简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading The Gartley Pattern

Abstract:Gartley patterns are chart patterns used in technical analysis and are known for their relationship using Fibonacci numbers and ratios. Gartley pattern as One of such pattern created by a super smart trader called Harold McKinley Gartley all the way back in the 1930s. He had a stock market advisory service in the mid-1930s with a bigger following.

Gartley patterns are chart patterns used in technical analysis and are known for their relationship using Fibonacci numbers and ratios.

Gartley pattern as One of such pattern created by a super smart trader called Harold McKinley Gartley all the way back in the 1930s. He had a stock market advisory service in the mid-1930s with a bigger following. This service was one of the first to apply scientific and statistical methods to analyze the stock market behavior.

As reported by Gartley after his analysis he was finally able to solve two of the biggest problems of traders which are: what and when to buy. Soon enough, traders get to understand that these patterns can at the same time applied to other markets. Ever since, several books, trading software, and other patterns (discussed below) have been made available based on the Gartleys.

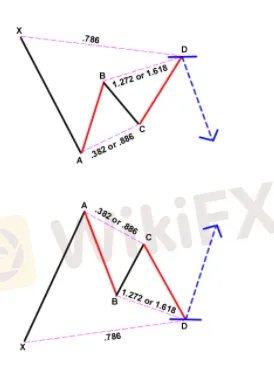

Gartley a.k.a. “222” Pattern. The Gartley “222” mode is named after the page number it found in H.M. Gartleys' book, the stock market's profit. They are patterns that include the basic ABCD pattern we have already talked about, but are followed by a notable high or low. And these patterns generally form when a correction of the overall trend is taking place and look like ‘M’ (or ‘W’ for bearish patterns). These patterns are used to also assist traders find good entry points to rebound in on the overall trend.

A Gartley pattern forms when the price action has been moving on a recent uptrend (or downtrend) but has started to show signs of a correction. One thing that makes the Gartley such a nice beginning when it forms is the reversal points are a Fibonacci retracement and Fibonacci extension level. This gives a visual signs that the pair may actually rebound. This pattern can be hard to mark out and once you do, it can get uncertainty when you brings up all those Fibonacci tools. The lead to staying away from all the confusion is to take things one step at a time.

No matter what, the pattern contains a bullish or bearish ABCD pattern, but is followed by a point (X) that is beyond point D. The “perfect” Gartley pattern has the following characteristics:

Move AB should be the .618 retracement of move XA.

Move BC should be either .382 or .886 retracement of move AB.

If the retracement of move BC is .382 of move AB, then CD should be 1.272 of move BC. Consequently, if move BC is .886 of move AB, then CD should extend 1.618 of move BC.

Move CD should be .786 retracement of move XA

Gartley Mutants: The Animals

The Animals As time went by, the popularity of the Gartley pattern grew and people eventually came up with their own variations.

For some unique reason, the discoverers of these variations concluded to name them after animals (Maybe they were part of PETA?). Without further trouble, here comes the animal pack.

The Crab

Back then In 2000, Scott Carney, a real believer in harmonic price patterns, discovered the “Crab”. According to him, this is the most correct among all the harmonic patterns due to how greatest the Potential Reversal Zone (sometimes called “price better reverse or imma gonna lose my shirt” point) from move XA. This pattern has a high risk return ratio because you can put a very tight stop loss. The “perfect” crab pattern must contain the following aspects:

Move AB should be the .382 or .618 retracement of move XA.

Move BC can be either .382 or .886 retracement of move AB.

If the retracement of move BC is .382 of move AB, then CD should be 2.24 of move BC. Consequently, if move BC is .886 of move AB, then CD should be 3.618 extension of move BC. Then CD should be 1.618 extension of move XA.

The Bat

As we Come 2001, President and Founder of HarmonicTrader.com Scott Carney founded another Harmonic Price Pattern called the “Bat.”

The Bat is defined by the .886 retracement of move XA as Potential Reversal Zone. The Bat pattern has the following qualities:

Move AB should be the .382 or .500 retracement of move XA.

Move BC can be either .382 or .886 retracement of move AB.

If the retracement of move BC is .382 of move AB, then CD should be 1.618 extension of move BC. Also as a result, if move BC is .886 of move AB, then CD should be 2.618 extension of move BC. Then CD should be .886 retracement of move XA.

The Butterfly

And Then, another pattern also discovered called the Butterfly pattern. Like Muhammad Ali, if you spot this setup, youll surely be swinging for some knockout-sized pips!. It was Created by Bryce Gilmore, the perfect Butterfly pattern is defined by the .786 retracement of move AB with respect to move XA. The Butterfly contains these specific characteristics:

Move AB should be the .786 retracement of move XA.

Move BC can be either .382 or .886 retracement of move AB.

If the retracement of move BC is .382 of move AB, then CD should be 1.618 extension of move BC. Consequently, if move BC is .886 of move AB, then CD should extend 2.618 of move BC. Therefore CD should be 1.27 or 1.618 extension of move XA.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator