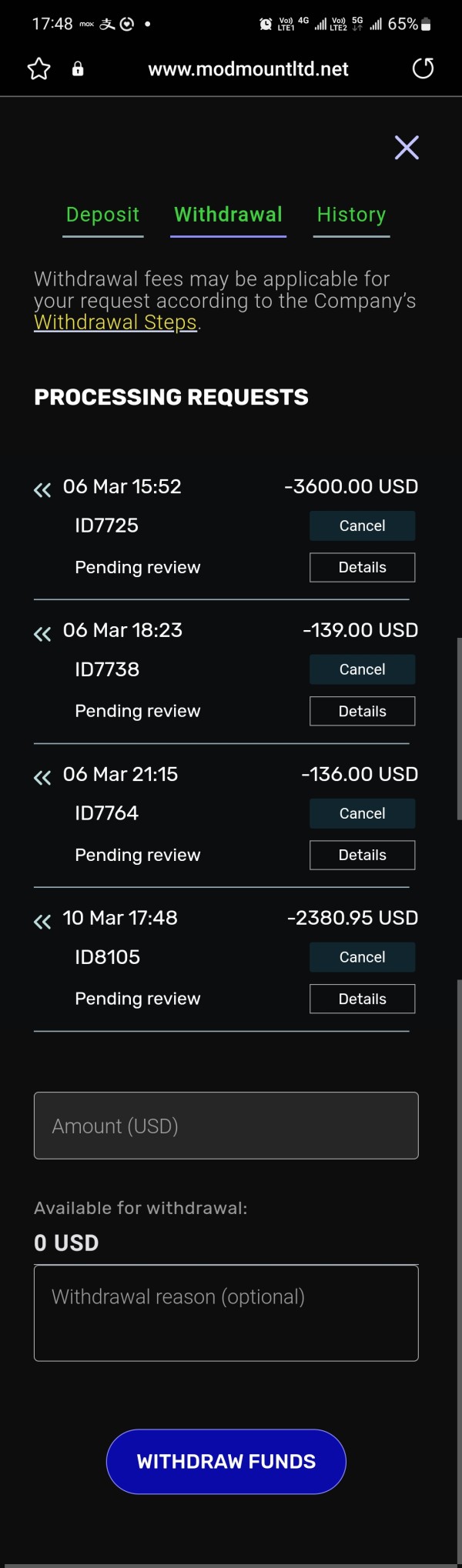

Withdrawals

Traders have the option to cancel a withdrawal request as long as the transfer has not been processed yet. This allows flexibility in managing withdrawal requests.

The minimum withdrawal amount from a ModMount account is 10 EUR/USD/JPY for Credit Card withdrawals and 100 EUR/USD/JPY for Wire Transfer withdrawals. If traders use e-wallets, they may withdraw any amount as long as it covers the applicable fee.

To request a withdrawal, traders need to sign in to their ModMount account and follow the simple instructions provided on the withdrawal page. The process is designed to be user-friendly and efficient.

The withdrawal process typically takes about 8 to 10 business days to complete. However, it is important to note that the actual processing time may vary depending on the trader's local bank or financial institution.

Traders can withdraw funds from their ModMount account even if they have open positions. However, it is crucial to ensure that there is sufficient margin in the account to cover the withdrawal amount and any associated fees that may apply.

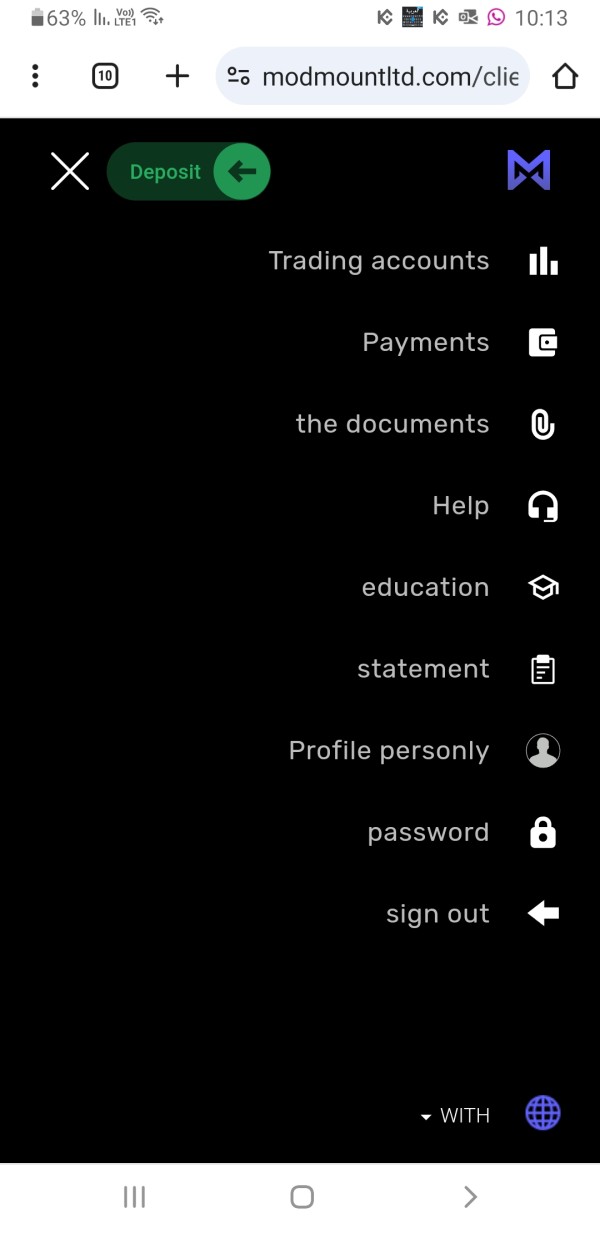

Trading Platforms

WebTrader

Trade anytime, anywhere with ModMount WebTrader. Access 160+ CFDs on global assets, utilize 60+ advanced analytical tools, and refine your strategies using detailed trading history.

Firebase Test App

Explore and test ModMounts features in a secure environment with the Firebase Test App. Visit the app page on Firebase to experiment and provide feedback for continuous improvement.

Trading Tools

ModMount offers a range of trading tools designed to assist traders in their market analysis and decision-making process. These tools provide valuable insights and help traders stay informed about key economic events and price movements. Here are two notable trading tools provided by ModMount:

- ModMount Economic Calendar: The ModMount Economic Calendar is a cutting-edge market calendar that allows traders to stay on top of important economic events. By keeping track of upcoming events such as economic indicators, central bank announcements, and key reports, traders can better understand the potential impact on the markets. This tool enables traders to make informed decisions and take necessary steps to optimize their portfolio's performance.

- Chart Analysis Widget: ModMount offers an all-inclusive Chart Analysis Widget, which enables traders to stay updated on price movements in the markets. This tool provides real-time charting capabilities, allowing traders to analyze price trends, patterns, and indicators. By utilizing the Chart Analysis Widget, traders can effectively monitor market dynamics, seize control of their trading positions, and diversify their asset portfolio accordingly.

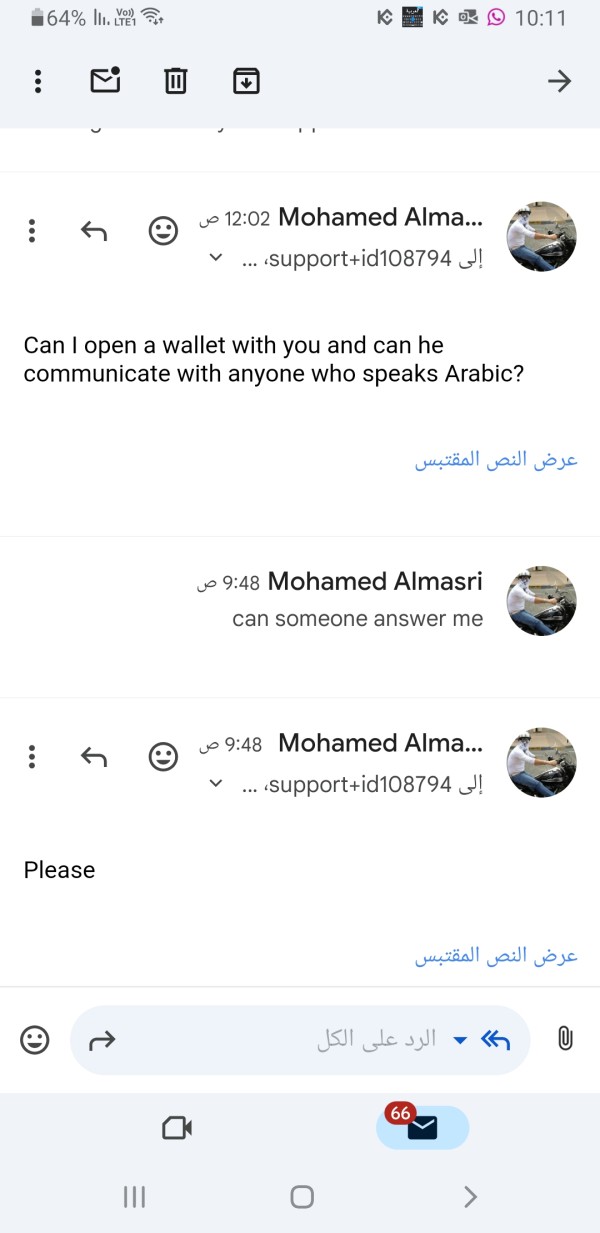

Customer Support

ModMount provides customer support services to assist traders with their inquiries and concerns. The customer support team is available during regular business hours, Monday to Friday, from 12:00 till 21:00 GMT.

Traders can reach out to the customer support team via email at support@modmountltd.com. Email communication allows traders to articulate their questions or issues in detail and receive a written response from the support team.

Live Chat is also available as a customer support option. Traders can engage in real-time text-based conversations with a representative from the support team. Live Chat offers a convenient and efficient way to seek immediate assistance or resolve any urgent matters.

For those who prefer direct communication, ModMount provides a phone support option. Traders can contact the customer support team by dialing +2484632002 during the specified business hours.

FAQs

What is the regulatory authority overseeing ModMount?

ModMount is regulated by the Seychelles Financial Services Authority (FSA) under license number SD119.

What are the available account types at ModMount?

ModMount offers the following account types: Classic Account, Silver Account, Gold Account, Platinum Account, and VIP Account.

What is the maximum leverage offered by ModMount?

ModMount offers maximum leverage of up to 1:400 for Forex trading across all account types.

What are the deposit and withdrawal options at ModMount?

Traders can deposit funds using Credit/Debit Cards, Wire Transfer, or Alternative Payment Methods (APMs). The minimum deposit is 250 EUR/USD/JPY. Withdrawals can be made via Credit Card or Wire Transfer, with specific minimum withdrawal amounts depending on the method chosen.

FX7725615812

United Arab Emirates

This platform has made me shy and no longer responds to me, nor my calls, nor my communication with their mother, they promised me to trade with them and communicate with someone, but it is all lies and fraud, they took the amount of $ 300 and the communication ended

Exposure

2024-06-19

Hababa

Taiwan

Mark asked me to deposit money and kept calling me. When I found that there was a problem and wanted to withdraw money, I was not allowed to withdraw money because the margin was lower than the safe value. There is no stop loss in investment, and the losses are increasing. Mark says this is not a real loss, I have to believe him. This is a scam. In just one night, more than 5,000 US dollars were gone. I do not recommend this platform at all.

Exposure

2024-04-11

尤西

Taiwan

They kept asking me to deposit money, and they kept asking me to find a way to borrow money, but I said I couldn't. Robert said that was my business. The person who helped me with the operation was MARK. He called me every day. The day before I was about to liquidate my position, he said he would find a way to protect my investment. As a result, all my money was gone the next morning. I invested 20,000 US dollars, and it was all gone. Then they disappeared and stopped contacting me. Never trust this kind of departure supervision, there is no guarantee at all. The second time he promised me that he would pay me back, he broke his promise. These 20,000 US dollars were all borrowed, and they would only ask me to get the money out. If there was a profit at that time, they would not give me the money.

Exposure

2024-03-30

hksar5

Hong Kong

In mid-February, I was tricked into leaving my personal information on Facebook. Later, Modmount Services Ltd staff called me and said that they had opened an account for me. They then continued to press me to deposit money, and the entire process was handled by two staff from the company (one person). A person named Mark and another named Robert (hereinafter referred to as the company representative) conducted transactions for me (completely without my consent). I made multiple deposits totaling more than 13,000 US dollars. After that, the company representative forcibly traded for me and deliberately made losses (only I set a stop-profit but did not set a stop-loss). My capital lost nearly 7,000 US dollars. I asked for a stop-loss many times to no avail. Finally, I forcibly closed the position and requested a withdrawal (withdrawal), but Modmount refused my withdrawal without any reason.

Exposure

2024-03-10

FX1399694434

Cyprus

While browsing online, I came across the website of this offshore regulated brokerage firm, but unfortunately, the website seems to be still under construction and I don't have access to any other information at the moment. While I am disappointed that I cannot currently access more information, I will definitely keep an eye on this firm's progress and check back later when the site is fully functional.

Neutral

2023-03-28

Qさん

Japan

We believe Modmount is an excellent investment firm when viewed objectively or in its entirety. The maximum use of AI technology is also great. The rep is also excellent. We highly value the competence of the person in charge and the professionalism of the person in charge's individual research.

Positive

2023-06-17

Qさん

Japan

Modmount is great. The person in charge is also excellent.

Positive

2023-06-17

Helping forex!

Cyprus

Started trading with Modmount in the past few weeks. It's good for beginners. Good experience with my iPhone as well.

Positive

2023-06-08