简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

3 Different Types of Forex Charts and How to Interpret Them

Abstract:A chart, or more precisely a price chart, is the first tool that any trader who uses technical analysis should master. A chart is basically a visual depiction of the price of a currency pair over a certain time period.

To analyze how a currency pair's price fluctuates, you'll need a means to look at both its history and present price behavior.

A chart, or more precisely a price chart, is the first tool that any trader who uses technical analysis should master. A chart is basically a visual depiction of the price of a currency pair over a certain time period.

It visualizes the trading activity that takes place during a single trading period (whether its 10 minutes, 4 hours, one day, or one week).

Any financial asset with price data over a period of time can be used to form a chart for analysis.

Because price fluctuations are a succession of mainly random occurrences, our goal as traders is to manage risk and gauge likelihood, and charting may help us achieve so.

Charts are user-friendly because they make it simple to grasp how price fluctuations are portrayed over time since they are so visually appealing.

It is simple to recognize and evaluate the movements, trends, and tendencies of a currency pair using a chart.

The price scale is represented by the y-axis (vertical axis) on the chart, while the time scale is represented by the x-axis (horizontal axis).

Prices are plotted across the x-axis from left to right.

The price that is plotted the farthest to the right is the most current price.

Charts were created by hand back in the day!Fortunately for us, Bill Gates and Steve Jobs were born, and they made computers available to the general public, thus charts are now generated by software.

What is the meaning of a pricing chart?

A price chart depicts changes in supply and demand.

A price chart depicts changes in supply and demand.

A chart aggregates every buy and sell transaction of that financial instrument (in our case, currency pairs) at any given moment.

A chart incorporates all known news, as well as traders current expectations of future news.

Prices alter again when the future arrives and the reality differs from these predictions.

The “future news” has become “known news,” and traders have adjusted their expectations for future news as a result of this new information. The cycle continues.

Charts combine the activity of millions of market players, whether humans or algorithmic trading bots.

A chart combines ALL of this information together in a visual manner technical traders can examine and understand, whether the transaction was caused by an exporter's activities, a central bank's currency intervention, transactions performed by an AI from a hedge fund, or discretionary trading by regular traders.

Price Charts There Are Several Types of Price Charts

Let's look at three of the most common sorts of pricing charts: Graph with a line. Graph with bars. Chart with candlesticksNow we'll go through each of the forex charts and tell you what you need to know about them.Line Chart

A basic line chart depicts a line drawn from one closing price to the next.

We can examine the general price movement of a currency pair over time by stringing them together with a line.

Although it is simple to understand, the line chart may not give the trader with much information regarding price behavior over time.

All you know is that at the conclusion of the term, the price was X. You have no idea what occurred after that.

It does, however, make it easier for the trader to see trends and graphically compare closing prices from one period to the next.

This style of chart is typically used to provide a “big picture” view of price fluctuations.

The line chart, which is merely the slope of the line, also displays patterns the best.

The closing level, according to some traders, is more important than the open, high, or low. Price changes throughout a trading session are ignored when just the closing is considered.

Here's an example of a EUR/USD line chart:

Bar Graph

This isn't a bar chart, unfortunately.

A bar chart is a little more difficult to understand. It displays the highs and lows, as well as the opening and closing prices.

A trader can examine the price range of each period using bar charts.

From one bar to the next, or throughout a range of bars, the size of the bars may change.

The lowest traded price for that time period is at the bottom of the vertical bar, while the highest price paid is at the top.

The vertical bar represents the whole trading range of the currency pair.

The bars get bigger as the price variations become more erratic. The bars get smaller as the price changes get quieter.

Because of the way each bar is built, the size of each bar varies. The range between the peak and low price of the bar period is reflected in the vertical height of the bar.

With linked horizontal lines, the price bar also records the period's opening and ending prices.

The initial price is represented by the horizontal hash on the left side of the bar, while the closing price is shown by the horizontal hash on the right side.

Here is an example of a bar chart for EUR/USD:

Keep in mind that the term “bar” will be used to refer to a single item of data on a chart throughout our lectures.

A bar is just a unit of time, whether it's a day, a week, or an hour.

If you see the term 'bar' in the future, be sure you know what time frame it refers to.

Because they show the Open, High, Low, and Close for a particular currency pair, bar charts are sometimes known as “OHLC” charts.

The OHLC chart (open, high, low, and close) may highlight volatility, which is a significant distinction between a line chart and an OHLC chart.

Heres an example of a price bar again:

Open: The little horizontal line on the left is the opening price

High: The top of the vertical line defines the highest price of the time period

Low: The bottom of the vertical line defines the lowest price of the time period

Close: The little horizontal line on the right is the closing price

Candlesticks Charts

A version of the bar chart is the candlestick chart.

Candlestick charts provide the same price data as bar charts, but in a more appealing visual manner.

This chart is popular among traders since it is not only more attractive but also simpler to understand.

With a vertical line, candlestick bars still show the high-to-low range.

The bigger block (or body) in the center of a candlestick chart, on the other hand, represents the range between the starting and closing prices.

Candlesticks exhibit “bodies” in various hues to assist visualize bullish or bearish mood.

If the center block is filled or colored in, the currency pair has traditionally closed lower than it opened.

The 'filled color' in the following example is black. The opening price is at the top of the block, and the closing price is at the bottom of the block for our 'filled' blocks.

If the closing price is more than the beginning price, the center block will be “white,” hollow, or empty.

We don't like to utilize the typical black and white candlesticks at wikifx.com. They just don't appeal to me.

We think it's simpler to look at a colorful chart because we spend so much time looking at them.

Because a color television is superior than a black-and-white television, why not colorize those candlestick charts?

We just replaced the white with green and the black with red. This signifies that the candlestick would be green if the price closed higher than it opened.

The candlestick would be red if the price closed lower than it opened.

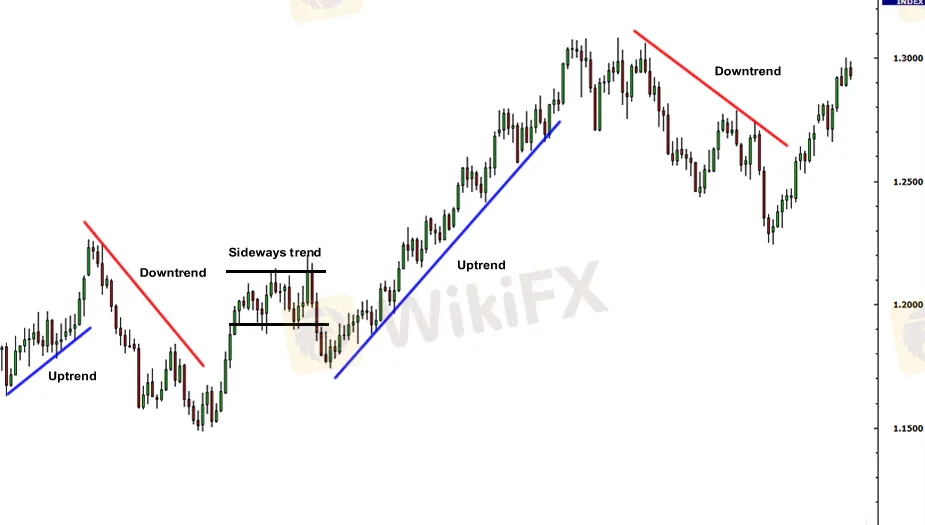

In following classes, you'll learn how to use green and red candles to “see” things on the charts more quickly, such as uptrends and downtrends, as well as probable reversal points.

For the time being, simply remember that we use red and green candlesticks instead of black and white on FX charts, and we'll be utilizing these colors from now on.

Take a look at these candlesticks...

Styled after wikifx.com! Yes, You know how much you enjoy it!

Here is an example of a candlestick chart for EUR/USD. Isnt it pretty?

· Because the identical information shows on an OHLC bar chart, the sole function of candlestick charting is to provide as a visual help.

· Candlestick charting has the following advantages: Candlesticks are simple to read and are a fantastic spot for novices to start learning about chart interpretation.

· Candlesticks are simple to work with. The information in the bar notation adapts to your eyes nearly instantly. Plus, studies suggest that images aid learning, so it's possible that they'll aid trading as well!

Candlesticks and candlestick patterns have catchy names like “shooting star,” which makes it easier to remember what they're for.

Candlesticks are good in spotting market reversals, such as from an uptrend to a downtrend or from a downtrend to an uptrend. Later on, you'll learn more about this.

There are several sorts of charts to choose from, and one is not always superior than the other.

The data used to make the chart may be the same, but the way the data is presented and understood will differ.

Each chart will have its own set of benefits and drawbacks. For technical analysis, you may use any sort of chart or a combination of charts. It is entirely up to your particular choice.

Now that you know why candlesticks are so awesome, you should know that candlestick forex charts will be used for the most, if not all, of the forex chart examples on this site.

Putting Everything Together

Traders can use a variety of price charts to keep track of the foreign exchange market.

When you first start reading price charts, keep things basic.

Look for the right mix of having enough information on the chart to make excellent trading decisions, but not so much information that your brain is immobilized and can't make ANY judgments while you figure out your chart preferences.

Every trader is different when it comes to finding the correct mix, so it's vital to start with the basics before moving on.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator