简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is the difference between support and resistance?

Abstract:One of the most often used trading ideas is "support and resistance." Surprisingly, everyone appears to have their own opinion on how support and resistance should be measured.

One of the most often used trading ideas is “support and resistance.”

Surprisingly, everyone appears to have their own opinion on how support and resistance should be measured.

Let's start with the fundamentals.

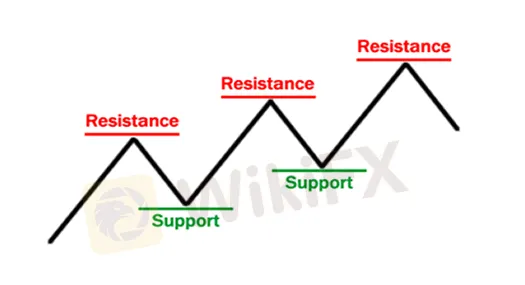

Take a look at the illustration above. As you can see, this zigzag pattern (a “bull market”) is moving upward.

The highest point hit before the price dropped back is now resistance when it climbs up and then pulls back.

Where there is an excess of sellers, resistance levels imply.

When the price rises again, the lowest point reached before it began to rise again will serve as support.

The presence of a surplus of buyers is indicated by support levels.

As the price swings up and down over time, resistance and support are generated in this manner.

During a decline, the opposite is true.

This is how support and resistance are generally traded in the most basic sense:

Invest in the “Bounce”

When the price falls below support, buy.

When the price approaches resistance, sell.

Trade the “Break” for the “Break”

When the price breaks through resistance, it's time to buy.

When the price breaks through support, sell.

What's the difference between a “bounce” and a “break”? What do you mean? If you're still confused, don't worry; we'll go over these concepts in greater depth later.

Support and Resistance Levels are Plotted

It's important to keep in mind that support and resistance levels are not exact figures.

Frequently, you'll notice a support or resistance level that appears to be breached, only to discover that the market was simply testing it.

The candlestick shadows are frequently used to indicate these “tests” of support and resistance on candlestick charts.

Take note of how the candle shadows tested the 1.4700 support level.It appeared at the moment that the price was “breaking” support.In retrospect, we can see that the price was simply attempting to reach that level.

So, how can we tell whether support and resistance have been broken?

This question has no definitive answer. Some say that a support or resistance level has been breached if the price can close above it. You will, however, discover that this is not always the case.

Let's revisit our previous example and observe what happened when the price closed over the 1.4700 support level.

The price had closed below the 1.4700 support level in this occasion, but it eventually rose over it.

If you had sold this pair believing it was a true breakout, you would have been in big trouble!

Looking at the chart presently, you can observe and conclude that the support was not broken; it is still very much intact and has become much stronger.

Support was “broken,” but only for a short time.

Support and resistance should be thought of as “zones” rather than precise figures to assist you weed out false breakouts.

Plotting support and resistance on a line chart rather than a candlestick chart might help you discover these zones.

The reason for this is that line charts only display the closing price, but candlestick charts show extreme highs and lows.

These highs and lows might be deceiving since they are often merely the market's “knee-jerk” reactions.

It's like when someone does something odd, but when questioned about it, they just say, “Sorry, it's just a reflex.”

You don't want the market's reactions while calculating support and resistance. You just want to track its deliberate moves.

Plot your support and resistance lines on the line chart around locations where you can observe the price generating many peaks or dips.

Other fascinating facts regarding support and resistance:

When the price passes through resistance, it may become support.

The more price tests a level of resistance or support without breaching it, the stronger the resistance or support area becomes.

The intensity of the follow-through move when a support or resistance level breaks is determined by how strong the broken support or resistance had been holding.

With a little practice, youll be able to spot potential forex support and resistance areas easily.

In the next lesson, well teach you how to trade diagonal support and resistance lines, otherwise known as trend lines.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator