Overview of Alfa-Bank

Alfa-Bank, founded in Russia within the past 2-5 years, offers a wide range of financial products including investment services, corporate and retail banking solutions.

Advantages include a wide range of investment options (e.g., equities, fixed income) and comprehensive retail banking features.

However, limited presence outside Russia and the absence of trading software are notable disadvantages. Despite being unregulated, Alfa-Bank provides stability as a strong financial institution.

Its geographic focus, primarily within Russia, restricts accessibility for international customers. The bank's transparency regarding fees and deposit methods is lacking, impacting customer experience.

Regulatory Status

Alfa-Bank operates without regulatory oversight.

This absence of supervision can lead to risks like unchecked lending practices, potential for financial misconduct, and inadequate protection for customers' funds. Without regulation, there's a lack of accountability and transparency in its operations.

Pros and Cons

Pros:

Wide Range of Investment Services: Alfa-Bank offers an extensive array of investment options, including equities, fixed income, brokerage services, and derivatives. This variety allows investors to diversify their portfolios and pursue different investment strategies based on their risk tolerance and financial goals.

Comprehensive Retail Banking Options: Alfa-Bank's retail banking services serves a wide range of customer needs, offering features such as news and events updates, personalized banking through Alfa Private, and partnerships with other banks.

Cons:

Limited Presence Outside Russia: Alfa-Bank's operations are primarily concentrated within Russia, limiting its accessibility for international customers. This geographic restriction poses challenges for individuals or businesses seeking banking services outside of Russia or conducting cross-border transactions.

No Trading Software Availability: Alfa-Bank's absence of trading software can hinder the trading capabilities of its customers, particularly those engaged in stock market investments or currency trading.

Unregulated:

Lack of Transparency in Fees and Deposit Methods: Alfa-Bank's lack of transparency in fees and deposit methods lead to uncertainty and confusion among customers regarding the costs associated with banking services and the procedures for depositing funds.

Products and Services

Alfa-Bank offers a range of investment banking services encompassing equities, fixed income, brokerage services, corporate finance, debt capital market, derivatives, structured products, and FOREX trading.

Corporate Banking Services

Alfa-Bank provides comprehensive corporate banking solutions including cash management, financing options, deposits, trade finance, liquidity management, factoring, and leasing services. These offerings support the financial needs of businesses across various industries, facilitating efficient cash flow management, funding for expansion projects, and risk mitigation through trade finance solutions.

Retail Banking

The retail banking segment of Alfa-Bank encompasses various services such as news and events updates, Alfa Private banking services, and partnerships with other banks to extend the reach of its retail banking offerings. These services provide personalized banking experiences, financial advisory support, and access to a wide range of banking products for individual customers.

Financial Institutions

Alfa-Bank offers cash clearing services and overdraft facilities to financial institutions, ensuring smooth transaction settlements and providing short-term liquidity support when needed. These services contribute to the efficient functioning of the financial ecosystem by facilitating easy money transfers and supporting liquidity management for partner institutions.

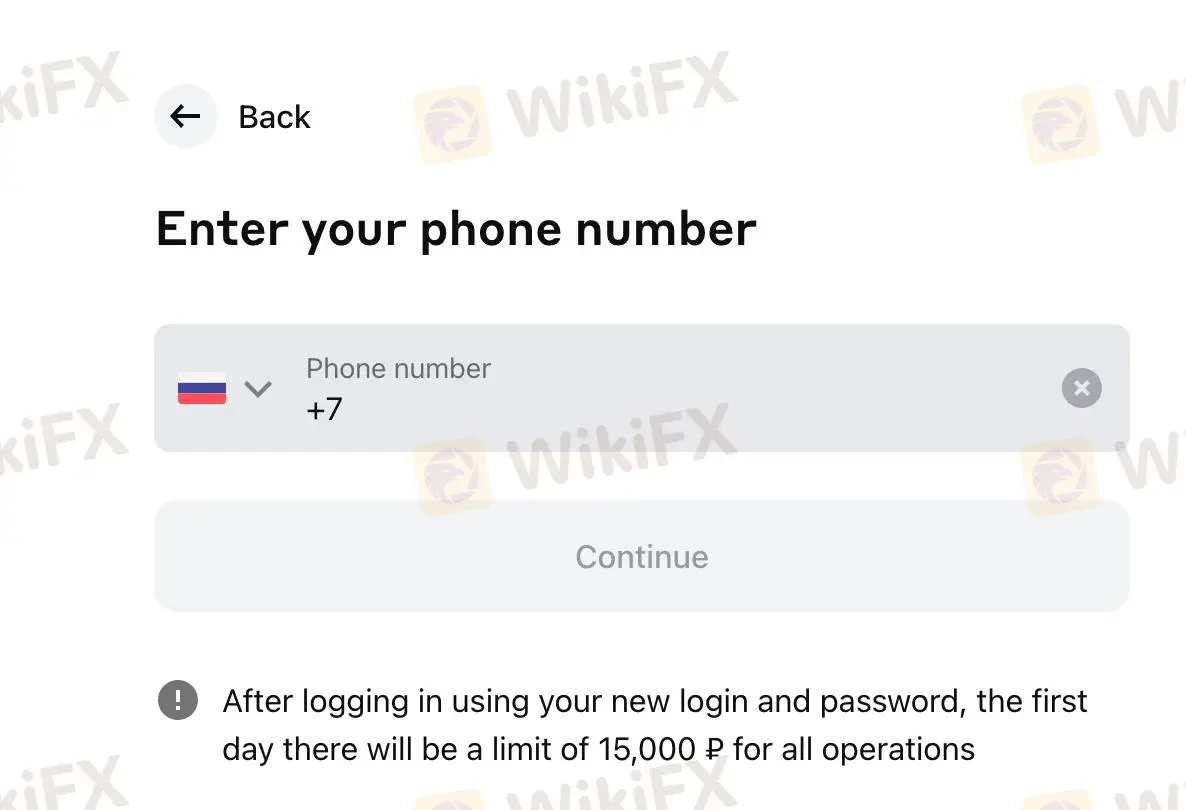

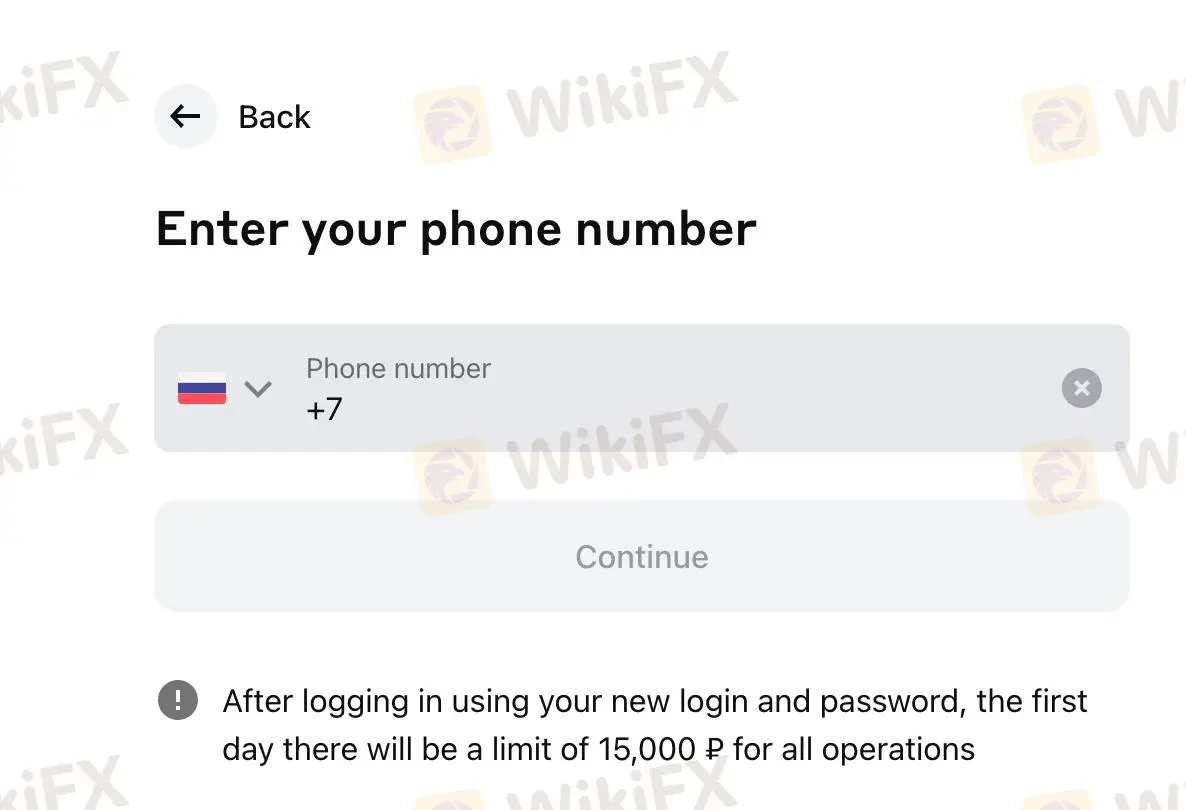

How to Open an Account?

Preparation and Documentation:

Gather required documents including identification (passport, national ID), proof of address (utility bill, rental agreement), and any additional documentation as per Alfa-Bank's requirements.

Ensure all documents are valid and up-to-date to facilitate the account opening process.

Application Submission:

Complete the application form accurately, providing all necessary personal and contact information as required.

Submit the application along with the supporting documents either online or in-person at the branch.

Verification and Review:

Alfa-Bank will verify the information provided in the application and review the submitted documents for compliance with regulatory requirements.

This verification process involves checks on identity, address, and other relevant details to ensure adherence to banking standards and regulations.

Account Activation:

Upon successful verification and review, Alfa-Bank will proceed to open the account.

You will receive confirmation of the account opening along with account details such as account number and any relevant access credentials.

Trading Platform

The current information shows that Alfa-Bank does not have a trading software. Please be aware!

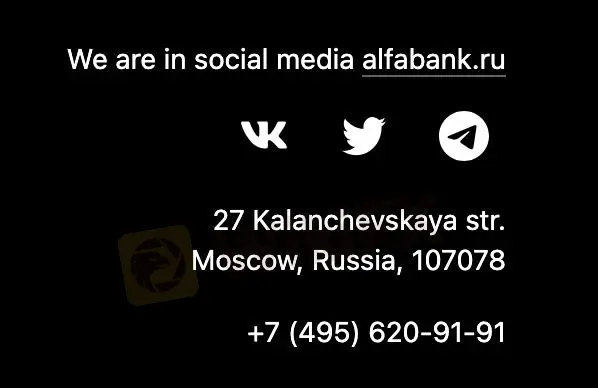

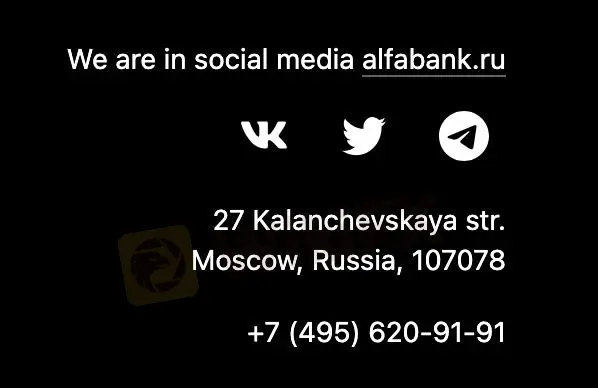

Customer Support

Alfa-Bank provides accessible customer support through various channels including phone, social media, and in-person assistance.

For inquiries or assistance, customers can contact their helpline at +7 (495) 620-91-91. Additionally, they engage with customers through social media platforms like Twitter and Telegram. Their physical address at 27 Kalanchevskaya str., Moscow, Russia, 107078, serves as a point of contact for in-person assistance.

Conclusion

In conclusion, Alfa-Bank offers a wide range of financial products and services including equities, fixed income, brokerage services, and derivatives.

However, its limited presence outside Russia restricts accessibility for international clients. Additionally, the absence of regulation poses risks such as unchecked lending practices and potential financial misconduct.

Despite these drawbacks, Alfa-Bank's strengths lie in its comprehensive retail and corporate banking solutions, along with robust cash clearing services.

FAQs

Question: What types of accounts does Alfa-Bank offer?

Answer: Alfa-Bank provides various account options, including savings, checking, and investment accounts.

Question: Does Alfa-Bank offer online banking services?

Answer: Yes, Alfa-Bank offers online banking, allowing clients to manage your accounts, make transactions, and access banking services remotely.

Question: What are the customer support options available?

Answer: You can contact Alfa-Bank's customer support via phone, social media platforms, or visit a branch for in-person assistance.