简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The ABCD and the Three-Drive

Abstract:We’ll just bring in another letter at the end, and we’ve got the ABCD chart pattern as simple than you thought. To easily point this chart pattern out, all you need are sharp hawk eyes and the helpful Fibonacci chart tool.

The ABCD

As we have mentioned the different types of harmonic patterns in the past lesson, Now Lets start this lesson with the simpler harmonic pattern. So what could be simpler than the good old ABCs?

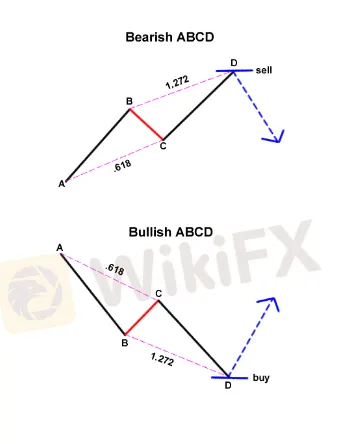

Here We‘ll just bring in another letter at the end, and we’ve got the ABCD chart pattern as simple than you thought. To easily point this chart pattern out, all you need are sharp hawk eyes and the helpful Fibonacci chart tool. For both the bullish and bearish versions of the ABCD chart pattern, the lines AB and CD are called as the legs while BC is called the correction or retracement. When you use the Fibonacci retracement tool on leg AB, the retracement BC should reach the 0.618 level. Next, the line CD should be the 1.272 Fibonacci extension of BC. Sounds simple right? So All you have to do is wait for the whole pattern to complete and extend point D before you take any short or long positions.

But when you choose to be more strict about it, then you need to think about these set of rules for a valid ABCD pattern:

The length of line AB should be equal to the length of line CD.

The time taken for the price to go from A to B should be equal to the time it takes for the price to move from C to D.

Three-Drive

The three drives pattern consists of a series of upper highs or higher lows. It is similar to the ABCD pattern. The difference is that a Three drives pattern is made of 5 legs, while an ABCD pattern has only 4. Simple as Burger, this three-drive pattern is the fore-elder of the Elliott Wave pattern. Usually, youll need your hawk eyes, the Fibonacci tool, and a smidge of patience on this one.

As you can notice from the charts above, point A should be the 61.8% retracement of drive 1. The same applies to point B should be the 0.618 retracement of drive 2. Then, drive 2 should be the 1.272 extension of correction A and drive 3 should be the 1.272 extension of correction B. The moment the whole three-drive pattern is complete, that‘s when you can pull the alarm on your long or short trade. Generally, when the price extend point B, you can already set your short or long orders at the 1.272 extension so that you would not be left over. But first, it’d be better to check if these rules remain true:

The time it takes the price to complete drive 2 should be equal to the time it takes to complete drive 3.

The time to complete retracements A and B should be equal.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator