It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Super Forex

Pros:

Wide range of trading products and account types to choose from

High leverage of up to 1:3000

No additional fees on transactions with your account

Extensive educational resources available, including videos and seminars

Multiple channels of customer support, including social media platforms and callback option

Fast processing time for deposits

Cons:

Limited regulatory oversight and licensing

Limited information on the company's history and ownership

Some account types have high minimum deposits, such as the Profi STP and ECN accounts

The spreads on some trading products can be higher compared to other brokers

Withdrawals may take longer to process compared to deposits

Limited options for trading platforms, only offering the MT4 platform.

What type of broker is Super Forex?

Super Forex is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Super Forex acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Super Forex has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Super Forex or any other MM broker.

General information and regulation of Super Forex

SuperForex is a global forex broker established in 2013 with a mission to provide its clients with top-quality financial services and a wide range of trading instruments. The company is headquartered in Belize. With its client-centric approach, SuperForex offers various account types, flexible trading conditions, a range of trading platforms, a variety of payment options, and a comprehensive set of educational resources to cater to the needs of both novice and experienced traders.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

Super Forex offers a wide range of trading instruments, including cryptocurrencies, precious metals, stocks, oil, forex pairs, and indices. The availability of multiple asset classes provides traders with diversification opportunities, access to global markets, and the potential for high returns. With access to popular asset classes such as forex pairs and indices, traders can also benefit from high liquidity, which means they can quickly enter and exit positions at the desired price. However, trading multiple asset classes can be complex, may require extensive knowledge and expertise, and may come with higher margin requirements, increasing trading costs. Additionally, as the research and analysis on each asset class may not be as detailed or comprehensive as traders would prefer, traders should conduct their own research and analysis to make informed trading decisions.

Spreads and commissions for trading with Super Forex

Super Forex offers competitive spreads and provides a detailed fee table that outlines spreads, commissions, SWAPs and lot sizes for various accounts and products. The absence of commissions and deposit/withdrawal fees makes trading cost-effective. However, as an unregulated broker, Super Forex carries a risk of potential hidden fees. Also, the high leverage of up to 1:3000 can be both beneficial and risky, as it can magnify profits and losses. Moreover, the lack of negative balance protection is a disadvantage that can expose traders to significant losses.

Trading accounts available in Super Forex

STP accounts:

ECN accounts:

Super Forex offers a variety of account types, ranging from Standard and Micro Cent accounts to more specialized accounts like No Spread and Crypto. The broker also offers ECN accounts with floating spreads for traders looking for a more transparent pricing model. Each account type has its own minimum deposit requirement and maximum leverage, giving traders the flexibility to choose an account that best fits their needs. Additionally, the Swap-Free account option is available for those who require it, and the Profi STP account is specifically designed for professional traders. However, it should be noted that some account types have limited leverage and some have higher spreads compared to others.

Trading platform(s) that Super Forex offers

Super Forex offers its clients the popular MetaTrader 4 (MT4) platform for trading, which has been in use for over a decade and is known for its user-friendly interface and flexible customization options. With MT4, traders have access to advanced charting tools, automated trading through expert advisors (EAs), and a large community of support with abundant resources. However, MT4 has limitations in terms of access to market data and news compared to newer platforms, and it does not offer two-factor authentication for added security. Additionally, while the platform is flexible and customizable, it does have limitations in terms of charting tools compared to other platforms.

Maximum leverage of Super Forex

Super Forex offers a very high maximum leverage of up to 1:3000, which can be advantageous for experienced traders looking to amplify their profits and gain greater market exposure with smaller initial investments. However, high leverage also carries a significant amount of risk, as it can lead to substantial losses in a short period of time. This requires traders to possess advanced risk management skills and strategies to mitigate the risks. Additionally, high leverage is not available in all jurisdictions due to regulatory restrictions.

Deposit and Withdrawal: methods and fees

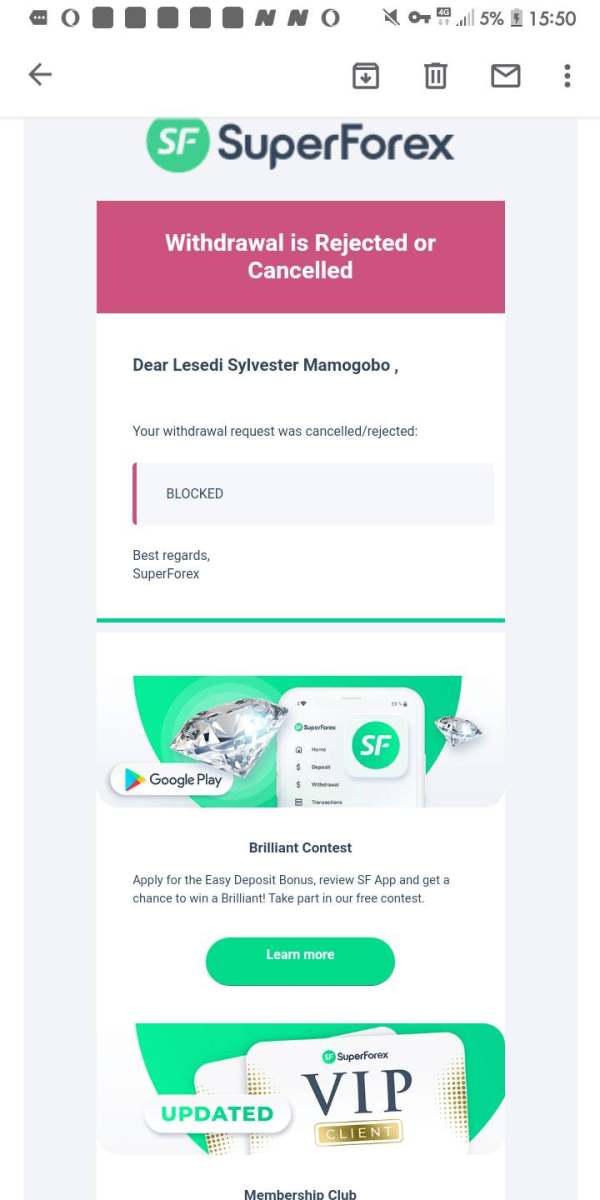

SuperForex offers a variety of deposit and withdrawal options to cater to clients' different preferences. One advantage is that the company does not charge any additional fees on transactions with your account. However, there is no information available on the fees charged by payment systems or banks, which may lead to unexpected charges for clients. Processing time for withdrawals may also take up to four business days, which may be longer than some competitors. On the other hand, deposits are processed instantly. SuperForex also offers local payment options, which can be convenient for clients in certain regions. However, the cryptocurrency options are limited compared to some competitors. It would be helpful for SuperForex to provide more information on withdrawal limits to assist clients in planning their transactions.

Educational resources in Super Forex

Super Forex offers a variety of educational resources for its clients. The company provides comprehensive lections, a glossary, seminars, training centers, educational videos, and other resources to help traders learn more about forex trading. Additionally, Super Forex has an official YouTube channel where clients can access even more videos to supplement their learning. These resources are available free of charge to Super Forex clients, and they are accessible to traders worldwide. However, there are some disadvantages to Super Forex's educational resources. While they are comprehensive, they do not offer personalized guidance, and there is no formal certification process. Additionally, the resources are self-directed, which may not be suitable for all learners, and some of the materials may be more basic than others.

You may also visit their official YouTube channel to watch more videos. Here is a recent video about technical analysis.

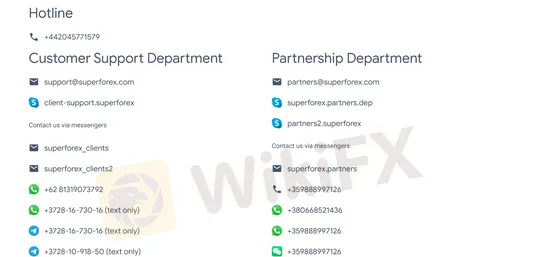

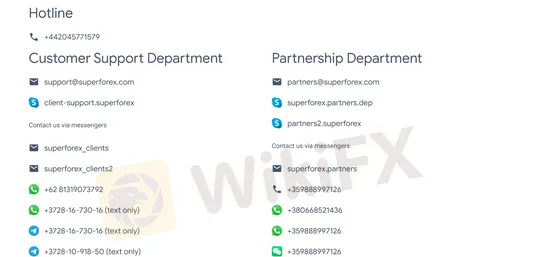

Customer service of Super Forex

Super Forex offers a variety of customer care options for their clients. The company provides 24/5 customer support through various channels, including email, phone, WhatsApp, WeChat, Telegram, and social media platforms such as Instagram, YouTube, Facebook, Twitter, and LinkedIn. The FAQ section on their website is another helpful resource for clients who prefer self-help. Additionally, the callback feature is available for personalized assistance. However, Super Forex does not offer 24/7 customer support and live chat is not available on their website. Furthermore, phone support may not be available for some countries and there is no physical office or location available for in-person assistance.

Conclusion

In conclusion, Super Forex is a reputable and reliable forex broker that offers a wide range of trading instruments and account types to its clients. Its multiple deposit and withdrawal options, as well as its educational resources and customer support channels, make it an attractive option for traders of all levels of experience. The company also stands out with its high leverage of up to 1:3000, which can potentially lead to significant profits. However, traders must be aware of the risks involved in high leverage trading and exercise caution when trading with such high ratios. Overall, Super Forex provides a solid trading environment for traders looking to participate in the forex market.

Frequently asked questions about Super Forex

Question: What is Super Forex?

Answer: Super Forex is a global forex broker that provides online currency trading services for both retail and institutional clients worldwide.

Question: Is Super Forex regulated?

Answer: No, Super Forex is not regulated.

Question: What trading platforms does Super Forex offer?

Answer: Super Forex offers the popular MetaTrader 4 (MT4) trading platform, which is available for both desktop and mobile devices.

Question: What is the minimum deposit required to open an account with Super Forex?

Answer: The minimum deposit required to open a Standard account with Super Forex is 5 USD.

Question: What types of accounts does Super Forex offer?

Answer: Super Forex offers various types of accounts, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, Crypto, ECN Standard, ECN Standard-Mini, ECN Swap-Free, ECN Swap-Free Mini, and ECN Crypto accounts.

Question: What is the maximum leverage offered by Super Forex?

Answer: Super Forex offers a maximum leverage of up to 1:3000.

Question: What educational resources are available on the Super Forex website?

Answer: Super Forex provides a variety of educational resources, including comprehensive lessons, a glossary, seminars, training centers, and educational videos, which are all designed to help traders improve their knowledge and skills in the forex market.

FX1023311901

Thailand

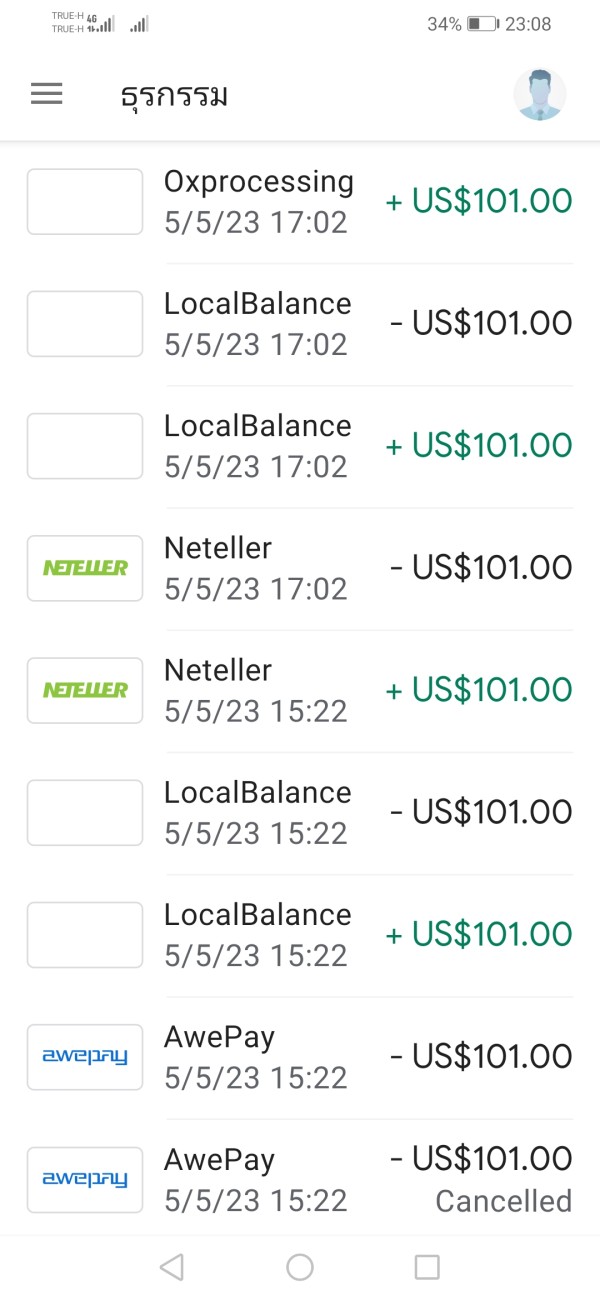

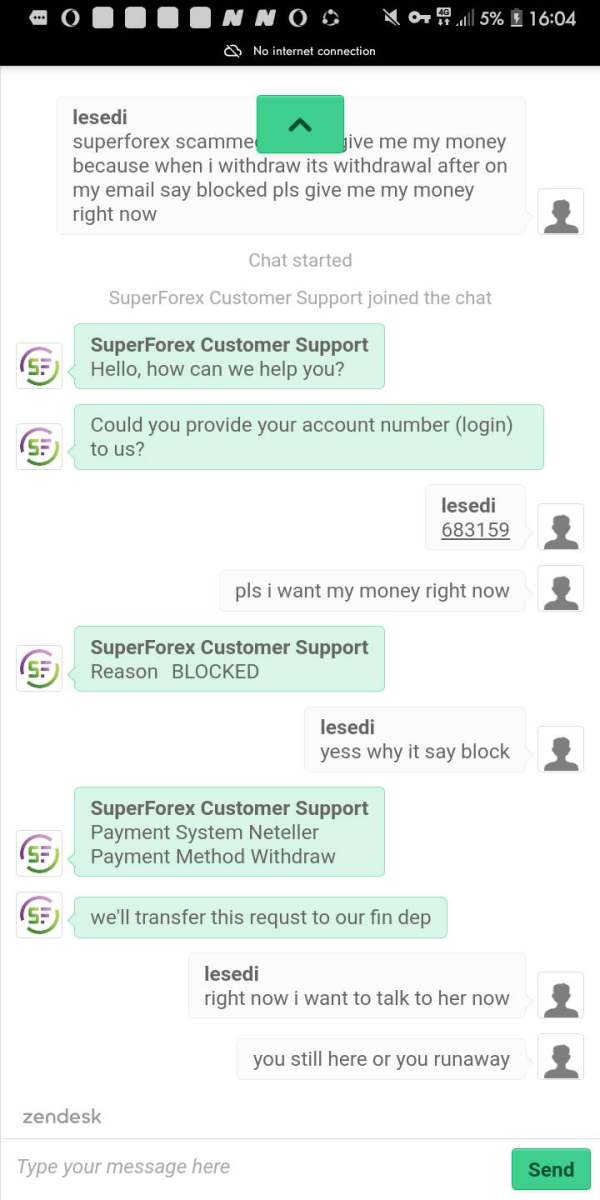

When the broker issued a withdrawal request, they encountered a rebound under the pretext that the bank did not support us to withdraw through cryptocurrency or Neteller. But when I pressed the withdrawal button, I posted a message saying that the amount was not enough. It was difficult to contact support like a diversion. I do not allow withdrawals.

Exposure

2023-05-06

Syafiqsyaw

Malaysia

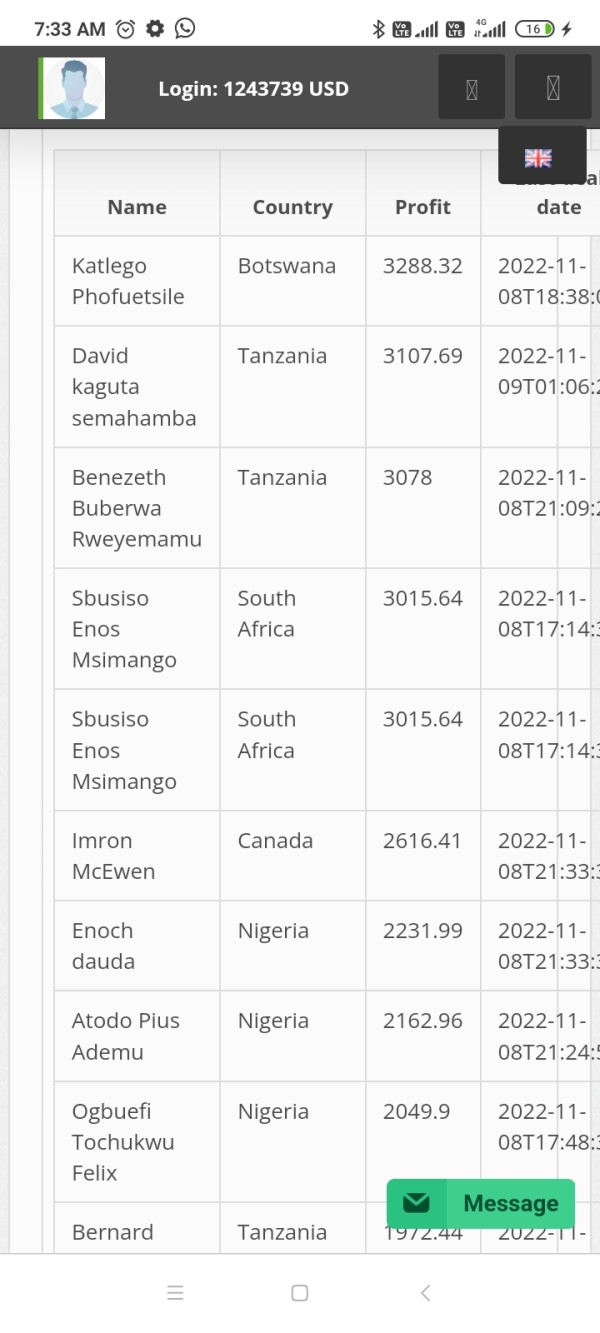

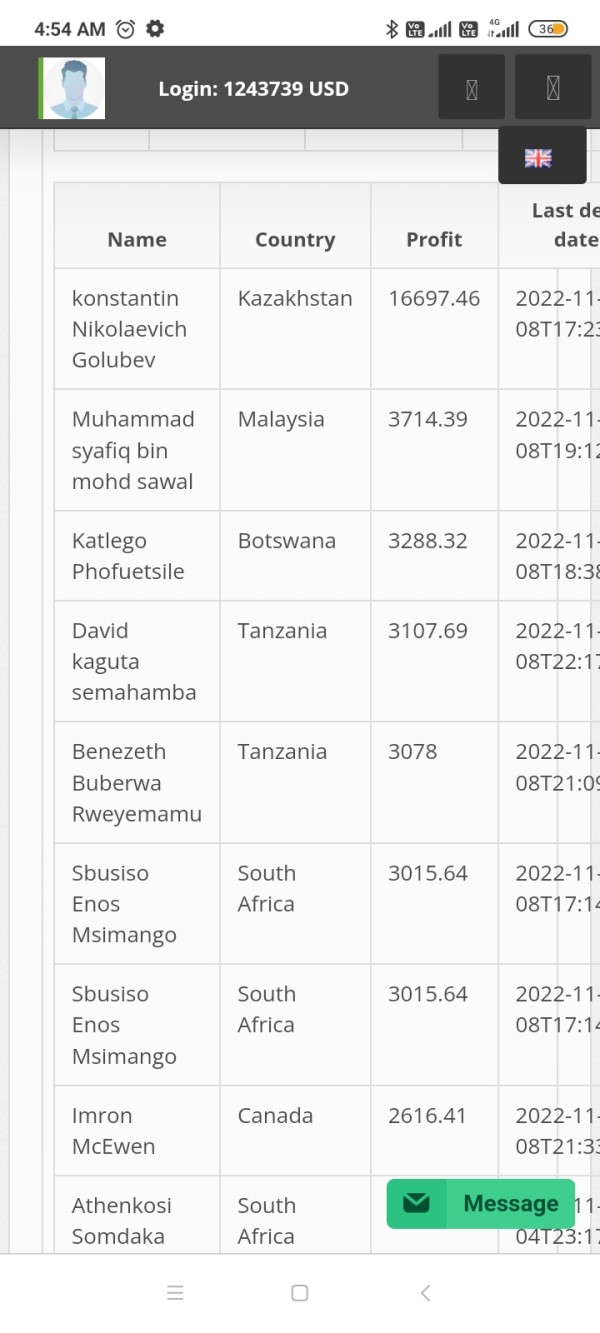

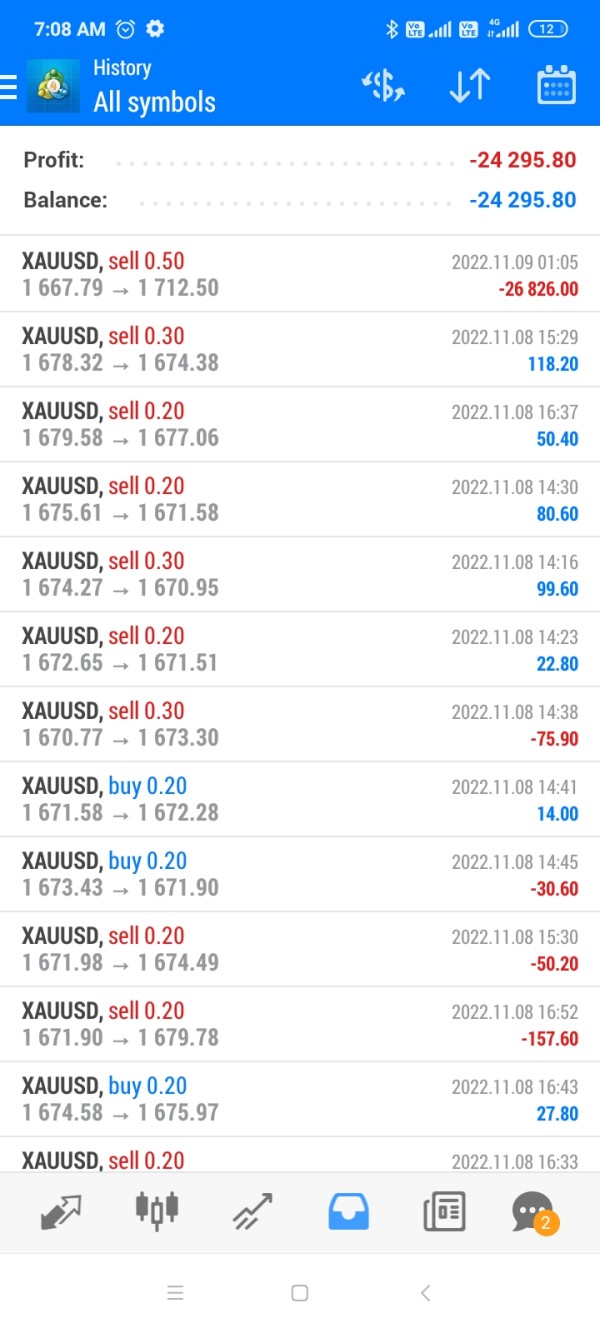

joined gold rush contest, and I got the number two position with a profit 3714k usd, suddenly my account was blocked without any information, and when I saw the leaderboard content my name kept disappearing, I wasted 1 week trading time with a stupid super forex contest

Exposure

2022-12-01

MendE

Turkey

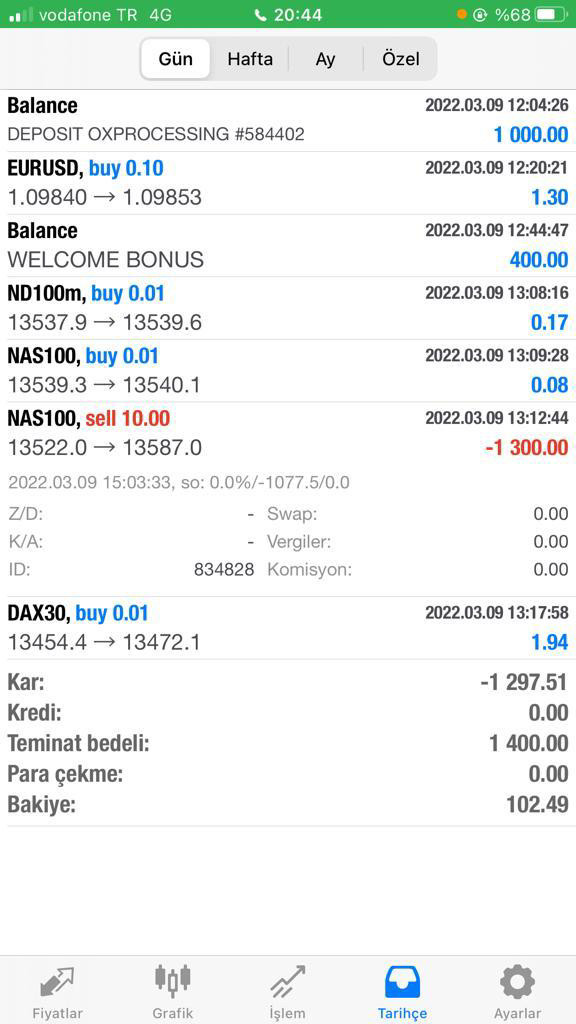

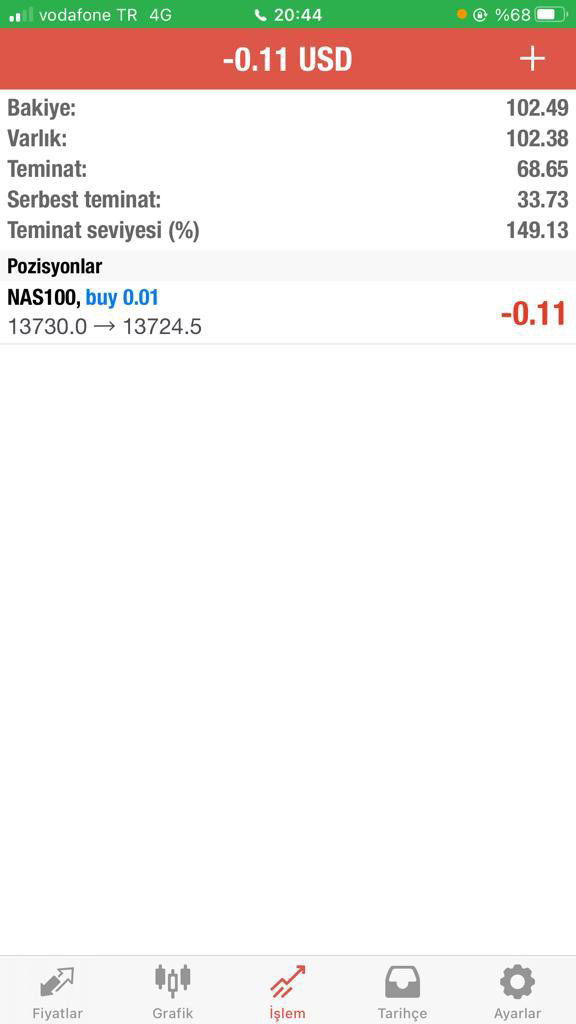

I deposited 1000 usd. they processed an order that was impossible to open due to collateral and stopped my account. I had 1000 usd + 400 usd bonus in my account and I entered 10 lots of Nastaq sell orders. When the price reached that point, the order did not work, saying there was no money. but a few hours later, when I entered the account and looked at it, my account had lost 1300 usd and the account went bankrupt. Then I wanted to see how much collateral he received by opening a 0.01 nastak transaction. The collateral he received for the 0.01 Nas100 transaction is exactly 68.65 usd. that is, in order for me to open 10 lots of Nas100 trades, my balance must be 68650 usd. this is impossible in my account only total assets are 1400 usd. moreover, the contract size of the Nas100 product could have incurred a maximum loss of 650 usd until the stop point (65 pips), even if 1, that is, 10 lots of Nas100 transactions were opened in this company. but they made a loss of 1300 usd and they destroyed my account deliberately by running a transaction without my knowledge. I have all the evidence. This company is a scam, do not deposit your money, they will eat your money too. they are all dishonest

Exposure

2022-04-14

Mayaz Ahmad

Bangladesh

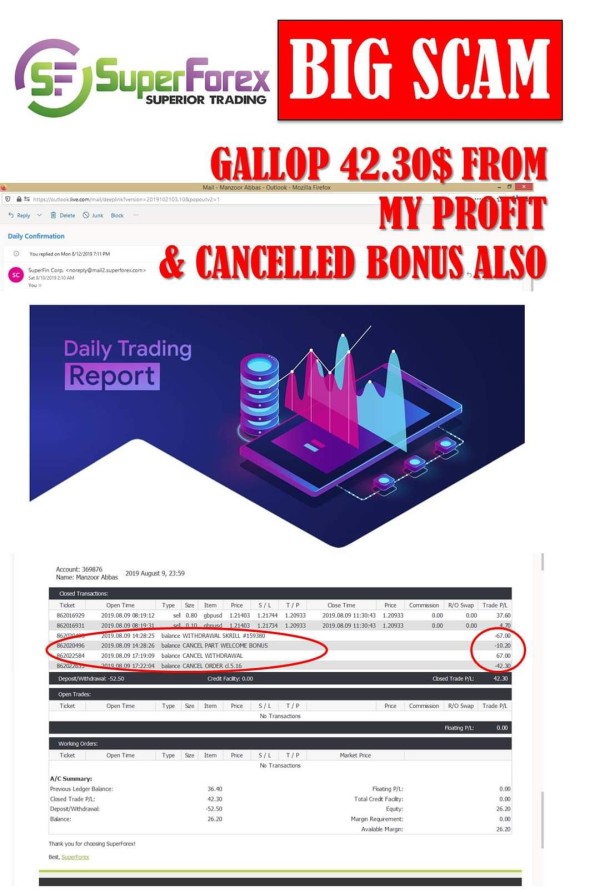

Stole $42.3 from my profit and cancelled my bonus.

Exposure

2021-08-25

FX1205639939

Singapore

suoerforex scammed me R59k pls be careful guys stay away from superforex you will never withdraw you deposit money and profits pls stay away im begging you

Exposure

2021-07-15

Mayaz Ahmad

Bangladesh

Lots of clients have complained they cannot withdraw after making a profit.

Exposure

2021-07-03

Mayaz Ahmad

Bangladesh

A client has complained against Super Forex that they cancelled all the profits he made and they are also not returning his deposit money. Stay away from this scam broker.

Exposure

2021-06-08

Mayaz Ahmad

Bangladesh

This broker has been declared scam in many forex websites.

Exposure

2021-05-03

FX9781453932

Algeria

i deposit with my real money without bonus , and i trade forex and I get good profits then I went to withdrawal all my money . but the broker take all my profit and 40% from my deposit money. I tried to texting then with no results . they told me that my trade are not legal according to regulation 5.16 ,Honestly Superforexa is a big scammer i have seen

Exposure

2021-04-24

FX2314735704

South Africa

Good afternoon I started a short term Investment with super Forex investment with an amount of R1700 and R1500. The investment was supposed to be for 5 working days and 2 working days. Mr Madonsela said I should pay R4220 for release fee because it is compulsory, I then paid the amount. They he sent an invoice from fnb saying payment on hold, he asked me to pay R650 so that the payment can be released, I paid the amount then he just disappeared on me. Please help me to get my money back

Exposure

2021-04-24

FX3803440575

Indonesia

I'm a normal trader. I applied for withdrawl of all my money on December 23, 2020. But suddenly, my profit was canceleld and I received an email. I've tried to email them many times but they just sent an email with the same content, which makes me disappointed. I hope WikiFX can help me. Tks.

Exposure

2021-04-09

FX6134881212

Indonesia

RATE DEPO BROKER 14,900 WD 13,900 IN THE REALITY DEPO EXTENDED TO 15,900. I get the benefit IN TRADING IN CANCEL FOR THE VIOLITY OF MARKET. WHEN I WAS TRADING IN ALL PAIR AND THE TIME WAS ABOUT GBPUSD UP 140 PIP IS STILL IN FAIRURE BATAWLS. I always use take profit and stoplost. IMMEDIATELYY ALL MY TRADING RESULTS IN CANCEL. THIS IS AN EVIL BROKER WHO DOES NOT WANT A PROFIT TRADER. MY WD CAPITAL CUT 7 PERCENT FROM MY CAPITAL DEPOSIT 7,600,000 IDR PROFIT IN TRADING 11,600,000 idr .FAKE BROKER

Exposure

2020-12-25

Tonyjamys

Nigeria

While trading with this broker, I was not able to shift my SL (Stop Loss) to my profit area, which altered my profitable trades.

Exposure

2020-09-13

MrTrader

United States

This is incredible. After i got an account with plugins, where they manipulate prices against costumers; when i request the withdrawal they charged me 7% SEVEN PERCENT of the requested amount. This broker is a SCAM! You better be really careful when you deposit with them. When theres a problem they will never fix it, they will tell " im going to send to the right department " LOL they do this in each email you send to them it doesnt matter if its to support or compliance or documents theres always another 'right department' to forward your email and never solve your problem. theres some pictures of SUPERFOREX SCAM BROKER. Where you can clearly see on their web site the 1% on withdrawal. My withdrawal request with the amount i should receive and then my skrill account with the transaction missing 6% of the right amount. COMPLETELY RIDICULOUS AND UNPROFESSIONAL. SCAM BROKER SCAAAAM

Exposure

2020-08-26

MrTrader

Brazil

First in their web site says the commission is 0.015 and when you open a position with 0.10 they charge you 1.96 SCAM.You request on the live chat for them to check it and they give you the email to contact so they can check for you. When you sent the email they will not help you. Also, i request my withdrawal after all this and they reject saying my account isnt verify SCAAAAM. My account is fully verify as you can see on the pictures. DONT OPERATE ON THIS BROKER. SCAM BROKER. THE LIVE CHAT/EMAIL SUPPORT IS HORRIBLE, THEY PROBABLY DONT KNOW WHAT THEY ARE DOING.

Exposure

2020-08-06

YSDJSTCKTO

Japan

I buy USDHKD around 7.75, but one day, they suddenly changed the rate to 7.72. What a terrible rate. Everyone knows that USDHKD move only 7.75 - 7.85 as the peg system. They made me lost cut intentionally.

Exposure

2020-06-05

Joppy Sugianto

Indonesia

I Deposit 300 and i got welcome bonus 40%, it mean 120usd. After i trading i only withdraw my profit 80 usd, look this broker scam take my profit and balance, and the note is cancel my welcome bonus. I just got 120 usd. Guys stay away from this broker...

Exposure

2020-03-05

El Troya

Indonesia

I applied for the withdrawal on October 10th, 2019. But I haven’t received the fund yet. And my trading was also canceled later, suffering a loss of $4698.69.

Exposure

2020-01-11

exness招代理*7*6

Hong Kong

I couldn’t withdraw mt profits in Super Forex . It also charges a high withdrawal fee.I deposited $400 for trading. The account balance was $500 while only 2569 RMB was available.

Exposure

2019-12-31

Liew Ming How

Turkey

I urge you to stay away from Super Forex. They will just steal your money. I have read too many negative reviews on this broker. DO NOT BE TRICKED! MASSIVE CON. DO NOT USE IT!

Neutral

2023-02-20