Overview of Access Direct

Access Direct, established in 2020 and based in Australia, is under exceeded status designated by the Australian Securities & Investment Commission (ASIC). The broker provides futures, forex, CFDs, commodities, shares, and ETFs. It offers four account types, including Classic, Pro, Classic ECN, and Pro ECN, with leverage up to 1:500. Trading is facilitated through platforms like WebTrader, Access Desktop (CQG), Access Mobile, and MetaTrader 5. Access Direct provides several customer support and educational resources to enhance trading proficiency.

Pros and Cons

Access Direct offers various trading instruments, including both hard and soft commodities. Additionally, Access Direct supports multiple deposit and withdrawal options. The absence of deposit fees reduces the cost of initial investments. Furthermore, the broker utilizes the MT5 platform, known for its advanced trading features and user-friendly interface.

However, the broker's “Exceeded” regulatory status indicates that it surpasses its authorized limits. Withdrawal fees for most methods add to the cost of transactions, and the longer processing times for bank transfers could inconvenience some traders. Higher fees for VISA and MasterCard withdrawals further increase transaction costs. Lastly, the absence of live chat support could limit immediate assistance for clients.

Is Access Direct legit or a scam?

Access Direct holds a Common Business Registration license from the Australian Securities & Investments Commission (ASIC). However, it is currently in an “Exceeded” regulatory status. This status means the broker surpasses its registered authorization limits.

Market Instruments

Access Direct offers several market instruments including:

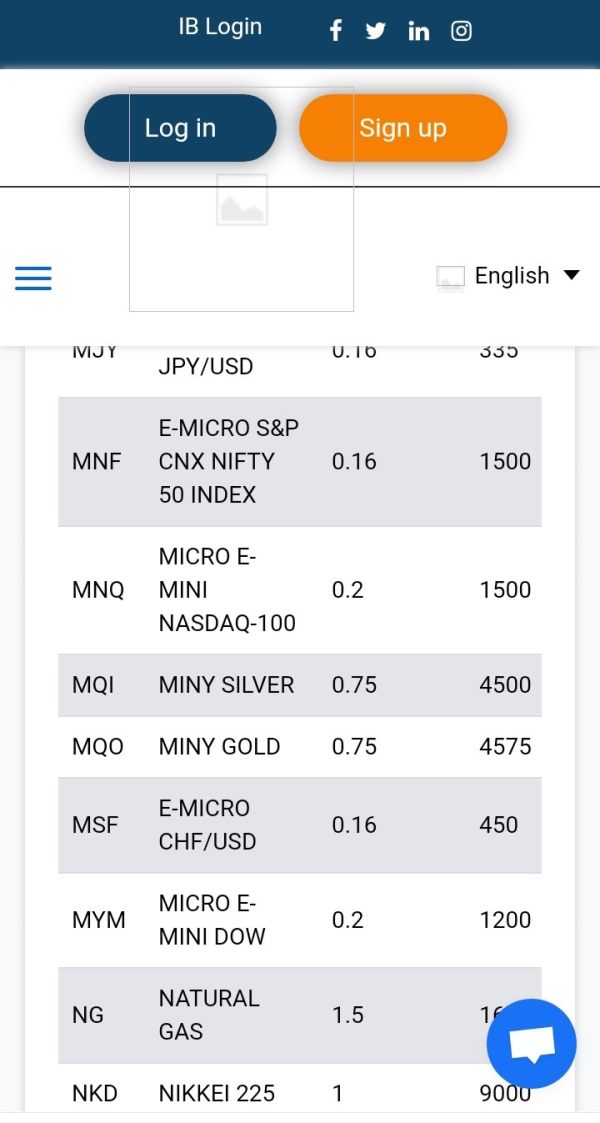

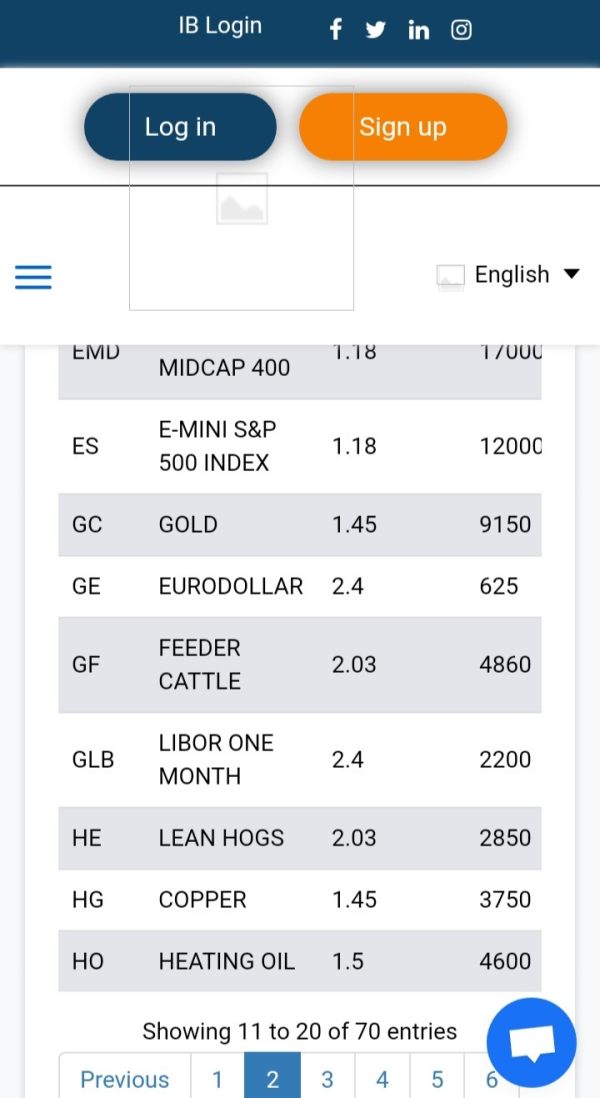

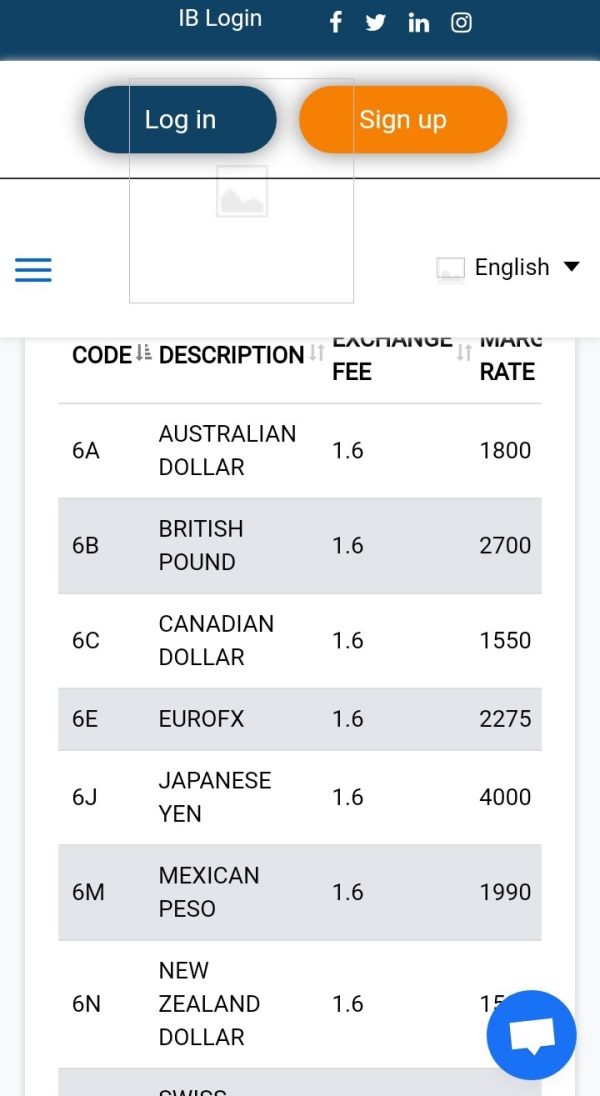

Futures: Exchange-traded derivative contracts that lock in the future delivery of a commodity or security at a set price today. Futures traders are categorized as hedgers or speculators.

Forex and CFDs: Trade on the highly liquid and transparent Forex market, with multiple currency pairs available. CFD trading allows trading on price movements of the underlying market without owning the asset.

Commodities: Investment in both hard commodities (e.g., gold, silver, crude oil) and soft commodities (e.g., cotton, coffee, corn, livestock). Commodities provide diversification and quick income opportunities.

Shares: Trade stocks to build savings, protect against inflation and taxes, and maximize income. Shareholders own a portion of a company's assets and earnings proportional to the number of shares held.

ETFs: Exchange Traded Funds that include stocks, bonds, and commodities, offering trading flexibility and diversification. ETFs track specific indices and trade close to their net asset value.

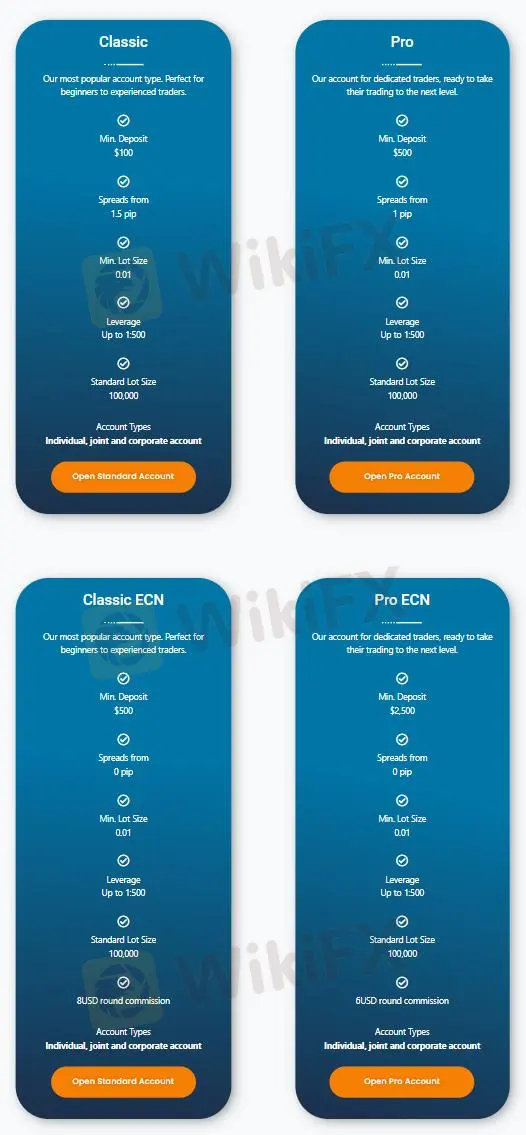

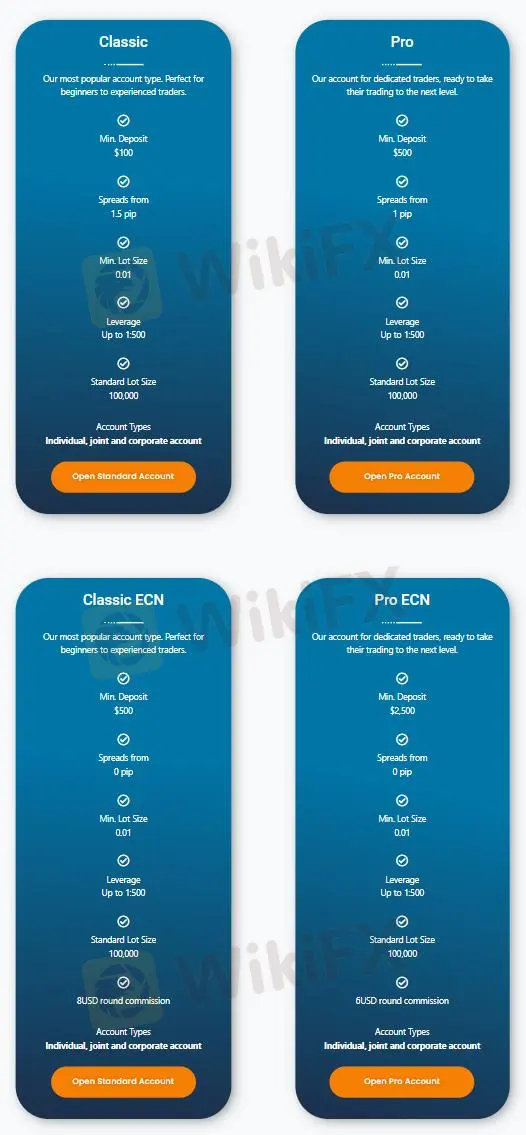

Account Types

Classic Account: Ideal for both beginners and experienced traders, with a minimum deposit of $100, spreads starting from 1.5 pips, leverage up to 1:500, and a minimum lot size of 0.01.

Pro Account: For more dedicated traders, requiring a minimum deposit of $500, with spreads from 1 pip, leverage up to 1:500, and a minimum lot size of 0.01.

Classic ECN Account: Suitable for traders seeking tighter spreads, with a minimum deposit of $500, spreads from 0 pips, leverage up to 1:500, a minimum lot size of 0.01, and a commission of $8 per round-trip.

Pro ECN Account: Targeted at professional traders, requiring a minimum deposit of $2,500, offering spreads from 0 pips, leverage up to 1:500, a minimum lot size of 0.01, and a commission of $6 per round-trip.

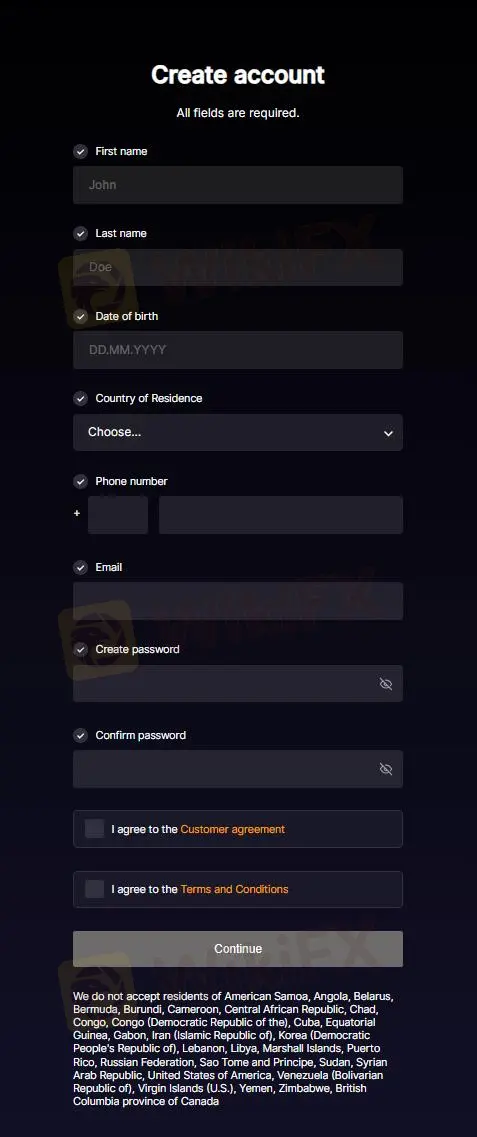

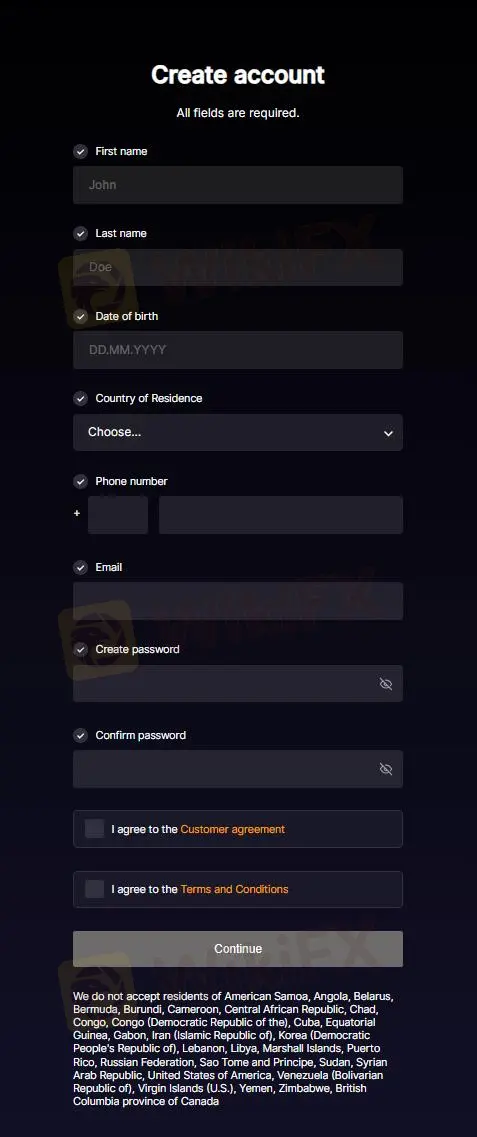

How to Open an Account with Access Direct

Sign Up: Go to the Access Direct website and click 'Sign Up' or 'Open Account'. You will be directed to the registration page.

Fill Out Registration Form: Provide your personal details, including your full name, email, phone number, and country of residence. Create a unique username and password.

Verify Email: Check your email for a verification link and click it to verify your email address.

Submit Additional Documents: Upload necessary documents like a government-issued ID and proof of address to complete the account verification process, ensuring regulatory compliance and account security.

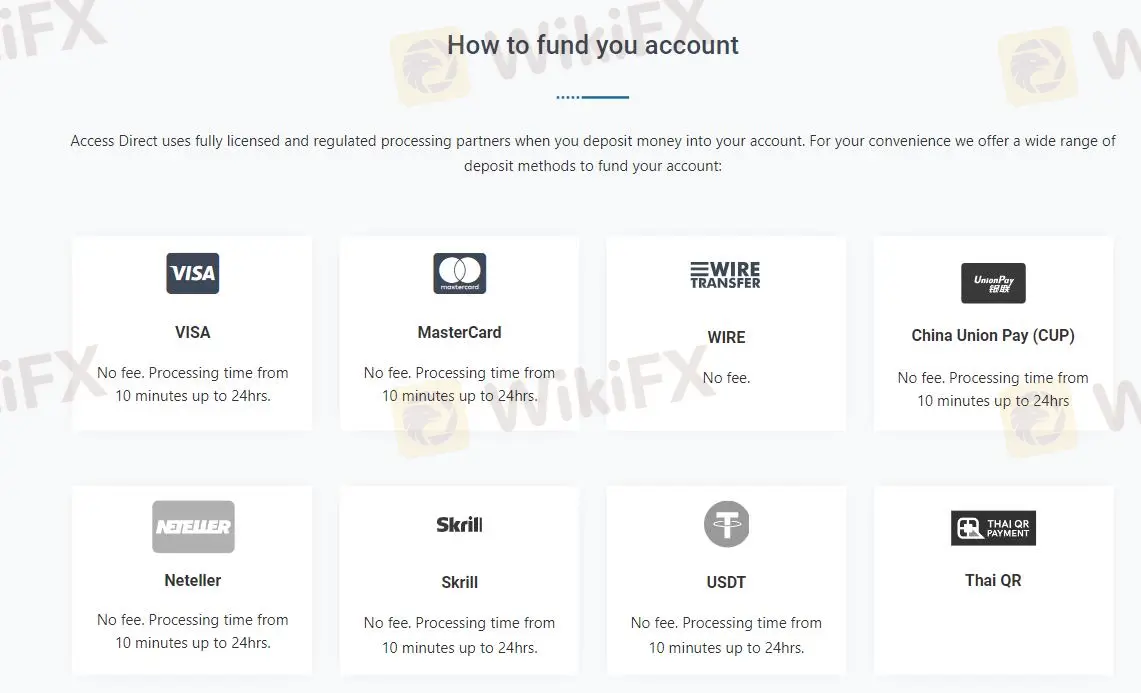

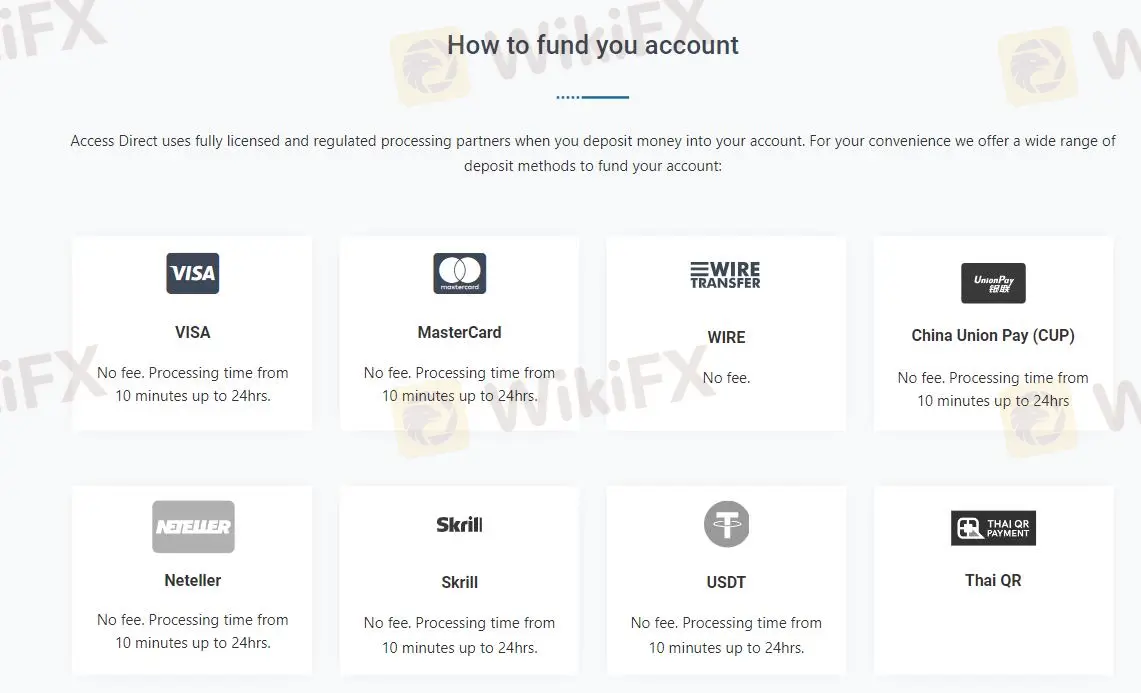

Fund Your Account: Once verified, deposit funds into your account using various payment methods such as VISA, MasterCard, wire transfers, China UnionPay, Neteller, Skrill, or USDT. You need to meet the minimum deposit requirement.

Start Trading: Log in to your selected trading platform (WebTrader, Access Desktop, Access Mobile, or MetaTrader 5) with your credentials and start trading. Beginners are encouraged to use a demo account initially.

Leverage

Access Direct provides maximum trading leverage of up to 1:500.

Spreads & Commissions

The Classic account provides spreads starting from 1.5 pips, while the Pro account offers more competitive spreads beginning at 1 pip. Both account types are commission-free.

The Classic ECN and Pro ECN accounts, offer raw spreads starting from 0 pips and round commissions of $8 and $6 per lot, respectively.

Other Fees

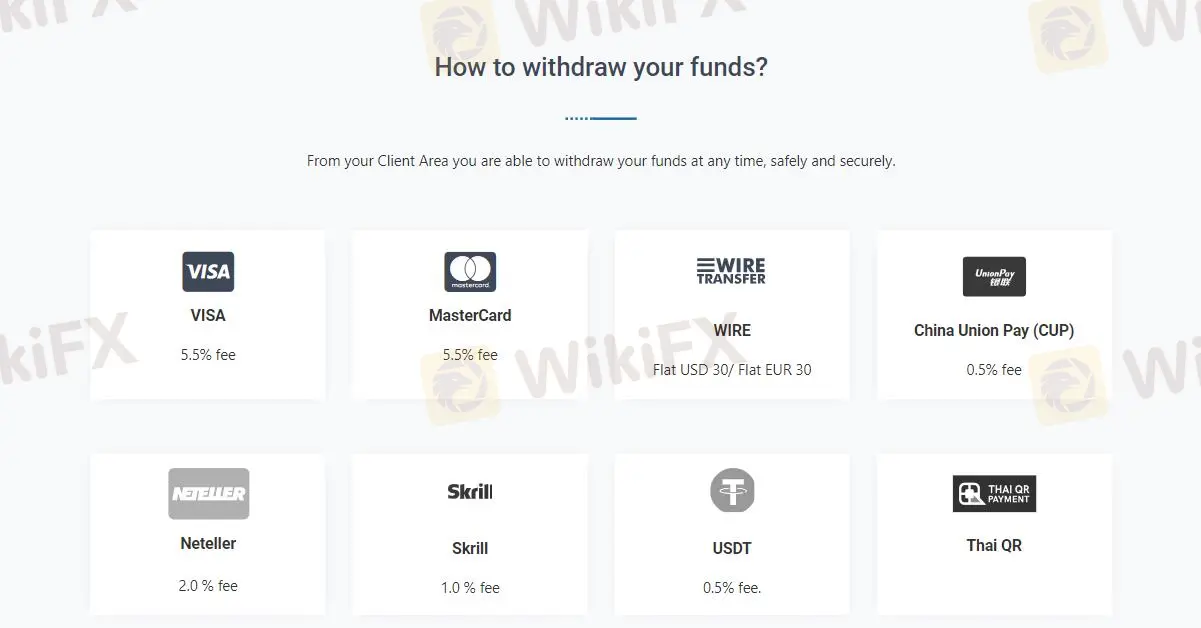

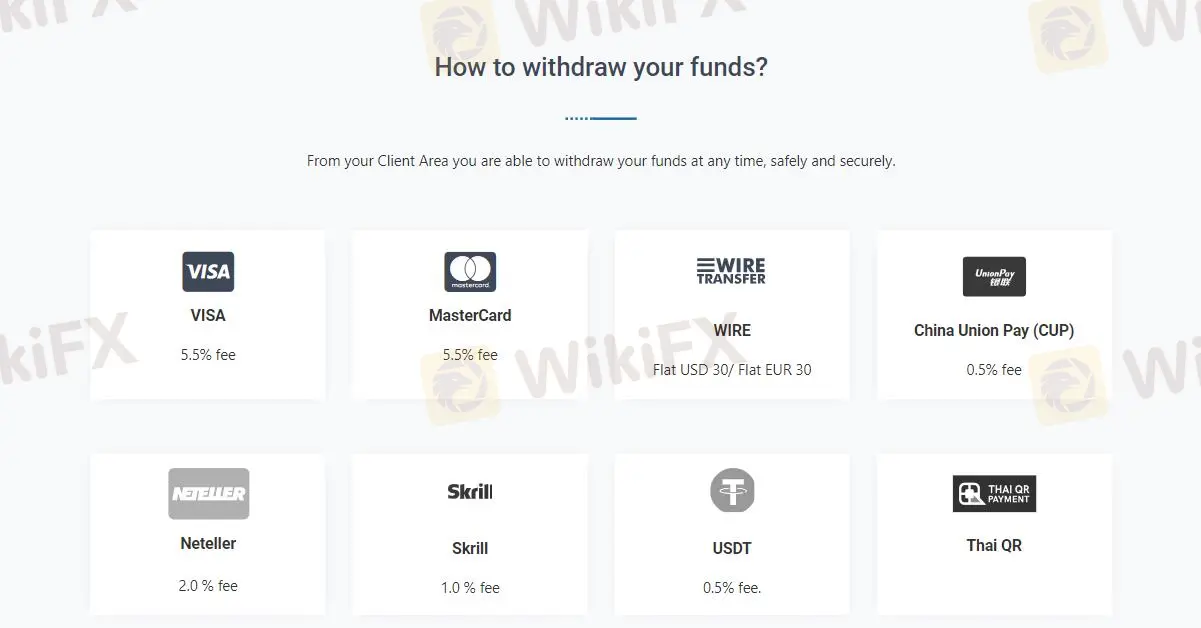

Access Direct applies withdrawal fees, differed by method: VISA and MasterCard transactions incur a 5.5% fee, bank transfers cost a flat $30, China Union Pay charges 0.5%, Neteller transactions have a 2.0% fee, Skrill transactions charge 1.0%, and USDT withdrawals come with a 0.5% fee.

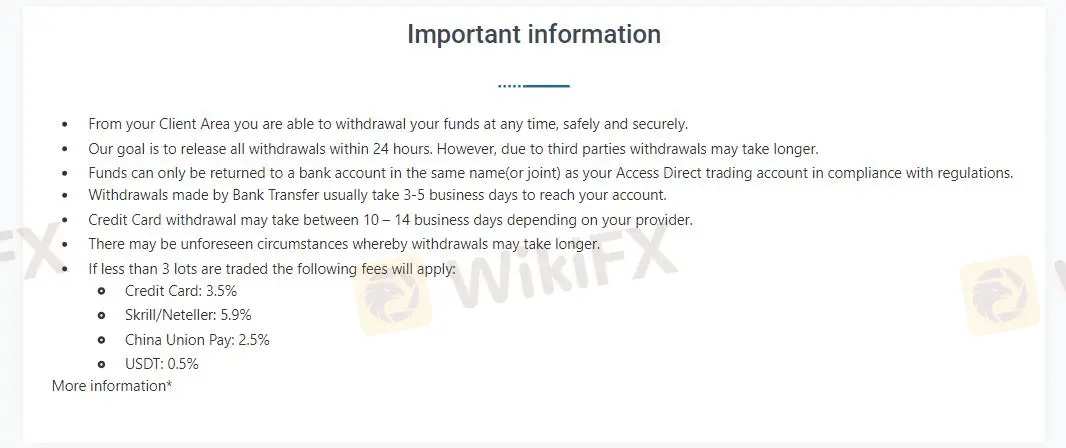

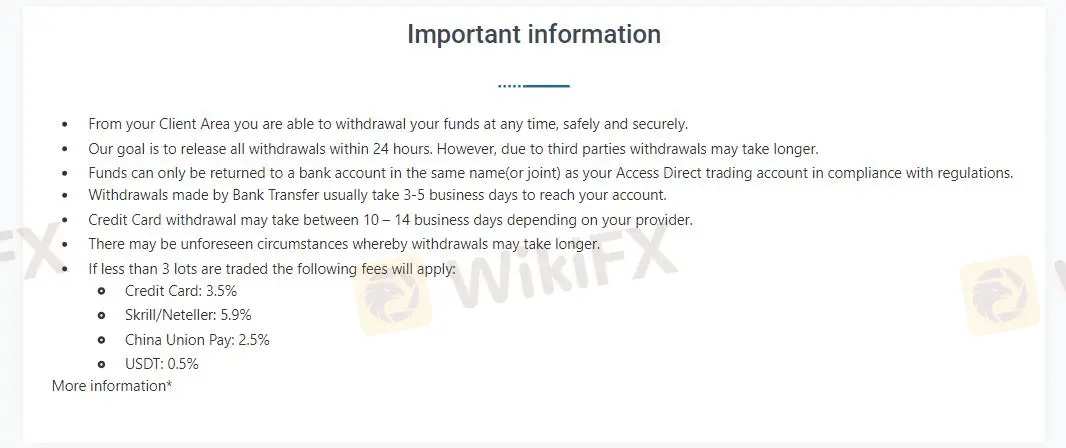

Furthermore, if fewer than 3 lots are traded, additional fees are levied: 3.5% for credit card transactions, 5.9% for Skrill/Neteller, 2.5% for China Union Pay, and 0.5% for USDT. An inactivity fee is also in place for dormant accounts, although specific details on this fee were not provided.

Trading Platform

Access Direct provides four trading platforms:

Access Desktop, powered by CQG, delivers a comprehensive trading experience with access to over 3000 financial instruments, real-time news, an economic calendar, and advanced charting tools. It is available for both desktop and mobile, running on any HTML-5 compatible browser.

MetaTrader 5 (MT5) is an all-encompassing platform for trading stocks, futures, and forex, featuring support for algorithmic trading, copy trading, and extensive analytical tools. MT5 is available on Windows, Mac, iOS, and Android, providing a versatile trading solution across devices.

Deposit & Withdrawal

Deposits can be made using VISA, MasterCard, wire transfer, China Union Pay (CUP), Neteller, Skrill, USDT, and Thai QR, with no fees and quick processing times from 10 minutes to 24 hours.

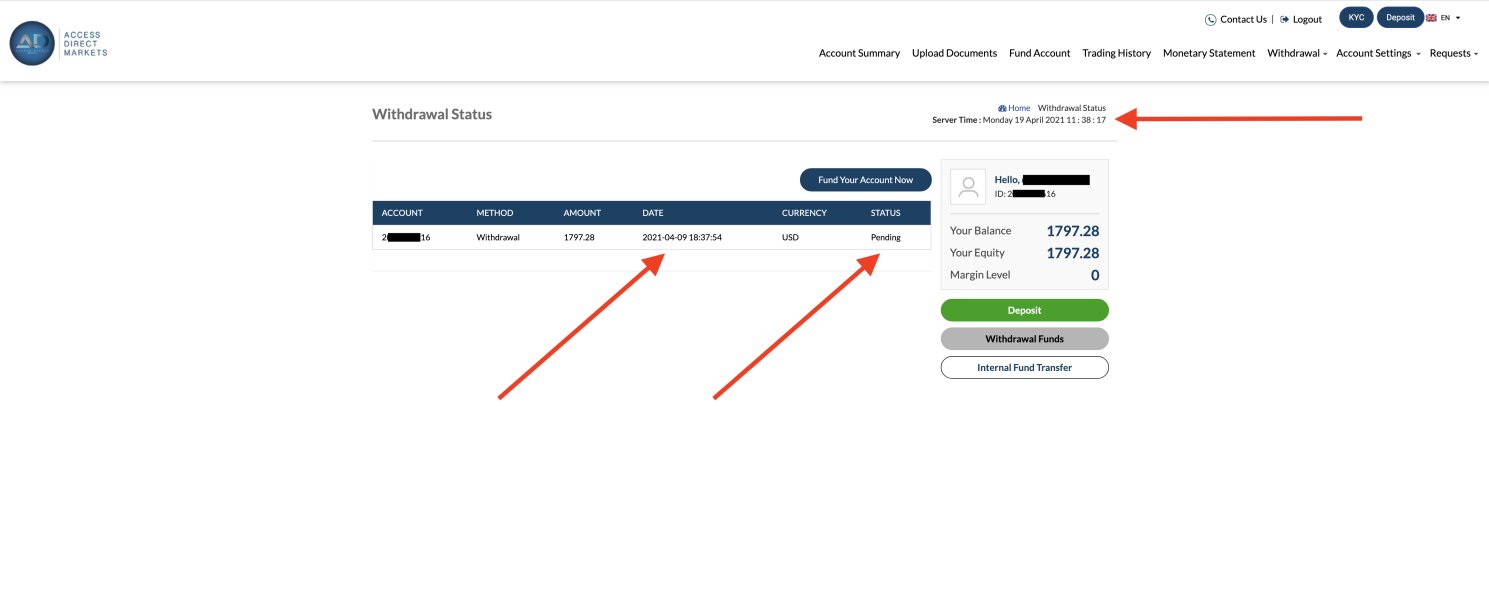

Withdrawals come with varying fees: VISA and MasterCard incur a 5.5% fee, wire transfers have a flat fee of USD 30 or EUR 30, China Union Pay has a 0.5% fee, Neteller incurs a 2.0% fee, Skrill has a 1.0% fee, and USDT withdrawals have a 0.5% fee. Withdrawals are aimed to be processed within 24 hours, but often take longer as a result of third-party delays, with bank transfers taking 3-5 business days and credit card withdrawals 10-14 business days.

Customer Support

Email: support@accessdirectmarkets.com

Phone: +230 529-70998

Company Address: 3A King George V Avenue, Floreal, Mauritius

Contact Form: Available on their website

Social Media: Facebook, LinkedIn, Instagram, and Twitter

Educational Resources

Access Direct offers three types of educational resources. These include:

Glossary: A detailed glossary explaining essential trading terms, aiding traders in familiarizing themselves with market jargon.

Trading Central: A sophisticated tool integrating AI analytics and expert insights to help traders discover opportunities, time their trades, and manage risk effectively. Access varies by deposit level: $250 deposits unlock exclusive trading reports, $1000 deposits grant access to Trading Central, and $3000 deposits provide full access to Recognia, a premier market analysis tool.

Economic Calendar: A live economic calendar providing up-to-date information on key global market events and economic data releases, ensuring traders stay informed and make well-timed trading decisions.

Conclusion

Access Direct, an Australian broker established in 2020, provides trading instruments such as futures, forex, CFDs, commodities, shares, and ETFs. It offers four account types, including Classic and ECN, with leverage up to 1:500 and spreads from 0 pips. Platforms include WebTrader, Access Desktop, Access Mobile, and MetaTrader 5 (MT5). Although the broker operates under an “Exceeded” ASIC regulatory status, it still provides solid customer support and educational tools like a glossary, Trading Central insights, and an economic calendar.

FAQs

Q: Is Access Direct regulated?

A: Access Direct is under ASIC but currently holds an “Exceeded” status.

Q: Which instruments can I trade with Access Direct?

A: You can trade futures, forex, CFDs, commodities, shares, and ETFs.

Q: What platforms does Access Direct support?

A: WebTrader, Access Desktop, Access Mobile, and MetaTrader 5 (MT5) are the platforms available.

Q: What's the minimum deposit required to trade?

A: The Classic Account needs a minimum deposit of $100.

Q: Does Access Direct have withdrawal fees?

A: Yes, different methods incur various fees, such as a 5.5% fee for VISA/MasterCard and a flat $30 fee for bank transfers.

Q: Does Access Direct offer educational content?

A: Yes, it offers a glossary, economic calendar, and Trading Central's market analysis tools.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. We strongly advise readers to verify updated details directly with the company before making any decisions, as the readers must be aware of and willing to accept the inherent risks involved in utilizing this information.