Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Seyhmus POLAT

Turkey

No one should trust this company and deposit money. Don't let the company's ratings mislead you. Definitely a scammer and not sending money.

Exposure

2023-11-07

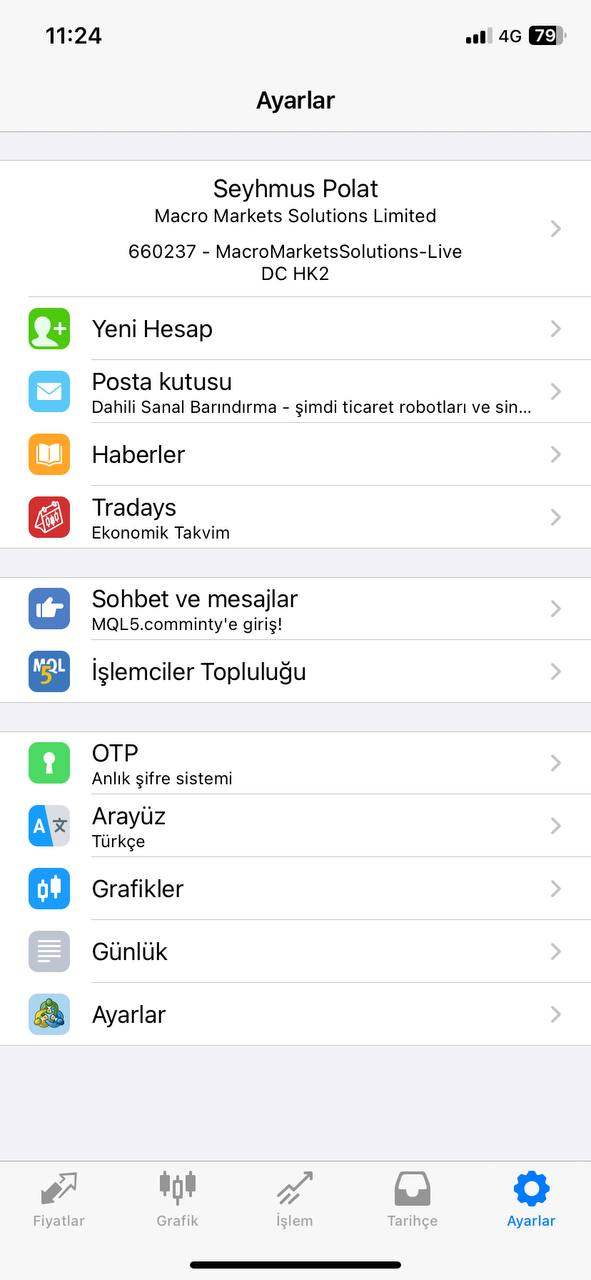

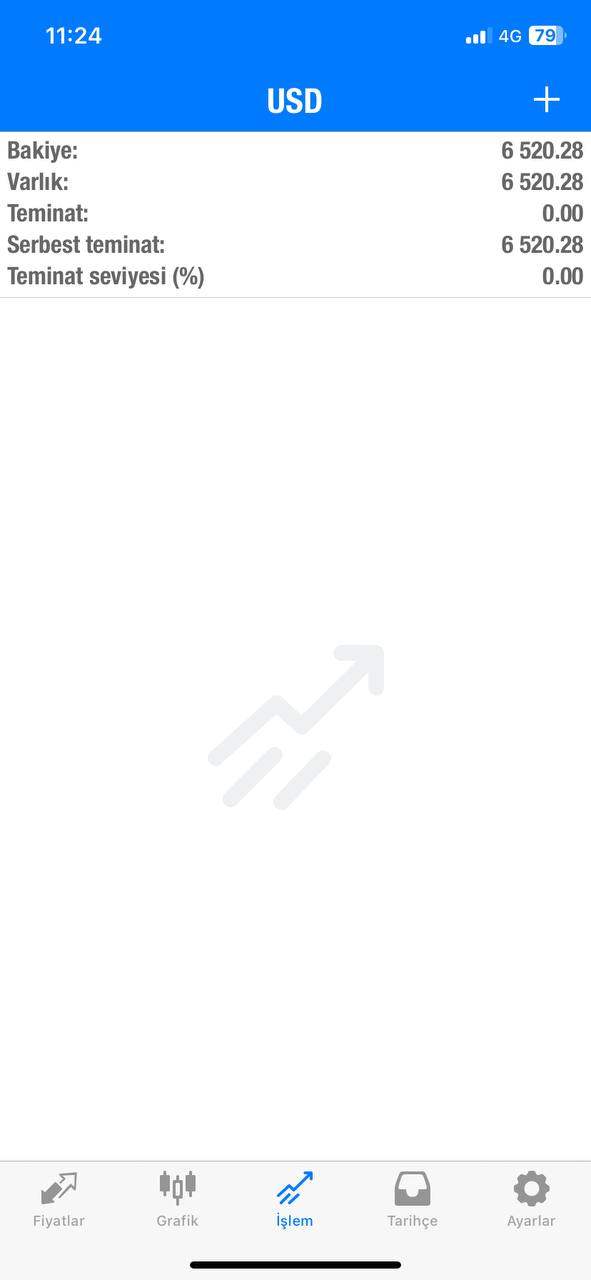

Seyhmus POLAT

Turkey

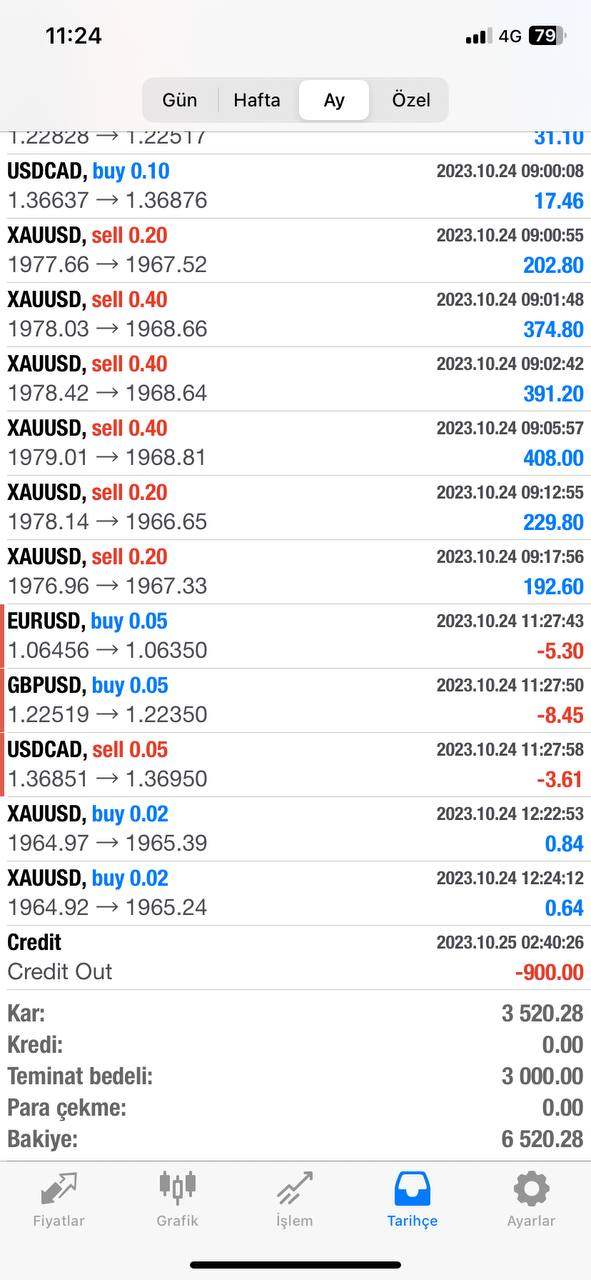

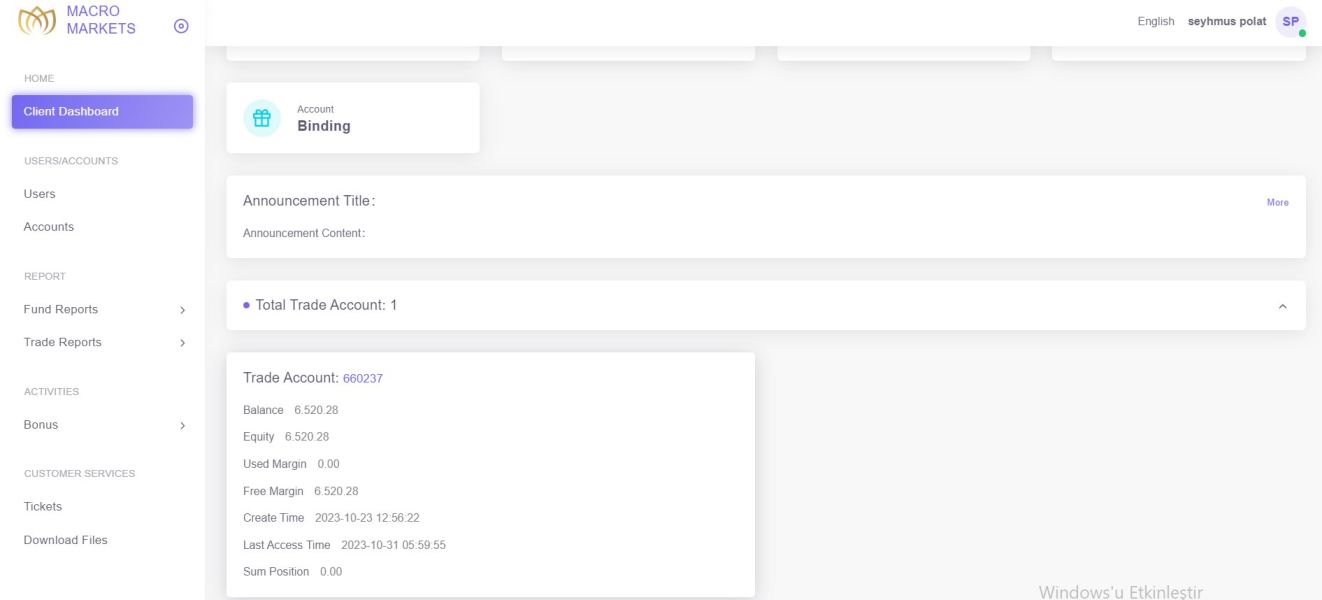

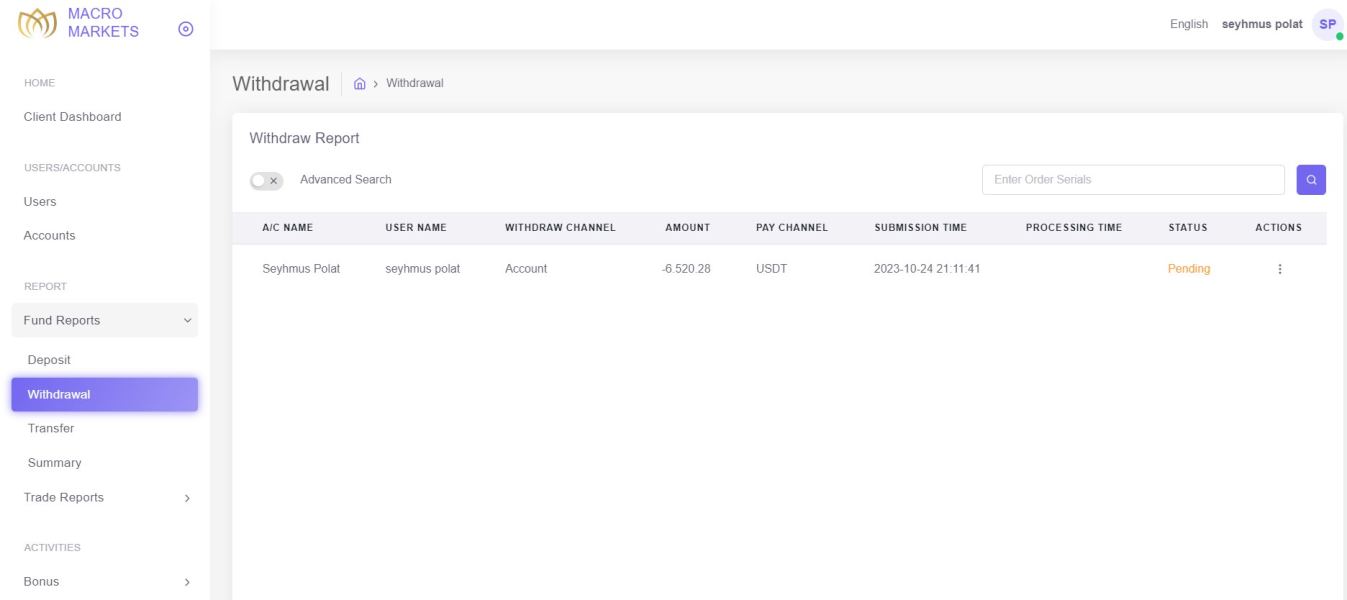

İ made deposit to Macro Markets 23-10-2023. After my deposit,they were providing bonus promotion to the deposits,so i got deposit 3000$,they got me credited 900$ on 24-10-2023. İ traded on my account,after my transactions are done from my side. İ wanted to make a withdrawal to test,how they are fast and reliable. My balance reached 6520$. İ made a request from client panelt o withdrawa the amount. So i waited 24 hours in a patiente way,because they told formal procedure is 24 hours for withdrawals. After that,they told me suddenly,your account is under investigation from risk department of Macro Markets. After this messafe they are not paying my money. 8 days are already done from my request. Still i can not withdraw,my money.

Exposure

2023-10-31

Pongin

Italy

MACRO MARKETS offers a robust selection of market instruments with a strong regulatory framework, making it a reliable choice for traders looking for a secure and diverse trading platform.

Positive

2024-07-30

Mark Carter

New Zealand

Trading costs are transparent, but the overnight interest rates seem a bit high. The regulatory status is solid, offering peace of mind about fund safety. Well, it's a decent choice for cautious traders, like me.

Positive

2024-06-28

46etth

Philippines

I enjoyed using the MT4 and Pro Trader platforms and appreciated the variety of trading instruments. The hassle-free account opening and smooth deposit and withdrawal process were positives.

Positive

2024-05-15